Crypto Boom Incoming?

|

Listen to this post

|

Editor’s Note: Today we’re sharing another guest editorial from Andy Swan, founder of LikeFolio. The value of LikeFolio’s consumer-driven research is unmatched, and we’re proud to have the company as our only third-party partner. Enjoy Andy’s insights on a new cryptocurrency trend. We hope you enjoy your Labor Day; Keith will be back tomorrow with his thoughts on the “September Slump.”

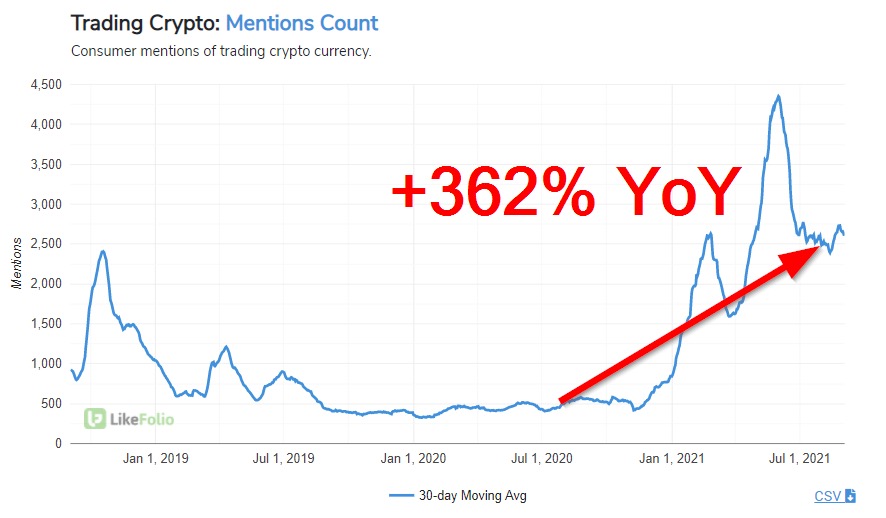

Interest in trading cryptocurrencies is picking up again. We know this through LikeFolio’s tracking of Mentions around trading crypto:

Obviously, something big is happening here, and I’m starting to see the leadership of traditional cryptocurrencies beginning to spark opportunities in the relatively new blockchain gaming space.

“Old School” Crypto Is Surging

Ethereum ($ETH) has always played second fiddle to Bitcoin ($BTC) in terms of relevancy and recognition, but rising adoption of the Ethereum blockchain is starting to change that.

Over the past week, Ethereum (not Bitcoin) led the entire cryptocurrency market higher, surging by more than +25% to new highs.

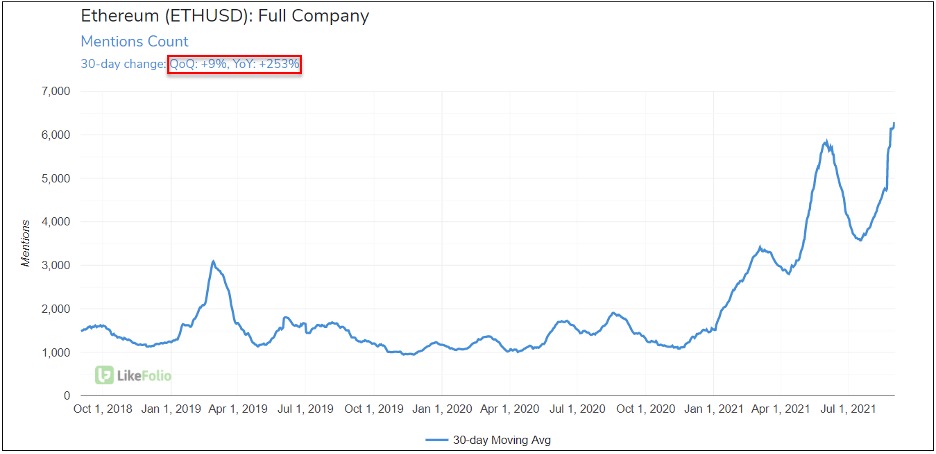

Underlying Consumer Buzz confirms ETH’s growing relevance: Total Mentions of Ethereum are at a new all-time high (ATH) and still trending higher, +9% QoQ and +253% YoY (30-day moving average).

As the centerpiece of the push for decentralized technology, Ethereum’s DApp (decentralized app)-friendly blockchain attracts additional active users by the day.

The organic growth of the ETH network seems to contradict speculation that cryptocurrencies are “worthless” and will “go to zero.” It’s hard to argue against proven utility.

Despite this “utility awareness” surge in Ethereum, Bitcoin (BTC) maintains a commanding lead in terms of market cap and sway over the crypto market.

The $50,000 price level provided strong resistance last week, but now Bitcoin is fast approaching another test of that level.

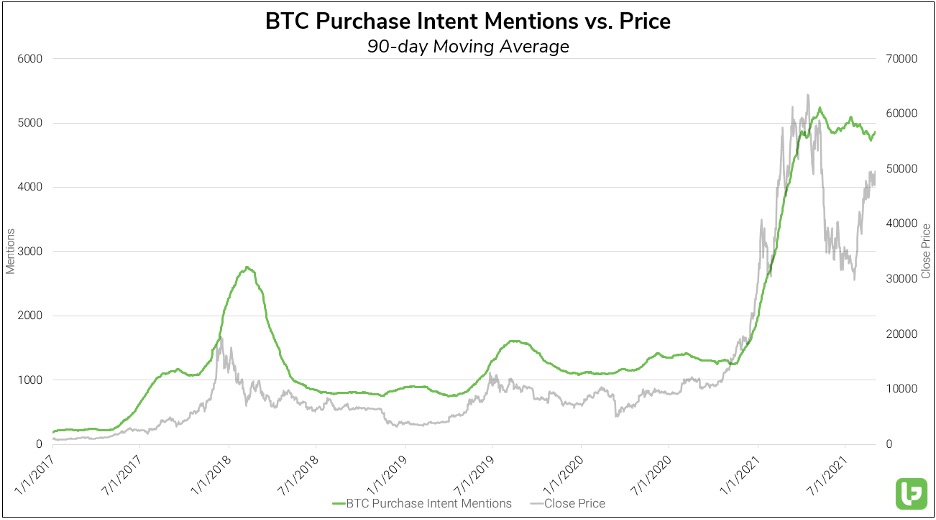

Although recent price action suggests some similarities to the 2017-2018 bull cycle, a chart plotting Bitcoin’s Purchase Intent Mentions against the price reveals immense relative strength in 2021.

It’s been a little more than four months since BTC reached its 2021 ATH of around $63,000. And its near-term outperformance versus the prior bull cycle can be quantified:

- Since the 2021 ATH price, BTC Demand has risen +1% on a 90-day moving average. In the four months following the 2017 high, BTC Demand had already declined -37%.

- In 2021, BTC’s price fell roughly -53% from the ATH, and has since bounced more than +66% from those lows. In 2017, BTC sold off by -66% from the ATH, with a max gain of +49% in the resulting bounce.

Bitcoin is still showing strength, and a clean break above $50,000 would be a bullish indicator for the entire crypto market.

The success of these traditional coins is partly due to the expansion of their utility in other sectors. Gaming is one example…

“Blockchain Gaming” is on the Rise

We first featured “Axie Infinity,” a blockchain-based trading and battling game, in an email to LikeFolio members approximately a month ago… And its unprecedented success has already had a profound impact on the cryptocurrency space at large.

Axie Infinity Shards ($AXS), the Ethereum tokens that both govern core gameplay and serve as investable shares, have gained nearly +70% in the past month, alongside a massive spike in active users around the world.

This growth has not gone unnoticed.

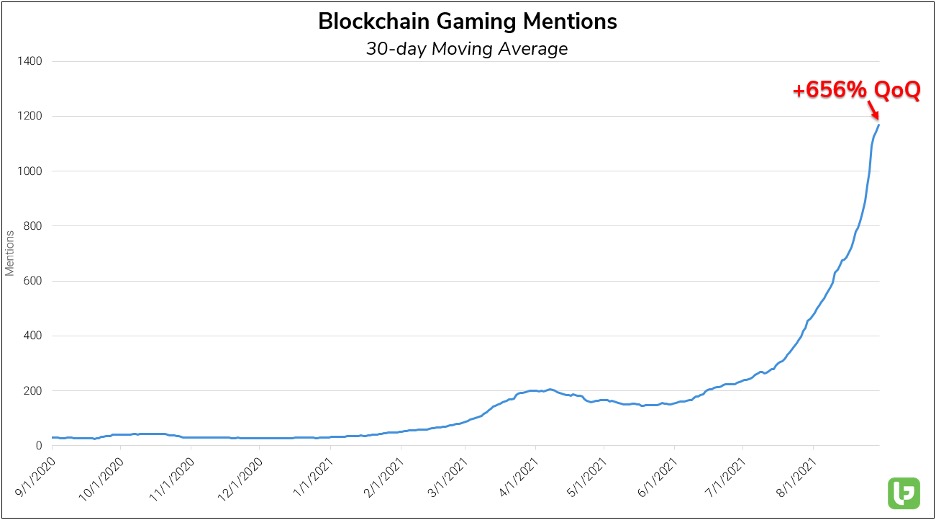

Consumer Mentions of blockchain-based games have exploded higher in recent months: +656% QoQ (30-day moving average).

Several key elements make blockchain games unique, the most important being the ability to play to earn.

Players earn cryptocurrency tokens (like $AXS) for completing in-game challenges. Additionally, all items and assets are NFTs, which can be sold on the open market for financial gain.

Axie still holds a commanding lead as the No. 1 blockchain game, but there are untold hundreds that have appeared in the past month, hoping to capitalize on its success.

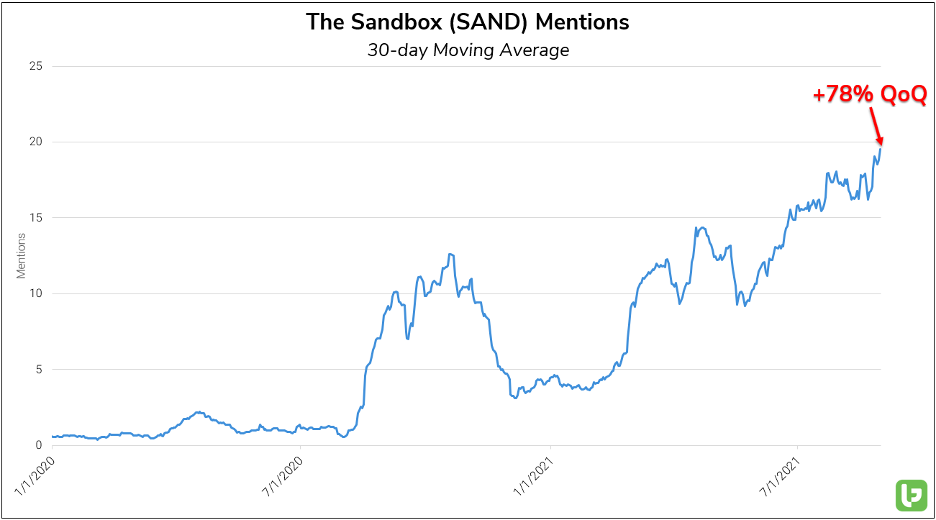

“The Sandbox” ($SAND) is another high-profile project in the crypto gaming space, and LikeFolio data shows that consumer interest is on the rise.

Mentions of The Sandbox have risen to an all-time high, currently +78% QoQ on a 30-day moving average.

Much of the recent increase in Buzz can be attributed to the performance of the underlying protocol token, $SAND, which has gained nearly +200% in the past quarter and +55% in the past week.

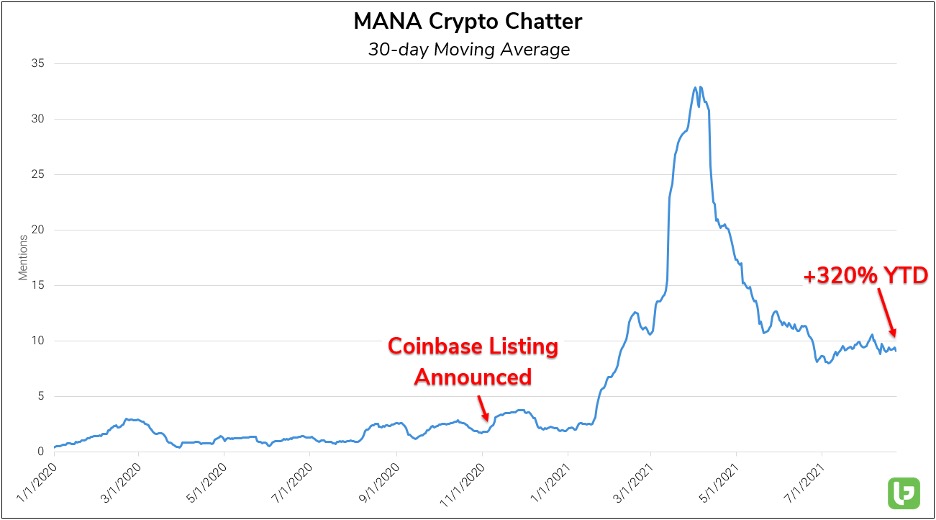

The Sandbox is similar in form and function to another blockchain game called “Decentraland” ($MANA), which allows users to create, experience, and monetize their content and applications – a similar concept to Roblox (RBLX), but with a unique twist:

There is a finite, traversable, 3D virtual space within Decentraland called LAND, which is a non-fungible digital asset maintained in an Ethereum smart contract.

LAND is divided into parcels that are identified by Cartesian coordinates (x,y).

These parcels are permanently owned by members of the community and are purchased using the governance token, $MANA.

Investor Mentions of $MANA have maintained a higher level despite a pullback in the price, trending +320% YTD on a 30-day moving average.

Since its initial listing on Coinbase in November 2020, the price of $MANA has soared from below $0.10 to nearly $1.45 at its peak, and it’s rising again.

These blockchain gaming companies will make for interesting comparisons as adoption rises in the future.