Inflation is Like the Cat in the Hat

Inflation is like the Cat in the Hat. It always comes back.

There are periods, like the one we are in right now, where inflation has a long absence. And, at minimum there are periods where inflation is present, but doesn’t show up in the official government statistics.

But inflation never goes away permanently. It always comes back. This is partly because governments make it come back.

In a downturn or a recession — which is just a natural part of the business cycle — a lack of inflation can threaten to become deflation, a phenomenon where falling prices become a self-fulfilling prophecy.

If prices fall too much, consumers can start cutting back their spending, which makes prices fall even more. That can turn ugly quickly. With a total lack of inflation, you can get decades of economic malaise, like Japan after 1990. Or, if the deflation gets bad enough, you can get widespread economic despair and death squads roaming the streets, as with Germany in the 1930s.

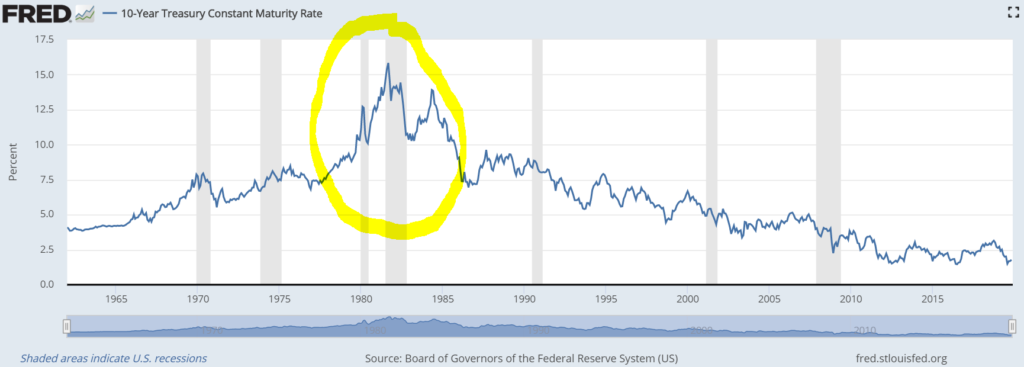

The graphic below, from the St. Louis Federal Reserve, shows interest rates dating back to the late 1950s. The circled area is a spike of high interest rates, coinciding with a window of out-of-control inflation.

Inflation was so bad in the late 1970s, it was killing the stock market. In its famous “Death of Equities” cover, which marked the bottom of the grinding 1970s bear market, Businessweek noted how inflation was a killer of company profits.

Investors are behaving as if those days can’t come back right now. But they can come back. And they will. Inflation, like the Cat in the Hat, always comes back. It’s just a matter of time.

We can also consider at least one other data point as we contemplate the return of inflation. As of this writing, the skyrocketing U.S. national debt has climbed above $23 trillion. It has also roughly doubled in the past decade or so.

An explosion of debt levels like that has not happened before in a peaceful time of growth. In the past, you would see government deficits and borrowing levels rise in a time of recession or economic downturn. It used to be that when governments borrowed money, they at least borrowed for reasonable intent.

Now the debt keeps rising whether the economy is cold, lukewarm, or even hot. So, what happens when another recession comes and real panic hits the Federal Reserve? Does the debt expand to $25 trillion? $30 trillion? More?

At some point, Wall Street, which more or less sees no inflation today, could wake up and start acknowledging the warning signs. If Wall Street sentiment turns back to “old school,” to a renewed fear of inflation, who knows where we could ultimately wind up. Because after all, inflation is like the Cat in the Hat. It always comes back.

But this time, way too many investors simply aren’t prepared, or have no preparations at all.

TradeSmith Research Team