How I Solved My Biggest Trading Dilemma

|

Listen to this post

|

Dear Reader,

Keith Kaplan here.

I came to TradeSmith about seven years ago. When I first arrived, our only software was TradeStops.

Now, TradeStops is as great today as it was then at solving a huge problem investors constantly face – the question of when to sell. But I was very eager back then to solve a problem TradeSmith hadn’t solved yet… One that customers were constantly writing us about at the time.

They were happy that TradeStops told them when to sell. But they also wanted us to “flip” our algorithms to tell them when to buy.

To do that, we’d have to buy a lot more data, build new algorithms, and write tens of thousands of lines of code. It wouldn’t be easy. But doing it meant solving the biggest problem our readers were facing. So naturally, it was always the focus of our meetings about our software roadmap.

Not long after we started thinking about this, my own experience as a trader helped us figure out how we should execute it. Read on for more.

-Keith

How I Solved My Biggest Trading Dilemma

By Keith Kaplan, CEO, TradeSmith Daily

Trading options a few years ago, I used to run into a dilemma I like to call “two steps forward, one jump back.” It would go something like this…

I’d make one good trade with a respectable profit. I’d bank the profit in cash and start hunting for the next one.

I was happy… but still humble. I knew the next trade might not go in my favor.

Then that next one would come along and… lucky me, I’d win again.

Now, as it happens with lots of traders, greed started to creep in. “I’m on a hot streak,” I’d think. “I should go bigger next time.”

You can guess where that led me. I’d put on that next trade, betting more than the last, maybe more than the last two combined. Then it would inevitably turn against me, and I’d be right back to where I started.

Two steps forward, one jump back to the starting line. Zero progress.

This was frustrating. It felt like doing a whole lot of work for no result. A waste of time and energy.

I had to find a way to put the odds on my side – or at least know what the odds were to begin with. Otherwise, I’d be flying blind… and owing too much to “gut feelings” or “luck.”

Back then when I was first starting out, I didn’t have access to any advanced tools to help me do this. But because I recognized this problem when I joined TradeSmith, and didn’t want it to happen to anyone else, we now have the tools.

It was a monumental challenge to pull off. We needed to access billions of rows of options data. Further, we needed the ability to make millions of database queries to constantly get updated options pricing.

The options market is so volatile and has so much more data than the stock market that this challenge felt insurmountable.

It took us close to a year to build the solution. We first called it CoPilot, and as the platform grew it morphed into Options360.

We built massive databases and algorithm after algorithm. And in the process, we built my favorite indicator of them all.

It helps you see the probability of any trade under your own defined conditions. And it’s had a 95% (or higher) success rate ever since we released it.

At TradeSmith, we call it the Probability of Profit indicator.

With this tool, we can see the statistical likelihood of a stock hitting a certain target price by a specific date. We can construct far more intelligent options trades… raising our chances of winning and lowering the likelihood of a “jump back.”

Today I’d like to show you how it’s done with a couple of the options strategies I mentioned last week…

Trading the Nasdaq 100 Two Ways with Probability of Profit

A lot of folks hold exposure to the Nasdaq 100 in their 401(k) or other retirement account.

It makes sense. The Nasdaq 100 is the home of growth and tech stocks. It’s a great place to hold exposure for portfolio growth.

If I wanted to do that, I could buy and hold the Invesco QQQ Trust (QQQ), which tracks the Nasdaq, collecting some dividends along the way.

But that will just track the market, not beat it. And that’s where options selling comes in.

With the two techniques I’ll tell you about today, you’ll learn how you can get paid to put low-ball offers on the Nasdaq 100 and get paid to offer your holdings for sale at high prices – both of which earn you income.

We’ll use QQQ today as an example, but you should know there’s no “ideal stock” to use these techniques with. The factors that make a great option-selling candidate change all the time, and we can dig into those factors in a future issue.

Furthermore, it’s not always the right time to use either strategy. Generally you want to sell uncovered put options when the market dips, and you want to sell covered call options when you don’t expect huge gains in the time frame of your trade.

Now, let’s get into it…

(Please note: What follows are examples and not recommendations. Options and probability data are as of May 1, 2024.)

1. Selling Put Options

Instead of simply buying and holding QQQ, I could first sell a put option on the stock.

When you do this, you’re essentially putting a low-ball offer on the stock at a price you decide that lasts until a certain date. That’s because you’re selling the right for another investor to sell you their stock at a price and by a date you set.

For example, the QQQ May 17 $400 put option is trading for $1.04 per contract. For every contract I sell, I’d earn $104 in income. In exchange, I’d agree to buy shares of QQQ if it gets down to $400.

So, if I want to sell these put options, I have to have the capital on hand to buy shares if that happens. (Specifically, I’d be on the hook for 100 shares for every options contract I sold.)

But, if I’m mostly interested in this trade for the income, I could check the Probability of Profit tool against the options chain and make sure I use puts with a high likelihood of expiring “out of the money.” Because then I keep that $104 I collected upfront and I don’t have to pay for the shares. I just walk away scot-free.

But just how likely is it that QQQ will, in fact, stay above $400 by May 17?

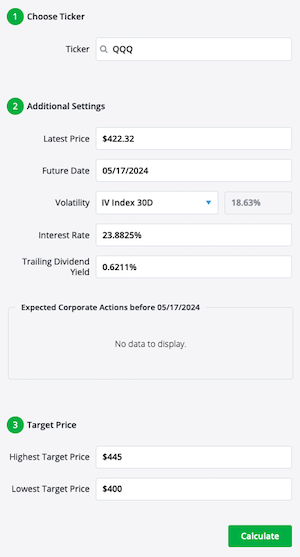

We can use the PoP tool to find out. Here’s what I put into the tool just now:

Everything but the ticker, the future date, and the target prices are filled in automatically. There’s a lot more you can tweak here based on the various measures of volatility we track in our system, but let’s leave those alone for now.

I’ve set the downside target at $400 to match our option strike price, and our upside target at $445 for a reason I’ll show you in just a bit.

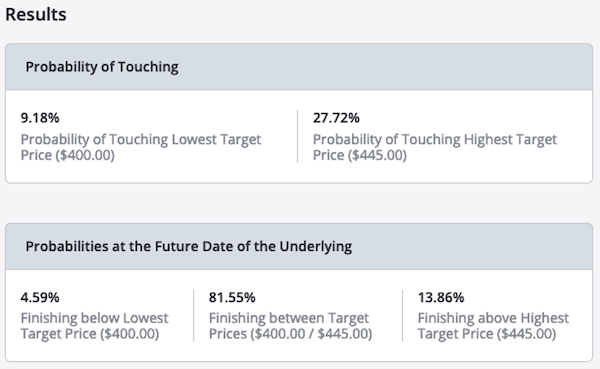

PoP does its thing… and here is the result:

We can see that QQQ has just a 9% chance of falling to $400 per share by May 17. It’s also only 5% likely to close even lower by my target date.

In other words, the odds are greatly in my favor for this trade setup.

Now to be clear, this is just a demonstration. I’m not recommending to trade this option.

But I hope it inspires how you can use this tool to trade this way. Let’s keep going with another strategy I love, selling covered call options.

2. Selling Covered Call Options

Sticking with QQQ, let’s say I’ve either decided to buy the ETF or I was put the ETF from my uncovered put option trade.

I’m happy to hold it, and I don’t want to sell it… but I also don’t want to just holdand hope it goes up.

I know that by trading certain options strategies on QQQ, I can earn income and lower my cost basis on the shares – effectively creating profits even if this stock goes nowhere.

One way is by selling covered call options. That starts with owning shares of stock, and then selling another investor the right to buy those shares at a price you decide by a certain date. In other words, it’s the opposite of selling puts.

When you do this, you still get paid upfront. And so long as the stock you sold the option on doesn’t reach that higher price by the expiration date, you keep your stock and the cash earned for selling the option.

Now, back to Probability of Profit. How can that help us trading options this way?

All we need to do is see the probability of QQQ rising to a certain price by a certain date, and then match that up with what options are available to sell.

If you looked at the above PoP results closely, you’ll notice that the stock has just a 28% chance of hitting $445 by May 17. With that in mind, we could sell the May 17 $445 covered call on QQQ and earn $0.58 per contract, or $58 per contract sold.

You may be scoffing at that payout, just $58 per contract, but consider this…

An income strategy like this isn’t just one home run trade. It’s dozens of small trades, on lots of different stocks, all with a very high probability of paying out.

Also think of the only real downside to trading this way…

With selling uncovered puts, the only risk is you’ll have to buy a stock at lower price…

And with selling covered calls, the only risk is you’ll have to sell your stock at a higher price.

I don’t know about you, but I personally don’t have an issue with either of those things!

These two strategies combined help you take more control over your buy-and-hold portfolios for the long haul. And TradeSmith’s tools help empower you to make intelligent trades that create a continuous streak of payouts with fewer setbacks.

Of course, this is all on the long-term buy-and-hold side of the equation. There are more ways to use these tools for short-term speculation in the options market.

I’ll share my ideas on that with you next week.

All The Best,

Keith Kaplan

CEO, TradeSmith