A Powerful New Tailwind for Energy Stocks Is Coming this Year

Keith’s Note: Last month I explained why energy prices are likely to remain higher for longer than many folks expect. This should provide a continued tailwind for stocks in the Energy sector, which were already among the best performers over the past couple years.

However, this week’s guest essay from Inside TradeSmith editor Justin Brill highlights an additional catalyst that could drive energy stocks – and oil and gas stocks in particular – even higher in the months and years ahead.

If you’re an energy investor – or simply interested in earning more income in the stock market – be sure to read on. And if you know someone who could benefit from these ideas, please share this email or encourage them to sign up for Money Talks (for FREE) right here.

All the best,

Keith

There’s no sugarcoating it: 2022 was a dismal year for most stocks.

The S&P Global Broad Market Index – which tracks more than 14,000 stocks from 25 developed and 24 emerging markets – fell more than 20%.

Here in the U.S., the “big three” indexes – the S&P 500 (SPX), Dow Jones Industrial Average (DJIA), and Nasdaq 100 (NDX) – lost as much as 35%.

And unfortunately, many of the most popular and widely owned individual stocks plunged even more.

Yet one sector of the market defied this larger downside trend.

I’m referring to the Energy sector (XLE).

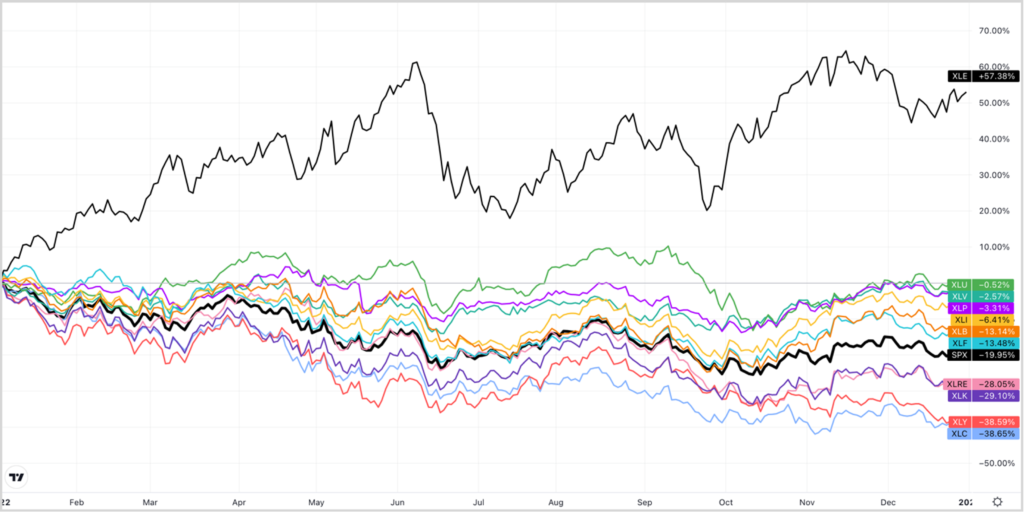

As you can see in the chart below, this sector didn’t just hold up better than others; it soared.

XLE gained more than 57% for the year. All ten of the market’s other sectors declined, from a loss of 0.52% in Utilities (XLU) to nearly 40% in Communications Services (XLC).

Given this dramatic outperformance in 2022, you might assume the Energy sector would likely lag the market in the year (or years) ahead.

But that isn’t necessarily the case.

Despite the big rally this year, energy stocks remain remarkably cheap today – both versus the S&P 500 Index (SPX) and other sectors, and its historical average.

Energy stocks are currently trading at a forward price-to-earnings (P/E) ratio of around 9. That’s nearly 40% below their long-term average P/E of 14, and it’s roughly half the SPX’s forward P/E of 16.

However, I don’t expect this to be the case for long. You see, a new catalyst could push energy stock valuations significantly higher in 2023.

In short, the Energy sector – and the Oil and Gas Exploration & Production (E&P) sub-industry, in particular – is generating HUGE cash flows for the first time in years.

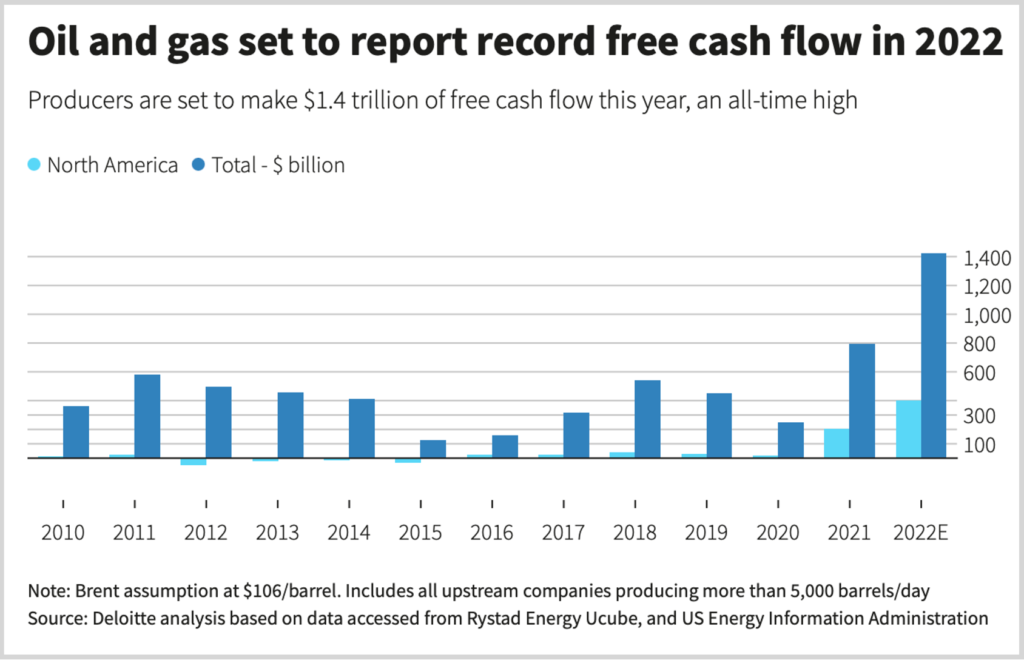

The following chart puts this shift in perspective.

Source: Reuters

The improvement in U.S. and Canadian oil companies (the light blue bars in the chart) is particularly noteworthy.

By the end of October, they were on pace to nearly double free cash flow (FCF) in 2022. That follows an already impressive 2021, where the industry generated meaningful FCF for the first time in over a decade.

What accounts for this dramatic improvement?

Well, rising oil and gas prices have obviously played a role. However, these companies generated significantly lower FCF when energy prices were near similar levels in the early 2010s.

What has also changed is how these companies are operating today.

Rather than funneling profits back into developing new production as they had for the past decade, companies have been focusing on cutting costs and increasing the efficiency of their existing production.

This shift was partly in response to investor demand; energy shareholders had grown tired of losing money from years of overspending. But punitive governmental energy policies have also disincentivized these companies from investing in new production.

In any case, this combination of higher energy prices and conservative management has allowed companies to do two things they haven’t been able to do in years: pay down debt and return cash to shareholders.

For many energy companies, 2022 was mainly about the former: deleveraging and getting their balance sheets in better shape. (Though some companies – primarily large-caps like Pioneer Natural Resources (PXD), Diamondback Energy (FANG), and APA Corp. (APA) – did dramatically raise their dividends by 100% or more last year.)

This year is when we’re likely to see much more cash begin to flow back to shareholders, in the form of large share buybacks and higher dividend payments. And that, in turn, is likely to push valuations significantly higher as energy stocks become more attractive to investors.

Again, the sector would have to rally another 50% or so just to return to its long-term average valuation. But I expect it could ultimately exceed that average as this trend ramps up.

In other words, growing buybacks and dividends could potentially push energy stocks another 50% to 100% higher, even if oil and gas prices go nowhere. And if oil and gas prices resume their recent ascent, there is no telling how high these stocks could move.

Of course, it’s still possible we could see further near-term – and potentially severe – weakness in energy prices if the economy falls into recession this year. So be sure to keep an eye on your trailing stops in energy stocks, just in case.

However, even in this worst-case scenario, we’ll be looking to get back into energy stocks at the first possible opportunity. The long-term fundamental outlook for energy prices remains incredibly bullish, which means these companies could continue to return vast amounts of cash to shareholders for years down the road.

Here at Inside TradeSmith, we first turned bullish on the Energy sector when it re-entered the Health Indicator Green Zone in March 2021, and I’ve highlighted it several times since. So, I suspect most readers already have significant exposure to these stocks.

However, if you’re looking to make additional investments in the sector today, you may want to focus on those in the Oil and Gas E&P industry that are likely to be the biggest beneficiaries of this trend.

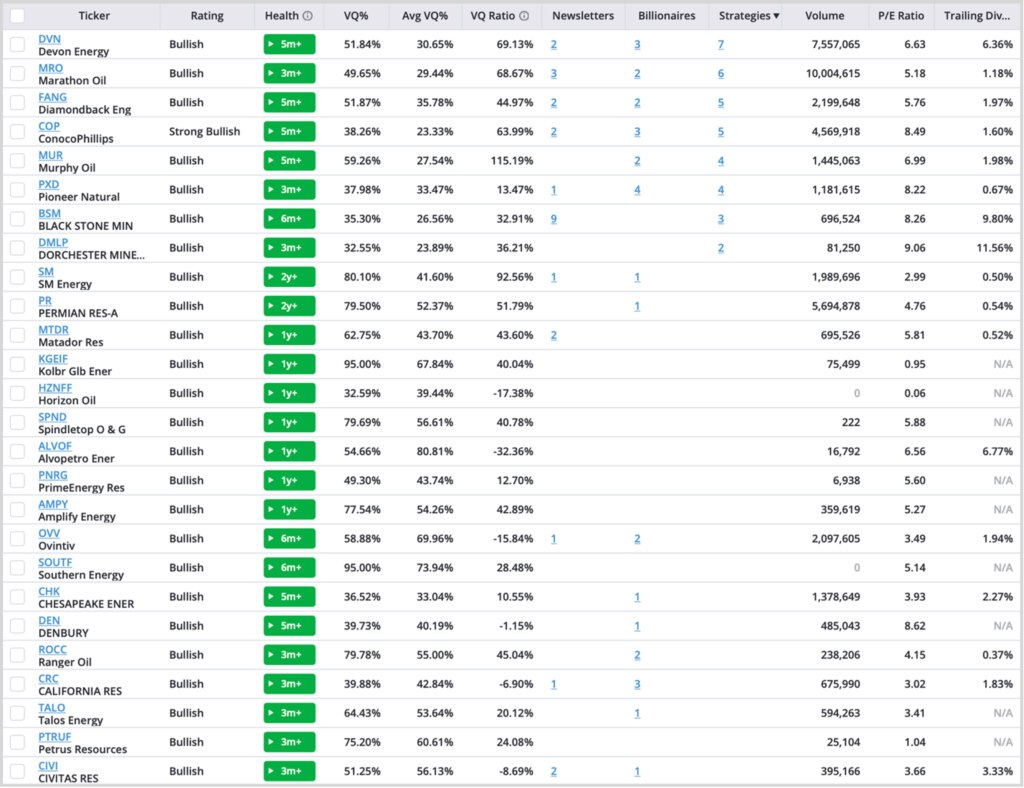

To help you get started, I used our Screener tool to search for Oil and Gas E&P stocks in the Health Indicator Green Zone with positive FCF and a P/E below 10.

Here are the top results of that search. As you can see, many of these stocks are also favorites of the legendary investors in the TradeSmith Billionaires Club and qualify for multiple Ideas by TradeSmith strategies.

Regards,

Justin Brill