Big Opportunities in the Foundation of our Tech-Driven World

Our modern life arguably began roughly 140 years ago in the late 1800s.

Seems impossible, I know. The world was so different then.

In 1882, a house in Appleton, Wisc., became the first home to be powered by electricity.

Thomas Edison developed the country’s first power plant in Manhattan, also in 1882, three years after he invented the light bulb.

And around that same time, our nation’s railroads started to become powered by electricity.

Railway electrification was made possible by converters that changed alternating currents (A/C) into direct currents (D/C). These converters were the forerunners of semiconductors, which are now everywhere and in everything.

Computers. Mobile phones. Airplanes. Cars. Appliances like your toaster, refrigerator, and dishwasher.

Even some diapers have semiconductors so they can notify parents when they need changing. (Now all that’s needed is robots to change the diaper for you, right?)

Demand for semiconductors has skyrocketed as technology has continued to grow, innovate, and seep into every corner of our lives. The chips themselves have also advanced and become much more specialized.

Even the latest, greatest tech craze – artificial intelligence – will never reach its mind-blowing potential without maximum processing speed.

Few things in life are certain, but we know that the world will need more and better semiconductors in the future.

And that’s a big opportunity for investors. Just look at how the three biggest semiconductor companies have done in the last six months…

Nvidia (NVDA), Taiwan Semiconductor (TSM), and Broadcom (AVGO) have averaged 70.7% gains in half a year.

A New Revolution

As you would expect, the semiconductor industry is already massive, generating $527 billion in revenue last year. Management consulting firm McKinsey & Company estimates sales will soar to $1 trillion by the end of the decade.

That’s because semiconductors are essential in electronics, and electronics are essential to everything in our world today.

If we didn’t know it before the COVID pandemic, our absolute reliance on “semis” became abundantly clear when supply chain disruptions caused a global chip shortage. Thousands upon thousands of new cars sat on massive parking lots unusable because they lacked the chips necessary to power their functions.

And not just one or two chips. Modern vehicles have anywhere from 1,000 to 3,000 chips in them.

Semiconductors are vital to our modern lives. Their impact has been, is, and will be staggering. They have fostered advances in communications, health care, computers, transportation, energy, the military – and yes, even diapers.

The first semiconductor seeds were planted in the late 1800s with those AC/DC converters, and a key turning point came a little more than 50 years later when Bell Labs invented the point-contact transistor in 1947.

The story from there is one of meteoric rises – in technology, demand, production, sales and earnings growth, and share prices.

And we are now in a new growth revolution in semiconductors and technology.

The industrial revolution brought us from hand tools to machinery between 1760 and 1840 – a period of wild change and progress. This gave way to mass production in the late 1800s (encompassing railroads), driven by electricity and oil. Automation arrived in the late 1960s, driven by electronics and technology.

And now, a new revolution is afoot with rapidly advancing technology driven by the Internet of Things, AI, the cloud, and Big Data. It is a data revolution that requires next-generation semiconductors.

The U.S. Pushes Hard

Taiwan produces the most chips – 60% of the world’s semiconductors – followed by South Korea, Japan, the United States, and China.

As you can see, most of the production is in Southeast Asia and China, and the U.S. wants to bring some of that business back home. The CHIPS and Science Act in 2022 authorized nearly $300 billion in funding to move more production to U.S. soil.

Taiwan Semiconductor (TSM) could receive up to $6.6 billion from the government, according to reports today. The company is based in Taiwan, but it is building three plants in Arizona to manufacture advanced chips.

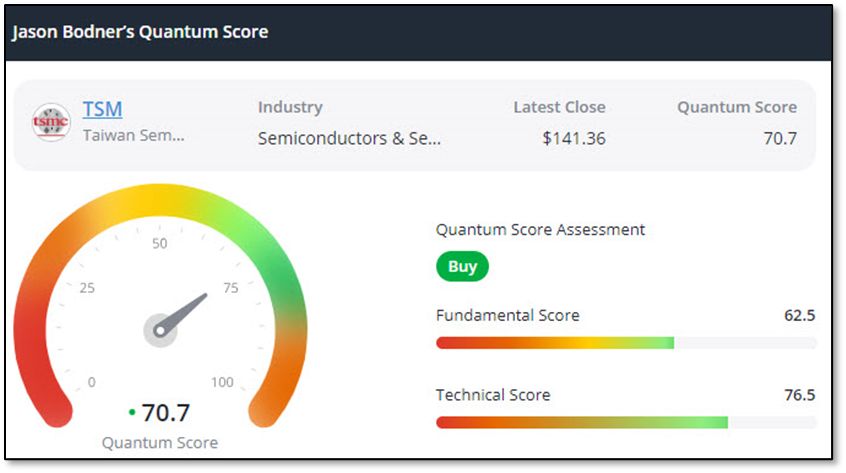

Source: TradeSmith Finance and MAPsignals.com

TSM falls into my buy zone with a Quantum Score of 70.7. If I had a quibble with it, it would be the fundamental ranking of 62.5.

It’s certainly not horrible, but it’s not as strong as I ideally like to see when buying a stock. The 8.7% sales decline in the last year dings the Fundamental Score a little bit, though analysts do expect a nice revenue rebound with 20% growth this year.

Synopsys (SNPS) is a higher-rated semiconductor stock, and one I recommend in TradeSmith Investment Report. This California-based innovator provides high-performance chips and advanced software for some of the coolest slices of tech – artificial intelligence, driverless cars, edge computing, design-automation software, 5G mobile networking, the all-inclusive Internet of Things (IoT), and more.

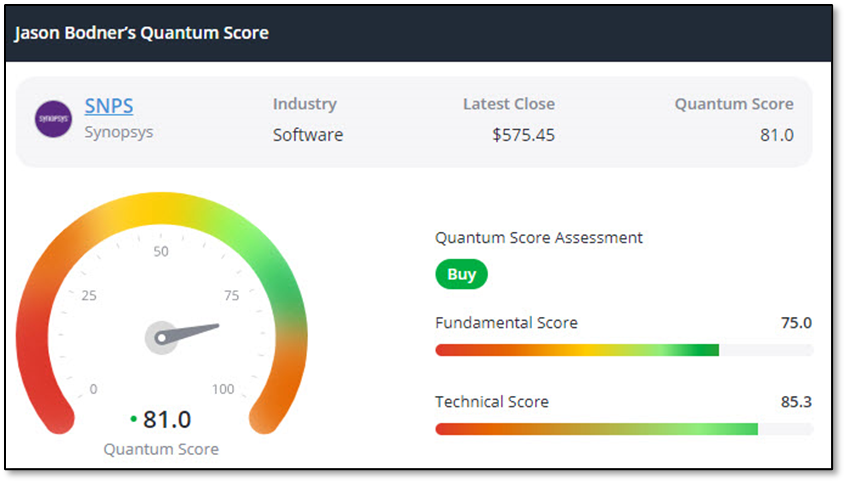

Source: TradeSmith Finance and MAPsignals.com

Synopsys has a potent Quantum Score of 81, with a strong fundamental rating of 75 and a powerful 85.3 technical ranking.

It’s been a great stock for us since we added it a little over a year ago, gaining 59.5% in that time.

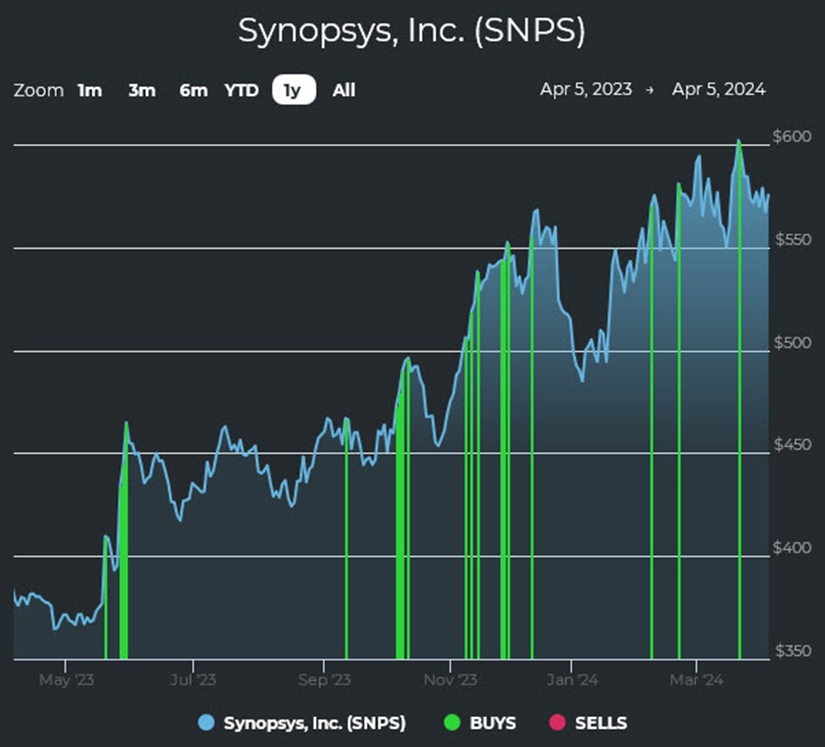

Source: MAPsignals.com

We’re riding the wave with multiple semiconductor stocks in TradeSmith Investment Report, and I expect more outsized profits in this industry that undergirds the next tech boom.

If you’d like full access to our complete portfolio, including our semiconductor stocks and my brand-new recommendation just released on Friday, click here to learn about joining TradeSmith Investment Report today.

We put semiconductors to work for us every day in many different products and technologies. Consider putting your money to work in semiconductors as well and ride this next growth wave to increase your own wealth.

Talk soon,

Jason Bodner

Editor, Jason Bodner’s Power Trends