5 Reasons Penn National Gaming Is Playing with a Full Deck

It may be time to double down on Penn National Gaming Inc. (PENN).

Let me set the table for you.

As the casino industry recovers from the pandemic, some operators are growing faster than others. PENN’s rejuvenated brick-and-mortar footprint and emerging digital presence have the company in a great position to increase profits and outperform expectations.

Now, it’s true that we got bullish on PENN last summer. Admittedly, the stock hasn’t done well since.

But as Kenny Rogers sang in “The Gambler,” “You’ve got to know when to hold ’em / Know when to fold ’em.”

Based on the data we’re seeing, this is no time to fold ’em!

Penn National Gaming is still well worth the gamble for the following reasons:

1. Demand Growth Is Forward-Looking… and Yet to Be Realized in the Stock Price

When Penn National provided its first-quarter update, we knew we had a good bet on our hands. That’s because the prevailing uptrend in consumer demand that we’ve been tracking was confirmed by the results and commentary.

Revenue jumped 23% to a record $1.56 billion, which is an incredible turnaround from the days of shuttered casinos and cancelled sporting events.

But won’t inflation hurt a discretionary industry like gambling?

Based on Penn’s record sales and recent commentary from Draft Kings’ CEO, the company appears to have a rather inflation-proof business.

When you have a passionate, loyal customer base like casino and sports betting operators do, the product is akin to those of other “sin stocks” like alcohol or cigarette companies. Economic weakness has little effect on demand.

LikeFolio’s proprietary measure of consumer demand, Purchase Intent (PI) mentions, began moving higher soon after the stock hit its March 2021 peak of $142. Like Moses parting the Red Sea, the divergence has accelerated in 2022.

Check this out.

The rise in PI mentions is due to a combination of pent-up consumer demand for casino trips and the growing availability of legalized sports betting. Penn National checks both boxes in a big way.

The company operates 44 casinos in 20 states in the Northeast, South, Midwest, and West. Most are under the popular Hollywood Casino brand.

It also operates 24 retail sportsbooks and offers mobile sports betting in 12 states. Penn National has captured an 18.6% share of the U.S. retail sportsbook market, excluding Nevada.

This hybrid model allows PENN to capture both ends of the gambling funnel (digital and physical).

And that’s a good thing, because…

2. Casino Traffic Is Back

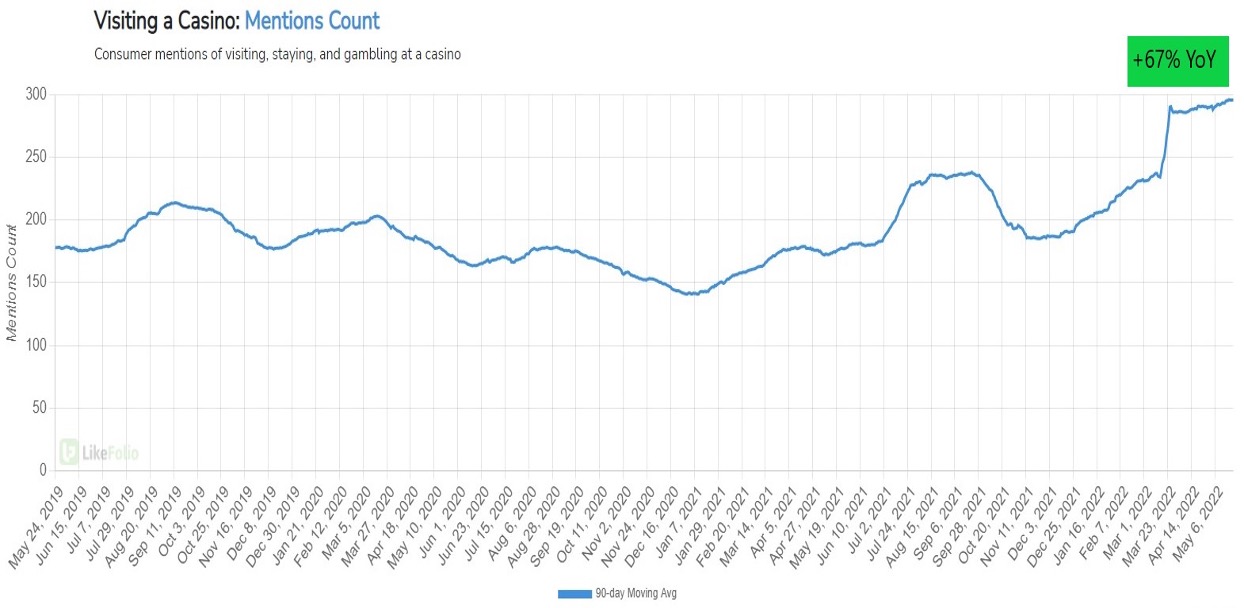

As the chart below shows, mentions of visiting, staying, or gambling at a casino are up 67% from last year.

Even better, PENN management noted that core customers are returning and the younger customer demographic is growing.

With Penn’s casinos hopping again, so too is its legacy database of more than 25 million members.

Penn’s mychoice casino loyalty program is forming deeper connections with this customer base. 350,000 people registered for mychoice in Q1, gaining access to casino rewards and lodging perks in conjunction with Choice Hotels.

3. Sports Betting Is Hot

According to the American Gaming Association, legal sports betting is live in 30 states plus D.C., and sports betting is legal but not yet up and running in an additional five states. Three more states, including the massive California market, have active legislation around in-person or mobile sports betting.

So, with sports stadiums and arenas filling up again, the hype is building.

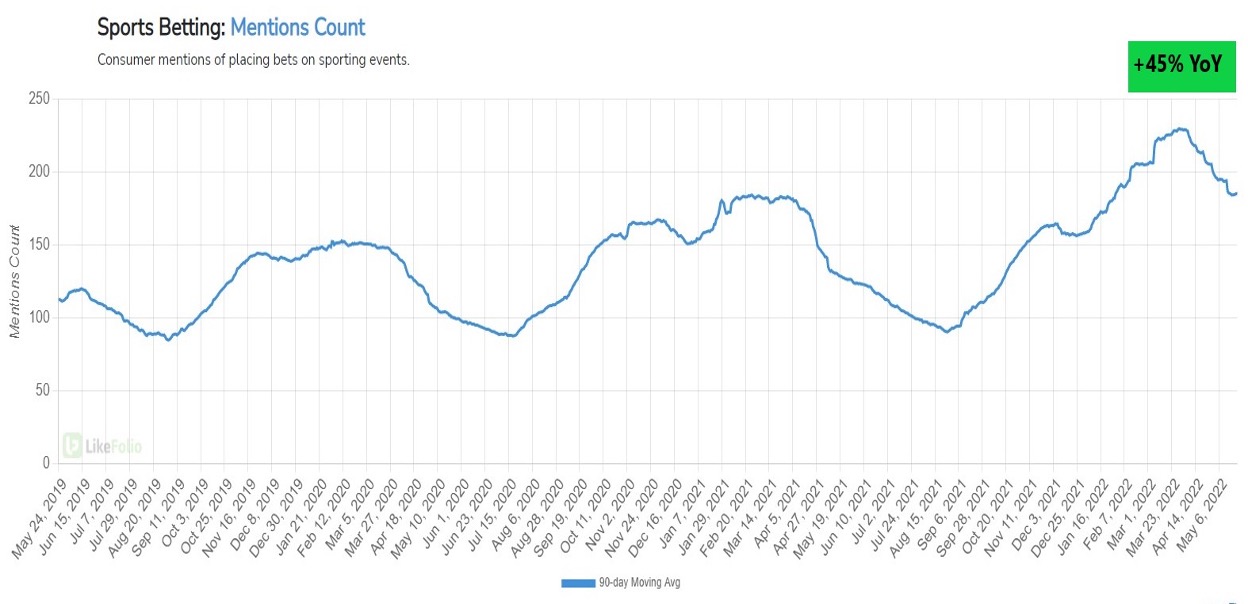

LikeFolio has been tracking consumer mentions of betting on sports events for the past decade. The buzz has reached its highest level since the pandemic began. And with legislative momentum behind it, it appears destined to climb to new highs.

We are further encouraged to see that the trend is consistent across all major sports. NBA, MLB, NHL, and soccer betting mentions are each up 50% or more YoY.

Plus, the NFL season is right around the corner, so things are shaping up for it to be a lucrative period for PENN.

How are other online sports betting players doing?

Purchase Intent mentions are also up at DraftKings Inc. (DKNG) and FanDuel parent Flutter Entertainment (PDYPY). Ditto for horse-racing specialist Churchill Downs Inc. (CHDN).

But not up as much as PENN.

Still, it’s good to see demand up among the peer group. Note that PENN has a 10-year strategic partnership with DKNG covering seven states, so they’re competitors but also running the same race.

4. PENN Is Attracting a Younger Crowd

In addition to the mychoice program, Penn’s digital database is booming. Since its digital platforms went live, more than 1 million people have registered. Sign-ups were up across all age segments in Q1.

But one segment stood above the rest: Digital signups were up 29% among 21- to 34-year-olds, the most of any age group.

Penn’s data around drawing younger visitors is consistent with the buzz growth we are seeing on social media.

Yes, social media is open to all. Aunt Carol keeps reminding us of her pending friend request.

But it’s notoriously popular with the younger generations, who we think are driving the chatter around PENN more than seniors playing the penny slots.

The sports betting crowd naturally seems to be on the younger side, since they are growing up alongside this entertainment form.

On March 17, when word broke that Brooklyn Nets superstar Kyrie Irving was dealing with an injury, it was just a cherry on top of a strange season due to issues with ever-changing vaccine mandates.

Social media was buzzing. More specifically, sports enthusiasts following Canada’s top sports betting app theScore went bonkers! Many felt the Nets right then and there became the dynasty that never was.

Yes, Kyrie ultimately made it back for the playoffs. But blaming a lack of continuity, the team once favored to win it all was swept in the first found. Bettors were all over it.

What does this have to do with PENN?

First, Penn National acquired theScore for $2 billion last year. Since its launch, it is Canada’s most downloaded sports betting app.

Second, the tweet caused a spike in consumer mentions that ignited a lot of interest in theScore and Penn’s other online and onsite betting platforms. It’s been all uphill since.

We think PENN’s fresh focus on 20- and 30-somethings is driving this buzz.

In reference to this newfound wave of younger customers, the CEO highlighted a plan to “reimagine our properties and offerings to enhance the entertainment appeal to this steadily growing segment of consumers.”

5. Barstool Sports Will Soon Be Fully Owned

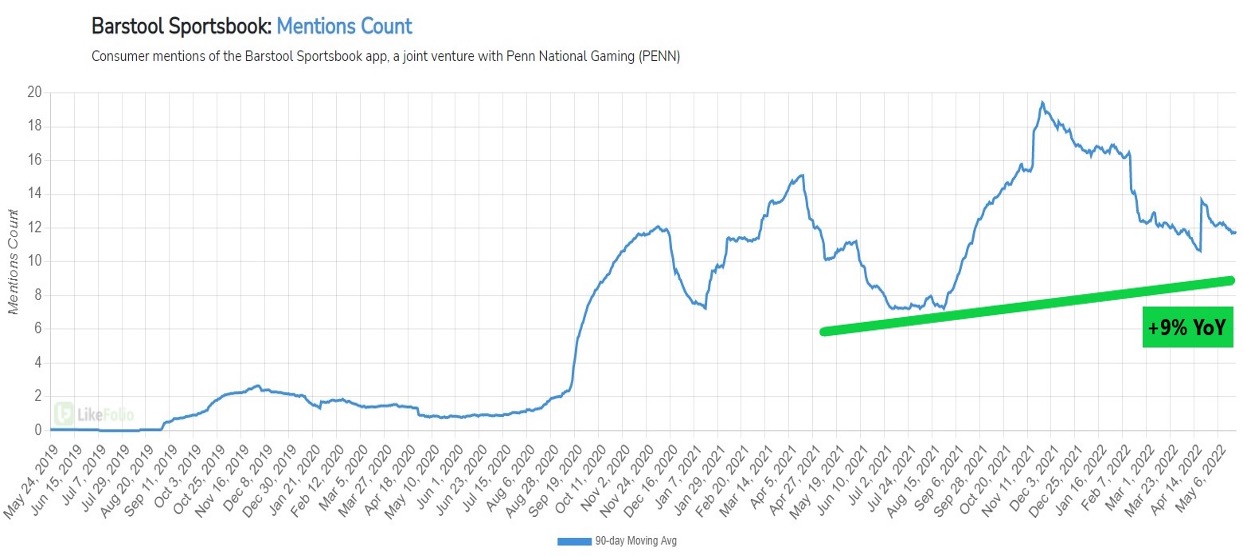

When Penn National formed a strategic partnership with Barstool Sports in February 2020, it gained a 36% stake in the business and access to 66 million sports nuts. Barstool agreed to exclusively promote Penn’s land-based and online casinos as well as its sports betting products.

The Barstool deal has been fire for PENN and is stimulating database growth.

In the first quarter of 2023, the put/call trigger date kicks in. This is when Penn will own the rest of Barstool—and a lot of value will be unlocked for the company and investors. Synergies will start to be fully realized. Barstool will also soon be integrated with the Score app. This combined with the introduction of new features is expected to boost customer acquisition and growth across the U.S. and Canadian markets.

Leaving no stone unturned, Penn is also building out its Barstool-branded sports bars. It opened up locations in Philly and Chicago, and both locations are reportedly seeing strong demand.

Expanding into live sporting events is also on the agenda. Barstool Sports provided an alternative commentary to the May 7 Canelo vs. Bivol boxing match in Las Vegas, a taste of its ambition in live events.

Penn National is taking a different approach to building out its digital ecosystem than peers and the results are showing. It is:

- Effectively identifying cross-sell opportunities across the ecosystem

- Investing in technology by building an in-house, state-of-the-art media and betting platform and an iCasino content studio

As part of this strategy, “3 C’s” technology (cordless, cashless, contactless) is being rolled out at more casinos. Driven by the mywallet app, the offering is gaining traction and expected to enhance efficiency, customer service, and marketing opportunities.

Bottom line: Most investors are calling it a night on PENN, but the action is just getting started. We are staying at the tables.

Summary: PENN Is the Best Bet in the Gambling Space

It is vital to be an omnichannel player in any consumer-focused market these days. Penn National Gaming is just that to the resilient gaming industry. It is a leading U.S. casino operator with a burgeoning online sports betting business.

Both in-person and online, casino and sports betting trends are heating up. We love that this is being led by younger consumers, whose growing interest is breathing new life into Penn National, not to mention record revenue.

There is a disconnect not only between consumer trends and the share price trajectory but also with regard to the growth that lies ahead. The stock is down approximately 80% from its peak and trading at 11x the consensus FY23 earnings estimate. There is $575 million left on an active buyback program.

In the volatile gambling space, PENN is a value well worth a roll of the dice.

Andy Swan

Founder, LikeFolio