Small Caps Rise and Shine, Here’s How to Find Potential Winners

As the S&P 500 Index keeps pushing to new highs, I’ve spotted a change in market leadership over the past month: It’s not just Nvidia and the rest of the Magnificent 7 mega-cap stocks leading the way anymore. And that suggests that the market rally is broadening out to include more than just large-cap growth stocks. In fact, it may be finally time for small-cap stocks to shine again.

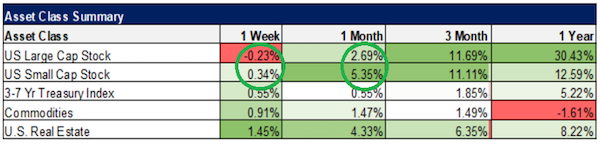

In the table below, you’ll see a summary of stock market asset class performance. No surprise that over the past year large-cap stocks have been shooting the lights out, as you can see in the far-right column. In fact, large-caps are beating the pants off small-cap stocks over the last year by a factor of almost 3-to-1! But as you scan the boxes to the left, you can see a potential shift in leadership for yourself:

Over the last three months, it’s virtually a dead heat between large- and small-cap performance. And over the past month, you can see market leadership has completely switched, with small-cap stocks now leading by nearly a 2-to-1 margin. That’s a big change from 2023, when growth stocks led by a wide margin.

Now, granted, one month doesn’t make it a trend. But this kind of leadership switch is worth paying attention to.

It’s telling me that small caps – after a prolonged nap – may finally be about to rise, shine, and grab the performance lead. And, if so, you should consider shifting your own asset allocation to take advantage of this shift.

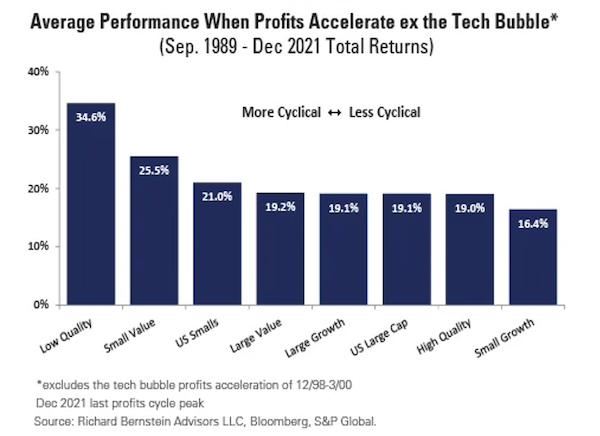

This recent market rotation isn’t the only reason why I believe it’s time for small caps to shine, either. We are now at the point in the business cycle when earnings (or profits) accelerate, which historically has been very bullish for small caps, as you can see below:

As you can see above, Small Value stocks are up 25.5%, on average, during this phase of the cycle, second only to Low Quality stocks. And small caps (“US Smalls”) beat large caps (“US Large Cap”) by a solid margin.

As a bonus, small caps are dirt-cheap today. In fact, by some measures, small-cap stocks are trading near their steepest discounts in 25 years!

With that in mind, let’s go to our trusty TradeSmith Screener tool and build a new screen from scratch to uncover small caps that may be poised to make a market-leading upside move.

Note that members with Ideas by TradeSmith Premium or higher, TradeSmith Essentials, Trade360, or TradeSmith Platinum will find these tools within their platform. (And if you don’t see these tools in your TradeSmith Finance dashboard — and would like to — call 888-623-0858 to discuss.)

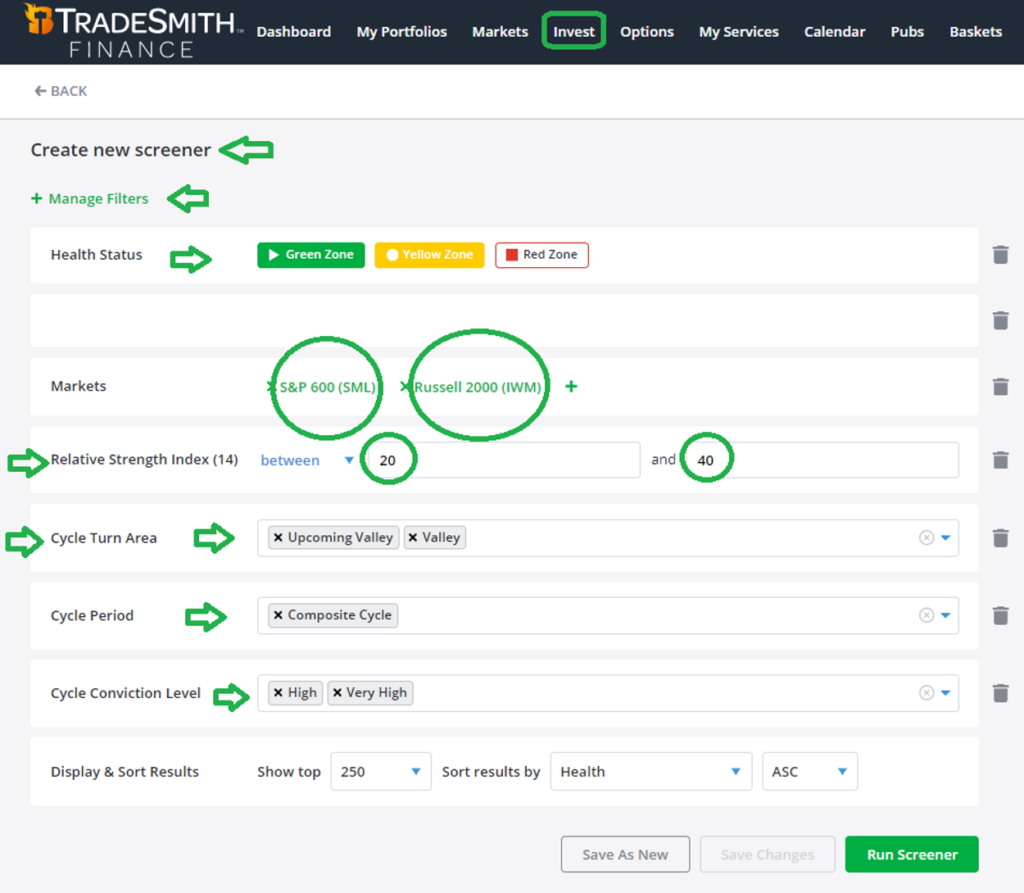

Log in to TradeSmith Finance and select Invest from the top menu bar. Then select the Screener tool and click on + Create new screener. Now let’s add some filters by clicking on + Manage Filters.

First, we want to screen out any unhealthy stocks that have been stopped out in the Red Zone. So, click on Health Status and select Green Zone and Yellow Zone.

Next, for Markets we want to zero in on small caps that are represented by the S&P 600 Index (SML) and the Russell 2000 Index ETF (IWM).

Now come the filters to find oversold small caps that are poised for a turnaround. To do so, I added Relative Strength Index (RSI) and set this filter to between 20 and 40.

RSI is a time-honored technical indicator. It oscillates between 0 (oversold) and 100 (overbought), but it’s rare to see stocks reach those extremes. When a stock turns up through the RSI 30 level, it’s considered a buy signal. So, I chose a range of RSI between 20 and 40 to find more stocks in the sweet spot of a possible buy signal.

Now, the reality is that oversold stocks can stay that way for a long time. So, we want a catalyst that increases the odds of the stock moving higher soon. That’s where our Trade Cycles by TradeSmith indicators come in handy. (Note, you need access to Trade Cycles to add these filters to your Screener.)

I add a filter for Cycle Turn Area, then check Upcoming Valley and Valley. These are stocks poised to turn higher from recent lows. For Cycle Period, I’ll use the Composite Cycle, since that’s a good blend of all our cycle terms: short, middle, long, and very long.

Finally, for Cycle Conviction Level, I checked the two highest conviction states: High and Very High. After all, we want confidence that these oversold small caps are likely to break out to the upside soon.

That way we’re not sitting on dead-money stocks that are going nowhere. Our Trade Cycles timing indicators help stack the odds of an upside move in your favor.

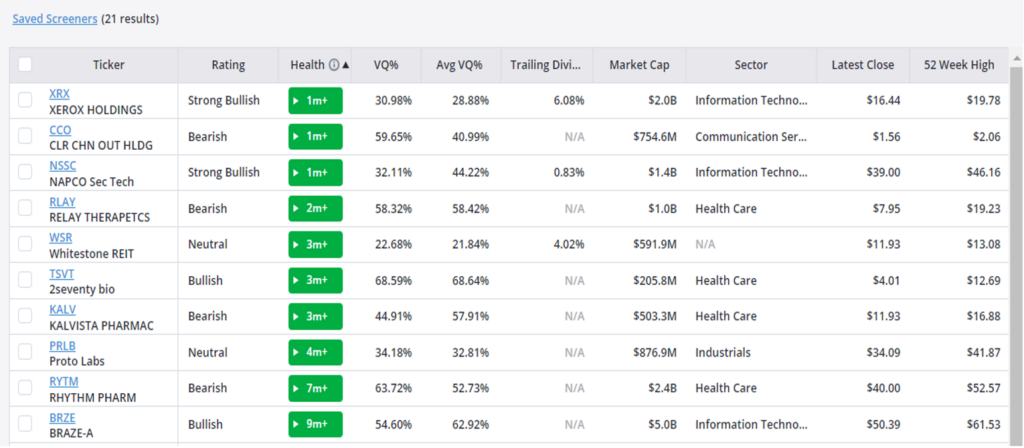

When I ran this screen earlier this week, I got only 21 results. But you could easily increase your list for further research by simply adjusting a few filters. You could increase the RSI range up to 50 or even 60 to get more hits. Likewise, including Cycle Conviction Level: Medium should really increase the number of stocks on your list.

Below is a partial list of the stocks that made the cut for my screen.

Notice how many of these stocks are trading well below their 52 Week High (right two columns above). And several stocks have solid dividend yields, so you can get paid while you wait for an upside move to unfold.

Right at the top of the list, Xerox Holdings (XRX) looks interesting to me with its 6.08% yield and a Strong Bullish rating.

Mike Burnick’s Bottom Line: Be sure to keep tabs on shifts in stock-market leadership, particularly when it comes to sectors and styles (like small cap vs. large). This can give you early clues to the stocks, sectors, and styles that could take the lead in performance. And when you do spot a shift, use our TradeSmith Screener tools to identify the stocks that can benefit most.

Good investing,

Mike Burnick

Senior Analyst, TradeSmith