Gold Now Looks Bearish — and the Dollar Bullish — because of the Quantum Deficit Effect

The TradeSmith Decoder portfolio hit a new milestone this week. Our highest conviction equity position became a ten-bagger as of the Feb. 9 close, reaching the 1,000% gain mark in less than a year.

The wild thing is, this company is just getting started. We wouldn’t be surprised to see it reach thirty- or forty-bagger status in the next few years.

Nor is it just the one position. There are other names in the portfolio — all long-term holdings of meaningful weight — up more than 205%, 584%, and 750% as of the Feb. 9 close.

There are also two more equity holdings up more than 100%, and four additional ones up between 35 and 60%, spanning an industry range of crypto, copper, solar, oil and gas, and more.

To see gains like these across the board — with a real potential for more — a powerful bull market is required. And right now, investors are experiencing one of the biggest bull markets of all time.

This brings us to gold, which looks terrible, and the U.S. dollar, which looks strong.

A great many financial editors are bullish on precious metals these days. We are not. In fact, we would not be surprised to see the gold price drop 25% or more over the course of the next year.

If you are the type of investor who prefers to keep a gold allocation no matter what, that is all well and good. Gold will rise and shine again, in our view. But if you are going to hold, be psychologically prepared for a significant amount of pain over the next few quarters.

The wide-ranging equity bull market, and the deteriorating outlook for gold, are related to each other, for reasons we shall soon explain.

We also see a significant possibility the U.S. dollar could strengthen, by a meaningful amount, over the next few quarters. This could surprise a lot of people — especially those expecting the precious metals complex to rise rather than fall.

It’s a very strange environment. And the picture could change quickly. But we are going by what we see and understand, and updating our views as events unfold in real time.

To clarify something important, we are long-term bullish on gold and long-term bearish on the U.S. dollar.

Over the next few years, we fully expect the price of gold to rise by a lot — and the value of the U.S. dollar to fall by quite a lot.

But in the medium-term, and possibly for the next few quarters, we are more inclined to see the opposite — a strengthening U.S. dollar, and a weaker gold price — because of the Quantum Deficit Effect.

The “Quantum Deficit Effect” is our name for a theory developed by George Soros, the founder of the Quantum Fund, and Stanley Druckenmiller, a long-time portfolio manager of the Quantum Fund and one of the greatest money managers of all time.

The Quantum Fund was a pioneer in the “global macro” style of hedge fund investing, reportedly earning 33% annual returns over a period of 30-plus years.

Stan Druckenmiller, who managed money separately while also running the Quantum Fund for Soros, is also known for earning better than 30% years over decades — with no negative calendar years, ever, since 1981.

Think how good a money manager has to be to never lose money, on a calendar basis, for 40 years straight, while routinely shooting the lights out. That is what Druckenmiller was (and still is) known for.

The Quantum Deficit Effect — which is not an official name, but our own descriptive reference — is a theory that was first put forth by Soros in the 1980s, in his book The Alchemy of Finance.

It is no ordinary academic-style theory, however. Academic theories don’t generate billions of dollars in profits on currency trades, and this one actually did. Soros and Druckenmiller used the theory, on more than one occasion, to score billion-plus wins in gigantic forex trades.

It applies today because, if 2021 plays out the way we think it could, the Quantum Deficit Effect could be responsible for a surprise strengthening in the dollar, even as the U.S. budget deficit expands.

The theory had its origins in the big budget deficits of the Reagan administration.

Because the Reagan administration was spending heavily to win the Cold War, and budget deficits were rising, there was a widespread belief that the U.S. dollar would weaken, or even fall precipitously.

But Soros saw things differently. He thought that, if deficit spending is coupled with tight monetary policy and economic growth, the currency would be more likely to strengthen than to weaken.

If monetary policy is tight — or heading in a tighter direction — and deficit spending is contributing to economic growth, then capital is likely to flow into a recovering economy, and into its bonds, as interest rates rise at the long end of the curve.

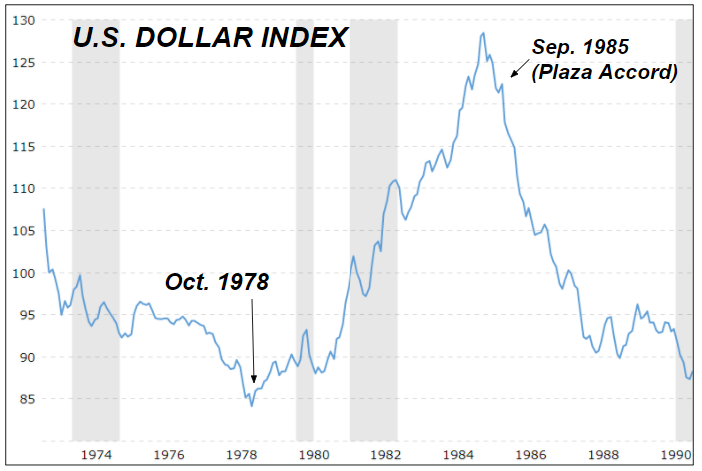

The theory helps explain why the U.S. dollar bottomed out in October 1978, and then rose relentlessly in value until March 1985, at which point the dollar’s relentless strength had become a real problem.

In September 1985, a coordinated central bank policy intervention, known as the Plaza Accord, was agreed to by the G5 — the United States, Japan, Germany, the U.K., and France — to push the value of the dollar lower.

You can see the dollar’s seven-year rise, powered by a cocktail of tight monetary policy, budget deficits, and economic growth, in the chart below via macrotrends.net.

As the manager of Quantum Fund, Druckenmiller used this theory to book a gigantic forex win in the German deutsche mark after German reunification in 1990.

When the Berlin Wall fell in 1989, and West Germany prepared to reunite with East Germany, the popular consensus was that the deutsche mark, Germany’s currency, would weaken, because German budget deficits were about to explode as a function of reunification.

The thought was that West Germany, a rich country, would have to spend a lot of money to help East Germany, a poor country, catch up to Western norms. That meant budget deficits, which meant the deutsche mark should weaken.

But Druckenmiller, like Soros, understood that tight monetary policy coupled with budget deficits could be bullish for the currency, not bearish — and he knew that the German Bundesbank was likely to tighten up substantially to avoid inflation. So, Quantum Fund bought the deutsche mark as a bullish forex trade, even as others were selling it, and made a lot of money on the position.

So, the gist of the Quantum Deficit Effect is as follows:

- Big budget deficits do not automatically mean a weaker currency. If budget deficits are coupled with tighter monetary policy and economic growth, the currency can actually strengthen.

- A combination of economic growth, higher interest rates (through tighter policy), and a more hawkish monetary stance can all combine to push the value of a currency higher, rather than lower, even as budget deficits are expanding.

And now, with those details explained, we can cycle back around to the current backdrop, which now looks bullish for the U.S. dollar and bearish for gold — at least temporarily anyway.

Investors are anticipating a vaccine-powered global recovery. There is no question this is happening. A few elements that demonstrate this are as follows:

- U.S. equity markets, and various indexes around the world, are at all-time highs.

- The U.S. yield curve, a barometer of economic bullishness, is at its steepest point since 2015, indicating greater expectations of economic growth than any point seen in the past six years.

- The yield on the U.S. Treasury 30-year bond surpassed 2% for the first time since the pandemic began, again indicating more belief in a long-term inflation and growth pick-up.

- The price of Brent crude oil, a barometer of global economic activity, has surpassed $60 per barrel, and traded above its 200-week moving average, for the first time since the pandemic began.

- Junk bond yields touched their lowest levels ever — falling below 4% — indicating speculative appetite for growth-oriented credit even as long bond prices fall and long-term interest rates rise.

- The debate over the coming $1.9 trillion stimulus package — likely to be pushed through via budget reconciliation — has centered around inflation, and fears of inflation.

With all of the above happening, COVID-19 cases are also declining in the United States.

“Newly reported cases have dropped 56% over the past month,” the Wall Street Journal reports, adding that hospitalizations have fallen 38%.

Meanwhile the seven-day average for positive COVID tests is at its lowest since Oct. 31, and vaccine rollout efforts are ramping up. The Defense Production Act has been utilized, and the U.S. might even see military medics administering shots in NFL football stadiums.

Then, too, they are sending everyone money. The next round of $1.9 trillion stimulus will include another “helicopter drop” of cash sent to households — the biggest one yet — coming on the heels of prior helicopter drops that helped boost personal savings rates to multi-decade highs during the pandemic.

All of this means the following is highly likely over the next few quarters:

- We are going to see accelerated growth coming out of the pandemic, turbo-boosted by the combination of vaccine rollouts and a new $1.9 trillion stimulus.

- This growth will come at a time when American consumers are flush with cash and ready to spend it, especially after being cooped up in a pandemic, and furthermore at a time when commercial bank deposits have exploded.

- U.S. banks will be ready to lend in this environment — and there will be plenty of attractive growth opportunities, as corporate franchises that survived the pandemic with strong balance sheets intact see an opportunity to expand into areas that dying small businesses left behind.

- U.S. treasuries will sell off at the long end of the curve — with a real possibility the 10-year yield could double, from 1%-plus to 2%-plus. The 30-year could also rise significantly, or even double to 3 or 4%.

- “Inflation” will become a new buzzword — this is already happening at lightning speed — and the Federal Reserve will adopt a tighter monetary stance, not by raising rates, but simply by pulling back on their bond market support efforts.

“How can the Fed tighten?” you might ask. “Isn’t the recovery too weak for monetary policy to get tight?”

The answer is that the Federal Reserve is likely to keep short-end rates at zero. They certainly won’t engage in any interest rate hikes and have promised not to do so for years.

And yet, the Federal Reserve can tighten up monetary policy simply by doing less of what they were doing all throughout 2020.

If the Fed was a big buyer of U.S. Treasuries in 2020 — which they were — and they buy far fewer Treasuries in 2021, that is a form of tightening. Easing off the accelerator is directionally a hawkish thing to do, even without stomping on the brake.

All of this is bullish for the dollar, bullish for U.S. equities, and very bad for gold.

Then, too, Europe is falling behind in the COVID recovery race.

For a whole host of reasons, some of them surprising, Europe has bungled the vaccine rollout, which means their recovery pace is likely to stumble, or even fall into a new recession, even as the U.S. pulls out of recession by way of vaccine rollout progress, renewed commercial lending, and a gargantuan boost of fiscal stimulus.

And then, last but not least, inflation fears will prove premature.

Serious inflation will come — we are very much expecting that — but it will take a while to get here.

Those who anticipate inflation right away are mistaking a clear view for a short distance, in the words of futurist Paul Saffo.

In the near-term, a large amount of fiscal stimulus will be absorbed by consumers paying down debt, or catching up on rent, and it will also take time for capital expenditure spending to ramp up again.

That means, in the near-term, we could see mostly inflation-free growth, or growth with very mild inflation, coupled with rising yields at the long end of the curve.

In a world where Europe is slumping due to COVID missteps as the United States moves back into growth mode, that is, once again, very bullish for the dollar — and very bearish for gold.

This is also a recipe for a continuing equity bull market. What happens when a flood of new currency comes into the system (via stimulus), but inflation is delayed (because it takes a while to show up), and investors remain excited about growth opportunities as capex picks up and banks start to lend?

You get valuations that push higher, simply because there is more currency available, in the pockets of savers and investors, that winds up going into the market. And you also have private equity firms, sitting on giant piles of cash remaining to be deployed, that still need to find their way into investment opportunities, and special-purpose acquisition company (SPAC) capital raises adding billions of dollars per week.

Eventually the script flips back again — against the dollar and in favor of gold — because the U.S. economy will have to pay for this fiscal tsunami of stimulus.

The tricky part is that the inflation bill is not immediate — rather it comes due further down the road. You get the growth boost first and the headache later, sort of like financing business expansion with credit card debt. Happiness leads and the sting is in the tail.

To state it plainly: Big fiscal stimulus now, in the presence of an organic, vaccine-powered recovery, can mean healthier growth now, but much worse inflation farther down the road.

That is why, longer term, we are raging dollar bears and committed precious metals bulls.

But in the near term the vaccine-powered recovery, coupled with the Quantum Deficit Effect, looks likely to generate growth in the United States, coupled with tighter monetary policy, rising long-end rates, and global capital flows attracted to U.S. credit, U.S. equities, and U.S. expansion opportunities.