2023 Guide to Investing in Electric Vehicles

|

Listen to this post

|

As a percentage on its own, 5% doesn’t sound impressive.

You wouldn’t want to take home just 5% of your salary.

Or eat only 5% of your dinner.

Or watch only 5% of a movie.

But in July 2022, when electric vehicles (EVs) accounted for 5% of new car sales in the United States, that was a massively important percentage for investors — a Bloomberg report said it’s the signal that we’re now headed toward mass adoption of EVs.

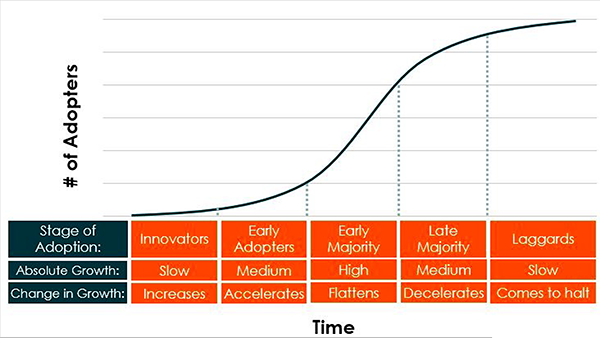

Because that 5% number is a key threshold when it comes to adoption trends of technology. From televisions to mobile phones to the internet, sales of a new technology have tended to follow an S-shaped adoption curve, starting slowly and then reaching a point of rapidly going mainstream.

Source: GlobalXETFs

In other words, for electric vehicles, 5% of sales appeared to be the tipping point when early adopters will soon be overtaken by mainstream demand.

This faster adoption will be thanks to more public charging stations, less expensive cars, and buyers being more educated…

All of which is accelerating much faster than most people anticipated. Already by February, that 5% had become more like 8% of monthly car sales being EVs.

For a lot of investors, they may feel like they have missed out on the EV boom because they didn’t invest in Tesla Inc. (TSLA) early on and make a 4,000% return in 10 years.

But what that 5% tipping point told us is that you are firmly in the very early innings of widespread EV adoption, and making the right moves could even outshine the returns from Tesla.

Crucially, the EV industry is starting to overcome a key obstacle: people’s concerns with charging an EV. Fear that the car will run out of battery “juice” when they need it is one of the most common reasons people avoid electric vehicles, according to BlinkCharging.com…

But inside the big Bipartisan Infrastructure Law (signed November 2021), the U.S. government pledged to provide $5 billion over five years to help build EV charging networks across the country, in what it’s calling the National Electric Vehicle Infrastructure (NEVI) Formula Program.

As for the chargers already in place – many of which are just for Tesla vehicles – the Biden administration has cut a deal to change that. Tesla has apparently agreed to open up roughly half of its charging stations to all EVs (not just Teslas) by the end of 2024.

With people starting to see more charging stations – not to mention higher prices for gasoline – this increased access to chargers should help alleviate those concerns about EVs and have more folks considering driving one.

Already, half of all cars sold in the United States are expected to be EVs by 2030. That number should be even higher globally: 60%, according to the International Energy Agency (IEA).

And naturally, adoption this widespread will do wonders for the global market value of the industry. The electric vehicle market is expected to skyrocket in value from $178.5 billion in 2021 to $1.1 trillion by 2030, projects Beyond Market Insights.

The investment ideas provided in this guide are intended not only as a starting point for your own research – but also to put a few promising EV companies you may have not heard of before onto your radar.

How to Invest

There are a few different facets of the EV megatrend that we’ll discuss today – from the cars themselves… to critical components that are in high demand to produce them.

First, we’ll look at EV makers, and there are two groups within this category worth following: “old guard” automakers, and the “new kids on the block,” of which Tesla is the oldest and has still only been around since 2003.

A handful of those companies include:

| Company | Stock Ticker | CEO | Stock Price to Start 2023 |

| Tesla Inc. | TSLA | Elon Musk | $118.47 |

| Nio Inc. | NIO | William Li | $10.21 |

| Lucid Group Inc. | LCID | Peter Rawlinson | $6.97 |

| Fisker Inc. | FSR | Henrik Fisker | $7.37 |

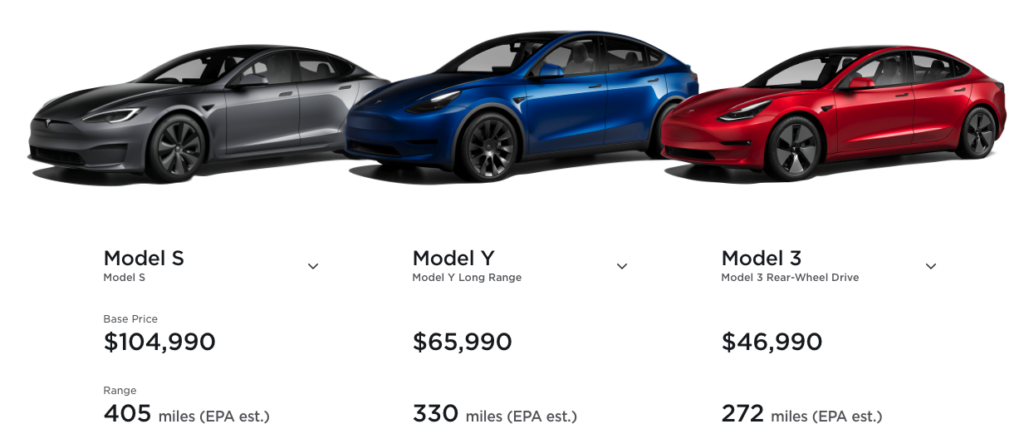

Tesla is the most well-known EV maker in the space, selling the Model S, Model Y, Model 3, and Model X.

Pictured below from Tesla’s website are the price points and mileage ranges for the Model S, Model Y, and Model 3.

Then there’s the “Chinese Tesla,” Nio Group, founded in Shanghai in 2014.

- Nio’s lineup of seven EVs features the ET7 luxury sedan, pictured below:

Lucid Group was founded in 2007 and is firmly focused on this luxury electric vehicle category.

Its models launched or being launched include:

- Air Sapphire

- Air Grand Touring

- Air Touring

- Air Pure

- Air Dream Edition

- Gravity SUV

The Air Sapphire pictured below has a price tag of $249,000 and is expected to go on sale in the first half of 2023.

Finally, that brings us to Fisker, which was founded in 2016.

It currently sells the Fisker Ocean SUV and is developing the Fisker PEAR compact car, as well as the world’s first all-electric, four-door convertible, the Fisker Ronin sports car.

The Fisker Ocean has a solar roof, which helps support the vehicle’s battery-powered motor.

The picture below of the roof of the car is from Fisker’s website:

The companies we just mentioned were the “new kids on the block,” but don’t think that the old guard is missing out on selling EVs.

While the traditional auto makers still sell gas-powered cars, they are also being pushed by world governments to phase them out, so they are all expanding their offerings with EV models.

In the United States, Ford and GM are updating their familiar offerings as new electric options.

| Company | Stock Ticker | CEO | Stock Price to Start 2023 |

| Ford Motor Co. | F | Jim Farley | $11.82 |

| General Motors Co. | GM | Mary Barra | $34.02 |

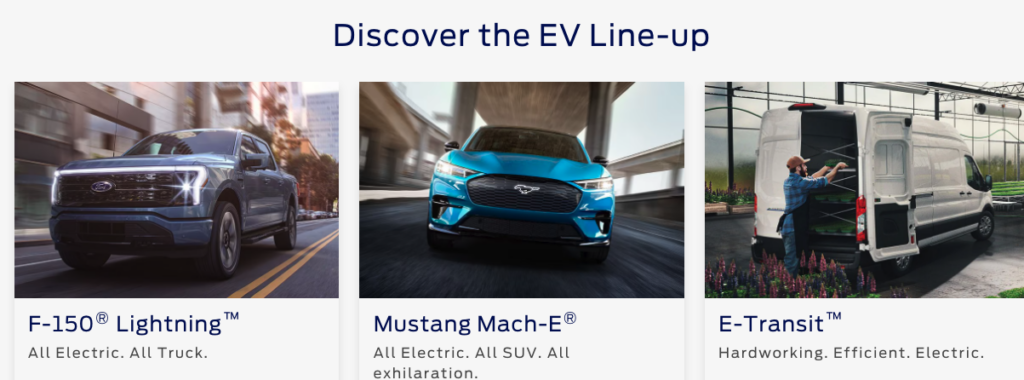

Below we see Ford’s EV offerings so far: the F-150 Lightning truck, the Mustang Mach-E, and the E-Transit van.

Source: Ford.com

In 2022, Ford sold 61,575 of these three EVs in the United States– more than double the sales total from 2021.

GM also had a strong 2022 in EV sales: It delivered 39,096 all-electric vehicles in the United States, which is a 57% year-over-year (YoY) increase.

GM’s lineup includes the Bolt EV, a compact hatchback, and the Bolt EUV, a larger SUV model. Throughout 2023, it will launch the Equinox EV, Blazer EV, and Silverado EV:

Source: Chevrolet.com

There are also automakers outside of the United States in the “old guard” offering their own EVs.

| Company | Stock Ticker | CEO | Stock Price to Start 2023 |

| Volkswagen | VWAPY | Oliver Blume | $12.91 |

| Nissan Motor Co. | NSANY | Makoto Uchida | $6.20 |

| Toyota Motor Corp. | TOYOF | Akio Toyoda | $137.96 |

Besides investing in auto makers, another way to get in on the EV boom is by investing in semiconductor stocks.

EV Semiconductor Stocks

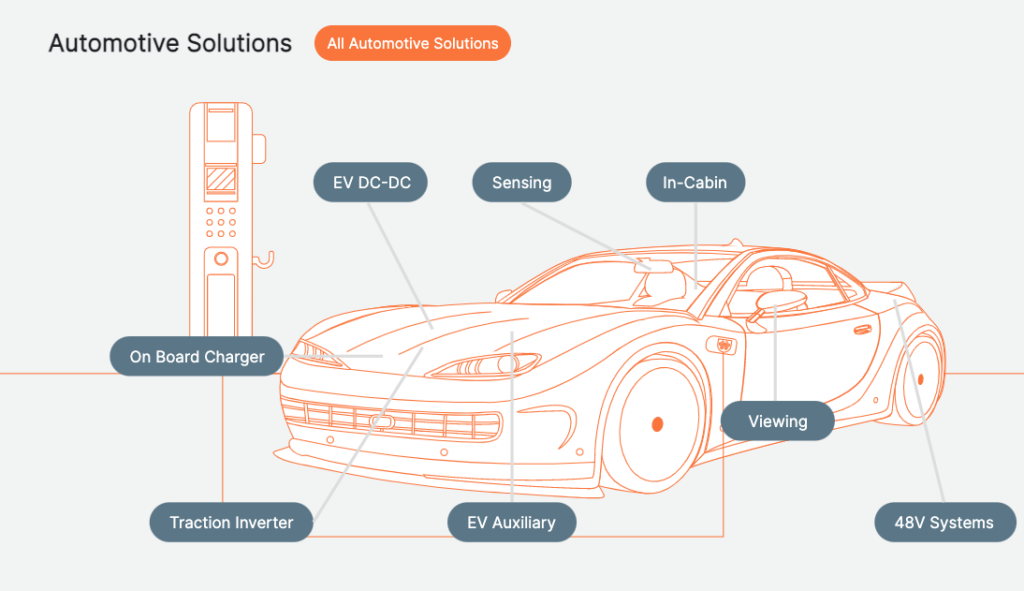

One of our favorites at TradeSmith is ON Semiconductor Corp. (ON), which is also known as onsemi.

Source: onsemi.com

There’s a growing demand for semiconductors made from silicon carbide, as they can provide up to 50% faster charging and up to 10% longer driving ranges for electric vehicles.

Customers are obviously going to be more eager to own a car with faster charging and longer driving ranges, and that demand could help silicon carbide chip revenue from electric vehicles reach $14.4 billion by 2030, up 1,066% from an estimated total of $1.2 billion in 2022.

And as you may have guessed by now, ON is a beneficiary of that increased demand.

On Aug. 11, 2022, onsemi cut the ribbon on its newest silicon carbide production facility in Hudson, New Hampshire, an important development to ensure that it can keep up with demand.

In addition, onsemi expanded its operations in the Czech Republic, constructing a building that will allow it to increase production capacity by 16 times. It has invested $150 million into this building and will spend an additional $300 million through 2023.

With silicon carbide chip revenue expected to be 12 times larger by 2030, those investments into expanding production should be money well spent for onsemi.

EV Charging and Battery Stocks

Another way to invest in EVs is to think about what is needed to keep them on the road – namely, charging stations and batteries. Companies providing them include:

- ChargePoint Holdings Inc. (CHPT), which operated more than 18,000 charging stations as of October 2022.

- BYD Company (BYDDY) focuses on rechargeable lithium-ion batteries for hybrid and battery-powered vehicles.

- Panasonic Holdings Corp. (PCRFY) is a leading producer of EV batteries.

- Nikola Corp. (NKLA) provides heavy-duty batteries for commercial EVs.

- EVgo Inc. (EVGO) is the largest public fast-charging network in the United States, with more than 140 million Americans living within 10 minutes of an EVgo charger.

- Solid Power Inc. (SLDP) produces solid-state rechargeable batterie for EVs.

There are plenty of other companies out there to research when it comes to facilitating electric vehicles, but we wanted to at least make sure you have a handful to start out with.

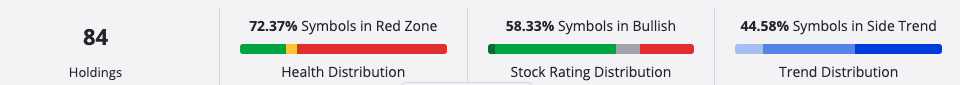

To peek beneath the hood (so to speak) on these stocks, our tools can give you the bottom line on each stock’s fundamental health and volatility.

The automakers and battery/charger stocks tend to vary widely, in terms of their TradeSmith ratings; the stocks also tend to show a high Volatility Quotient when you stray outside of the “old guard” automakers (and electronics makers). Be sure to take these sorts of factors into account before you buy.

EV ETFs

In addition to all the investment opportunities listed above, you can also invest in an electric vehicle fund. Because they hold a “basket” of investments, their returns will be watered down by the laggards within the group, so the profit potential may not be as high versus owning single stocks.

But if you like the idea of investing in electric vehicles and want to limit your risk through easy diversification, EV exchange-traded funds (ETFs) can be a great way to test the waters.

A few options include:

- Global X Autonomous & Electric Vehicles ETF (DRIV)

- KraneShares Electric Vehicles & Future Mobility ETF (KARS)

- SPDR S&P Kensho Smart Mobility ETF (HAIL)

For anyone with our Health Indicator tool, you can look at the holdings within these ETFs and see how many are in our Green Zone, which are considered “buys.” You can also see which ones are in our Red Zone, which are considered ones to avoid.

This guide is intended as a starting point for your own research, and as you can see , there are plenty of options in what will be a very lucrative market.

How to Buy the Right Stocks Today

As mentioned before – it’s not just the ETFs that get a helpful Health Indicator from TradeSmith Finance. Our members can also see the health of every publicly traded company we mentioned in this guide.

Thanks to our color-coded ratings, investing becomes pretty straightforward. In an instant, if you see it in the Green Zone, you will know it’s considered a “buy.”

If it’s in the Yellow Zone, it means hold the stock if you already own it or proceed with caution if you have a higher risk tolerance.

If it’s in the Red Zone, you’ll know right away if you shouldn’t touch it with a 10-foot pole.

With so much noise, worry, and confusion out there, how can you invest with high conviction in your ideas – AND save time in the process? That’s exactly what TradeSmith does for our members.

Find out more here about TradeSmith Finance and how our tools can help you approach red-hot investment categories like electric vehicles wisely – and profitably.

It may be the best decision you make in 2023.

To your investing success,

Team TradeSmith