How to Screen for Potential Earnings-Season-Surprise Stocks

In last week’s column, I pointed out that earnings reporting season is about to get underway and how you can keep track of all the action using our TradeSmith Finance Market Calendar tool.

By consulting two of our exclusive Ideas by TradeSmith strategy filters, you can also search for stocks that just might be great candidates to make big post-earnings moves, as I’ll show you here in today’s Inside TradeSmith.

Circle this coming Friday on the calendar for a barrage of big bank earnings. BlackRock (BLK), Citigroup (C) and JPMorgan Chase (JPM), among others, will kick things off by reporting their latest results before markets open.

Then fasten your seat belts over the next several weeks as nearly every stock in the S&P 500 posts their results.

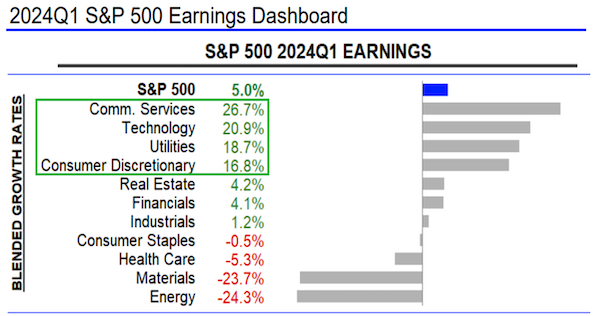

In the chart below, I’ve highlighted with a green box the sectors that are expected to report the strongest year-over-year profit growth, according to data from LSEG I/B/E/S:

Communication services, technology, consumer discretionary, and even stodgy old utilities are all expected to post stronger earnings growth than the S&P 500 overall.

Again, using our TradeSmith Finance Market Calendar, you can see every stock that’s reporting on a particular day of the week or for the entire month of April.

And when it comes to uncovering stocks that could make big moves after a positive earnings surprise, look no further than our proven Ideas by TradeSmith strategies. Specifically: Low Risk Runners and Kinetic VQ. Note that Premium or Lifetime members of Ideas by TradeSmith, as well as members of Trade360, TradeSmith Essentials, or TradeSmith Platinum, will be able to access these tools. (And if you don’t see them in your TradeSmith Finance dashboard — and would like to — call 888-623-0858 to discuss.)

- Low Risk Runners identifies healthy stocks that have pulled back in price more than halfway to their Health Indicator Stop Loss (hence the “low risk”). And like a rubber band that’s been stretched to the limit, these stocks tend to rebound higher in the near term.

- Kinetic VQ identifies healthy stocks that have a higher-than-usual Volatility Quotient (“VQ”). This extra volatility acts like stored-up “kinetic energy.” Think of this like a coiled spring. As soon as that kinetic energy gets released, the stock price can move significantly higher.

Combining these two strategies gives us a great chance of finding stocks that are likely to start moving higher quickly and continue to rally for some time, perhaps after a positive earnings surprise.

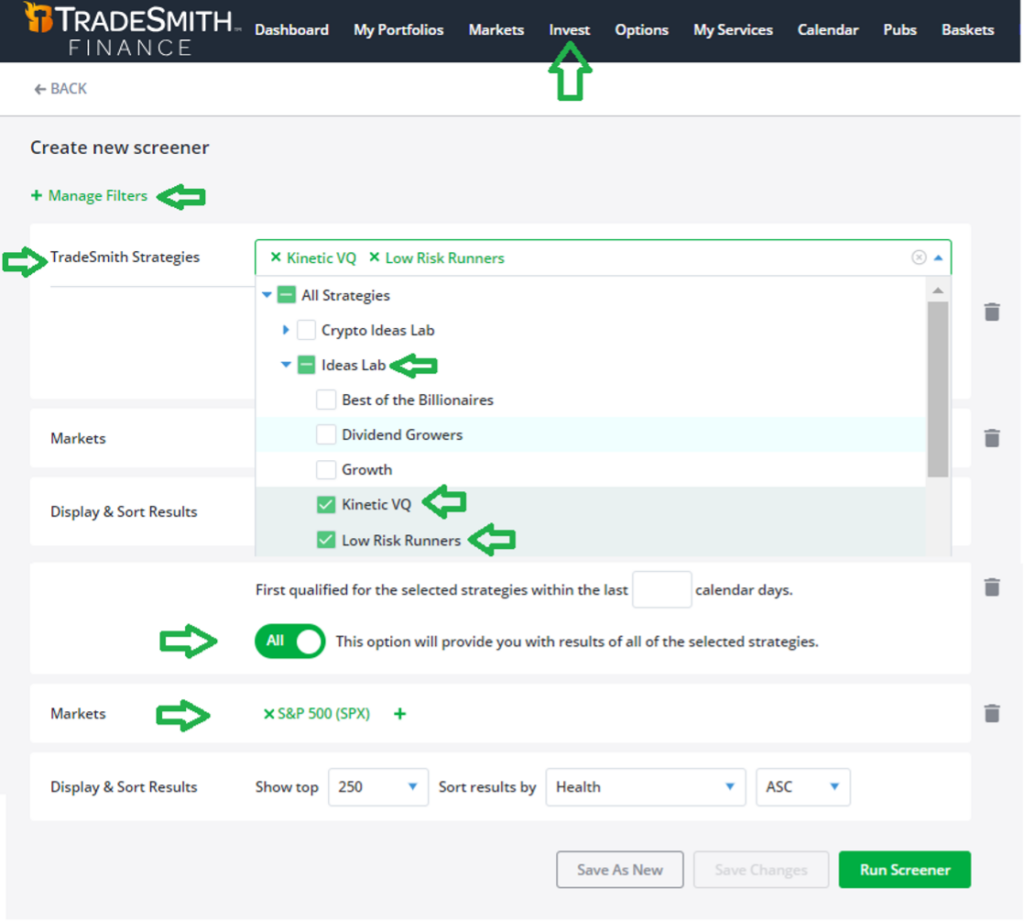

To find stocks that fit the bill, you’d simply log in to TradeSmith Finance and click Invest on the top menu bar. Then, click the Screener tab just below it, where we’ll build a simple stock screen using our Low Risk Runners and Kinetic VQ strategies.

We’ll focus on blue-chip stocks found in the S&P 500, but you can widen your screen to include more stocks, both large and small.

The screenshot below shows how I set up this easy screener:

Here are the steps.

Click on + Manage Filters to add the following.

- TradeSmith Strategies: Under All Strategies, click on Ideas Lab, then scroll down and select Kinetic VQ and Low Risk Runners from the list.

Also, be sure to toggle the button below this filter window to All. This will give you a list of stocks that qualify for both of these powerful strategies.

- Finally, add the Markets filter and select S&P 500 (SPX).

To qualify for either the Kinetic VQ or Low Risk Runners strategies, the stocks must already be healthy and in the Green or Yellow Zone, so no need to add specific filters for those.

You can add other quant filters if you wish: perhaps Business Quality Score (BQS), Cycle Turn Area, Projected Price Change, or any of the numerous TradeSmith filters that might be available to you depending on your subscription.

But, for this screen, let’s keep it super simple. Be sure to click on Save As New to save your work for later. That way, you can experiment with more filters but always return to your basic Screener. Now click on Run Screener to see the results:

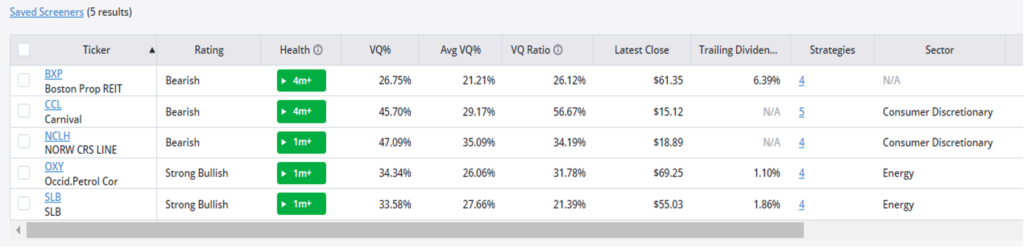

As shown above, this screen gave me just five results, but I was impressed with several names, including one of Warren Buffett’s favorite energy stocks, Occidental Petroleum (OXY), and oil & gas services giant Schlumberger (SLB). And by simply adding filters for a few more market indexes, I was able to expand the list to over 20 results.

Mike Burnick’s Bottom Line: Earnings season can be a great opportunity to prospect for new stock ideas to buy. And our TradeSmith Market Calendar, together with several of our leading strategies like Kinetic VQ and Low Risk Runners, can deliver powerful new trading and investing opportunities.

Good investing,

Mike Burnick

Senior Analyst, TradeSmith