How Many Stocks Should You Own?

We told you about the second most-asked question we get at investment conferences – how does an investor more effectively manage all the stocks he or she has bought?

This is not new. Investors, especially newer ones, get excited about all the stock recommendations they read about and in just a few months, they can own well over 100 stocks. We’ve spoken with investors recently who own more than 200 positions. And just like that, they have a problem managing so many investments.

Once you’ve made the decision to cut down on the number of stocks you own, and you’ve started the process, how will you know the best number to ultimately own and manage?

The first step in making this determination is knowing your own investment style. Do you like to know a lot about the companies you own, read the research reports and earnings announcements, or are you just interested in following the price movements and following the alerts you set up?

If you’re more hands-on, you might want to follow fewer stocks, but if you’re only looking for signals, then maybe you can handle more positions in your portfolios.

Either way, you need to determine the maximum number of stocks you can comfortably manage. Owning a smaller number gives you a better chance to outperform the markets while owning 100 or more stocks limits your ability to outperform. It’s also potentially more expensive (though with the move to zero commissions by many of the larger brokerage firms, cost shouldn’t be a big disadvantage) to manage a large portfolio of stocks.

A few years ago, we ran a couple of tests on how many stocks to own while still beating the markets. We started with our eyeball estimate of 20 positions being the best number for individual investors. And that number turned out to be really good.

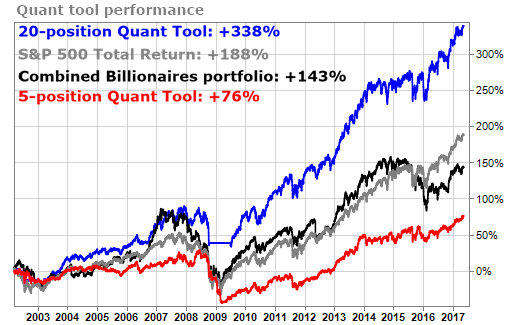

Using our Pure Quant tool, we looked at the TradeStops billionaires and measured their returns using just 5 stocks, 20 stocks, and their entire portfolio of stocks over 16+ years.

The five-position portfolio decidedly underperformed both the S&P 500 and the billionaires themselves, but the 20-position portfolio greatly outperformed.

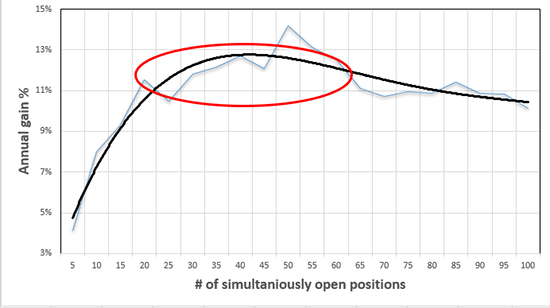

We weren’t content to just sit on these findings alone, however. Our team wanted to determine if there was an “optimum” number of positions that an investor could hold without being overly burdened.

So, we conducted further testing, and you can find those results below. The red circle highlights the peak performance. Overall, anywhere from 20 to 60 stocks had around the same gain, within 1-2% of each other.

Anywhere within that range will optimize your returns, based purely on numbers. We say that 15 to 25 stocks is a good starting point, for several reasons:

- Even with the move to zero commissions, many brokers still charge a fee, and transaction costs increase as the number of stocks increase. Starting with 15 to 25 and only adding more stocks after careful research helps to minimize those costs.

- Your portfolio should consist of “winners” — stocks with low volatility and consistent returns.

- You should be familiar with each stock in your portfolio; confidence in your investments comes with knowledge!