Mortgage Rates Are Just One Reason to Avoid New Housing Investments Now. Here Are a Few More.

I warned Money Talks readers back in May that the housing market could soon be in serious trouble.

Well, I’m sorry to say that trouble has now arrived.

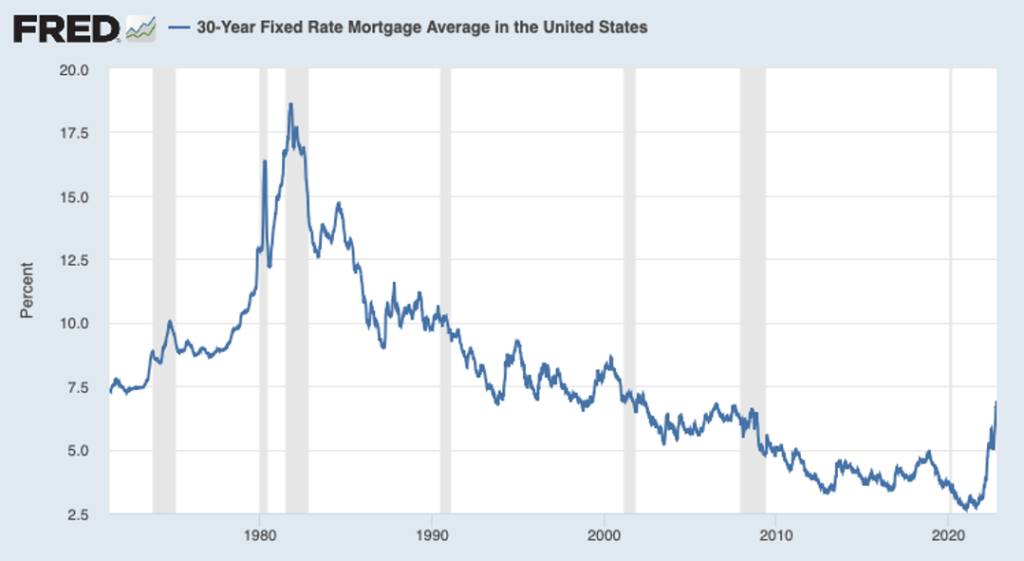

As you can see below, mortgage rates have continued to rise since that update.

Source: Federal Reserve Bank of St. Louis, Freddie Mac

The average rate on a 30-year fixed-rate mortgage is now 6.92%. That’s up from an already high 5.3% in May and higher than any time since 2002.

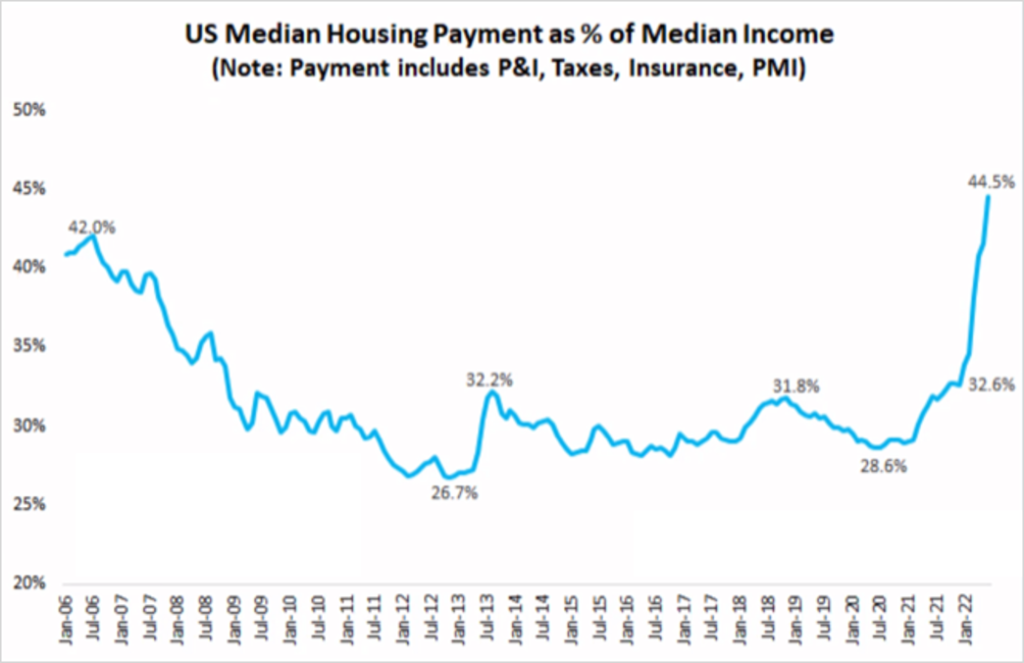

This combination of surging rates and already soaring home prices of the past couple of years means that the cost of buying a home has skyrocketed relative to incomes.

Specifically, the median U.S. housing payment has risen to as much as 44.5% of the median U.S. income. That’s nearly double what it was in July 2020 and higher even than the prior peak in 2006.

Source: Compound Capital Advisors, Federal Reserve Bank of Atlanta

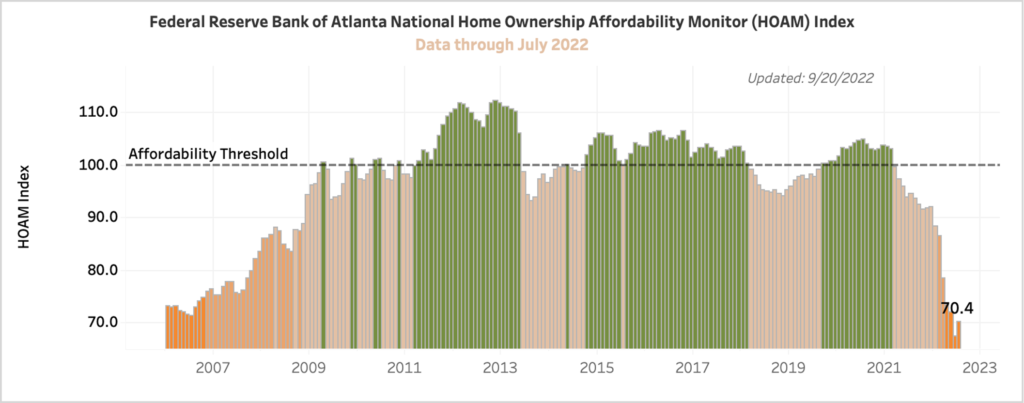

In other words, housing is currently less affordable for the average American than at the peak of the housing bubble in 2006!

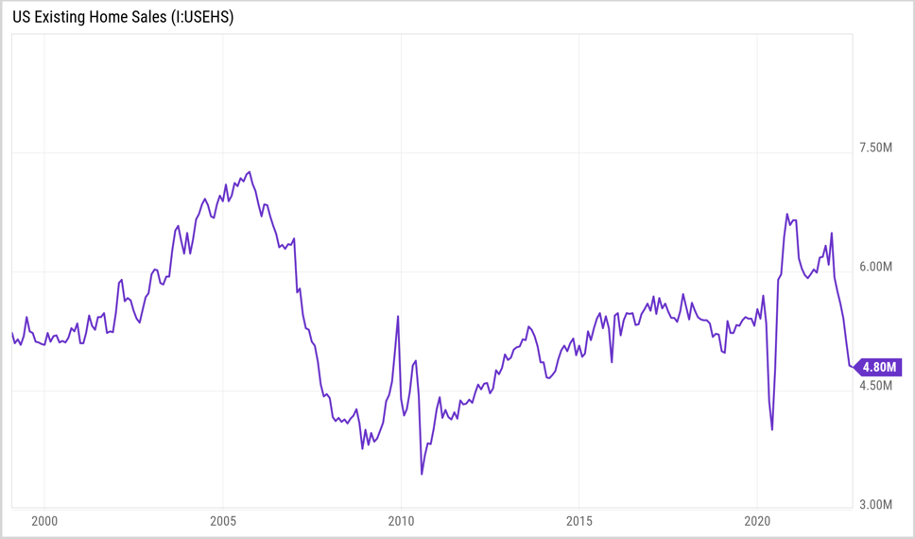

Given this massive drop in affordability, it’s no wonder we’re seeing a significant decline in housing demand.

As you can see in the next chart below, the slowdown in existing home sales I showed you in May has accelerated over the past several months. Sales have now plunged back to their lowest levels since early 2020.

History suggests this trend will continue until housing affordability returns to more reasonable levels.

Unfortunately, barring a dramatic and immediate reversal in mortgage rates (which appears unlikely with the Federal Reserve continuing to tighten monetary policy), that means housing prices need to fall significantly.

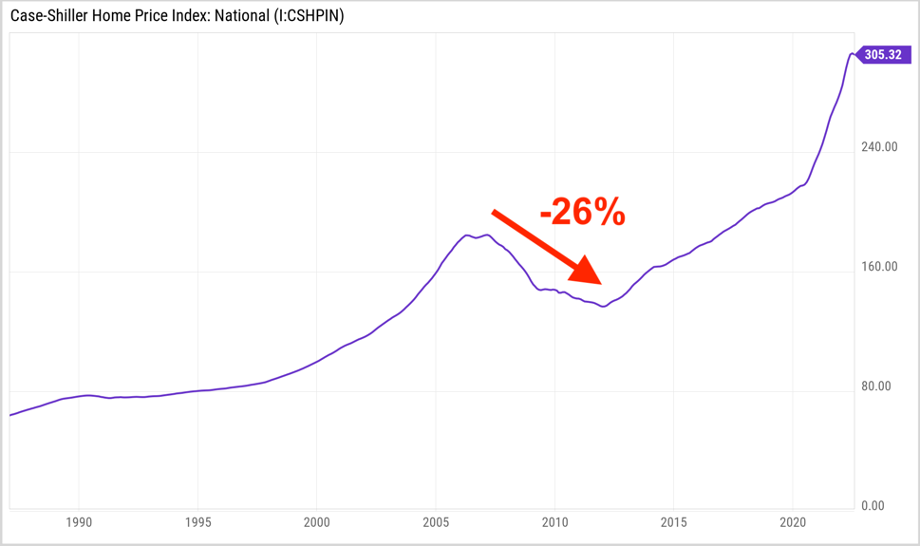

That’s what we’ve typically seen in the past. In fact, the last time we saw a similar combination of record-high home prices and low affordability, in 2006, home prices fell an average of 26% over the next several years.

That’s a relatively small decline. But it’s the first monthly decline in home prices since December 2011, and it’s likely just the start of a much bigger trend.

Now, let me be clear… I’m NOT predicting we’re about to see another housing-centric crisis like we did in 2008. Banks are far less levered to real estate this time, and data suggests there are far fewer homeowners risking subprime, adjustable-rate mortgages (ARMs) today.

But we could see a similar decline in home prices this time, especially if rates continue to rise or the rest of the economy begins to slow, and we enter a recession. Again, that’s because affordability is actually worse today than it ever was back then.

So please, if you didn’t heed my advice back in May, I urge you to do so today.

First, I would continue to avoid homebuilder stocks and other housing investments dependent on a strong housing market. These investments are likely to struggle so long as affordability remains low.

If you’re looking to buy a home, consider waiting if you can. History suggests affordability is likely to improve in the months and years ahead.

If you’re considering an investment in physical real estate, I would continue to focus primarily on cash-flow-producing properties. You don’t want to rely on price appreciation alone to produce a return.

Finally, as I mentioned last time, falling home prices aren’t necessarily a cause for concern if you’re already a homeowner. So long as you have a fixed-rate mortgage you can afford – and don’t expect to need to sell your home in the next few years – you should be fine.

However, if you’re in a situation where you’re struggling to make your home payments or may need to sell in the next year or two, I urge you to seek a solution immediately.

Home prices in most areas are only starting to roll over, so you may still be able to sell for a favorable price. In some locations, renting your home could also be an option. And as I mentioned before, you might still be able to lower your monthly payment to an affordable level by refinancing, even if it’s at a higher interest rate than you currently have.

In any case, I urge you to do whatever you can to avoid getting stuck in a home you can’t afford and can’t easily sell.