Don’t Forget About One of the Most Important Rules of Trading…

When I was little, my grandmother taught me how to fish. Every weekend in the summer, I begged my parents to drop me off at the family farm so I could spend time with her at the lake.

My grandmother was a tenacious woman, and she passed along two truths of fishing she learned through experience:

- Catfish love frozen hot dogs.

- Once you hook a fish, keep the slack out of the line.

I’m not sure that frozen hot dogs can be applied to trading and investing, but keeping slack out of the line certainly can.

As head of research at LikeFolio, I have a front-row seat to seeing how this premise of pulling back when you detect slack is how our members raked in major profits last week during company earnings.

Spotting Slack in the Demand Line

At LikeFolio, we are constantly scanning for slack in the lines of companies we track. Even companies that have been major winners.

“Slack” can look like weakness in consumer mentions of a product or service provided by a publicly traded company.

When we spot this weakness, it’s time to assess the situation. Has the stock gotten ahead of itself? Is a pullback in store?

Last week, we detected some major slack in one of our largest winners to date: Zoom Video Communications (ZM).

How LikeFolio Data Predicted a Major ZM Pullback

Zoom has been on our radar for years.

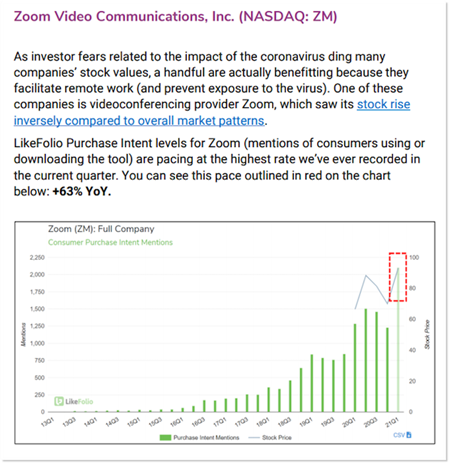

In fact, we featured ZM on a MegaTrends report just before the pandemic-induced lockdown took hold and remote work exploded.

Seriously.

Check out this excerpt from our March 2020 MegaTrends report, “Powering the Evolving Workplace,” when the consumer data was screaming at us.

Zoom demand was exploding, alongside major shifts in consumer behavior. More consumers were working from home than ever before.

And it was only March 1.

Since then, Zoom shares gained as much as +400% in value.

That’s not a typo.

But part of investing is understanding when expectations get too high.

That’s why real-time consumer data is so powerful.

And it’s how members profited last week on Zoom’s major earnings-related move to the downside.

Consumer Macro Trends Shift our View of Zoom’s Favor

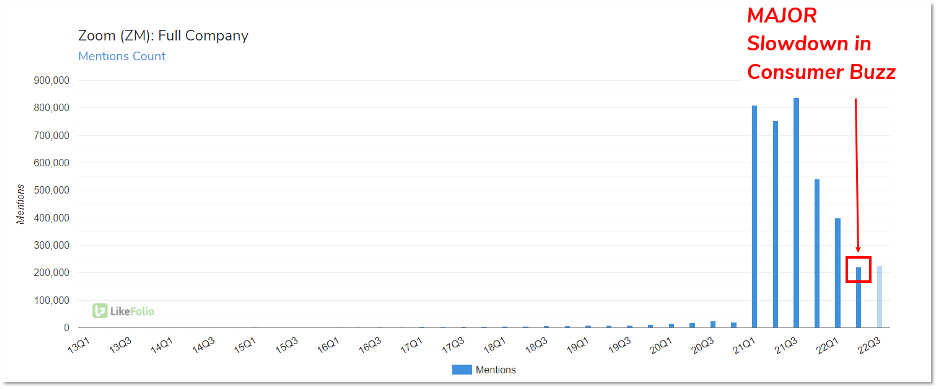

As we previously highlighted, Zoom buzz was dropping… fast.

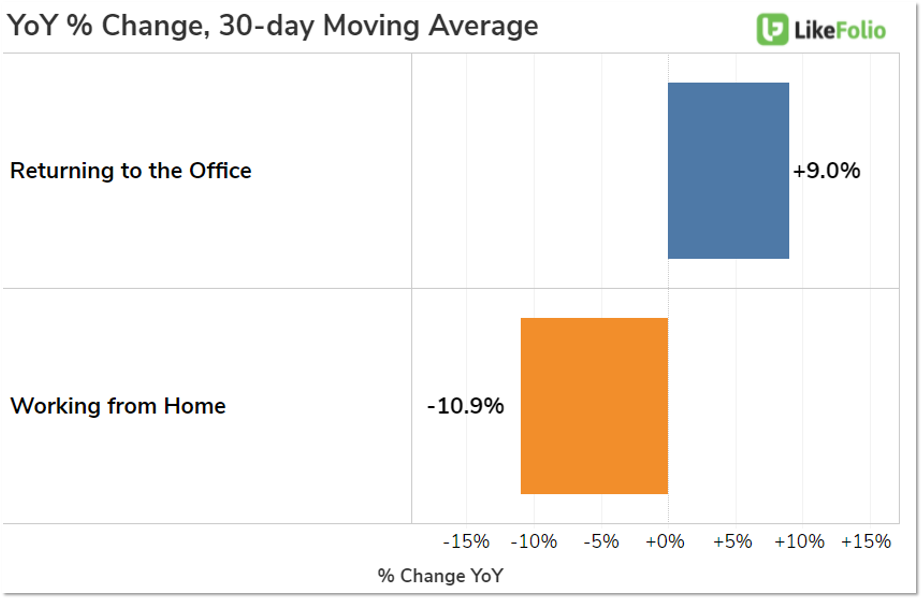

Not only were consumer mentions of Zoom products and services waning, major consumer macro trends that previously propelled Zoom were swinging in the other direction.

The pandemic-fueled blaze was dimming.

More employees were returning to the office, and fewer were working from home.

Even though mentions of working from home remained significantly higher versus 2019, this growth was slowing down.

Slack was building in the line.

This is extremely valuable information. Especially when macro trends line up with company-specific consumer data.

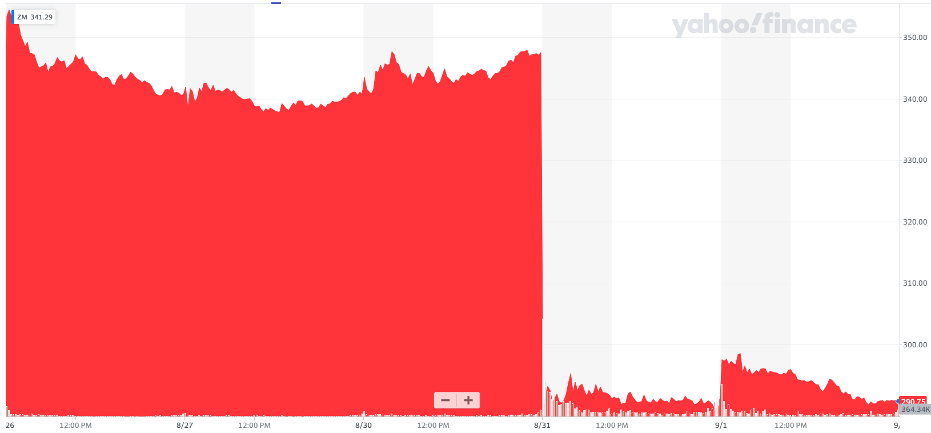

These factors informed LikeFolio’s bearish earnings call ahead of Zoom’s 22Q2 Earnings Report. And, boy, was the data spot on.

The result?

ZM shares plummeted after the company posted slowing growth and revenue numbers that just met expectations.

The key takeaway?

By leveraging real-time consumer data, investors can detect when it may be time for a stock to pull back.

And on the flip side, the same data can inform investors when it’s time to jump back in.

That’s what we’re watching for now.

When we feel a tug on the line, members will be the first to know.

We’re always diligent in heeding consumer data… and Grandma’s advice.

Megan Brantley

Head of Research, LikeFolio