This Stock is Breaking the Mold

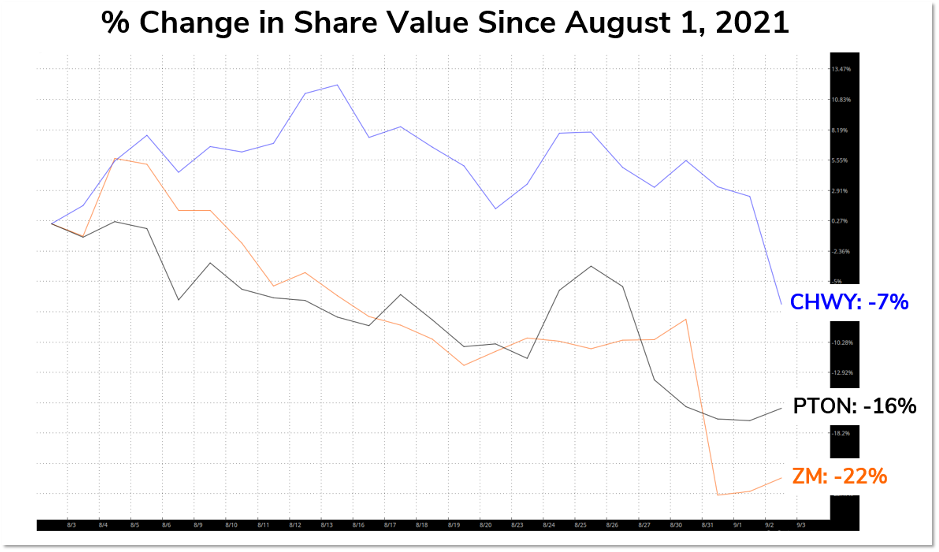

In the past two weeks, we’ve watched major pandemic winners fall from grace.

ZM, CHWY, and PTON shares plummeted after earnings failed to dazzle investors.

You can see each company’s relative stock performance over the last month on the chart below.

Each of these companies benefited from major shifts in consumer behavior in the past year and a half. Think about it — how many video conferences, home workouts, and e-commerce orders have you placed or participated in since the pandemic set in?

Probably too many to count.

But now, data shows things are changing. Consumers are returning to the office, the gym, and physical stores.

Does this mean ALL pandemic-related winners are doomed?

Not so fast.

Spotting Outliers

This is where the power of real-time consumer data comes into play.

At LikeFolio, we’re constantly scanning for opportunities when data reveals consumer behavior that the market is not expecting.

When we examined names that benefited from COVID-19 lockdowns, many datasets tell the same story as Chewy, Peloton, and Zoom Video Communications: slowing growth and an uncertain outlook.

But analysis suggests one company that benefited from pandemic-related tailwinds is just getting started.

In fact, this strength in consumer demand is what caught our eye when we featured the little-known company on our Next-Gen Health Services MegaTrends report in April.

What company are we talking about?

Hims & Hers (HIMS)

HIMS is an alternative health service provider that bypasses the traditional “insurance” middleman by serving its audience directly, at a reasonable price.

The company targets a younger audience that increasingly seeks convenience, simplicity, and affordability.

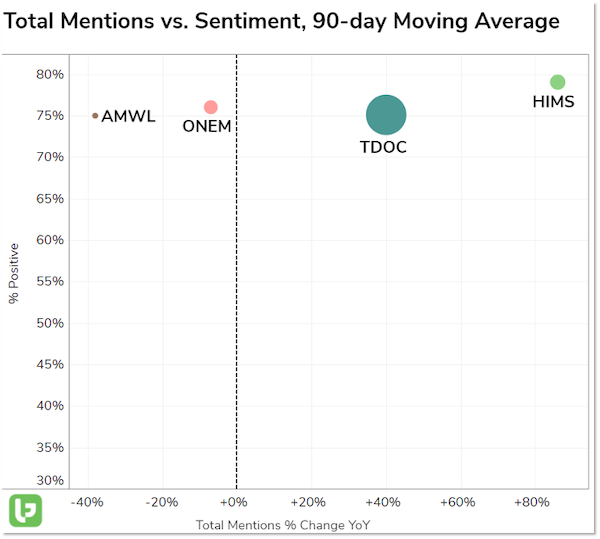

While there are many players in the direct-health market, data shows that HIMS boasts the happiest consumers and the highest growth rate versus peers in the space, including Teledoc Health (TDOC), One Medical (ONEM), and Amwell (AMWL).

The number of consumers talking about HIMS has actually increased on a YoY basis, building on success achieved during lockdown itself… an impressive feat.

What is the company doing right?

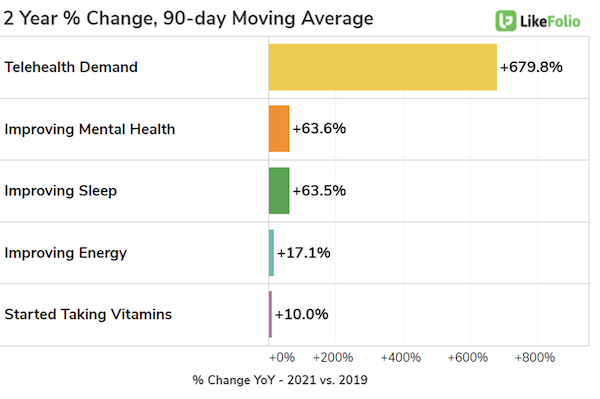

It’s tapping into major consumer trends.

Check out some of the most quickly growing trends we track in the health and wellness space:

Hims & Hers not only provides health access directly to consumers, but is focusing on areas that its audience base cares about, including improving mental health, energy, and sleep.

HIMS’ focus on mental health propelled the company’s revenue and subscriber growth in Q2, and the company is expanding services to other high-demand areas, including dermatology.

However, the market doesn’t seem to have caught on yet.

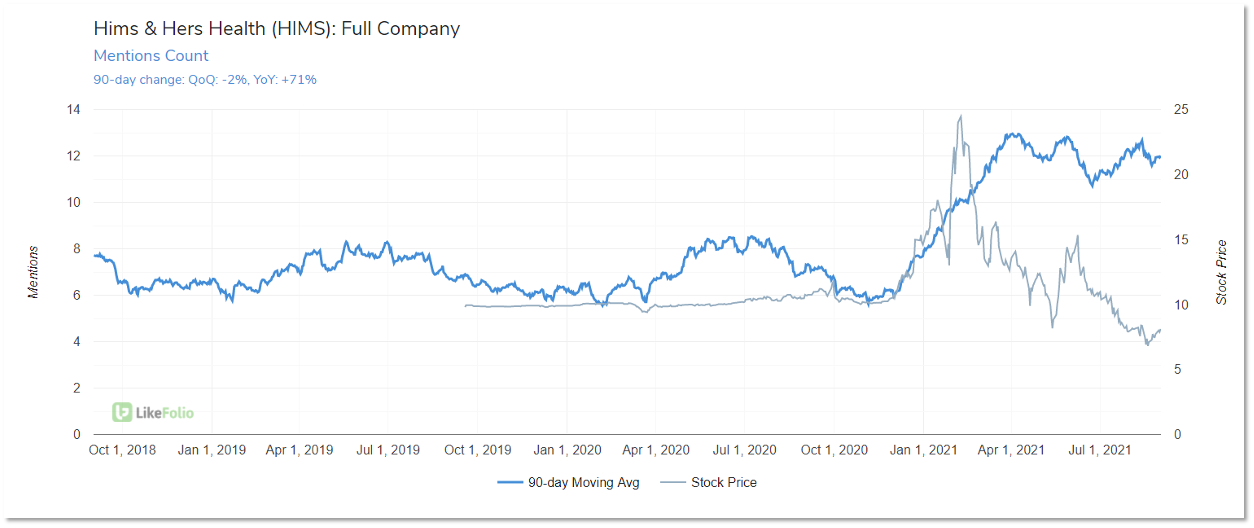

Check out HIMS mention volume below, alongside its stock price.

Shares are trading well off all-time highs while YoY growth continues. This is a classic example of what we call “divergence.”

All of these factors — outperformance versus peers, major macro-trend growth, and rising buzz — provide a major edge for investors.

HIMS investors can feel confident in existing positions. And others can use this data to inform a potential entry.

We like the trajectory for this company. And we like it even more that the market seems unaware.

When we spot opportunities like these, our members are the first to know.

Andy Swan,

Founder, LikeFolio