Don’t Jump Off the Tech Train Yet

|

Listen to this post

|

Higher and higher the tech stocks go…

AI-fueled companies like Nvidia (NVDA) have been surging this year, taking large-cap benchmarks to places few expected we’d see so quickly.

As I write, the S&P 500 just captured a new high point of 5,360.

But at TradeSmith, we saw reason to believe that the bull market was far from over when stocks were previously making new highs in January, for example.

Then as a follow-on piece, we showed how brand-new highs for the market were undoubtedly bullish for software and semiconductors, specifically.

In the latter study, history proved how semis and software stocks were bound for 23% and 15.5% gains six months after a new high in the S&P 500.

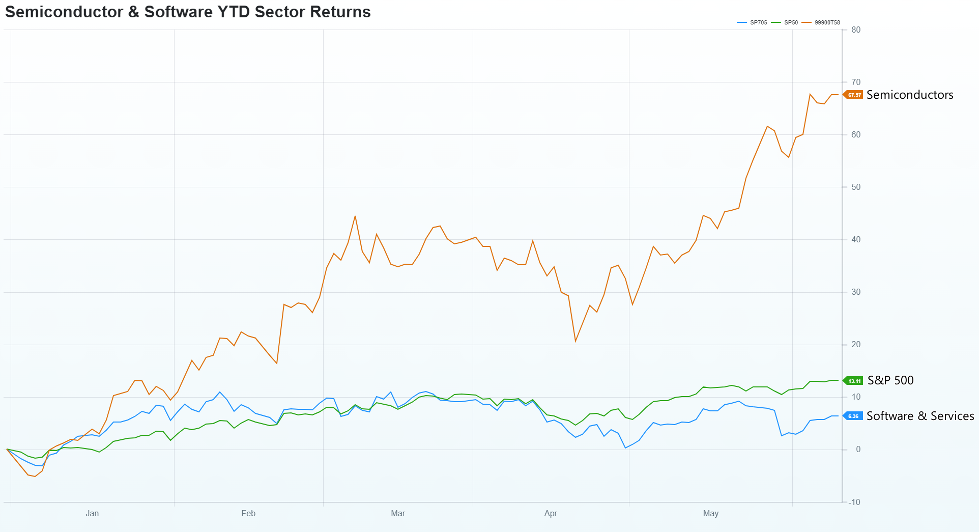

Less than five months after this prescient call, we’ve been handed 51% gains for semiconductors… and only 1% gains for the software space.

Averaged out, those performances are better than expected.

But here’s the even better news.

Historical evidence still points to further upside for the high-octane growth pockets of the market… namely the red-hot semi space.

June typically kicks off a powerful continuation trend that you’ll want to learn.

But before we get into that, let’s investigate the current tech landscape and understand why the group is undoubtedly the king right now.

Semiconductors Reign Supreme in 2024

2024 has thus far marked an epic surge in semiconductor stocks.Just one look at the 67% year-to-date ripper in the Semiconductors & Semiconductors Equipment Industry shows this beautifully.

Below plots the 2024 returns for semis (orange) compared to software (blue) and the S&P 500 (green). All are positive, with semiconductors stealing the show:

They’re all gaining for good reason, too… earnings acceleration.

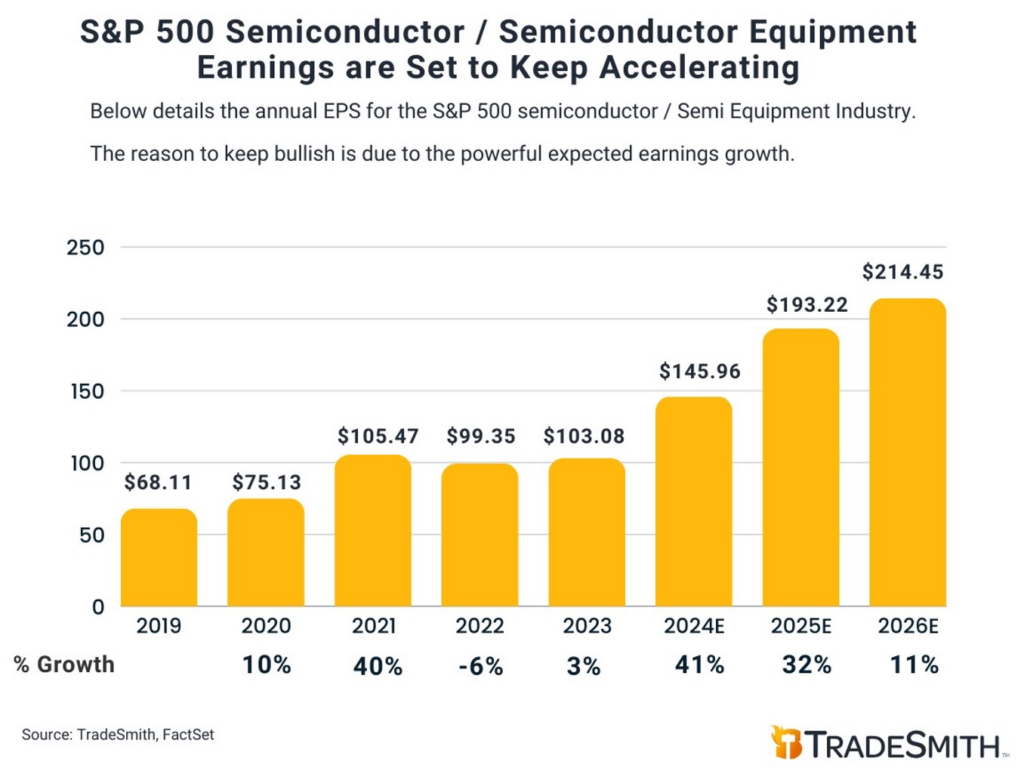

Check out the earnings per share (EPS) figures below for the semiconductor space since 2019…especially what’s slated for 2024 and beyond.

If estimates shake out accordingly, we should see EPS surge to $145.96 in 2024, representing an incredible 41% jump from 2023.

Even more impressive is the 32% growth expected in 2025, followed by 11% in 2026:

That’s why it’s paramount to bet on the highest-quality stocks.

But having a technical tailwind isn’t a bad idea, either.

And that’s what’s coming this month.

Keep Holding Semiconductor and Software Stocks into Year-end

Having a solid earnings picture is the main criteria for owning a basket of stocks. However, understanding historical tendencies stacks the odds in your favor even more.

Given the powerful gains we’ve enjoyed in 2024 for popular tech stocks, I wanted to see what June to December typically holds for the groups.

Turns out that since 1995, June to December amounted to nearly 10% gains for the big three tech industry groups.

That’s right. Just because we’ve enjoyed handsome gains thus far, it isn’t a reason to bail on stocks. From 1995 through 2023, here’s how the Tech industry groups performed:

- Semiconductors jumped 9.2% on average

- Software & Services ripped 10.2%

- Tech Hardware & Equipment vaulted 9.7%

Also included in the graphic are the average industry returns in the months of January to May (includes 2024) and the full-year performance.

Even though software has been a laggard this year, it’s historically the strongest performer in the back half of the year. That means it’s not too late to buy in… but it’s getting close.

With both a solid earnings backdrop and a technical picture that spells even more gains into year-end, I’m not jumping off the Tech train yet. And neither should you.

We’re in the midst of one of the greatest bull markets in history. Now’s the time to sharpen your pencils and isolate the best technology businesses primed for years to come.

Regards,

Lucas Downey

Contributing Editor, TradeSmith Daily

P.S. As America enters an “Age of Chaos,” full of uncertainty and tumult, the idea of prosperity may seem nonexistent. But Charles Sizemore, Chief Investment Strategist at our corporate partner The Freeport Society, has developed a system to bypass the market fear and doubt using a hidden income strategy ignored by 99% of investors.

This “CHAOS Cash” system pulls together 29 specific metrics to spot opportunities in all markets – up, down, or sideways. But this isn’t your usual income strategy… it thrives in market volatility, so your portfolio can keep growing.

Make more money with less risk … that’s how most folks want to invest. Charles Sizemore can show you how to do that here.