3 Top-Ranked Stocks for the Summer Travel Season

I’m always looking for trends to identify great stocks. And one just smacked me right in the face.

I’m on vacation with my family traveling in Spain and Portugal. So far, I’ve been to four cities. The streets are packed, the restaurants are full, the hotels are booked, and the flights are oversold.

The optic test tells me the travel and leisure market is vibrant right now.

That makes sense. School is out, summer is here, and people are ready to take that vacation time.

According to a Bank of America survey, 70% of respondents are planning to travel this summer. They also plan to travel for longer and spend more compared to previous years.

Squaremouth.com, a marketplace for travel insurance, reported that travelers are spending an average of $10,000 on their summer trips – a 7% increase over last summer and 14% increase compared to 2022. In total, that’s $220 billion just in summer travel this year, according to Allianz’s Vacation Confidence Index.

Clearly the data backs up what I’m seeing, and that means we can look to make some money. So, I fired up my Quantum Edge system from Europe to see which travel-related stocks come out on top.

I filtered for Consumer Discretionary Stocks focusing on Hospitality. Out of 121 stocks, I then filtered down the list to find those that have a Quantum Score of 60 or higher – 20 made the list.

But as regular readers know, I like a score of at least 70 when buying a stock. So today, I’ll go over the top three travel companies that have everything I look for: strong fundamentals, superior technicals, and Big Money flowing in.

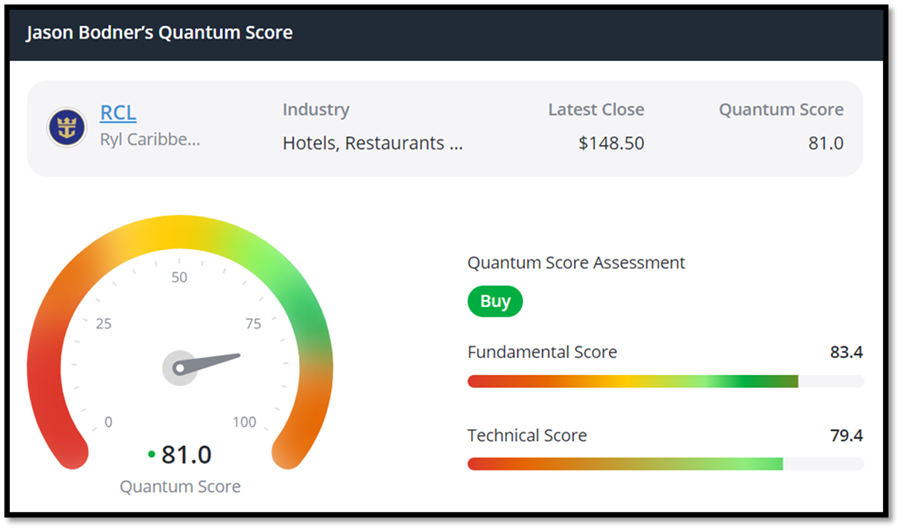

Royal Caribbean Group (RCL)

Source: TradeSmith Finance and MAPsignals.com

I’m sure you’ve heard of Royal Caribbean Group (RCL), and maybe you’ve taken one of their cruises before.

Its newest ship, the Icon of the Seas, is the largest cruise ship in the world at nearly 1,200 feet. It has more than 40 restaurants and bars, a water park with six different water slides, ice skating rink, an open-air space called Central Park, and can accommodate up to 7,600 passengers. It’s also largely booked until 2026.

This cruise line is about more than one ship. RCL’s strong one- and three-year sales growth of 57.2% and 167.9%, respectively, lead to its muscular Fundamental Score of 83.4. Other things I love about this company are its 12.2% profit margin and high institutional ownership of 81.1%.

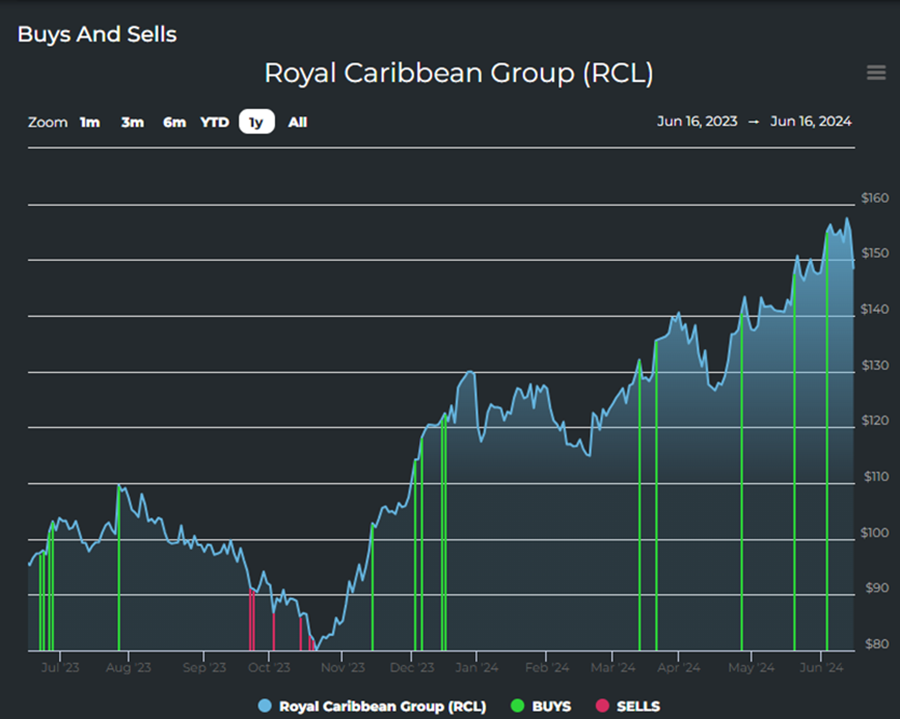

That’s the Big Money, and it’s flowing in. My system picked up 10 buy signals (green bars) since its last sell signal (red bars) in October of last year, with two buy signals in the last 30 days.

Source: MAPsignals.com

All of this leads to Royal Caribbean’s impressive Quantum Score of 81. That’s right in my optimal buy zone of 70 to 85.

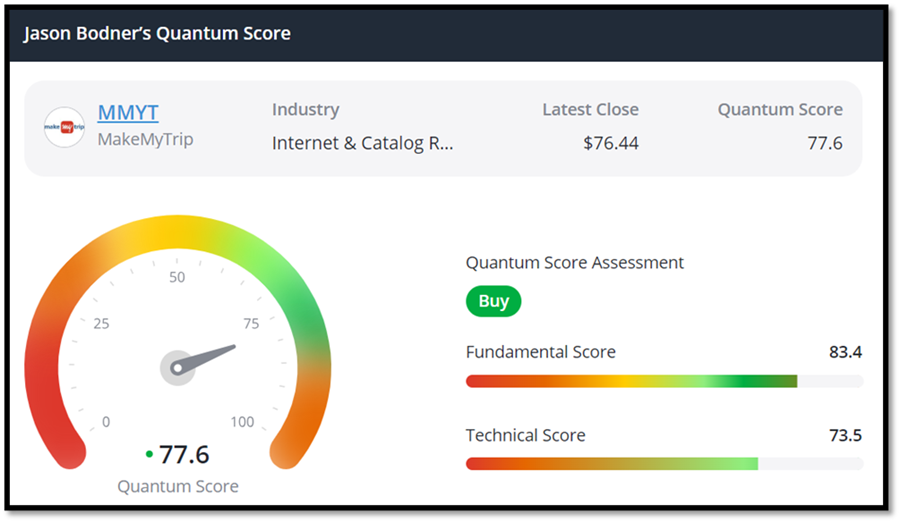

MakeMyTrip Ltd. (MMYT)

Source: TradeSmith Finance and MAPsignals.com

MakeMyTrip (MMYT) is a flight and hotel booking company based in India. Until recently, MMYT primarily operated in India, the U.S. and United Arab Emirates. However, it made a push in April to extend its services to over 150 countries.

The company provides customers “the best air ticket deals along with making the entire booking experience seamless and achievable with just a few clicks.”

Think Priceline, Expedia, and KAYAK but on a smaller scale, for now. That doesn’t stop MMYT from beating those companies in my system, though.

Once again, its Quantum Score rates a buy at 77.6, with equally strong technicals of 73.5. Even more impressive are the fundamentals at 83.4. This is a solid company that is poised to grow. It has everything going for it: good sales growth, profit margins, debt-to-equity ratio, and strong institutional ownership.

My system also picked up five Big Money buy signals in the last 90 days… and 0 sell signals since way back April of 2021.

Shares have nearly tripled in the last 12 months, and this company looks as if it’s going places. (See what I did there?)

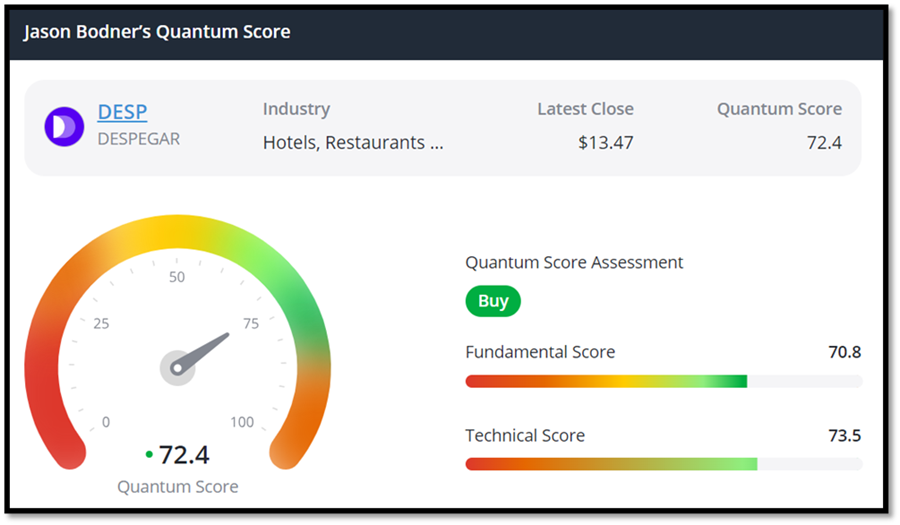

Despegar.com, Corp. (DESP)

Source: TradeSmith Finance and MAPsignals.com

One of the great things about my system analyzing more than 6,000 stocks is that it finds lesser-known companies that might otherwise go overlooked. Like Despegar.com (DESP).

Despegar also offers flight and hotel booking services but extends its offerings to car rentals, tickets, and packages.

I want to be clear that DESP is a very small stock with a market capitalization under $1 billion. It also has a high beta at 2.05 – which means it’s twice as volatile as the market. It’s not a stock for everybody.

The company itself is the leading travel technology company in Latin America, so it only makes sense that it recently teamed up with musical artist Shakira as part of its new marketing campaign. Though that’s not typically the music I listen to, she is known as the “Queen of Latin Music” and has sold more than 100 million records worldwide.

Despegar.com just made it to my optimal buy zone with a Quantum Score of 72.4, and both the fundamentals and technicals also rate in the low 70s.

Like RCL and MMYT, it has good one- and three- year sales growth, but I don’t love its high debt-to-equity ratio of over 600%. It also has less institutional ownership of 63.7%.

That said, my quantitative analytics system did pick up two Big Money buy signals in the last 30 days and seven in the last 90.

DESP is coming off of a pullback this past week, but investors are still up 92% over one year. I like a lot of what I see, but there are risk factors to consider.

We can all spot trends around us (like travel and tourism) and use those as starting points for investing research. It’s ultimately the data and analysis behind my system that pinpoints exactly where we should invest our money.

This powerful tool found me these three companies, and it can help you find your next investments, too. My Quantum Edge Pro subscribers get exclusive access to my Quantum Score widget right on TradeSmith Finance. They can access the score for all of the stocks in my system.

If you’d like to receive my stock recommendations and be able to score the companies in your portfolio and ones you’re interested in, click here to learn how you can join today.

Maybe your investments are helping fund your summer travel plans. I know mine did.

Talk soon,

Jason Bodner

Editor, Jason Bodner’s Power Trends