Lofty Valuations Mean Stocks May Not Get a Free Pass this Earnings Season

Earnings reporting season is about to roll around again, with the big banks reporting at the end of next week.

There is always a lot riding on earnings reports, particularly for traders attempting to handicap earnings beats vs. misses.

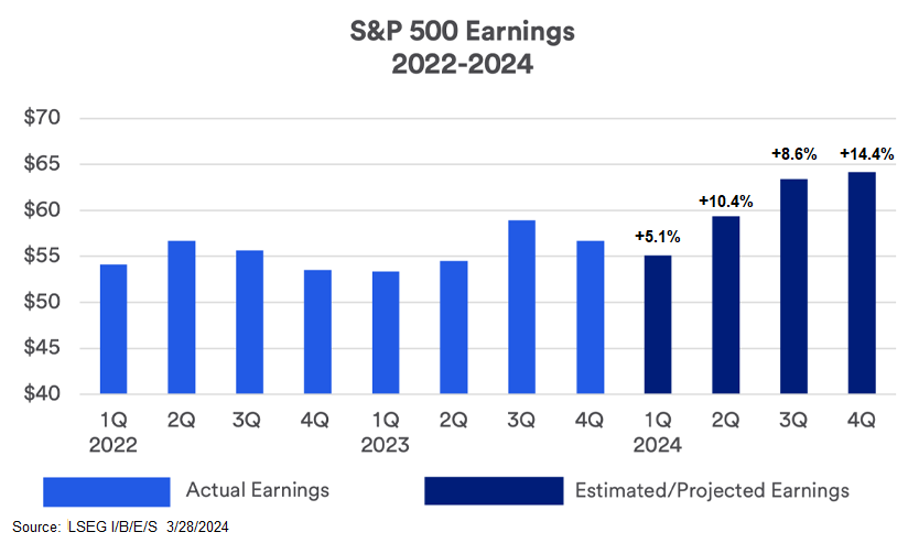

But, this time around, strong economic data is casting doubts about the likelihood of interest-rate cuts anytime soon. So, earnings need to come through again this reporting season to support the lofty valuations of the stock market. Going into the last round of earnings reports, Wall Street’s forecast for fourth-quarter earnings per share (EPS) growth across the S&P 500 was just over 4.5%. But when all was said and done, results came in much more robust than expected. S&P 500 profits surged 10.1% higher in Q4, with 76.3% of companies beating the low-ball EPS estimates.

So, analysts set the bar too low, and S&P companies easily beat it. And those positive EPS surprises certainly helped propel stock prices higher so far this year.

Apparently, Wall Street didn’t learn much from that experience:

The current estimate of S&P 500 earnings growth for the first quarter of 2024 is just 5.1%. That’s down from 7.2% on Jan. 1. The bar may be set too low once again, setting up the prospect of more positive EPS surprises in the next month and beyond.

Let’s hope so, because analysts’ EPS forecasts for the rest of 2024 do not exactly set low expectations. In fact, estimates are rather lofty not only for this year, but beyond.

As you can see below, current S&P 500 EPS estimates call for EPS growth of more than 11% over the last three quarters of 2024. That includes 14.4% profit growth in Q4 alone!

And it’s not just this year’s estimates that appear lofty:

The long-term earnings growth estimate for the S&P 500 sits at 18.8%, according to data from LSEG I/B/E/S. That’s well above the 12.5% average; in fact, it ranks in the 97th percentile over the past 40 years!

Companies need those lofty estimates to come through in the months and years ahead to justify today’s rich market valuations. The S&P 500 is already trading at about 24 times operating earnings today, compared to a long-term average Price/Earnings (P/E) ratio of 17.7.

To keep tabs on earnings season, let’s look at how you can track upcoming EPS reports in the TradeSmith platform.

How TradeSmith Helps You Track EPS

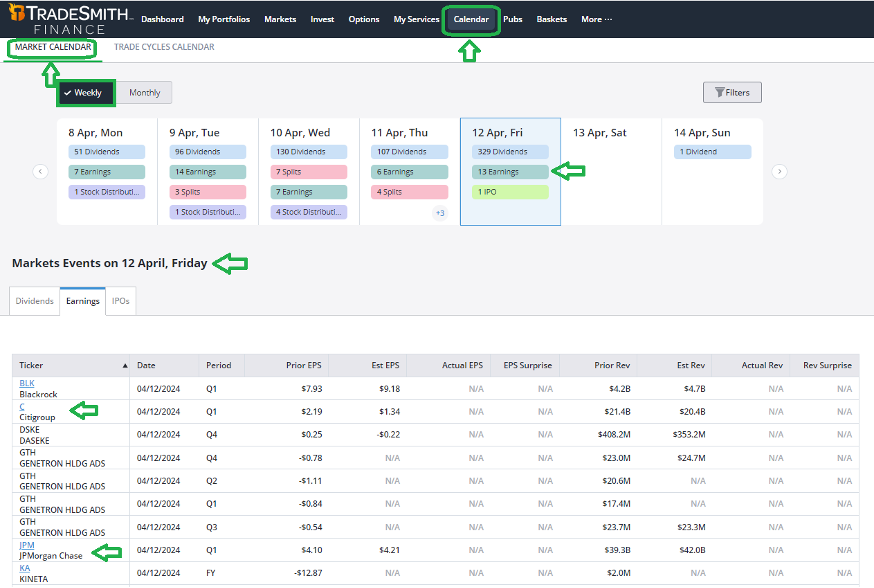

Our TradeSmith Finance Market Calendar tool is a central timeline for every earnings report, dividend disbursement, IPO, and other action you may find useful. And, whether you subscribe to TradeStops Basic or go all out with TradeSmith Platinum, you can access this tool.

Simply log in to TradeSmith Finance, click Calendar in the top menu bar, then click the Market Calendar tab just below it.

Here on the main calendar page weekly view, you’ll see a list of corporate actions for the week ahead on all the stocks we track. This includes upcoming dividends, earnings reports, stock splits, and spin-offs.

Click on the Earnings button for any day of the week, and you’ll see a list of all upcoming earnings reports for that day:

In the screenshot above, you can see that next Friday, April 12, will be a busy day. Big banks Citigroup (C), JPMorgan Chase (JPM), and others are due to report results.

From there, you can toggle from Weekly to Monthly to change the view from the current week to the entire month ahead for corporate actions such as earnings, dividends, or whatever events you’re interested in seeing.

By clicking on the Filters tab at top right, you can select which corporate actions you want to view using the dropdown box for Events, as shown in the screenshot above.

Another cool feature is that you can look beyond right now to find scheduled events for the months ahead … and behind.

Mike Burnick’s Bottom Line: With market valuations elevated today, it’s important that EPS results not just meet but beat expectations. And our TradeSmith Market Calendar can help you keep track of all the action week by week for the entire earnings reporting season.

Good investing,

Mike Burnick

Senior Analyst, TradeSmith