Another Way to Lower Risk and Squeeze Gains in the Market

Last Thursday, we discussed a very conservative strategy to boost your income and increase the odds of beating the market.

This simple options strategy is known as “selling covered calls.”

But if options aren’t for you, I have another conservative strategy to help you manage your risk and build a rockstar portfolio of stocks.

It doesn’t matter if you’re on par with Warren Buffett or a first-time investor. Regardless of experience, we all need a strategy to improve our odds of success.

During choppy periods of the market, I encourage you to build your portfolio using a simple strategy called “dollar-cost averaging.”

What is it? And what are the benefits?

I’ll keep this lesson short on Memorial Day. So, let’s dive in.

Defining Dollar-Cost Averaging

Dollar-cost averaging is a simple process.

Here you buy a proportionate number of stock shares in different blocks.

You purchase them once a month, once a quarter, or in another predetermined period. It’s entirely up to your discretion.

Investors use this strategy to minimize the impact of stock market volatility.

Instead of buying all of the shares at once, investors can break their purchases into smaller buys until they exhaust the capital allocated to a particular asset.

So, for example, let’s say that you have $20,000 and want to buy shares of a stock. Let’s look at how you might improve the overall performance of a portfolio.

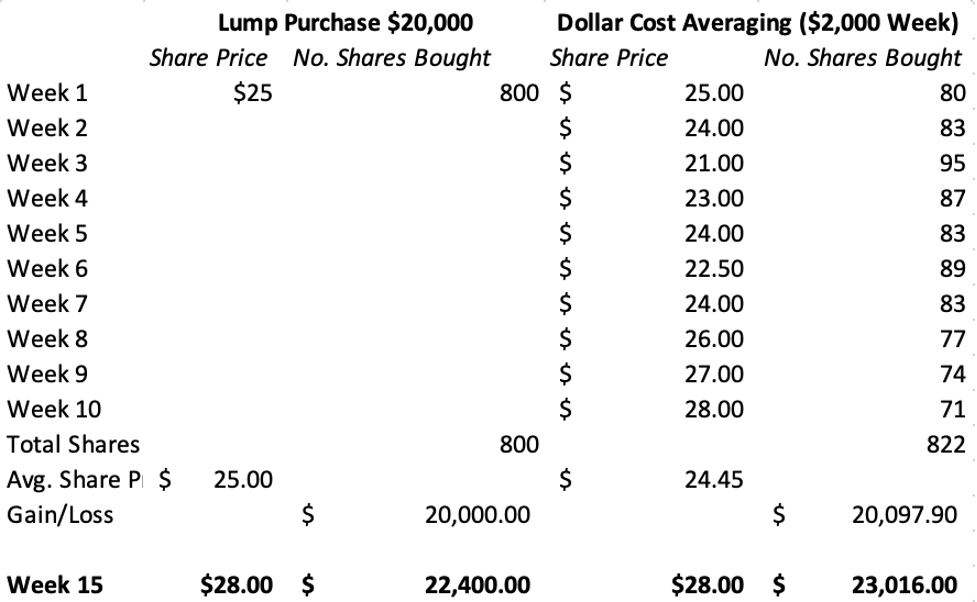

In the example below, you have $20,000 and two options.

The first option is to purchase a one-time lump sum of 800 shares at $25 each. This exhausts all of the money from the account.

In scenario 2, you break up the purchases into 10 weekly buys. In this case, you buy as many shares as possible with $2,000.

On the right side of the chart, you see that you could purchase a different number of shares each week depending on the movement of the price.

As you can see, the second option produced a situation where the dollar-cost averaging allowed you to end up with a larger number of shares (822 compared to 800) by the end of the period. Naturally, the dips in the stock price in the first few weeks allowed the investor to buy more shares with the $2,000 allocation.

So, even though the stock surpassed the $25 level in the final three weeks, the early volatility and decline made a big difference. In this example, you end up with 22 more shares using the same amount of capital.

Pay attention to the final line. Let’s say hypothetically that the stock was to increase to $28 a share a few weeks later. Since the first strategy had a stagnant purchase price of $25, you make a net $3 per share on the gains — 12%. That translates into about a $2,400 gain over the next five weeks.

But in the second scenario, dollar-cost averaging allowed the investor to purchase shares at an average of $24.45. Therefore, the investor gains more over the next five weeks — a return of 14.5% (or $2,918.10). And — as a result of this strategy, the second option generated $616 more over the 10-week period compared to the first strategy.

Now, it’s possible that the stock could decline. Of course, there is risk in this scenario. Well, let’s say that by week 15, the stock falls to $24 per share. In the first option, you would be down $800 or 4% on the original investment.

But the second scenario produces smaller losses. Since you averaged each purchase at $24.45, you would be off $369.90 from the combined investment of $20,097.90. This represents a loss of just 1.84% in total.

How to Use This Strategy

So, how can you use this strategy right now?

Well, it starts with using TradeSmith Finance.

You can look at various stocks on our platform. As always, you’ll want to buy shares in the Green Zone. As long as they remain in the Green Zone, you can purchase shares with confidence and build your position.

Should they fall into the Yellow Zone, don’t do anything. Wait to see if it trades back in the Green Zone and invest with confidence in your next batch of stocks.

And if it does fall into the Red Zone, exit your positions and reallocate your money elsewhere.

I will be back again tomorrow with another myth that investors need to ignore. It involves the size of your positions and portfolio.

Trust me, you don’t want to miss it. Have an excellent end to your holiday weekend.