Options Trading Runs Wild; Here’s How to Profit from It

In yet another sign of excessive speculation in the markets, option trading volume is going through the roof. In fact, options have grown so popular that it can influence the market beneath the surface. Luckily, this explosion in volume is also great news for investors using the strategy we’ll highlight here in today’s Inside TradeSmith shortly.

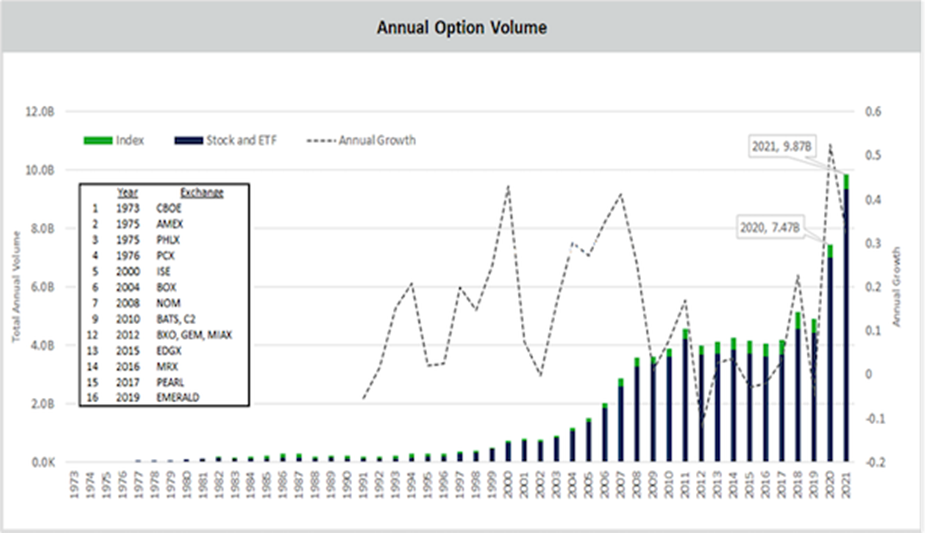

To give you an idea of the scope of this phenomenon, volume on individual stock options so far this month is on track to surpass total stock trading volume itself for the first time since late 2021. This incredible rise in options trading has been years in the making, as seen in the chart below:

The Cboe Global options exchanges saw 3.7 billion options contracts traded in 2023 – breaking annual volume records for the fourth consecutive year. By NYSE estimates, roughly 45% of that volume came from retail investors and traders.

Each of those individual options trades may not have much impact on their own. However, the growing volume of options trades overall does contribute to higher market volatility by fueling some of the dramatic swings we’ve seen in stocks over the past few years.

Here’s how it works: when market makers on Wall Street sell options contracts, they balance their risk by purchasing or shorting enough shares to cover their open options positions.

So, when option volumes increase dramatically and rapidly, it can trigger elevated buying or selling of the underlying stocks. That’s because market makers and broker dealers scramble to hedge the other side of these option trades.

And, at certain times, that action in the underlying stocks can move them dramatically – influencing the entire market.

The good news is that higher options volatility can be your best friend, IF you’re a seller of stock options. And especially if you sell options with the highest Probability of Profit (POP) the market has to offer.

TradeSmith has the cutting-edge trading tools you need to find high-probability option income trades that can put cash in your pocket instantly.

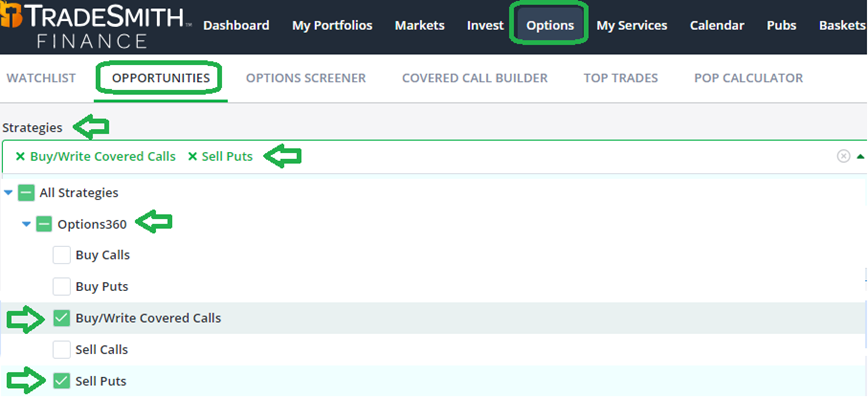

For my money, the easiest way to locate high-probability option trades is by visiting the Options page on TradeSmith Finance. From there, click OPPORTUNITIES, then in the Strategies dropdown menu, select Options360 and click to check Buy/Write Covered Calls and Sell Puts.

Members with Options360, TradeSmith Essentials, or TradeSmith Platinum can find trades like this every day using our Options tools within their platform. (And if you don’t see these tools in your TradeSmith Finance dashboard — and would like to — call 888-623-0858 to discuss.)

These are my two favorite instant income option trades. And our TradeSmith A.I.-powered algorithms do all the heavy lifting for you. Our systems crunch the numbers on thousands of stocks and tens of thousands of listed options contracts.

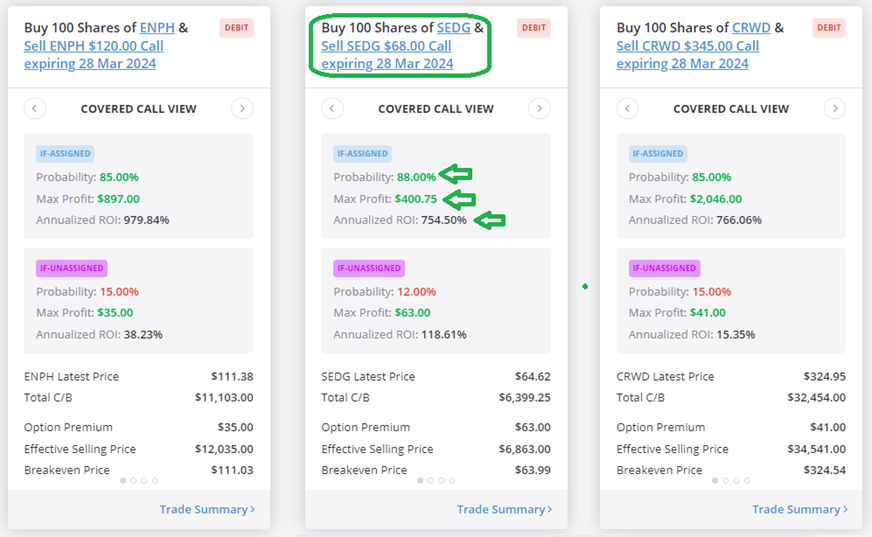

The goal is to find the trades with the best combination of POP and Return on Investment (ROI). I ran this simple screen just yesterday; here is a sampling of the results starting first with Buy/Write Covered Calls.

A buy/write is one of the simplest and lowest risk option strategies there is. You are buying 100 shares of a stock, and in the same trade you sell 1 call option contract that is slightly out of the money. Remember, 100 shares of the underlying stock covers 1 call or put option contract. Hence, the name “covered calls” for this strategy.

You get paid cash income for selling the option, plus you stand to earn more money from stock appreciation up to the strike price of your option.

Check out the middle trade highlighted above. Our system suggests buying 100 shares of SolarEdge (SEDG) and sell the SEDG March 28, 2024, $68 call option.

- You earn $63 in instant income on the call-option sale alone.

- You have the potential to earn a maximum profit of $400.75 on the trade if SEDG rallies through $68 and your shares are called away at that price.

- Plus, there is a very high POP: an 88% probability that this trade will be a winner, according to our system.

- And this is just a one-week trade, expiring on March 28. So, if you were to keep repeating that over the course of the year, you’d earn the equivalent 754% in possible ROI.

A buy-write trade like this one is actually lower risk than just buying the stock. That’s because you’re getting paid $63 in cash up front ($0.63 per share), which means your cost basis is lower than some investor who just bought SEDG stock at the market price.

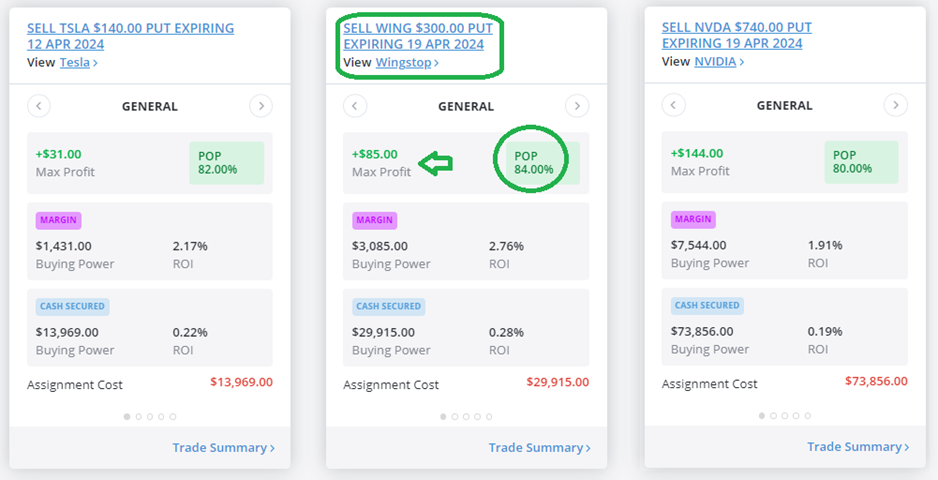

Next, let’s take a look at the results for Sell Puts.

When you sell a put option, you agree to buy the underlying stock at a discounted price – and you get paid cash income in the bargain. The highlighted trade above on Wingstop (WING), selling the WING April 19, 2024 $300 put option, jumped out at me. What can I say – I love their hot wings.

- Again, you earn cash up front from this trade. This time, it’s $85 of instant income,

- You agree to buy WING at $300, but its current price is about 20% above that level.

- That means you have an 84% POP; again, high odds of success.

Every single day you can visit our Options360 Strategies page to review the latest Buy/Write Covered Calls and Sell Puts trade that our A.I. algorithms selects as best bets. Or, you can make it even easier on yourself by subscribing to one of our dedicated option trading services, like:

- Constant Cash Flow, which features new Sell Put trades every single day of the week, including weekends and holidays,

- Or Predictive Alpha Options, which uses our exclusive A.I.-driven price forecasting tools to identify stocks about to move up or down over the next 21 days, then recommends either a Sell Put or a Buy Call trade. A great opportunity to trade options on quick stock moves.

Mike Burnick’s Bottom Line: Options trading is growing like gangbusters, much of it fueled by speculative retail investor interest. This can influence the underlying stocks, creating higher volatility. But you can aim to profit from it by systematically selling put and covered call options. That way, the elevated option volatility can earn you consistent cash income.

Good investing,

Mike Burnick

Senior Analyst, TradeSmith