How to Find Bargain Stocks with Three Indicators I Use in My Daily Scans

One of my primary investing rules is: Never pay retail!

If you’ve been reading Inside TradeSmith, you know I just love to find bargains, especially when it comes to high-quality stocks with big upside potential. Every day, I’m out here looking for new opportunities to buy great businesses at a discount. Today I’ll show you which indicators you can use to build a watchlist like mine.

First, to find stocks about to turn higher in price from a near-term low, we can apply our own proprietary Trade Cycles timing indicators and Seasonality tool. Members with Trade Cycles, TradeSmith Essentials, or TradeSmith Platinum can screen for stocks like this, or check the cycles and seasonality for a particular stock, right within their dashboard.

Second, another technical indicator I’ve used religiously for years to spot potential bargain stocks, which you can also display on your TradeSmith Finance charts, is the Relative Strength Index (RSI).

RSI measures the speed and change of price movements over time (usually a 14-day period). RSI oscillates up and down between zero and 100. When RSI is above 70, it generally indicates overbought conditions. And when the RSI is below 30, it indicates oversold conditions, which could be a bargain buying opportunity.

Third, you can use TradeSmith Finance to spot support levels on a stock’s price chart (or resistance levels where that stock is likely to hit a ceiling, then fall back). If the stock is holding up nicely at previous support, that price could provide a platform for the stock to bounce higher, which is yet another way to identify bargain stocks about that may be about to rebound.

The Volume at Price (VAP) indicator, also displayed in TradeSmith Finance charts, shows as horizontal bars on the left side of the chart that correspond with price support levels where you may consider buying, plus resistance levels where you may consider selling afterward.

These indicators are a great help in spotting potential bargain stocks. They’re best used in combination including additional indicators of quality, fundamental strength and momentum.

Recently, I showed you how to combine our proprietary Business Quality Score (BQS) with Jason Bodner’s Quantum Score to screen for potential bargain stocks that also have strong fundamentals and momentum.

The Quantum Score is available with Jason’s Quantum Edge Pro membership, and the BQS is part of Ratings by TradeSmith – as well as TradeSmith Essentials and TradeSmith Platinum. If you’re subscribed to any of the programs, you can access these incredibly valuable indicators by simply logging into TradeSmith Finance every day. You can also call 888-623-0858 if you don’t see these in your dashboard.

In talking shop with Jason recently, I realized he has his own way of identifying bargain stocks using his Quantum Edge system. I’ll get to the details in just a moment, but first here’s a brief recap of Jason’s proven system.

The Quantum Edge system is built on three pillars.

- Superior Fundamentals: the strength of the business, as measured by Jason’s Fundamental Score. The company must grow sales and earnings, make a profit, manage debt, and several other key factors.

- Strong Technicals: the strength of the stock, as measured by the Technical Score. Shares should be trending higher, getting bought (on rising volume), and be among the leaders in their sector.

- Big Money Buying: Institutions control massive amounts of money, and the Quantum Edge system identifies when the big money is flowing into (or out of) individual stocks. It’s this massive buying pressure that really drives a lot of the upside price momentum for a stock.

When these three factors align, your odds of finding a winning stock capable of outperforming the market is very high…

But Jason also has an interesting way of using his system to buy the dip: Sometimes the Quantum Edge system shows a discrepancy between a stock’s Technical Score and its Fundamental Score. This can signal a fundamentally solid company where the stock has pulled back in price, perhaps just temporarily. And that can lead to unique, bargain-buying opportunities.

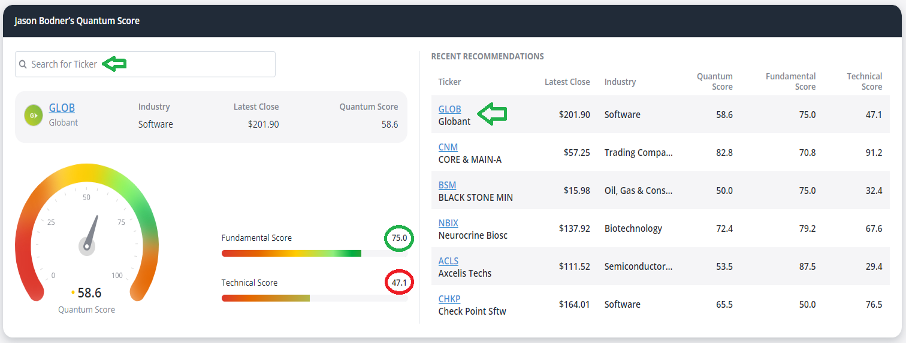

Let’s take a look at a prime example with a stock Jason recommended to his Quantum Edge program members. First, let’s go to the main TradeSmith Finance page, then scroll down just below the BQS to find the widget for Jason Bodner’s Quantum Score.

At top left, you can use the Search for Ticker box to view any stock’s Quantum Scores. And at right, you’ll see a few of Jason’s Quantum Edge recommendations. First on the list is Globant (GLOB). On the left side of this widget, you can see a summary of GLOB’s Quantum Scores.

The Fundamental Score for GLOB is a solid 75; that means strong business fundamentals. But the Technical Score is a low 47.1. This means GLOB has pulled back in price – but its strong business fundamentals could mean it’s a bargain buy.

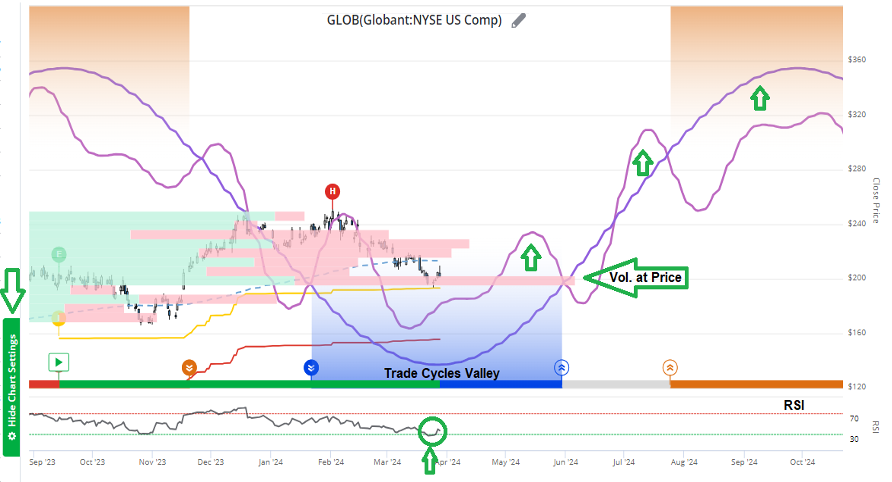

To help confirm this and provide more confidence, let’s pull up a TradeSmith price chart on GLOB and apply some of the other indicators mentioned above: Trade Cycles, VAP, and RSI.

Note that your own charts may be configured differently, depending on your settings and subscriptions. But if you don’t see these indicators displayed, simply click to open the green Chart Settings tab (on the left side) to easily adjust them.

Notice how GLOB is in a Valley turn area (blue shading). This means the price is expected to turn higher from here into the next Peak area (orange shading) this fall:

Next, look at the left side of the chart, where you’ll find your green and red horizontal VAP bars. You can see at a glance there is an extra-wide red bar at the recent low, roughly between $198 and $203. That means there’s strong support at those prices, so we can expect buyers to emerge and buy again at this level as they have before.

Finally, at the bottom of the chart is the RSI. Notice how GLOB went oversold recently, with RSI dropping below 30. But since then, shares have rebounded back above that level. That’s a potential oversold buy signal for GLOB!

Mike Burnick’s Bottom Line: When it comes to investing, you should follow a “weight of the evidence” approach: The more indicators that are in your favor, the higher your odds of success. In this example, GLOB rates a high Quantum Edge score. Its fundamental score is still solid, but the stock has pulled back in price, which is reflected in a lower technical score.

Plus, we have more supporting evidence this could be a bargain-buying opportunity from our Trade Cycles timing indicators, Volume at Price, and Relative Strength Index. Multiple data points help stack the odds of winning in your favor.

Good investing,

Mike Burnick

Senior Analyst, TradeSmith