3 Stocks that Will Win Christmas

Consumer Spending is Heating Up

Every week at LikeFolio we prepare a powerful earnings preview. This report features each name in our coverage universe scheduled to release earnings that week, alongside a proprietary score generated from LikeFolio’s real-time consumer Buzz, Demand, and Sentiment.

And recently, a theme has emerged.

Consumer demand looks strong!

Last week, nine out of 16 companies reporting logged significant demand growth (mentions from consumers completing a purchase): names like American Eagle, Gap, and Nordstrom.

The same earnings week a quarter ago, only one out of 12 companies featured an uptrend in demand growth. In fact, nine out of 12 logged a downtrend in consumer demand.

So this recent demand strength is a serious flex: The consumer is back.

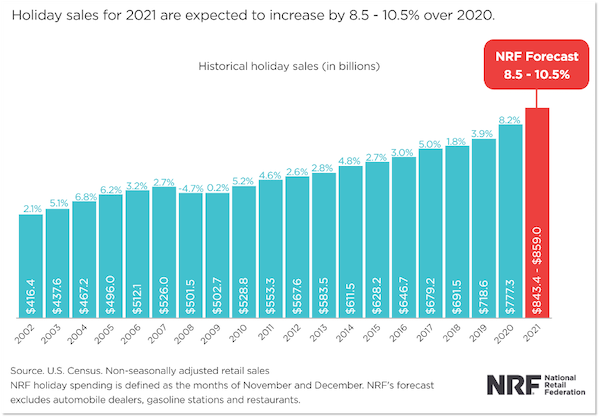

The National Retail Federation is projecting the highest holiday retail sales on record.

But recent earnings reactions reveal a double-edged sword

While consumer demand is palpable, company margins are being squeezed by increased costs associated with labor and supply chain stressors, from manufacturing to delivery.

Translation: Companies that effectively manage inventory, costs, and pricing power are being majorly rewarded.

Meanwhile, companies that can’t manage these headwinds effectively are feeling the burn…

We’re looking at you, Nordstrom and Gap, two names hit hard by rising costs associated with attempts to meet consumer demand and navigate supply challenges… and whose shares are trading accordingly.

Gap noted, “While we entered the third quarter with growing momentum, acute supply chain headwinds affected our ability to fully meet strong customer demand.”

But not ALL companies struggled to manage these impacts.

Here are three companies on our watchlist set to thrive this holiday season…

1. Macy’s (M) posted a strong 21Q3, with a comparable sales increase of +8.7% YoY and surprising gross margin improvement, driven by strong regular-price selling, fewer markdowns, and leaner inventory.

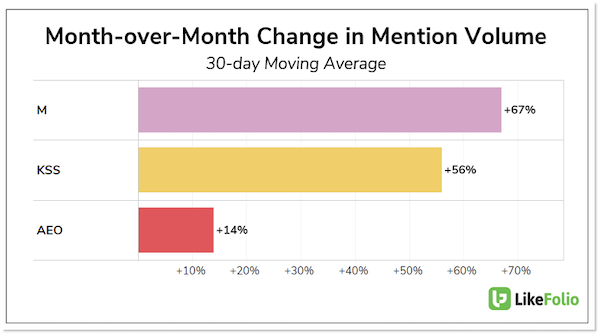

LikeFolio data shows continued Buzz growth for Macy’s: +67% across its suite of brands. In addition, Macy’s online partnership with “R” is getting traction.

2. Kohl’s (KSS) reported a sales increase of +16% YoY on its most recent report, driven by strong demand for clothing and makeup. The company also expanded its gross margin by effectively managing inventory and pricing strategies.

The company is leveraging high-end brand partnerships, including Sephora, Tommy Hilfiger, and Calvin Klein.

Not only do these brands operate at a higher price point, but they are ushering in new customers. Kohl’s reported that more than 25% of its Sephora shoppers are new to Kohl’s.LikeFolio data shows Kohl’s mentions have continued to gain steam in the last month (+56%).

3. American Eagle (AEO) also beat investor expectations on its most recent report, with revenue growth of +24% YoY, and gross margin expansion driven by higher full-priced sales, reduced promotions, and controlled costs.

The company is leveraging tiered pricing options for consumers, and so far, the consumer isn’t balking: “When we think of pricing and we look at our tiered price points, we ensure that our investments make sense. So, regarding the higher price points, as we learn, we will scale and we’ve seen no resistance at this stage, which gives us some runway for the future.”

LikeFolio data shows continued demand growth for AEO in the last month: +14%.

Bottom line: Companies that can effectively manage inventory and pass along price increases to the consumer are set to thrive in a potentially record-setting holiday season.

We’ll be keeping an eye on consumer Buzz, Demand, and Sentiment in real time to see where consumers are shopping the most, and if those companies are meeting expectations.

These next few weeks should be fun.

Megan Brantley,

Head of Research, LikeFolio