Can Shake Shack (SHAK) Deliver Huge Profits?

Editor’s Note: TradeSmith offices are closed today to observe Presidents’ Day, but we didn’t want you to go without timely and interesting commentary. Our friends at LikeFolio have stepped up, and we will be back with regular TradeSmith Daily content tomorrow. For now, enjoy! —JCL

When Shake Shack reports earnings on Feb. 25, it will be different than you’re used to.

Normally, when a company reports earnings, everything about the prior quarter is revealed for the first time.

But in Shake Shack’s case, the company already let the cat out of the bag in its shareholder update on Jan. 12. SHAK reported 20Q4 revenues of $157.5 million – at the top end of analyst expectations.

This early reveal gave Wall Street a sigh of relief.

It proved that Shake Shack’s business was recovering in the wake of the pandemic.

As a result, shares of SHAK have soared to new all-time highs above $126.

Impressive. BUT….

Revenue is only part of the story.

There are still three very big questions lingering in the minds of investors that will be answered during earnings on the 25th… and could make or break Shake Shack’s big stock run.

Did Shake Shack Make A Profit?

While we already know the company’s revenues, it has not released how much spending was required to achieve those numbers.

At LikeFolio, we focus on consumer demand and generally don’t have insight into company spending levels.

With analyst expectations ranging from -0.16 to -0.06 per share, it seems unlikely that the company will have produced a profit in Q4.

But far more important than the company’s profit last quarter will be what the company says about the current quarter and the rest of 2021…

What is Shake Shack’s Outlook For 2021?

The market is unforgivingly forward looking.

That’s why you’ll sometimes see companies report blowout earnings, only to have the stock fall due to company revenue and profit projections that disappoint Wall Street.

In Shake Shack’s case, there is reason for concern.

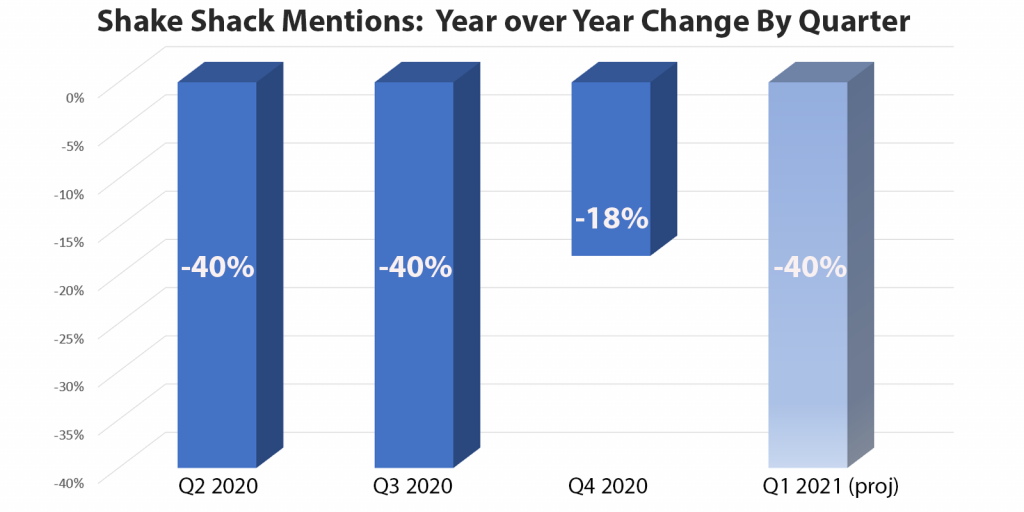

In the chart above, you can see that LikeFolio data accurately predicted the relatively strong Q4 revenue numbers that the company reported last month.

Wall Street saw that report as a signal that the company was starting to make a comeback following its massive revenue drops in the two prior quarters.

But when we look at the first six weeks of the current quarter, that “light at the end of the tunnel” starts to dim considerably.

This reversion back to a 40% decline in year-over-year consumer mention volume tells me that what happened in the last quarter of 2020 may have been an outlier and could actually be giving Wall Street a false sense of confidence regarding Shake Shack’s comeback.

So… what could have driven this “outlier” in Q4?

Has Shake Shack Become Dependent on Third-Party Delivery Services?

2020 completely changed the way consumers eat.

Instead of going out to restaurants, restaurants are coming home to us.

Third-party delivery apps have made meal delivery more popular than ever, giving consumers choices that they’ve never had before.

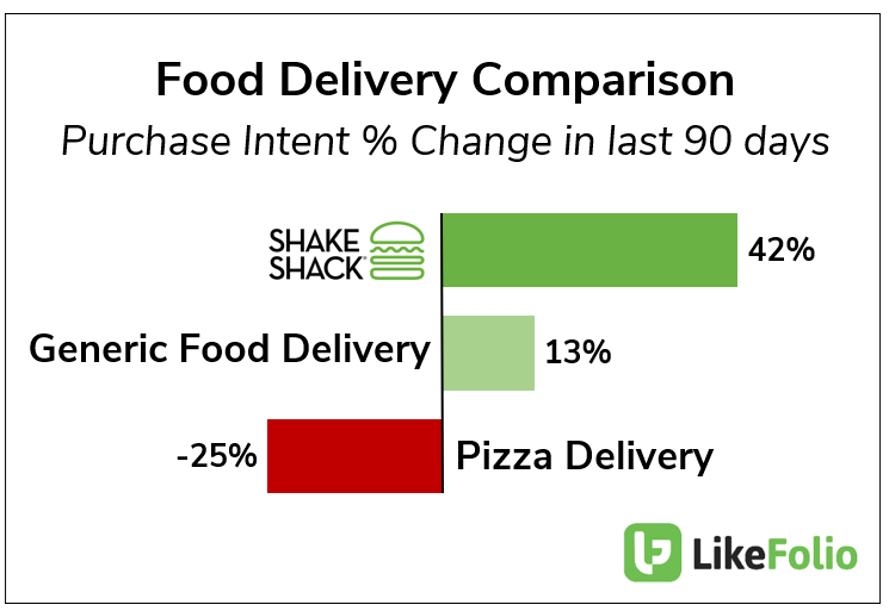

Instead of “which pizza place?” being the home-delivery question, it’s turned into “which restaurant?”

And companies like Shake Shack are benefitting in a big, big way:

Clearly, Shake Shack must be happy with a 42% increase in consumer demand for delivery of its tasty burgers and shakes. Any time you can outpace the overall trend (generic food delivery) by more than three-fold, you’re doing something right.

But third-party delivery is a double-edged sword.

On one hand, it makes Shake Shack’s product more accessible to a convenience-driven marketplace, increasing revenues.

On the other hand, third-party delivery introduces a middleman between Shake Shack and the customer, which not only reduces their control over the customer experience, but it costs money and can decrease profit margins.

This pressure on margins could become incredibly significant if it turns out that Shake Shack was pushing marketing dollars into third-party apps to improve its listing placements.

Playing Shake Shack (SHAK) From Here

Summary:

- SHAK stock is near all-time highs.

- The good news about company revenues is already “baked in the cake.”

- LikeFolio data suggests that consumer demand has already fallen back to the poor trends of Q2 and Q3 2020.

- Shake Shack’s business in third-party delivery is booming but could weigh significantly on the profit margins that the company reports.

This all suggests Shake Shack investors could be in for a nasty surprise when the company reports earnings next week.