Aim to Buy Stocks at a Discount and Get Paid Cash Upfront to Do It

Stock-market volatility has been on the rise recently, which is no surprise since earnings reporting season is getting underway. And as we’ll see today, there’s a great way for traders to cash in on this set-up.

Individual stocks will be under a microscope over the next month as each company reports its results. Positive earnings surprises (“beats”) will be rewarded while earnings misses will get punished.

And there will be extra scrutiny on results, considering that the stock market’s valuation is particularly elevated after a nearly straight-up 25% rally off the October low. The S&P 500 Index is now trading at 28 times trailing earnings. That’s a steep premium over the S&P’s average price/earnings (P/E) ratio of 15x over the last 10 years. Take these high stock valuations, add in the high anxiety about results, and you’ve got a recipe for generous stock option premiums!

In a recent column, I pointed out how to uncover stocks that may be poised for big post-earnings moves. Using two of our Ideas by TradeSmith strategies, Low Risk Runners and Kinetic VQ, you can position yourself for a possible earnings-season rebound in stocks that qualify.

But there is another way to cash in on this at a much lower cost than just buying the underlying stock right away.

I’m talking about a simple, income-producing option trade called a “bull put spread,” which is one of the strategies available in my Constant Cash Flow service.

When you think about put options, most folks associate it with buying a put option because they’re bearish on the stock.

But the seller of a put option takes the opposite side of the trade. You’re expecting the stock won’t decline much (or temporarily). And you pocket premium income you earn on the trade for selling the put option.

Instead of just selling a put option, using a put spread can be a much cheaper and lower risk way for you to place the trade and still earn income.

How to Deploy Put Spreads for Upfront Income on Your Stock Ideas

Here’s how it works:

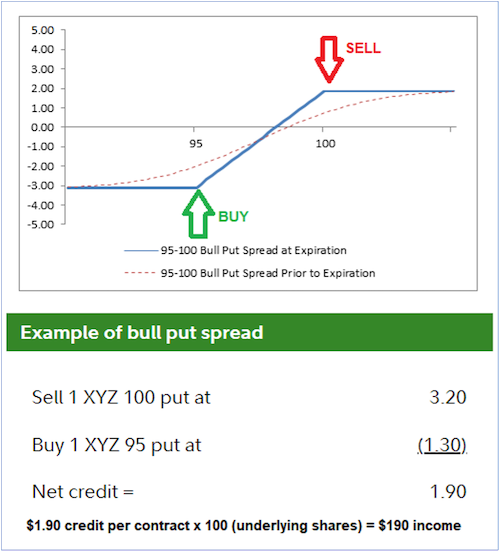

Yikes! OK, don’t let the above graphic scare you off. It’s really quite simple, as I’ll explain.

Let’s say you have your eye on XYZ stock as a potential buy-the-dip candidate. With XYZ shares trading at, say, $105, you could just buy 100 shares at a cost of $10,500…

Or you could position yourself to buy XYZ stock at a discount and get paid to do it with a put spread.

It’s a two-part trade, but most online brokers today let you place both parts in a single trade with a few mouse clicks.

Step 1. You sell 1 XYZ $100 put option for $3.20, as shown above. Each option contract represents 100 shares of the underlying stock. This earns you $320 in premium income for the opportunity to buy XYZ stock at $100: a 5% discount.

But you’re also on the hook to buy $10,000 worth of shares if the stock does reach $100.

- If you were just in it for the option income and not shares, as we are in Constant Cash Flow, you’d want to exit if that happens.

- But if you see it as a good buy at that price, as we do in this scenario, then buying at $100 is your goal. So, in that case, you’ll want to place the trade as cash-secured: in other words, set aside $10,000 in your account when you place the trade.

This is where the put spread comes in handy with part two of the trade. Here, you sell a put option, as before, but also buy a put option at a slightly lower strike price.

Step 2. You buy 1 XYZ $95 put option for $1.30, as shown in the graphic above. This costs you $130 per contract, but you’ve also lowered your risk considerably. Now, if XYZ falls below $95 a share, you’re covered because you own a $95 put. Your broker will simply exercise both options at a $310 net cost. So, that’s far less than the $10,000 it would have cost you to buy 100 shares (that are now worth $95 instead of $100).

And you still get paid upfront cash income to do this trade, just not quite as much.

Your net credit is the difference, or spread, between the two different option strike prices in this trade. In this case, it is $320 – $130 = $190 net credit to your brokerage account.

Now you’ve positioned yourself to earn upfront cash income of $190. You have the opportunity to buy XYZ stock under $100 a share. But you have no additional risk if the stock falls below $95.

This is a great way to earn consistent income on liquid, large-cap stocks. You may want to buy these stocks at a discount, as in this example. Or you may just be in it for the money, to collect regular income as we do in Constant Cash Flow. Either way, put spreads can be a valuable trade strategy to consider.

OK, enough of the theoretical…

Let’s Look at a Real-World Example of the Stocks You’d Use

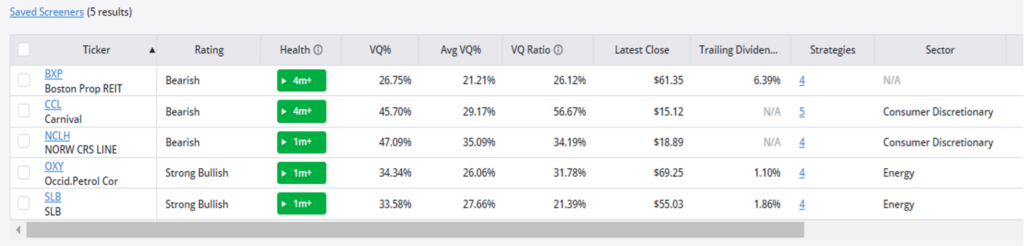

Just to recap my last column briefly, I used Kinetic VQ and Low Risk Runners filters to find low-risk stocks that may be poised for a rebound. Plus, I added the Markets filter to screen for only the S&P 500 large-cap stocks. Here again are the results:

I mentioned that one of Warren Buffett’s favorite energy stocks, Occidental Petroleum (OXY), made the list. But rather than buying the stock outright, you can consider a put spread on OXY. Here’s the difference in real time … at least as of this morning.

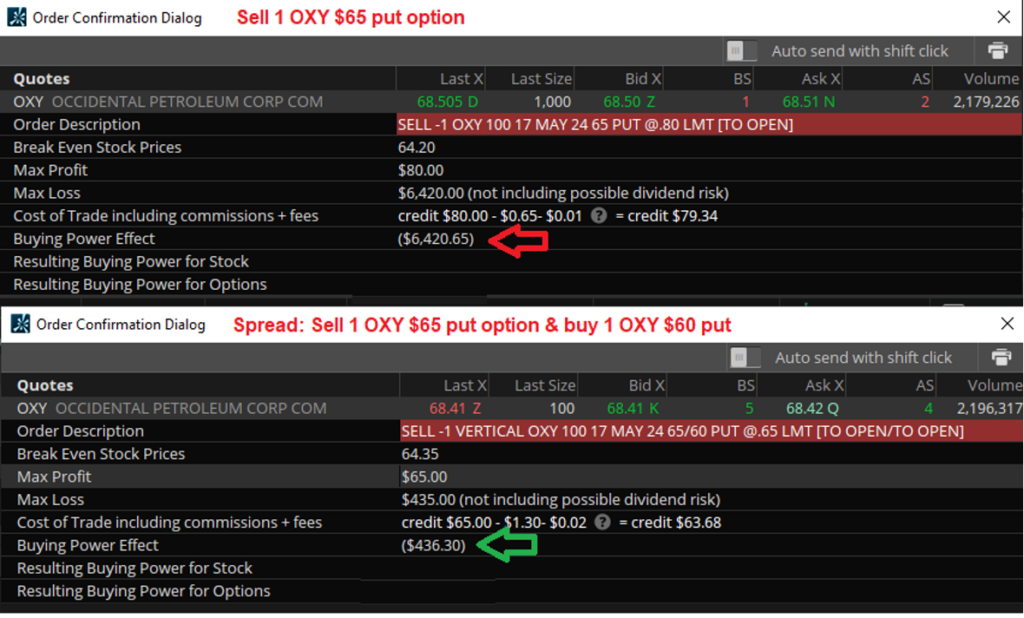

Here, I’m using my Thinkorswim option trading account to illustrate both trades. At top is a standard put sell, specifically sell 1 OXY $65 put. That’s about 5% below the current $68.50 stock price.

In the lower panel is the spread, specifically sell 1 OXY $65 put AND buy 1 OXY $60 put.

The buying-power effect of the put-only trade is $6,420.65. That’s how much of my trading capital is tied up as long as I’m in the trade. And I stand to earn $80 of income (the maximum profit), but I have $6,420.65 at risk if I were to acquire OXY shares and they go to zero.

For the spread trade, on the other hand, the required buying power is only $436.30. I still earn $65 of income with this trade, and I have limited my risk; if shares drop to $60 or below, my spread covers me, and my maximum loss is $435.

My Constant Cash Flow service searches the markets for these types of trades every day using our A.I.-powered algorithms. Each and every day, our members get a new income-earning sell-put trade. And if there is also a high profit potential put spread available for the same stock, we send the spread trade to members as well for a cheaper, lower-risk alternative.

Mike Burnick’s Bottom Line: Put spreads can be a great lower-risk way to use options to buy quality stocks at a discount AND get paid to do it. Or, if you’re only in it for the money, you can place a put-spread trade with the aim of earning income only, not intending to buy the stock. Either way, these trades put cash in your pocket upfront.

Good investing,

Mike Burnick

Senior Analyst, TradeSmith