7 Critical ‘Reopening’ Trends

At LikeFolio, we are laser focused on understanding consumer behavior.

That is how we were able to deliver such incredible opportunities to our members last year. We could see in March 2020 how the pandemic was impacting consumer behavior, way before Wall Street caught on!

We’re talking early bullish calls on Zoom, Chewy, Wayfair, and even Pinterest… all while Wall Street was panicking.

Now, more than 14 months later, America is (finally) beginning to reopen, and more big opportunities are set to emerge.

You see, consumer behaviors were changed over the past year in a big, big way.

Some of these “new behaviors” we will all be happy to get rid of (I’m looking at you, mask mandates).

But some of these shifts will become permanent because people actually enjoyed the change.

Knowing the difference between the two could be what makes or breaks our portfolios over the next 12 to 18 months.

Today, I want to walk you through seven of the hundreds of consumer macro trends I’ll be watching closely over the next three to six months.

Here goes…

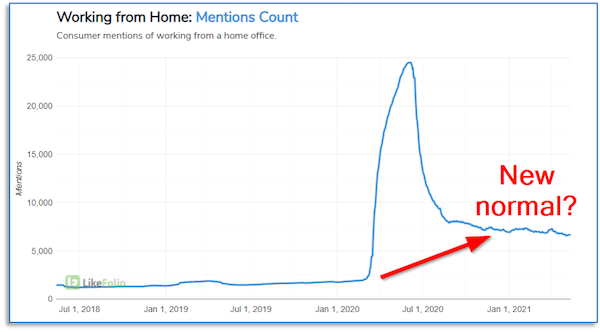

1. Working from Home

Perhaps the most defining element of the past year has been the shift from traditional office life to working from home.

Looking at the data here, it’s clear to me that this trend isn’t going away anytime soon.

The stabilization of work-from-home demand is occurring at levels more than 10x what they were before the pandemic.

This tells me that society really does see remote work as the “new normal,” which could bode well for technologies like Zoom Video Communications (ZM), Netgear (NTGR), Upwork (UPWK), and many others that enable workers to clock in from the comfort of their own home.

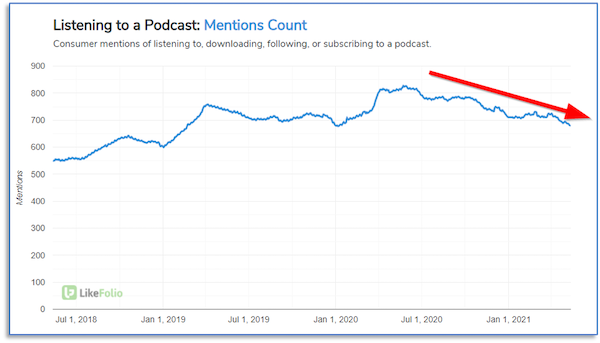

2. Podcast Consumption

People got bored last year, so they turned to streaming entertainment.

Podcasts benefitted, bringing in millions of new listeners and increasing the total listening time substantially.

But when I look at the LikeFolio data for podcast listening, I’m starting to see some yellow flags.

On a multi-year time frame, podcast demand is clearly in an uptrend. But as you can see from the chart above, consumers might be starting to reach the saturation point with long-form audio content.

This is one we’ll be watching extremely closely for potential impact on Spotify (SPOT), among others.

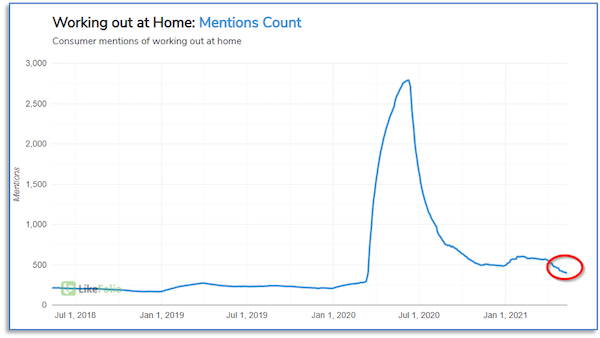

3. Home Gym Fitness

Peloton (PTON) and Nautilus (NLS) absolutely boomed over the past year as gyms closed and consumers searched desperately for ways to get in shape at home.

LikeFolio data was very early on this trend, so we are keeping a close eye on how it progresses as society begins to open back up.

While certainly not cause for alarm, that last little downtick in demand for working out from home is definitely worth keeping an eye on.

If it turns out that consumers are ready to head back to the gym, Planet Fitness (PLNT) could be a stock worth looking at.

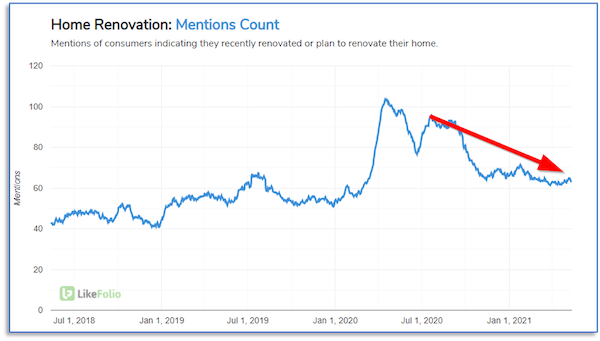

4. Home Renovation

I’m pretty sure every single person in America either moved, bought new furniture, or painted a room in 2020. We were stuck at home, and we were going to make the most of it.

Spotting this trend in March of last year is what led us to huge gains (over 1,000% at their peak!) on Wayfair. Incredible.

So, let’s look at the data now.

This one will be very interesting to watch over the next few critical summer months. There is no way we are going to see home renovation levels like we had last summer, but the question remains: Can consumers maintain elevated levels of demand for renovating as things open back up?

The answer could create big opportunities in Home Depot (HD), Lowe’s (LOW), and many more.

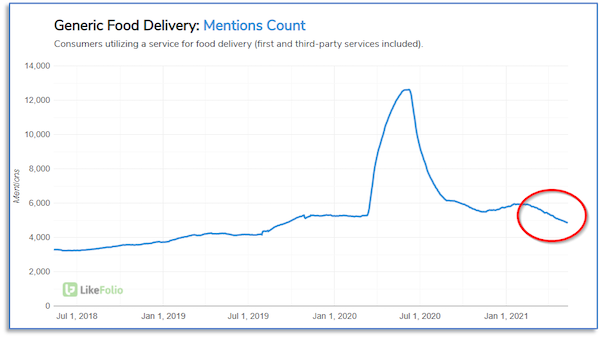

5. Meal Delivery

Just a few years ago, if you wanted food delivered to your house in most parts of the country your choices were pizza or pizza.

Now, thanks to DoorDash (DASH), Grubhub (GRUB) and UberEats (UBER), almost every restaurant in your town offers meal delivery.

But was America’s insatiable appetite for these services an act of lockdown desperation, or a permanent behavior shift?

Let’s look at the data.

This chart concerns me. A serious downtrend is underway over the past few months, and it looks poised to continue as the country opens up and people can be outside.

To be clear, I don’t think meal delivery is going by the wayside. People love it. It’s just that the pandemic-inspired growth rates are likely to prove unsustainable.

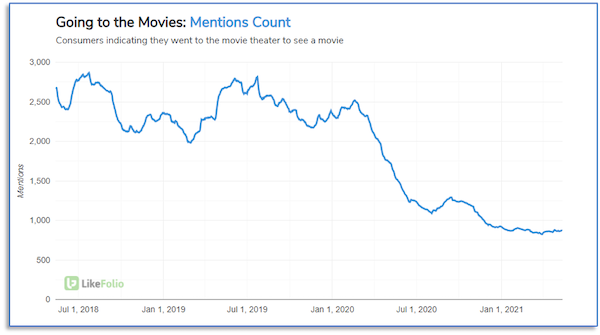

6. Going to The Movies

We look at demand for going to the movies as an indicator of overall consumer entertainment and nightlife demand.

Let’s get straight to the data on this one.

Ouch.

That’s what it looks like when an industry gets decimated.

We’ll be watching this consumer macro trend very closely over the next two months as we head into the typical summer blockbuster season for any shifts indicating the public is ready to get off the couch and head to the theater.

Positive signs that people are getting out and about in the evening could be key in spotting opportunities on AMC (AMC), Yelp (YELP), and restaurant chains like Darden (DRI).

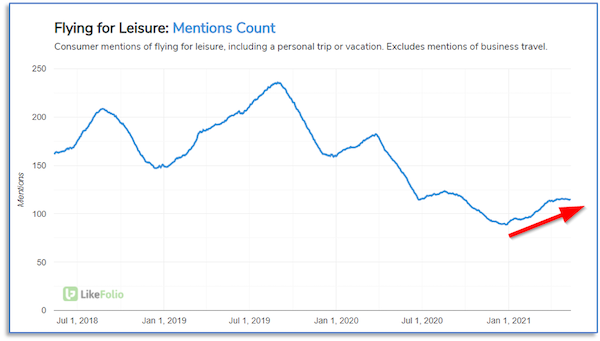

7. Leisure (and Business) Travel

Obviously, travel trends were completely upended over the past year.

But I’m seeing some really positive indications that the American consumer is ready to get back out there and explore.

Let’s take a look at the number of people talking about booking a flight for a vacation.

That small but consistent uptrend so far in 2021 is promising.

We’ll be watching this trend like a hawk over the next 30 to 90 days, as the implications for airlines like Southwest (LUV) and hotels like Hilton (H) could be massive.

Summary: Watch the Data!

I could talk consumer trends all day, every day.

The seven macro trends I’ve just shared are some of the most popular topics we cover, but really are just the tip of the iceberg when it comes to the hundreds of macro trends we are tracking on a daily basis.

We’ll continue to watch the data come in on all of these trends as the country reopens, so that we can better understand what “normal” will be like… and how we can get ahead of Wall Street in identifying the huge investment opportunities that will come from it.

Andy Swan,

Founder, LikeFolio