“Mission Accomplished”

In This Digest:

- Rate-cut rumors get louder at Jackson Hole…

- Why “Mission Accomplished” may be premature…

- It’s time for a sector check-in…

- The one asset set to stay above water next month…

- The Big Money’s favorite stocks last week…

- In case you missed it: the Road to AGI will boost “invisible” AI plays…

Now where have we heard this before?

Last Friday came a release of unbearable anticipation. The big man himself, Fed Chair Jerome Powell, got up on stage at the Jackson Hole Economic Policy Symposium and turned the market’s biggest rumor into news.

Bloomberg summed it up well in its headline quoting Powell. “The time has come for policy to adjust.”

Here’s a few more highlights, straight from the horse’s mouth:

All told, the healing from pandemic distortions, our efforts to moderate aggregate demand, and the anchoring of expectations have worked together to put inflation on what increasingly appears to be a sustainable path to our 2% objective.

[…]

The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.

[…]

The upside risks to inflation have diminished. And the downside risks to employment have increased.

[…]

We do not seek or welcome further cooling in labor market conditions.

Powell is declaring the end of the high-rate regime. To borrow the infamous words of a former U.S. president, “Mission Accomplished.”

In a few weeks, whether the cuts come slow (25 basis points) or fast (50 basis points… or more?), Powell will set it in stone. That’s when the rumor truly becomes news. But, if you’ll pardon our caution, we cannot turn away from the confidence of the Fed chair’s remarks toward inflation.

He’s declared victory on the path to 2%…

Problem is, the path to get there has stalled out.

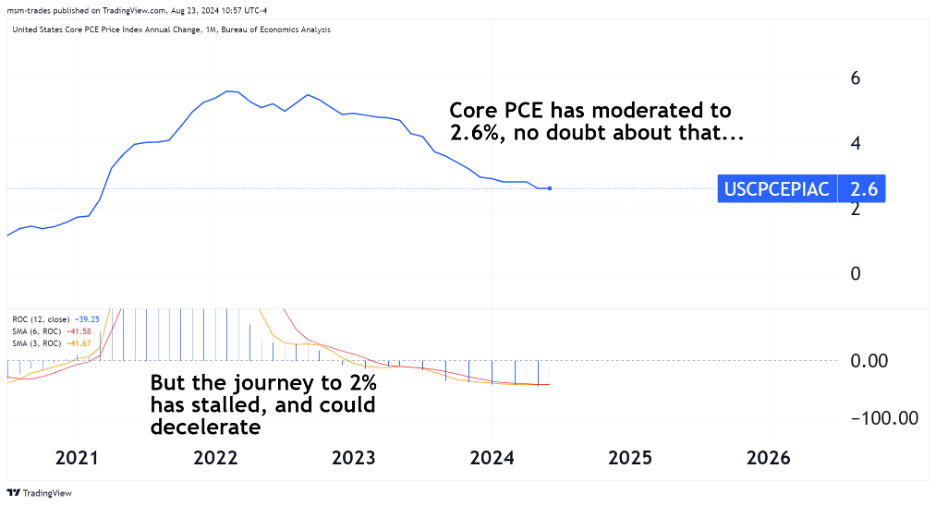

Take a look at this chart. It shows the Core PCE Consumer Price Index – the Fed’s preferred inflation gauge – along with a 12-month Rate of Change (ROC) indicator at the bottom:

As we can see, the core PCE has fallen to 2.6% year-over-year from highs of nearly 6%. That’s good.

What worries us is the 12-month ROC. When the indicator is negative, it means inflation has shrunk in the past 12 months. That’s had negative readings since late 2022.

But what we’re seeing today is that inflation is not shrinking as quickly anymore.

If we apply a 6- and 3-month moving average to this Rate of Change, we can see this more easily. The orange line is the 3-month average and the red line is the 6-month average.

Right now, both lines are in roughly the same spot. If the orange line crosses above the red, it means the trajectory has seriously slowed. That could begin a new uptrend – or rather, a downtrend in the progress of disinflation.

The Fed wants the orange line below the red line. If the inflation report out on Sept. 11 shows that the inflation downtrend is still stuck or slowing, that’s not what it’ll get. And that could throw a wrench into the works.

I don’t envy the Fed Chair’s position. There’s pressure from all sides to cut rates – politicians, investors (particularly in small-cap stocks), first-time homebuyers, and on and on. But to declare victory too early could lead to inflation stubbornly staying well above 2%, or even reigniting like we saw in the ‘70s.

The next few weeks will mean the difference between a “too early and too much” cut, or a Goldilocks scenario.

We’ll keep watch and let you know what we see…

Let’s check in on the strongest sectors through the volatile August period…

August isn’t in the books quite yet. But it was host to the biggest volatility event since the 2020 pandemic crash. One that happened to occur right at the start of the month.

So let’s take a look at the sector performance from the last week of July through this past Friday…

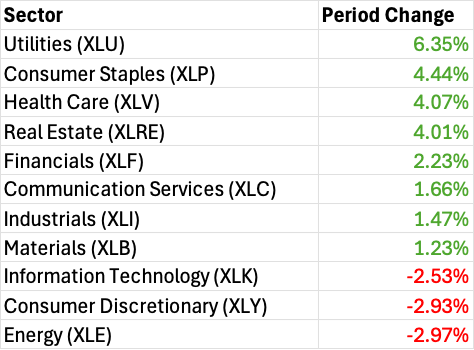

We can see that defensive sectors like Utilities, Consumer Staples, and Health Care held up… while Real Estate and Financials got a boost from talk of lower interest rates:

Meanwhile Technology and Consumer Discretionary stocks took it on the chin, still down over the past month. And Energy was the worst of the bunch.

Winners have a tendency to keep on winning. So one would think Utilities, Staples, and Health Care are the bets to make over the next 21 trading days.

Looking ahead, though, September is historically one of the worst months for stock market returns.

So let’s go ahead and check the seasonal data, seeing which sectors have historically done the best over the next four weeks.

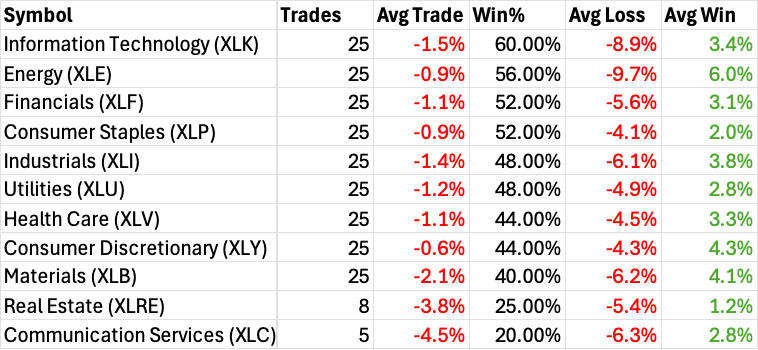

Turns out, September lives up to its reputation. It’s less about which sectors will win the most, and more about which could lose the least:

Only four of the SPDR sector ETFs have better than a coinflip odds of being positive over the next four weeks. But none of them have a positive average trade result (counting both wins and losses).

As for the average winning trade, the largest of this four is energy, with 6%.

And for the worst combination of average trade result and win rate, look to the Materials sector with a -2.1% average result and just a 40% win rate. (The Real Estate and Communications ETFs are a bit too young to count in the same regard, but we’ve included them above.)

However, there is one sector that tends to hold water over the next four weeks – gold.

Over the last 19 years, the SPDR Gold Shares ETF (GLD) rises 52.6% of the time over the same period. But unlike all of the sectors above, it produces a positive average trade (wins and losses) of 0.3%… a winning average trade of 4.3%, only bested by XLE above… and an average losing trade of 4%, the smallest compared to any of the sectors above.

With that in mind, gold may indeed be the best bet over the next month.

For single stock ideas, look no further than this…

When you work at a market analytics company like TradeSmith, constantly churning out unique weekly data reports, Monday is an exciting day overall – but one highlight is Jason Bodner’s Quantum Edge Hotlist.

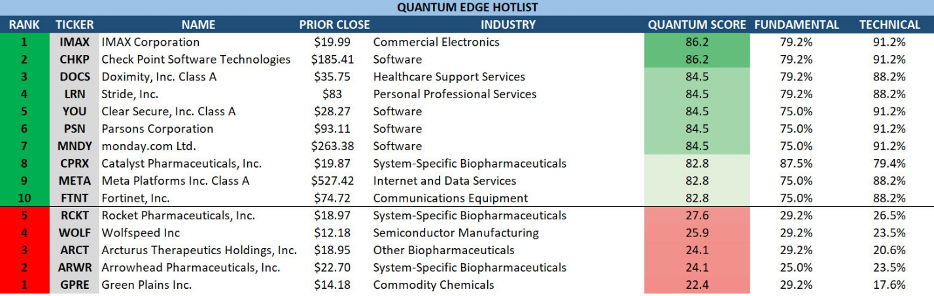

This list shows the stocks ranking highest on his Quantum Edge scores. This system rates stocks on fundamentals, technicals, and the telltale signs of buying activity from some of the largest financial institutions in the world.

Here’s the list published last Monday (Jason’s subscribers will get the freshest list this afternoon. Learn more about a membership here.)

One big piece of news is that, mercifully for Beyond, Inc (BYON) investors, that stock has finally dropped off the bottom of the list. BYON was a reigning champ of the “not-list” for months, and we pointed out last week that it lost more than 25% of its value since we started noting its presence.

The continuing trend of chemical and biopharma companies ranking low on the list continues, with repeat offender Wolfspeed (WOLF), a semiconductor company, also turning up again.

At the top of the list, we see some new names. A few of them, like Clear Secure (YOU), Monday.com (MNDY), and Parsons Corp (PSN), indicate a continued trend of institutional interest in software companies.

Meta Platforms (META) also returns to the list as the first large-cap stock we’ve seen in quite some time. And the No. 1 stock, surprisingly, is Canadian camera and movie screen maker IMAX Corporation (IMAX).

In addition to this list, every Monday Jason shares a value-rich market analysis and any necessary portfolio updates. And every four weeks, Jason publishes a new growth stock recommendation – especially attractive now with interest rate cuts on the near horizon. For more info on a subscription, go here.

In case you missed it…

Over the weekend we published an interview with Eric Fry, global macro expert and analyst for our corporate partner InvestorPlace.

The aim for the discussion was to get to the bottom of Eric’s thesis on artificial general intelligence (AGI) It could be the most significant tech breakthrough since the internet- and there’s evidence to suggest we’re less than 24 months from achieving it. Yet it seems like so few in the investment sphere are talking about it.

Well, Eric has really ramped up his research and writing about AGI the past few months.

So, I drew on his expertise to define what AGI is and why it matters…

And he had an even more fascinating revelation about AI investment – that the best opportunities are well outside the megacap tech sphere and into companies using AI “invisibly.”

Check out that conversation here. And if you’d like the full details of Eric’s AGI thesis and what type of stocks he’s looking to recommend – including one free speculative pick to ponder yourself – watch the replay of his recent research broadcast, The Road to AGI Summit.

To your health and wealth,

Michael Salvatore

Editor, TradeSmith Daily