Debunking Market Myths – ‘Cash Is Safer than Stocks’

There’s a lot of misinformation out there.

Time and time again, I find myself on blogs or reading Twitter…

And I constantly stumble across a wealth of stock market myths.

This week, I’m busting several of the biggest misconceptions about the stock market.

I’ll start with the biggest doozy of them all.

The belief that sitting on cash is SAFER than owning stocks.

There are two critical reasons why this is nonsense.

And, as always, I’ll give you a great, lower-risk stock that you can buy and hold instead of leaving your cash in the bank.

Have You Seen Interest Rates?

The most important reason why cash is not a better asset than owning stocks is based on historical returns. The S&P 500, as an index, has returned an average of 8% annually for the last 30 years.

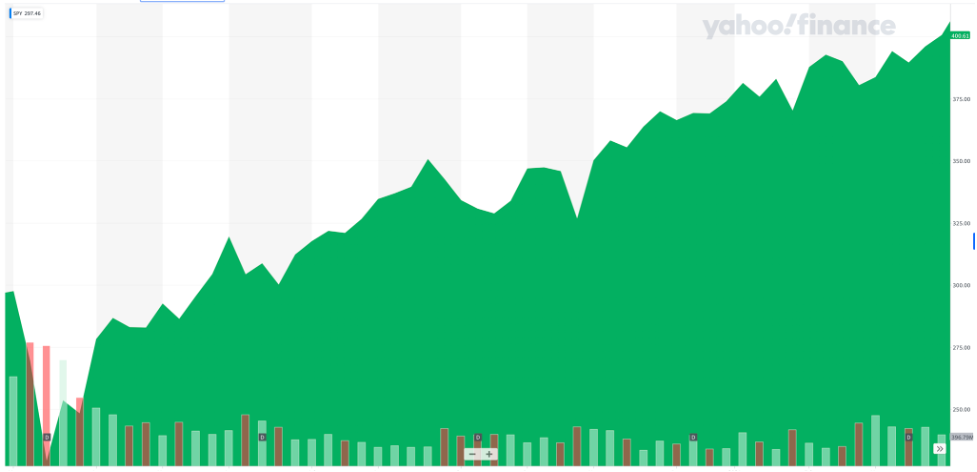

And in the last 10 years, that figure has hovered around 12%. Now, that doesn’t mean that every investor is going to achieve those returns. But by simply owning shares in the SPDR S&P 500 ETF Trust (SPY), a passive fund that replicates the performance of the S&P 500 index, an investor would have generated similar gains on that position.

You cannot get solid returns without risk.

But you definitely can’t generate big returns when you’re just sitting on a pile of cash. The Federal Reserve’s efforts to keep interest rates low over the last decade have punished anyone who has held their money in a savings account.

I’m taking a look right now at my savings account, where I keep emergency cash.

The annual interest rate is a pitiful 0.05%.

That’s right. It’s less than a tenth of a percent…

Even if you’re the most conservative investor in the world who can’t tolerate market volatility, some funds and stocks will give you much higher returns than what you’d get from your local bank.

For example, blue-chip stocks can provide strong dividends – typically between 2.5% and 5% – and give you strong appreciation upside over the long term.

These companies typically have a strong reputation, a strong balance sheet, and market capitalization in the billions. As a result, they tend to generate investment from large institutions that put their confidence in these stocks over the long term.

The “I” Word Evaporates Your Purchasing Power

Want to know the real danger of sitting in cash?

It’s the dreaded “I” word.

Inflation.

The Federal Reserve has said it will allow this economy to run hot and that it wants inflation to be higher. The Fed sets an annual target of 2% inflation. However, in April, the Consumer Price Index (CPI) increased by a staggering 4.2% year-over-year. And the Producers’ Price Index (PPI) increased by 6.2%.

You’ve probably noticed that the price of just about everything has been going up.

The government has largely blamed gasoline prices, which jumped by 22.5% over the 12 months ending March 30. But supply chain disruptions and pent-up consumer demand have just about everything going higher in prices.

It’s not just the price of gasoline that is rising. Used car prices increased by more than 8% year over year. Take a walk down the lumber aisle at Home Depot, and you might be paying double what you would have paid last year for wood.

And don’t even get me started on the price of a cookout heading into Memorial Day weekend. Bloomberg recently reported, “Food inflation has been inching up for months, driven by soaring commodity costs, costlier transportation, and challenges securing labor.”

Those delicious steaks I want to cook continue to surge in price. Butchers divide cattle into different types of cuts and then sell the meat as boxed beef. These cuts include chuck, rib, loin, sirloin, and brisket. Roughly 86% of all beef falls into one of two categories: Select or Choice. The wholesale price of 100 pounds of USDA’S Choice beef jumped above $300 per hundredweight (CWT).

That figure represents a $75 or 33% increase compared to the same period last year. Ouch.

We don’t even have to look at recent events to understand the erosion of the U.S. dollar’s purchasing power over time. Since 2011, the purchasing power of the U.S. dollar has fallen by 15.8%, according to usinflationcalculator.com.

That means an item that cost $100 today would have cost $84.23 just 10 years ago.

I want to stress that it’s very important to think about investments on a time horizon.

Yes, you could look at what happened in March 2020 and see that the sharp downturn pummeled many investment portfolios. But look at what has happened in the market from March 2020 to March 2021.

The markets surged.

Go even further with this analysis. Yes, in 2008-09, you might have seen the U.S. markets crash and hit their bottom.

But look about what happened over the next 10 years (March 2008 to March 2018).

The reality is that the longer the time horizon, the safer it is to own stocks and the riskier it is to hold cash.

The ongoing war against savers by the Federal Reserve combined with inflation has pummeled the value of the dollar.

Now, with the price of everything going higher and higher, it’s clear that the dollar could be worth several percentage points less at this time next year.

And keep in mind. The numbers that you get from the government on inflation are their “official” numbers. I think it’s fair to say that we are seeing much higher prices than what they’re telling us.

So What Can We Do?

I get it. The markets are sitting near all-time highs. Valuation levels are sitting at the frothiest points since the dot-com crisis. But sitting in cash at a time when the Federal Reserve is intentionally trying to run inflation higher is a real danger.

Rather than park your money in a low-interest savings account, you can put your capital into stocks that will perform well in any market. Consider “defensive” industries like consumer goods, utility companies, and even cybersecurity.

“Defensive” stocks sell products or services that are essential to humanity and can kick off higher yields and returns than cash. Their products remain popular and in-demand regardless of the market’s current state.

Looking for an example? Try Procter & Gamble (PG).

Procter & Gamble pays a 2.5% dividend and recovered quickly during the March 2020 crisis. The company produces toilet paper, dishwashing liquid, soap, hair products, cough and cold products, Pepto-Bismol, mouthwash, and many other household products. (It’s also a major manufacturer of diapers, a product that is constantly in demand.)

Right now, PG stock sits in the Green Zone on TradeSmith Finance. And even though it’s in a side-trend, the company falls into a variety of different strategies on the platform.

These include Dividend Growers, Best of the Billionaires, and Sector Selects. This is also a holding of big-time investors like Ray Dalio, Warren Buffett, and Charles Schwab.

Seeing the stock fit in those buckets helps increase our conviction.

And, instead of parking cash in a bank account, we can tap into the potential of both income and appreciation upside from this dividend stock. I’ll be back on Friday with another myth that requires busting.