How Our “Ozempic Hedges” Turned Out

|

Listen to this post

|

A new interpretation of the corporate debt binge… Short utilities, long energy… The Quantum Score top rankings spread out… The “Ozempic hedge,” revisited… A trading community to help you learn and grow…

By Michael Salvatore, Editor, TradeSmith Daily

Corporations around the world are selling bonds at the fastest rate in years. Here’s Bloomberg with some key details:

More than 40 investment-grade firms in the US have sold $53 billion of bonds this week through Wednesday, the most crowded three-day calendar since 2021, while high-yield issuers have priced nearly $11 billion, according to data compiled by Bloomberg. Despite a slew of holidays in Europe, blue-chip and junk-rated issuers have priced around $23 billion, including a cadre of riskier deals. Asian companies have sold at least eight offshore bonds.

Altogether, companies sold $87 billion worth of bonds in the span of a week. That’s a lot of debt… and at decades-high interest rates.

We’ve observed before that corporations are unperturbed by these high rates. They’re telling us that the interest rate policy set by the Federal Reserve right now isn’t all that restrictive… on the contrary, they’re so confident they can pay the average 5.28% coupon, they’re happy to meet the demand for it.

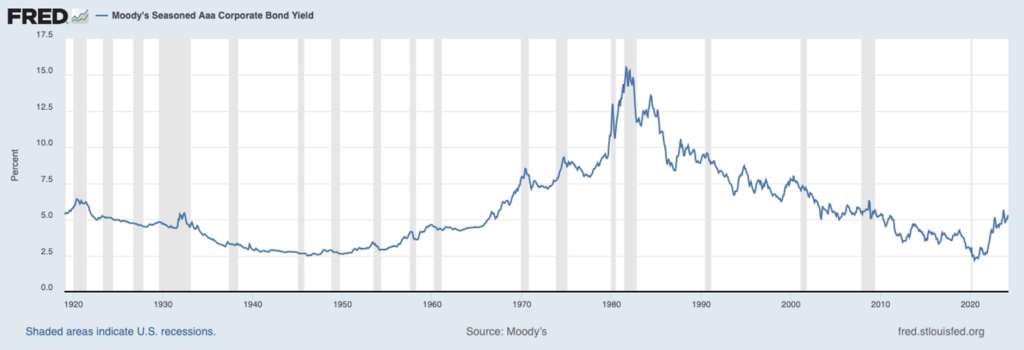

For context, here’s the long-term chart of AAA-rated corporate bond yields. While they’re high today, they’re only high relative to the zero-interest-rate-policy years, when corporate debt was just over 2% at the bottom.

This latest binge, though, might be telling us something different.

If corporations are falling over themselves to issue debt now, they must expect that the next move in interest rates is down, not up. Any hike in interest rates from this level would only be brought by a significant surge in inflation… and would likely be small, only 25 basis points.

So corporations are trying to capture the demand for yield now, before rates fall and the stock market takes back control of investor attention.

We bring this up to show that there’s more than one way to estimate what the Federal Reserve’s next move will be outside of FOMC meetings.

If corporations are issuing debt at such a fast pace now, they’re telling us rates have likely peaked… and that the next move down may come sooner than expected.

❖ Utilities stocks are the “trade du jour”… but will it last?

For the past few months, utilities stocks have been dominating the market. They’re actually outperforming the S&P 500 this year.

This is, as we’ve shown before, a traditional “risk-off” signal… but one that hasn’t yet turned into true risk-off action.

While the S&P 500 hasn’t yet surpassed the new high it set in March, it never fell much more than 5%… and is now back within spitting distance.

So what gives? Why are utilities running along with the market?

It seems a new narrative about utilities has emerged that investors are buying into… about, what else, but AI.

The thinking goes that AI is set to suck up a ton of electricity. Some estimates put its future annual energy use at upwards of 85 terawatt hours – the same amount that some countries use. This demand would largely benefit utilities companies, who we all pay a toll to power our homes… and big tech would do the same for their data centers.

In this way, the surge of interest in utilities companies is less a risk-off signal, and more risk-on.

Regardless, the utilities trade is not one to jump into now. The sector itself is at its most overbought level on the Relative Strength Index (RSI) since August 2022. And check this out – here’s the chart of utilities stocks (XLU) divided by energy stocks (XLE):

We can see that, since 2020, this ratio of utilities vs. energy stocks has been in a long downtrend. The declining support line formed from 2020 to 2021 (black line above) flipped into resistance the following year, and the ratio has struggled to break above it since.

We’re also, notably, seeing the most overbought RSI levels in this ratio since the 2020 pandemic crash, when the flight toward utilities stocks and away from energy stocks reflected the realities of a sudden global shutdown.

Finally, note that the Trade Cycles indicator shows utilities stocks about to exit a Peak area – a bearish sign:

If you ask me, the trade right now is to be short utilities and long energy. We should expect the resistance of the last two years in the XLU/XLE chart to hold, and for utilities stocks to come back to earth.

Interestingly, it seems that a fall in utilities could also accompany a fall in big-tech AI stocks – as the narratives are now intertwined.

If you believe the AI narrative and want to buy either of these groups, you’ll likely get a better chance in the weeks to come.

❖ Jason Bodner’s Quantum Edge Pro rankings spread out last week…

Each week in Jason’s elite stock-picking advisory Quantum Edge Pro, Jason shares the top stocks he’s seeing with institutional-style order flow alongside strong fundamentals and healthy technical setups. With it, he also shares some of the most hated stocks on the Street.

The list is like teleporting into the hallowed halls of Wall Street’s biggest institutions… peeking at the terminals of their deepest-pocketed traders… and seeing where they’re placing their bets.

Jason’s system is based on these signals. And following them over the long term makes big money.

One thorough backtest shows that investing in the top-ranked stocks from Jason’s Master Algorithm would’ve beaten the stock market 7-to-1.

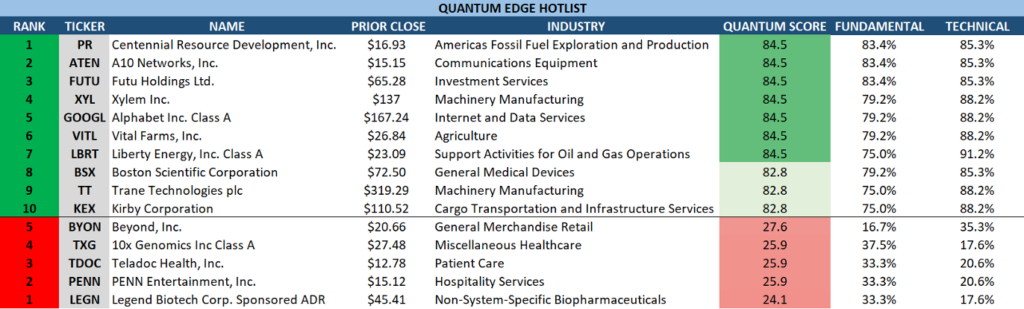

The last time we shared this insightful list, we noted that the top-ranked stocks were overwhelmingly in the oil & gas sector. This week, it’s a bit different:

While the top-ranked stock is yet again in the fossil fuel sector, we’re also seeing strong institutional buying in a wide array of areas – technology, investment services, manufacturing, medical devices, cargo hauling, and agriculture.

This broadening reads healthy to me – the trade isn’t so concentrated in one area of the market.

Just as interesting is the concentration at the bottom of the list in health care. Four of the five bottom-ranked stocks are in biotech or health care, the former of which is a major sector laggard in both the short- and long term.

Quantum Edge Pro members get the latest rankings every Monday, with the newest list set to drop later today.

❖ Highlighting the big winner and loser of the “Ozempic hedge”…

About six months ago, we kicked a hornet’s nest in TradeSmith Daily…

Right in the middle of weight-loss-drug fever, we struck out with the opinion that the drugs are a fad… and that the investors panic-selling high-quality food stocks were in error. We even got a few angry notes about it.

Jury’s still out on whether it’s a fad. The fact that cosmetic surgeons now advertise treatment plans for so-called “Ozempic face” – the gaunt look that comes with unnaturally rapid weight loss – can be an argument for either the top of a bubble or accelerant for a raging fire.

But we can say with certainty whether it was a good idea to buy our six proposed “Ozempic hedges”…

For the most part, it was. In one case, most definitely. But in one more… not so much.

Here’s a chart of their performance since we first wrote about the idea:

From Oct. 26, every one of our picks save for Hershey (HSY) is up. And one of them, Costco (COST), has beaten the broad market by close to double. (Disclaimer: I own COST, WMT, KO, MCD, and HSY.)

The outperformance of COST is hardly a surprise. It’s got a rock-solid Business Quality Score of 81, and its Ratings gauge currently sports a Strong Bullish 96. Its recent performance was likely also bolstered by its gold and silver bullion sales, well-timed with price rises in those precious metals.

But let’s focus on HSY…

Hershey’s is a titan of the confectionary world. Its brands include iconic candies like Reese’s Peanut Butter Cups, Twizzlers, Kit-Kat, my personal favorite Skor, and the list goes on.

But it’s hit a snag of late, as cocoa prices have surged almost fourfold over the last year.

The thing to understand about this, though, is it’s a classic Wall Street overreaction.

First of all, the cocoa price rise will take a while to hit Hershey. They, like many other food producers, lock in materials prices in bulk – they aren’t continually buying into the cocoa surge.

The fear from Wall Street is that, eventually, Hershey will need to pass on the costs to consumers in order to defend its profit margins. That may be true. But the peak fear of cocoa prices is already behind us.

At the end of the day, HSY is a high-quality, “buy forever” stock that will weather this storm. It holds an even higher Business Quality Score than Costco at 85. That tells me the recent lousy price action is an opportunity to buy.

❖ However and whatever you trade, don’t go it alone…

Fifty years ago, trading was a social endeavor. Most professionals would have to show up to the trading floor on Wall Street or the Chicago Board Options Exchange and rub shoulders with other traders.

Even mom-and-pop investors would have to call their broker to place orders.

These days, though, it can be far more lonely. Trading floors and calls to your broker have been replaced by trading apps and social media feeds.

That’s why what Jonathan Rose is doing with Masters in Trading is so special. He’s built a community of like-minded traders who gather every day to share their ideas and follow a similar technique.

In fact, Jonathan’s hosting a live welcome session for all the new subscribers that have come on board since he first broadcast his Masters in Trading Summit.

There he’ll be showing all his new subscribers how to make the most of Masters of Trading Live and the Advanced Notice system.

Advanced Notice is already pointing Jonathan’s subscribers to huge opportunities. Canopy Growth (CGC), for example, popped from $8 during one recent Masters in Trading session to over $14 within 24 hours. The options Jonathan featured for his audience that day went up by over 10x!

And if you haven’t already, go right here to check out my interview with Jonathan from Saturday. There he shows how the Advanced Notice system alerted him to massive unusual order flow in a stock that wound up falling nearly 80% in a single day.

To your health and wealth,

Michael Salvatore

Editor, TradeSmith Daily