Bitcoin is Back 😉

LikeFolio data predicted Bitcoin’s resurgence (BTC)

What’s the first word most people think of when they think of cryptocurrency?

Volatile.

Seriously.

At a conference this week, that was the top response when the question was asked — even among individuals living in the world of finance and investing.

But at LikeFolio, we’ve remained consistently bullish on Bitcoin (BTC/USD) and the crypto market at large since the steep decline from $60,000 earlier this year.

How are we so confident?

Because we’re armed with real-time consumer data. And this data told us two important things:

Bitcoin demand wasn’t lining up with price activity

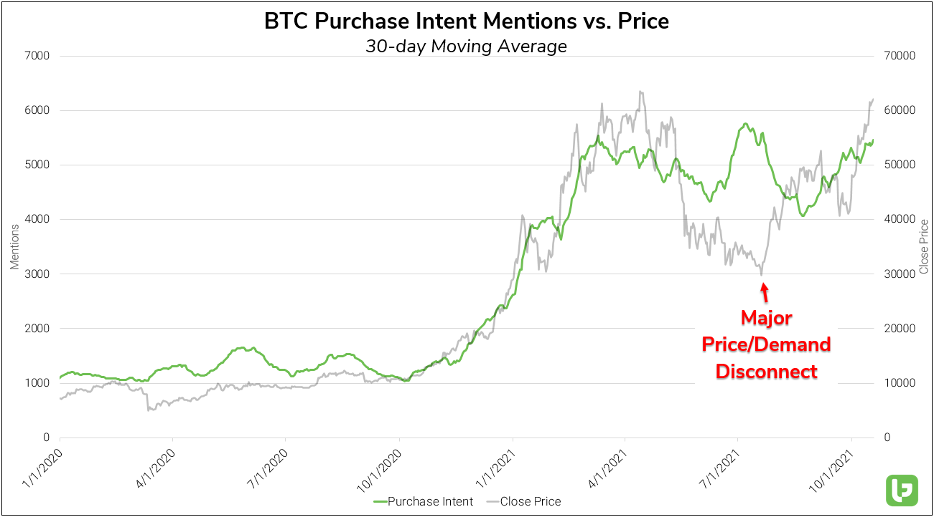

Check it out on the chart below, showcasing how underlying consumer demand for Bitcoin failed to pull back in tandem with the price.

Over time, Bitcoin Purchase Intent Mentions have tracked closely with the price of the asset itself, but a historically significant disconnect manifested in June and July 2021.

Bitcoin corrected by more than -50% in a matter of months, briefly trading below $30,000 in July. Yet demand for BTC surged to a new all-time high in the same time frame.

Consumer interest in cryptocurrency remains extremely high

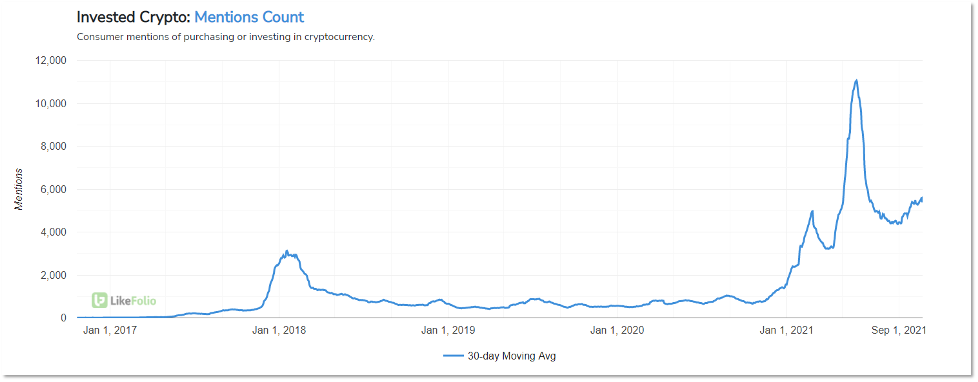

You can see mentions of consumers investing in cryptocurrency trending higher: more than +700% YoY, and higher on a QoQ basis as well.

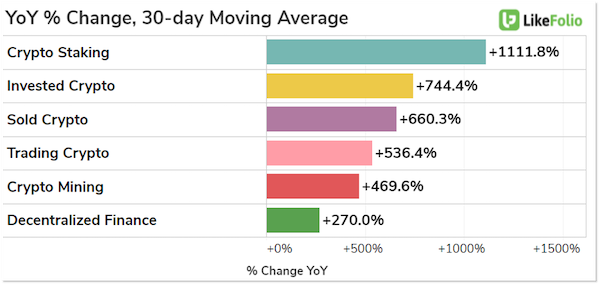

In fact, every crypto-related trend we track is recording at least a triple-digit increase in mention volume.

Access to major consumer macro trends alongside company- or currency-specific data creates an extremely powerful combo.

With BTC now trading above $60,000 once again, this chart stands as a testament to the predictive power of LikeFolio’s social data…

Ignore at your own risk!

Andy Swan

Founder, LikeFolio