Embrace the Dip, Then Ride the Rip

|

Listen to this post

|

By Lucas Downey, Contributing Editor, TradeSmith Daily

The bears are finally coming out of hibernation…

After a swift crowd-pleasing rally off the October lows, stocks are finally beginning to wobble.

This all comes on the heels of new worrisome factors like rising interest rates and Middle East unrest. Thanks to these developments, the popular “sell in May and go away” Wall Street adage arrived early this year.

But believe it or not, this market weakness shouldn’t come as a surprise. Turns out, there’s some truth to May being a challenging period for equities.

The thing is, that’s only half the story.

With a simple move, you can play this run-of-the-mill pullback to your advantage. And I’m not talking about shorting stocks, buying protection with put options, or anything like that…

Nope.

The evidence proves there’s a window of opportunity just around the corner for patient bulls.

Stay with me, because today we’re going to unpack an awesome evidence-rich historical study. It reveals why now is the time to start getting your offensive playbook ready. But first, let’s check up on recent price action…

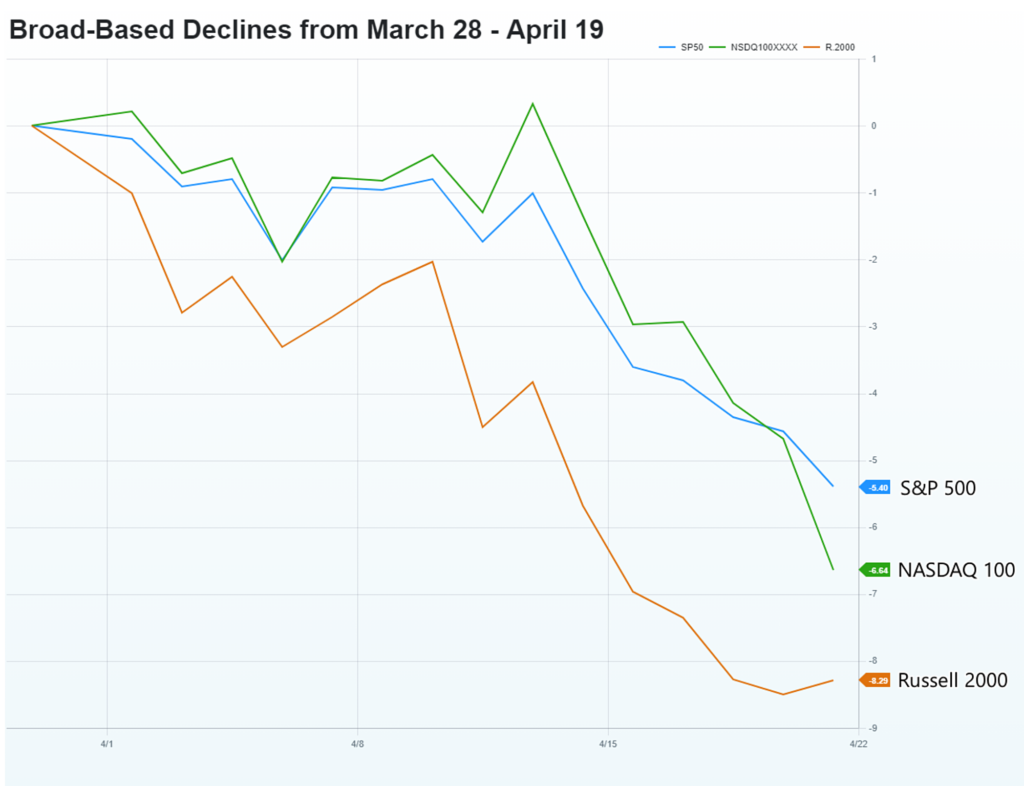

All Stocks Are Under Pressure Since March 28

The massive rally beginning in November has finally tapered off. Beginning March 28, the S&P 500 has dropped 5.4% and the tech-heavy NASDAQ has dipped 6.64% as of Friday’s close.

Those returns pale in comparison to down-and-out small-caps. The Russell 2000 has come under heavy pressure, sliding 8.29%:

Source: FactSet

As alarming as these stats appear, let’s remember that my favorite indicator, the Big Money Index, marked a significant change a couple of months back.

In early February I wrote about how this market canary is about to keel over. Markets were overbought and I noted how the BMI was starting its downtrend from those extreme levels.

As a reminder, this proprietary indicator plots the trend of institutional buying and selling in thousands of stocks. It gives you a wonderful picture of Wall Street’s demand.

You can revisit that piece and see how historical analysis suggested small caps should stay under pressure for a couple of months.

Our call didn’t disappoint …

Here’s an updated view of the Big Money Index. Institutional selling has dramatically picked up, sending the BMI free-falling:

I’ve drawn circles and arrows to illustrate how, once the BMI falls out of the red zone, stocks tend to pull back.

After years of trading institutional order flow on Wall Street, I’ve learned to respect the ultimate power law in markets: Supply and demand.

Right now, sellers are clearly outnumbering buyers.

But here’s the great news: Selloffs eventually end.

And we have strong historical evidence that a seasonal rally kicks off just one month from now…

Prepare Your “Buy the Dip” List Now

It’s never easy to stare at falling prices day after day. But down markets are part of the trading game.

And by knowing seasonal patterns, you’re armed with a playbook that takes a lot of the guesswork out of investing.

Let’s start with the not-so-good news.

There’s a good chance that the current pullback has further to go.

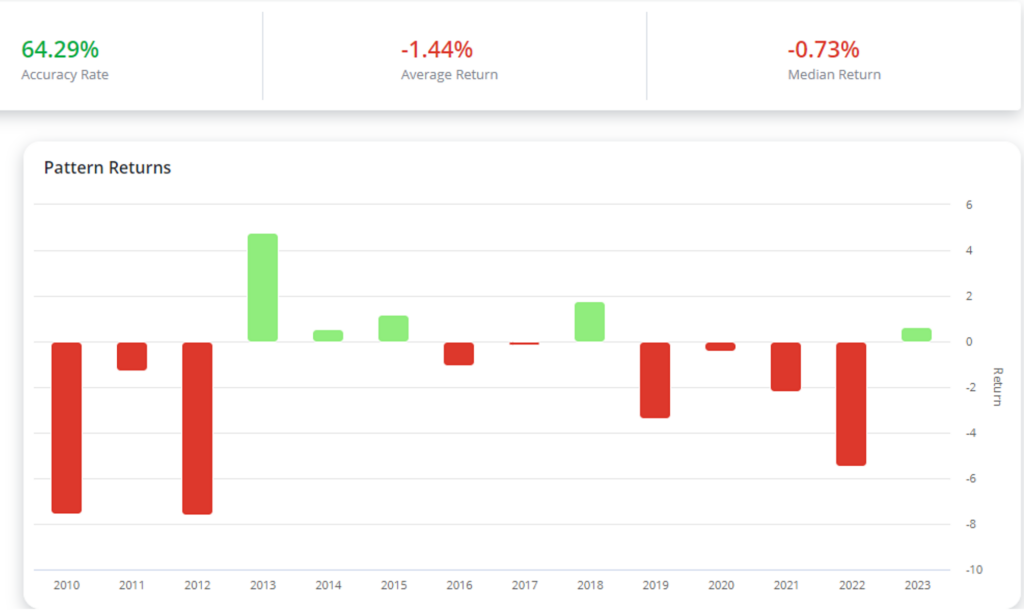

By using one of the latest enhancements offered at TradeSmith, we can see that, over the past 15 years, April 19 through May 19 has produced a negative 1.44% return for the S&P 500 (SPY ETF).

The chart below gives you an idea of how this four-week period is fraught with many pullbacks:

This is hard-hitting evidence that lines up with the weakness we currently see in major indices and the severe drop in the BMI.

Clearly, large investors are getting ahead of the “Sell in May” doldrums.

But here’s where the bad news ends and the great news begins.

May 19 tends to mark the end of seasonal weakness, kicking off a powerful rally.Check this out. Over the past 15 years, from May 19 through July 28, the S&P 500 (SPY ETF) averages a 4.57% return with a 78% accuracy rate.

If you’re allergic to green, look away now:

Don’t sell in May and go away. Focus on the bigger picture.

If history is any guide, this pullback will prove to be another amazing buy-the-dip opportunity.

Embrace the dip, then ride the rip.

Start prepping now.

Regards,

Lucas Downey,

Contributing Editor, TradeSmith Daily