With Food Prices Up 10.8% YoY, Mentions of This Discount Club Have Increased 50%

Last weekend was Mother’s Day, and, as the eldest daughter, I inherited hosting responsibilities for this special event.

On Sunday morning I woke up from my post-Derby slumber and cantered out to pick up supplies (all of my mom’s favorite foods and beverages).

When I sent these libations down the conveyer belt, I was shocked when the cashier read my final tally.

Wowza, groceries are expensive, I thought.

And I’m not alone.

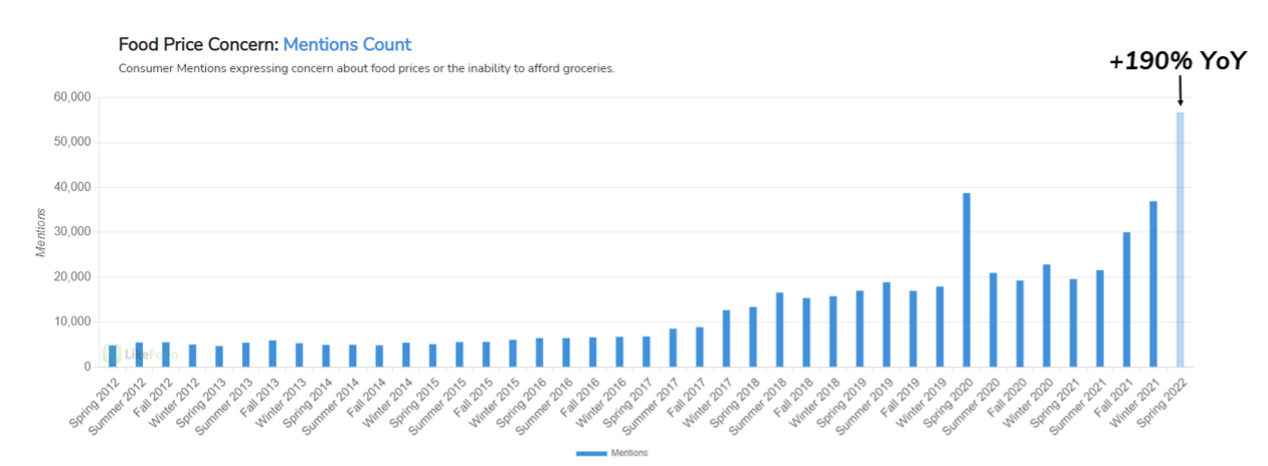

Consumer mentions of rising food prices are establishing new all-time highs, currently pacing +190% YoY.

At LikeFolio, when we see a trend like this, we begin searching for ripple effects.

When wallets get stretched, consumer behavior begins to change. This hurts many companies — but it benefits others.

Bulk Retailers Benefit from Value-Seeking Consumers

In this scenario, it means that many consumers are looking for bulk savings. This logic tracks.

Consumers can make fewer trips and buy higher quantities at lower prices.

We saw this “Costco Effect” unfold in 2020 (the last time food price concerns spiked to this degree).

And now it’s happening again. Except this time, a different company is stepping up to the plate that the market hasn’t caught on to yet.

Based on LikeFolio real-time consumer insights, a relative newcomer is funneling in value-motivated shoppers in droves.

BJ’s Wholesale Club (BJ) Buzz Is Rocketing

BJ’s is a membership-only bulk retailer akin to Costco, with a much smaller footprint: 215 clubs in 16 states.

But it is expanding.

In March, BJ’s announced the first wave of new club openings, located in Warwick, Rhode Island; Lady Lake, Florida; Canton, Michigan; and Greenburgh, New York.

And on its Q4 earnings report, BJ’s stated 2021 was “the best year in the company’s history.”

Glowing financial results, which beat earnings expectations, were underpinned by membership base expansion.

And according to LikeFolio data, this growth is still underway.

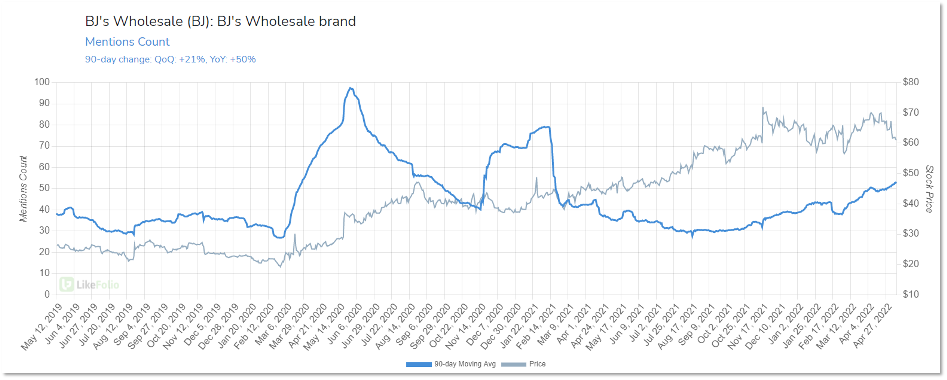

Mentions data shows the buzz surrounding BJ’s Wholesale is gaining traction, trending 50% higher on a YoY basis.

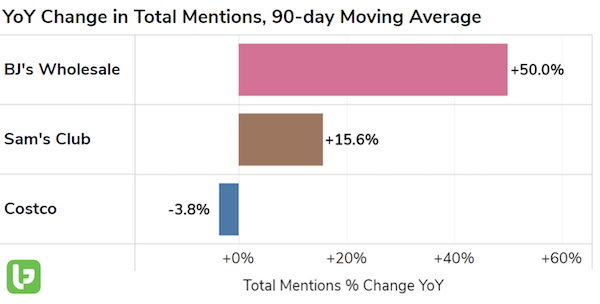

In fact, this buzz growth rate versus that of more established peers is a sign in the LikeFolio universe that BJ’s is gaining market share from its competitors.

As you can see, BJ’s is significantly outpacing Costco and Walmart’s Sam’s Club from a mention growth standpoint.

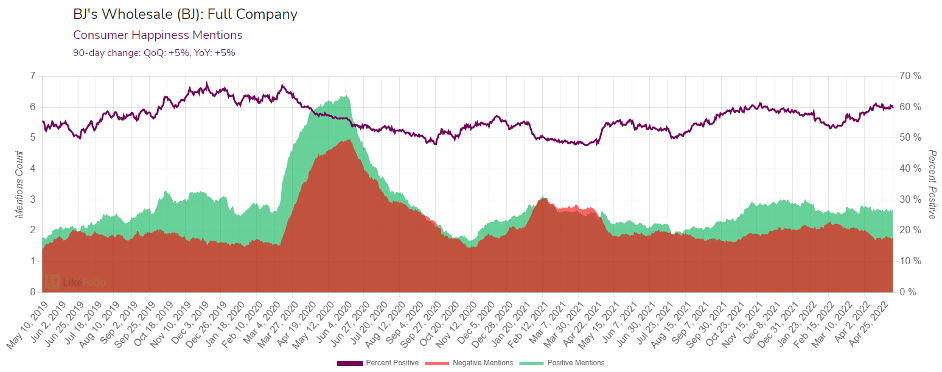

Consumer Happiness, while not the best in the LikeFolio universe at 60% positive, is making good strides forward: +5% YoY.

BJ’s is expected to report earnings on May 19 before the opening bell, and it currently has an exceptional earnings score of +90.

There could be some near-term strain with inflation, supply chain challenges, and talks of food shortages related to the Russia-Ukraine war, but as more people adjust their grocery spending habits and make bulk purchases to lower their overall costs, companies such as BJ’s, Costco, and Sam’s Club should benefit.

Reports suggest wholesale clubs are also capitalizing on rising gas prices by offering extra discounts at the pump to attract more shoppers (and add more memberships to the bottom line).

“[Gas price] cuts [are] so steep that the chains are effectively losing money for each gallon of gas sold in some states,” Barron’s says.

BJ’s long-term outlook is also getting rosier by the minute.

With the stock down 9% in 2022, a nice entry point could be emerging for investors with a long-term outlook.

In hindsight, maybe I should have gone to a bulk retailer on my Mother’s Day run.

Now I’m all the wiser – and so are investors who are tapping into LikeFolio’s real-time consumer insights.

Members will be the first to know when we spot actionable opportunities for companies like BJ’s that look primed for growth in a tough market environment.

Megan Brantley

Head of Research, LikeFolio