Can You Identify a Short Squeeze?

|

Listen to this post

|

During the first quarter of 2021, you couldn’t escape stories about GameStop Corp. (GME).

It’s no wonder.

GME shares shot up from $17.25 at the beginning of January to more than $350 on Jan. 27 — just three weeks later.

What made this stock surge?

It wasn’t an amazing announcement that made investors love the company or great sales.

Most everyone knows that it was because of a “short squeeze.”

GameStop wasn’t the only stock, or even the biggest one, to receive the short-squeeze treatment this year. And short squeezes have been around for a long time, so it’s important to know what they are, how they work, and most importantly, whether you should be getting in on the action.

As you can imagine, understanding a short squeeze requires two things.

Knowing what “shorting” is and what a “squeeze” is.

Let’s dive in.

Defining the Short Squeeze

In investing, a “short” is a strategy typically used by bankers and hedge funds on Wall Street to make money as stocks go down.

See, normal people like you and me buy stock in a company. So if the firm’s shares go up in price, the value of our shares also goes up, and we make money.

If the shares go down in price, we lose money. That’s pretty simple.

So we find the companies we like and believe in, buy their shares, and cheer them on.

This is called “going long” a company’s stock.

The TradeSmith system and alerts were originally built for exactly this type of position. You enter a stock in a long position and then get default and/or personalized alerts that fit your investing strategy if and when that stock begins to fall.

But going long is not enough for Wall Street.

See, hedge funds and other money managers (and really anyone with a short position) also want to make money as the price of a company’s shares goes down.

So they engage in a process known as “going short,” or simply “shorting.”

How to Short a Stock

To short a company, you don’t buy its shares.

Instead, you borrow them from someone who already owns them and pay them a fee.

Once you have the borrowed shares, you sell them and pocket the money. Then, ideally after the stock’s price drops, you repurchase the shares and hand them back to whoever owns them.

If the price of the shares has gone down as you expected, you’ll repurchase the shares for less than you sold them for. That price difference (minus the borrowing fee) is your profit.

But if the stock goes higher, you’re on the hook for the difference plus that borrowing fee.

Here’s an example. Say you had the same idea that Wall Street did, that GameStop would lose business to online game sales.

So way back on Aug. 1, 2018, you borrowed 10 shares of GME and sold them at the closing price of $13.27. That gave you a credit of 10 x $13.27 = $132.70.

A year later, GME shares had fallen to $3.97 — a drop of 70%. So on Aug. 1, 2019, you decided to buy back the 10 shares at the cost of 10 x $3.97 = $39.70.

Altogether, you made $132.70 – $39.70 = $93 (a gross profit of about 70% minus the fees your lender charged for lending you their GME shares).

That’s a sweet profit to make on a stock that imploded.

Here’s the thing, though.

When you and I “go long” and simply buy a stock, our risk is limited. The worst that can happen to a stock is that it goes down in price to $0.

That means you lose 100% of your investment.

That’s bad. Very bad.

But you only lose what you put in. The risk is limited.

On the other hand, shorts are the opposite because you’re betting the price will go down and there’s no upper limit to how high a stock could go, at least in theory.

A stock can only ever go down to $0, so the most you can make shorting a stock is keeping all the money you made selling it.

But the risk of shorting is unlimited. To go back to GME, suppose you’d been wrong, and the stock doubled in price. Or tripled.

Or went up in price 10 times.

You’d still be on the hook to buy back those 10 shares and give them back to your lender, whatever the price you had to pay.

So chances are that as the stock starts going up in price, you rush to buy it in order to limit your losses before it climbs even more.

And that’s where the squeeze comes in.

Understanding the Squeeze

By buying the stock to limit your loss, you’re increasing demand for it.

And that makes the stock’s price move up.

That increases pressure on others who are shorting the stock to also buy back their shares. When they do it, the stocks move up even more, which ratchets up the pressure again.

If enough people are shorting a stock, even a tiny uptick in price can cause a panic. Short sellers rush in to buy back their shares, pushing up the price even more and forcing even more shorts to do the same.

And if there’s no one to sell the shares, the price will just keep climbing.

Let’s go back to early January 2021.

At that point, about 140% of all publicly held shares of GME were sold short. Yes, that’s right. A stock can be shorted above 100%. Here’s what happens. Once the short seller has borrowed the stock from the lender, they can then sell them back to the market. At that point, the new owner can lend them out as well, and they can be shorted by another party.

Of course, some people on Reddit thought that was ridiculous. After all, you’d think you can’t sell more shares short than there are shares.

In any event, they started buying GME shares (and some options to speed things up), hoping to move the share price up. They hoped that would force some short sellers to cover their losses. In turn, that would start the avalanche of short sellers pushing other short sellers to buy.

In other words, it would start a short squeeze.

As you know, it worked. As the price started creeping up in the middle of the month, the people on Reddit encouraged each other not to sell. That kept supply of GME shares low even as demand soared.

The result? As I mentioned, GME shares went from $17.25 at the beginning of January to more than $350 on Jan. 27.

That’s an increase of about 1,930%.

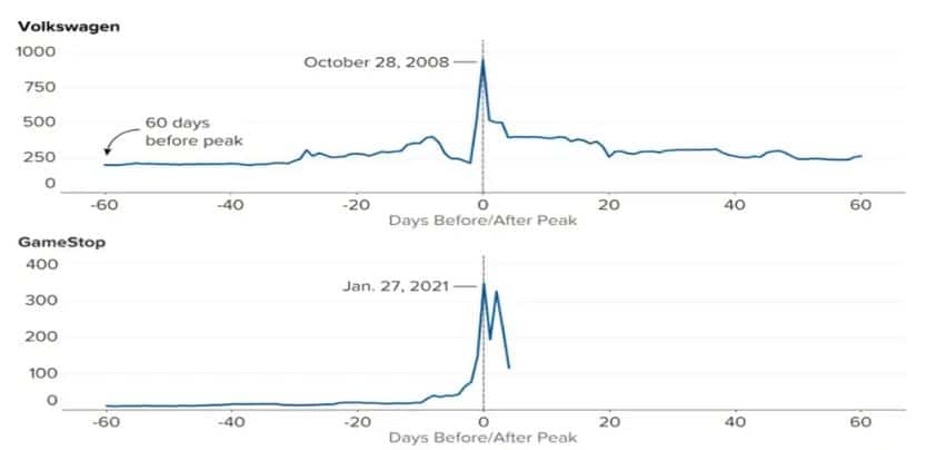

Something similar happened to Volkswagen back in 2008.

Two years before, Porsche had announced it was increasing its stake in Volkswagen.

It kept buying so many shares, the price rose steadily. Come 2008, some analysts thought that had pushed Volkswagen’s share price way too high.

Combine that with the recession and falling stock market, and people piled in on shorting Volkswagen.

The only problem was this: By October 2008, Porsche owned 43% of Volkswagen’s shares. Another 32% of Volkswagen’s shares were under Porsche’s control through options.

And the German government owned another 20.2%.

Altogether, that’s 95.2% of Volkswagen’s shares locked up.

Neither Porsche nor the German government would sell their shares.

So when investors shorted 12.8% of Volkswagen’s shares, that accounted for 2.6 times the available shares.

When the price of VW started moving up, with some help from a weekend announcement by Porsche, the jig was up.

Short sellers rushed to buy back shares to limit their losses. This pushed the price of Volkswagen up even more. Except barely anyone was selling shares because Porsche and the government had locked up so many.

So within 48 hours, Volkswagen’s share price quadrupled. The company briefly became the largest carmaker in the world by market cap.

Hedge funds lost billions, and four days later, the price settled 58% down from its peak.

The charts of both short squeezes are surprisingly similar.

To recap, short squeezes happen when large amounts of the publicly available shares of a company are being shorted. Then all it takes is a small increase in share price for the avalanche to start.

But while the price increase is huge, the drop in price after the short squeeze can be just as intense. The volatility on the way up usually matches the volatility on the way down. Let’s dig into more stocks tomorrow.