Breakout Stocks to Buy on Last Week’s Dip

|

Listen to this post

|

If you want to find great stocks to buy on a broad market decline, you have to go against the grain a bit.

Buying the dip is hard enough as it is. And many investors have the natural tendency to seek out stocks that were previously big winners and got slaughtered.

This sounds like a good idea. On paper, it seems like broad declines are an opportunity to buy previous high-flyers on a short-term sale.

But often, it’s better to fight this instinct. Stocks that fall hard, fall hard for a reason.

Instead, you should seek out the stocks bucking the overwhelming bearish trend. The stocks that prevail and run higher – even while everything else is falling apart.

Stocks like these have what we call strong “relative strength.”

We measure relative strength in multiple ways here at TradeSmith. You might be most familiar with the Relative Strength Index (RSI). But despite the name, it really just measures a stock’s performance relative to itself for the past 14 days.

In times like this past week, however, you want to measure relative strength against the broad stock market.

So whenever the broader market falls, I’ll start screening for stocks that recently flashed an Entry signal by crossing into our Green Zone.

Regular readers know the Green Zone is the best place for a stock to be. This indicator uses our broader measure of momentum: the TradeSmith Volatility Quotient (VQ%).

And despite the knock-down, drag out price action seen early last week, a few stocks made key crosses into the Green Zone around the same time.

Stocks like these should shoot right to the top of your watchlist: They’re where smart investors are pushing their money to when the rest of the market breaks down…

Let me show you five of these stocks, and I’ll break down a few key metrics to help you understand whether they’re good long-term buys from these levels.

Five Stocks That Flashed a Buy Signal While Markets Tanked

I just ran a simple search using our TradeSmith Screener, part of Ideas by TradeSmith.

My goal was to uncover stocks in the S&P 500, Dow Jones Industrial Average, Nasdaq 100, and mid-cap S&P 400 that crossed into the Green Zone over the past 14 days – right around the time markets started falling.

This cross into the Green Zone is what we at TradeSmith consider an Entry signal. You want to buy stocks that recently entered this zone, as they’re likely to keep running higher.

Here’s the top five results the search returned:

As you can see, these are all very different stocks. We have defense company Northrop Grumman (NOC), energy utility Dominion Energy (D), auto retail store O’Reilly Auto (ORLY), commercial gym Planet Fitness (PLNT), and New Jersey Resources (NJR), another energy services company.

We’ll take a look at a few of the columns in the table above shortly.

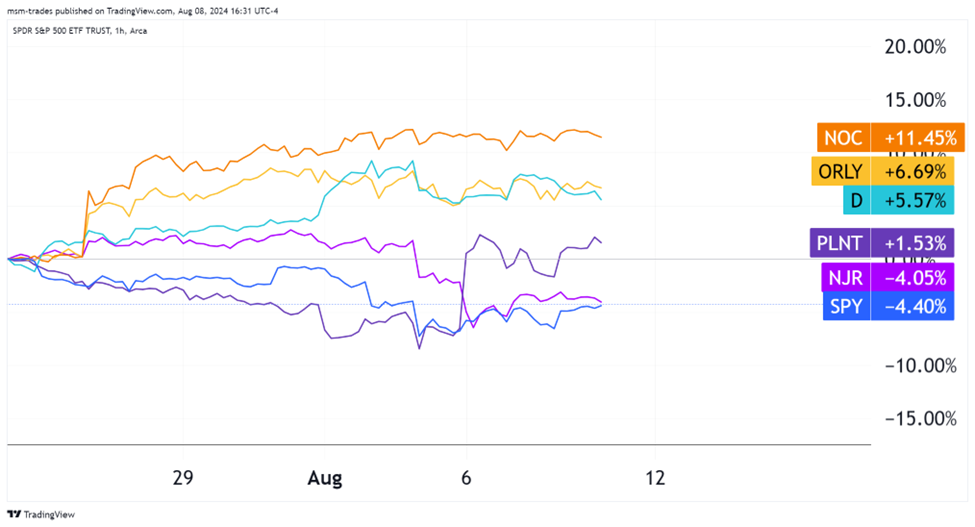

First, let’s take a quick look at how each stock has held up against the S&P 500 over the last 14 days. All these stocks have outperformed the market over that time period:

It’s important to take a critical look at this price action, though.

Of these five stocks, NJR has been most correlated to the market since the start of August. And while PLNT was weaker from the end of July to the start of August, it shot up the day after markets fell apart on August 5 – posting a new local high.

Meanwhile, NOC, ORLY, and D have all been consistently strong and are still holding up amid the volatility. That’s a good sign, especially considering they just broke into the Green Zone.

That alone should tell us these three stocks demand our closest attention.

Now, let’s look at a few key metrics I’ve included in the earlier table.

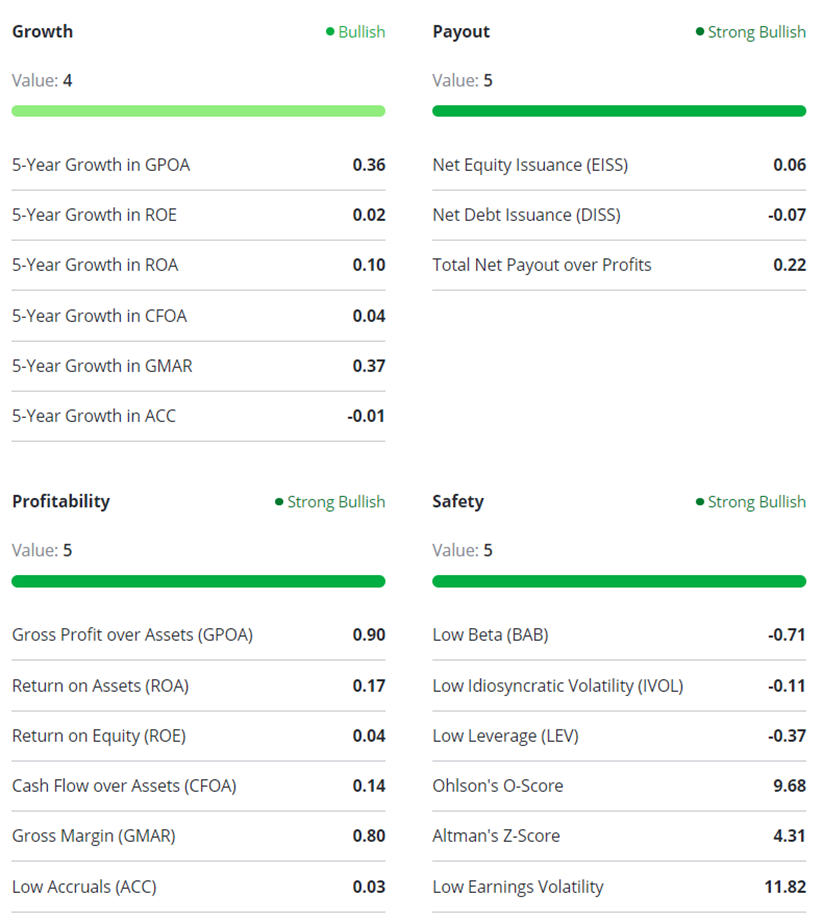

The first is the Business Quality Score (BQS). This is our unique composite score of a company’s fundamentals. It ranks each stock on Profitability, Safety, Growth, and Payout, resulting in a score from 0-100.

Looking over the top five stocks from our search results, two stick out for having very high or very low BQS scores. O’Reilly Auto (ORLY) gets a score of 96 overall – here’s the breakdown:

What we can quickly discern is that this company is a profitable, safe, and sustainable business. ORLY doesn’t have the best growth metrics, but they’re still pretty good.

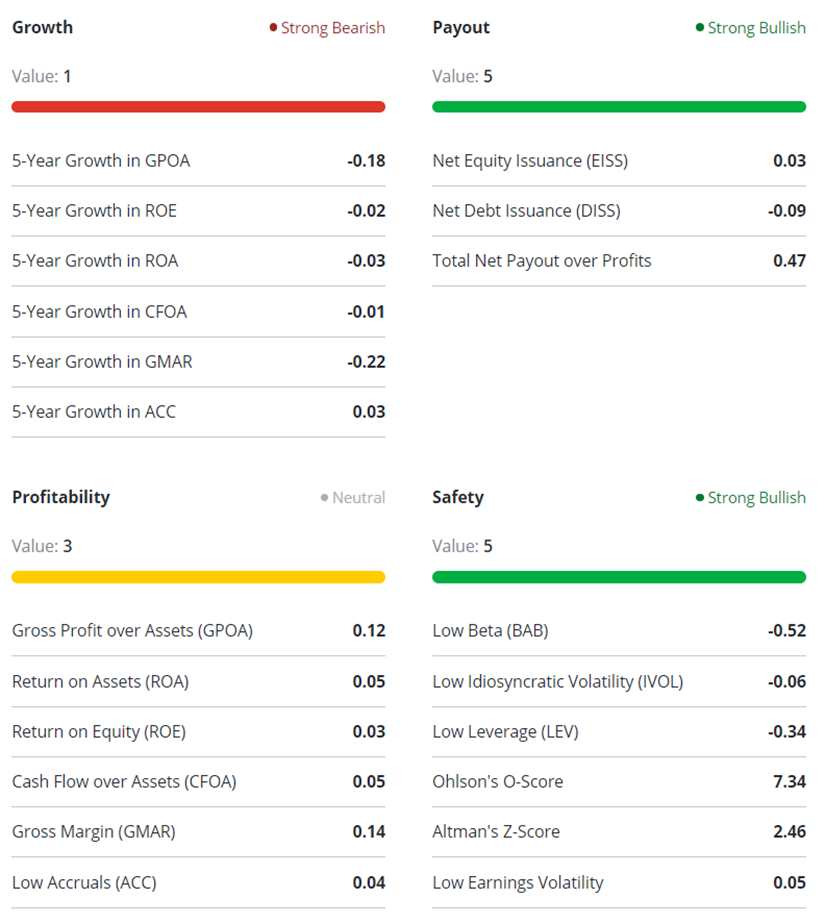

Compare that to the lowest-scoring business on our list, Northrop Grumman (NOC).

NOC falls down on both Profitability and Growth… and those two factors are more heavily weighted in the scoring system than Safety and Payout. This results in an overall score of just 29:

Next, let’s talk Free Cash Flow Yield.

Here at TradeSmith, we calculate Free Cash Flow Yield by comparing a company’s free cash flows to its enterprise value. The higher the number, the better: A higher yield means that the company’s generating a substantial amount of free cash flow compared to the valuation of its business.

The two energy companies that topped our search, New Jersey Resources (NJR) and Dominion Energy (D), both have negative free cash flow yields – simply because they have negative free cash flows to begin with. This can signal danger, especially when it comes to dividend paying companies (as both of these are), as it can be an unsustainable path and bring substantial headwinds later.

On the other hand, NOC, ORLY, and PLNT all have positive Free Cash Flow Yields, with NOC’s being the largest – while being the only stock among the three to issue a dividend.

And the presence of a dividend is always worth noting: If a company doesn’t issue dividends, it can use its free cash flows to reinvest in the business or buy back stock. Both ORLY and PLNT regularly buy back hundreds of millions in stock per quarter, which can be good for you as a shareholder.

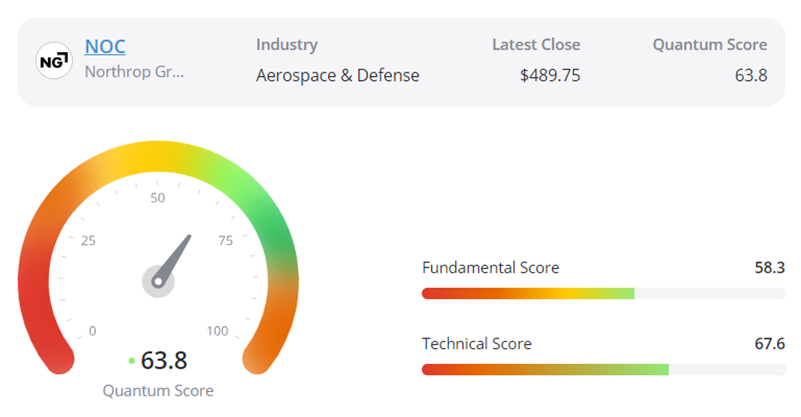

To wrap this up, though, let’s look at Jason Bodner’s Quantum Score for these stocks…

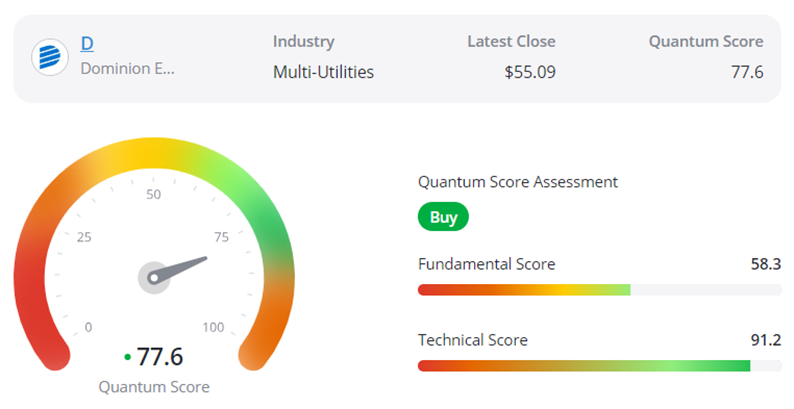

The Quantum Score factors in fundamental and technical factors, including the buying power of deep-pocketed Wall Street institutions. It’s designed to dial in on growth stocks riding momentum higher.

Pair this with stocks newly entering the Green Zone, and you have a recipe for finding great breakouts.

From the five stocks we found in our search, let’s look at the three names that most recently entered the Green Zone: NOC, D, and ORLY:

Unlike the BQS, the Quantum Score has a “sweet spot” between 60 and 80. Stocks in this zone are buys, while stocks whose scores have gotten above 80 are potentially overheated – and stocks with scores below 60 aren’t seeing enough buying pressure… or have otherwise poor fundamental factors.

All three of the stocks above are right where we want to see them. D is approaching the overheated level, but hasn’t got there yet.

Based on what we see between these proprietary metrics and the recent crosses into the Green Zone, it’s clear to me that NOC, ORLY, and D should be your top targets.

To your health and wealth,

Michael Salvatore

Editor, TradeSmith