How I Missed Out On a 1,200% Gain!

Last week, I showed you how to use fixed-percentage trailing stops to protect your hard-earned savings… make more money over the long-run… and take all of the emotion out of investing, so you can sleep well at night.

Not bad for a simple tool that literally any investor can use, eh?

We got a lot of questions, so I’m excited about what I’m going to share today… including some actionable insight on 10 popular stocks and funds you might already own.

Ok, so last week, I mentioned that our more advanced TradeSmith trailing stops — which we call VQ-based trailing stops and Health Indicator trailing stops — can help you make even more money from your investments.

How much more?

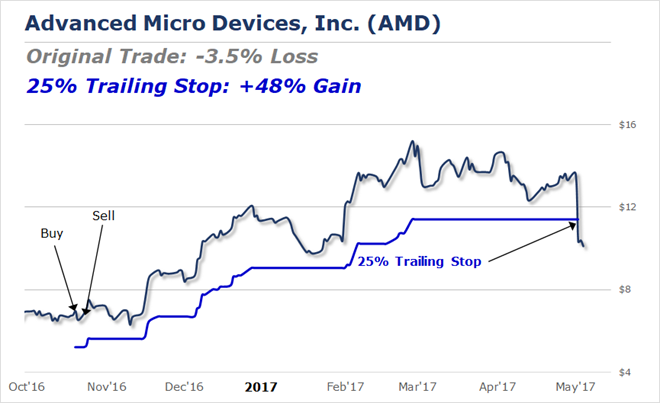

Remember that poorly timed investment in semiconductor company Advanced Micro Devices (AMD) I told you about last time?

And this chart where I showed you how using a simple 25% trailing stop would’ve turned that investment from a -3.5% loser into a 48% winner?

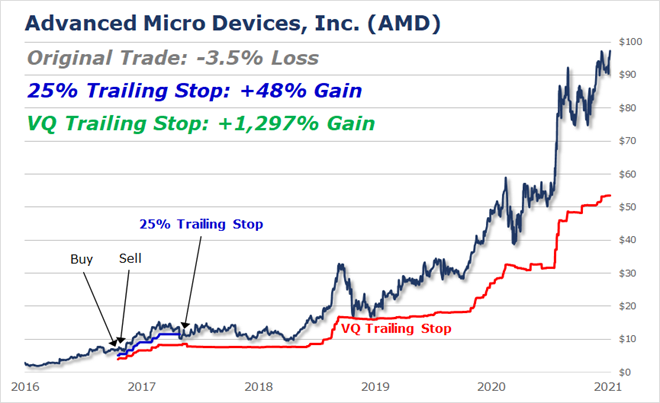

Well, if I had used a TradeSmith VQ-based trailing stop instead of a 25% trailing stop, I wouldn’t have sold for only a 48% gain.

In fact, I wouldn’t have sold at all.

I’d still be holding shares today… AND I’d be up more than 1,200% so far…

What makes our TradeSmith trailing stops so much better?

It all has to do with a special algorithm we created called the Volatility Quotient, or “VQ” for short.

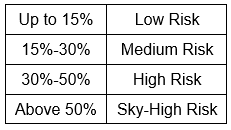

The actual math that goes into calculating the VQ for an investment is a little complicated. All you really need to know is that the VQ scans years of price history to tell you exactly how volatile, or “risky,” any individual stock, fund, or asset is likely to be.

The lower the number, the more stable the movement of that asset tends to be, and vice versa. Here’s how we classify different VQ levels at TradeSmith:

For example, AMD — the stock I just mentioned — currently has a VQ of around 44%, which we consider “high risk.” This tells us two important things:

- AMD could fall by up to 44% while remaining within a healthy, long-term uptrend. In other words, in this stock, moves of less than 44% are often just “noise” rather “signal.”

- If we’re going to own shares of AMD, we need to be comfortable risking up to 44% of our invested capital in order to maximize our potential long-term returns.

This explains why our VQ-based trailing stop would have performed so much better. The 25% trailing stop was smaller or “tighter” than ideal for a volatile stock like AMD.

Basing my stop on the VQ instead would have given the stock enough “wiggle room” to keep me from getting stopped out prematurely.

(By the way, No. 2 above is why we make a big deal about proper position sizing here at TradeSmith. Because we don’t want to limit our potential returns by using a “too tight” trailing stop on a volatile stock, we can reduce our risk by putting less total money into these positions. More on this another time.)

OK, I hope I’ve convinced you of how much better your results can be when you use a trailing stop that’s based on an asset’s unique VQ.

But what are the differences between our two proprietary TradeSmith stops? And how can you decide which to use?

Let’s start with the simpler of the two: the VQ-based trailing stop.

As you can probably guess, this trailing stop is based directly on an asset’s VQ.

Just like a fixed-percentage trailing stop, the VQ-based stop “trails” behind the highest closing price on or after your entry date. Only, instead of trailing behind by a fixed percentage like 25%, it trails by the current VQ of that asset.

However, unlike a fixed-percentage stop, the VQ-based stop is adaptive. You may have even heard me call it dynamic …

You see, our powerful TradeSmith computers calculate a new VQ each week for just about every asset we follow. (I say “just about” because the VQ calculation generally requires at least one full year of historical price data. This means some assets — like recent initial public offerings or stock spin-offs — won’t have a valid VQ yet.)

VQs don’t usually change too much from week to week. But the VQ-based trailing stop can widen its stop when the VQ of an asset increases, or tighten it when the VQ falls.

You can see this difference in the charts I showed you earlier. In the first chart, the 25% trailing stop only moves up or to the right. It never moves down. But the VQ-based stop in the second chart does sometimes move a little lower to accommodate a rising VQ.

Our Health Indicator trailing stops are a little more sophisticated. They’re part of our comprehensive Health Indicator system, which uses the VQ — alongside a handful of other algorithms — to tell you the overall health of an asset at a glance.

The Health Indicator system is designed to work something like a traffic light…

- Green means “Go”: Assets in the Green Zone are behaving normally and are in a healthy state. At TradeSmith, we usually consider these assets a “buy.”

- Yellow means “Proceed with caution”: Assets in the Yellow Zone have pulled back more than halfway toward their Health Indicator trailing stop but are not yet in an unhealthy state. These assets are usually a “hold.”

- Red means “Stop”: Assets in the Red Zone are in an unhealthy state. They have fallen below their Health Indicator trailing stop and are not behaving normally. These assets are usually a “sell.”

Like our VQ-based trailing stop, the Health Indicator trailing stop relies heavily on the VQ. But there are a couple of important differences.

First, the Health Indicator stop “trails” behind an asset’s highest closing price since it last became healthy (entered the Green Zone), rather than simply on or after your entry date like the VQ-based stop.

This means it’s always located roughly one VQ below a healthy asset’s highest close, no matter when you buy it.

Second, the Health Indicator stop will always use the lowest VQ calculated since that highest closing price.

This means the Health Indicator stop loss will tighten if the VQ drops, just like the VQ-based trailing stop. But it will NOT widen if the VQ increases.

Together these two differences make the Health Indicator trailing stop both a little more tailored and a little more conservative than our VQ-based trailing stop.

In other words, our Health Indicator trailing stops will generally help you stay invested in a healthy uptrend just as well as our VQ-based stops. But they will also allow you to risk even less of your hard-earned money to do so.

That’s a win-win in my book. And it’s why I believe our Health Indicator trailing stop is your best choice for most investments.

However, there are a couple situations where using a Health Indicator stop may not be possible.

First, our Health Indicator algorithm requires even more historical price data than the VQ. For most assets, it needs a full two years of trading history.

So, if an asset has a VQ but does not yet have a Health Indicator status, a VQ-based trailing stop is usually the next best option. (If an asset doesn’t yet have a VQ or a Health Indicator status, we typically recommend using a fixed-percentage trailing stop like I explained last week.)

The other situation where a Health Indicator stop isn’t your best choice is when investing in “unhealthy” assets in the Red Zone.

Our research shows buying these assets is usually a bad idea. Most of the time, you’ll be much better off waiting until an asset has started a new, healthy uptrend before buying.

However, there are times when it might make sense to deliberately “break the rules” and buy an asset in the Red Zone. There’s just one problem…

By definition, an asset in the Red Zone has already triggered its Health Indicator trailing stop by falling more than 1 VQ from its high. This stop can no longer protect you from further declines.

In this situation, a VQ-based trailing stop will still protect your capital until that asset re-enters the Green Zone again.

I want to leave you with one last thing…

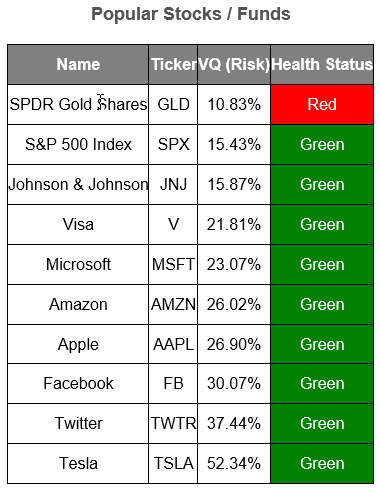

It’s a table of the current VQ and Health Indicator status for 10 popular stocks and funds.

If you like any of these stocks, you’ll know — at a glance — exactly how risky they are and whether they’re currently a buy, hold, or sell in our system…

As always, I’d love to hear from you. Send your questions and comments — about my recent Money Talks emails or anything else related to your financial life — to [email protected]. I’m not able to respond to every email, but I personally read every one.