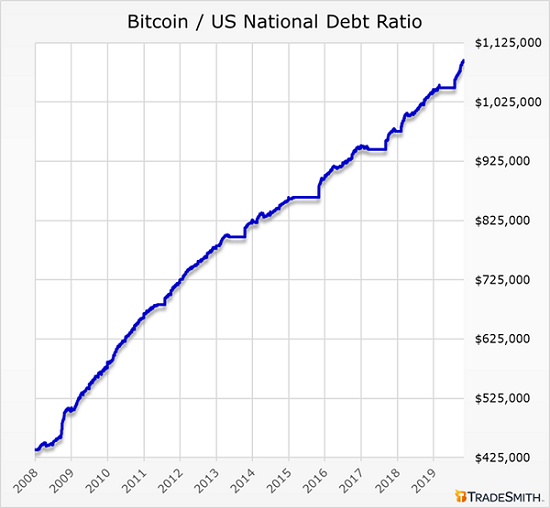

The Bitcoin to U.S. National Debt Ratio

Cryptocurrency can be complicated. But the case for Bitcoin is simple.

It all comes down to one chart: The Bitcoin to US National Debt Ratio. The chart itself is simple too, as you can clearly see below.

The chart is actually a little bit unfair — to Bitcoin. But even though the chart has an anti-Bitcoin bias (for reasons we’ll explain shortly), it does a good job of capturing the big picture.

The chart presumes a total number of 21 million Bitcoins. That is the total number that will ever be mined. As of late 2019, the current number of Bitcoins in existence is roughly 18 million. Beyond the 21 million threshold, there won’t be any more.

Bitcoin was conceived in 2008 (via the famous Satoshi Nakamoto whitepaper) and born in 2009. So the chart tracks the U.S. national debt since 2008, as broken out over units of Bitcoin.

The line moves up and to the right because the U.S. national debt keeps rising, while the max supply of Bitcoin remains fixed. No matter how big the debt pile gets, the total number of Bitcoins — a hard limit that is programmed into the Bitcoin blockchain — will never change.

We said the chart is biased against Bitcoin, in part because approximately 3 million of the total 21 million Bitcoins don’t even exist yet. But it is also biased in other ways.

For example, it is estimated that as many as 4 million Bitcoins have been lost, never to return to circulation. If that estimate is correct, the maximum supply of Bitcoins is 17 million, not 21 million. Then too, the Bitcoin supply will shrink further over time as additional units are lost or forgotten.

But that doesn’t capture the full bias either, because the U.S. national debt is priced in dollars, and U.S. dollars lose their purchasing power over time.

If you own a chunk of the U.S. national debt in the form of treasury bonds, and your payments from Uncle Sam are in dollars, the value of those dollars is decreasing, bit by bit, year after year.

But the real problem with the U.S. national debt, and the reason the chart goes up and to the right, is the rate of change at which new debt supply is being created.

Simply put, debt levels are exploding. Consider these wild stats:

- In 1986, the U.S. national debt was $2 trillion. In 2019 it topped $23 trillion, for a greater than elevenfold increase over a period of 33 years. If we continue at this rate, the U.S. national debt will surpass $250 trillion by the early 2050s.

- In the year 2000, the U.S. debt-to-GDP ratio — a national measure of debt versus income — was roughly 56%. Now it is above 106%, on track to almost double over the course of 20 years.

- In 2008, the U.S. national debt broke the $10 trillion mark. Currently above $23 trillion, it has more than doubled in less than a decade.

We just noted that, at the current pace, U.S. debt levels could surpass $250 trillion in 30-plus years. But in terms of global debt, we are already there. According to a new report from the International Institute of Finance, the total world debt burden will hit $255 trillion by the end of 2019.

Meanwhile, what kind of supply expansion will Bitcoin see as all of this debt comes online?

None. Nada. Zip. Zilch. Zero.

Keep in mind, too, that nominal debt levels don’t account for the impacts of inflation, or the erosion of purchasing power that comes with inflation.

Also keep in mind that U.S. debt levels, in debt-to-GDP terms, are near the highest they’ve ever been.

For the United States, the highest debt-to-GDP level on record is just under 119%. That was in the 1940s, as a result of fighting the Second World War.

In 2019, with the U.S. debt-to-GDP ratio at 106%, we are on track to break the 1940s World War II era record in the next few years — with no World War or recession in sight!

And thus the simple case for Bitcoin comes down to supply and demand.

- There is a huge and growing supply of national debt, plus expanding volumes of fiat currency to support that debt, plus value-eroding effects from loss of purchasing power and inflation.

- The supply of Bitcoin, though, is capped. Over time, that supply will shrink rather than grow. And Bitcoin is the only asset, besides gold, with sovereign currency characteristics and global appeal.

This simple case also supports a simple conclusion: Hold onto some Bitcoin and let it be.

If the position doesn’t work out, so be it — the total exposure should be small enough not to cause indigestion.

If Bitcoin rises tenfold to thirtyfold over the next few years, on the other hand, even a small position could have a large portfolio impact.

TradeSmith Research Team