The Simplest and Safest Way to Get Started with Options

In last week’s Money Talks, I did my best to clear up some confusion about options.

Based on the feedback I’ve received, I’m hopeful I hit the mark.

But I also got a fantastic letter from a reader (and experienced options trader) who shared one of the easiest-to-understand explanations I’ve ever read. In fact, it was so good I just had to share a portion of it with you here today. Here’s Money Talks reader Don B. (with some edits for clarity)…

“Great job with the options discussion. However, I think the real problem is the way everyone frames the discussion, which makes no sense, and makes it hard to understand…

“Options are really quite simple. When you buy or sell an option, you are simply placing a bet that the price of the underlying stock will do a certain thing… If you are right, the bet will make you some money, and if you are wrong, it will lose you some money.

“When you buy a call or a put, you are betting that the stock price will go up or down, respectively.

“If the stock price does what you want, you win the bet. The call or put will increase in value, and you can sell it back to the market for more than you paid to buy it and keep the profit. Very nice.

“If the stock price doesn’t do what you want, you lose the bet. The call or put will fall in value (potentially all the way to $0), and you will lose some or all of your initial investment.

“When you sell a call or put, you get paid your winnings up front, but you are still betting.

“If the stock price does what you want, you win the bet. The call or put will fall in value to $0, and you can keep the money you received up front.

“If the stock price doesn’t do what you want, you lose the bet. The call or put will increase in value, and one of three things will happen:

- You will have to buy the option back for more than you received up front (for a loss).

- If you sold a put option, you might instead have shares of the stock ‘put’ to you. In this case, you’ll have to buy those shares at a higher price than they’re currently worth (for a loss).

- Or, if you sold a call option, you may instead have shares of the stock ‘called away’ from you. In this case, you’ll have to sell shares of the stock at a lower price than they’re currently worth. If it’s a ‘covered call’ trade, this simply requires selling the shares of stock you already own. If it’s a ‘naked call’ trade, you’ll first have to buy shares at the current, higher price and then sell them at the lower price (for a loss).

“Speak in the terms people use when they think, and you can be the greatest name in finance; oh, that’s right, you already are. Thanks for reading.”

Thanks so much, Don! We appreciate the high praise, and the thoughtful suggestion. If there was any remaining confusion, I hope this excellent explanation helped clear it up.

Ok, now that we’ve covered the basics, we’re going to get into the details of how these different options trades work in practice.

I’m going to walk you through several different types of long (buying) and short (selling) options trades and show you all of the possible outcomes for each.

Today, we’re going to start with one of the simplest and safest options trades: Selling covered calls.

As I explained earlier in this series, a covered call trade involves selling a call option on a stock whose shares you own.

Selling covered calls is a great way to earn some extra profit from stocks you already own. But it’s also a lower-risk alternative to selling naked options.

In either case, it’s important to understand that you can only sell one call option contract for every 100 shares of the stock that you own. (Remember, one option contract always “controls” or represents 100 shares of the underlying stock.)

If you own 100 shares of a stock, you can sell one call option. If you own 200 shares, you can sell two call options. If you own 300, you can sell three, and so on.

But if you own anywhere between 101 and 199 shares, you’ll still only be able to sell one call option.

To keep things simple, we’ll use an example of selling a single call option on 100 shares of a stock. But the logistics work the same regardless of how many options you’re selling.

The first step is to choose the stock you’d like to sell a covered call on.

Typically, this will be a stock you already own, but you can also buy a stock specifically for trading covered calls. In either case, it generally makes good sense to sell covered calls only on stocks you like or wouldn’t mind owning as a longer-term investment.

For this example, we’ll use social media giant Facebook (FB).

Next, we’ll choose the call option we’d like to sell.

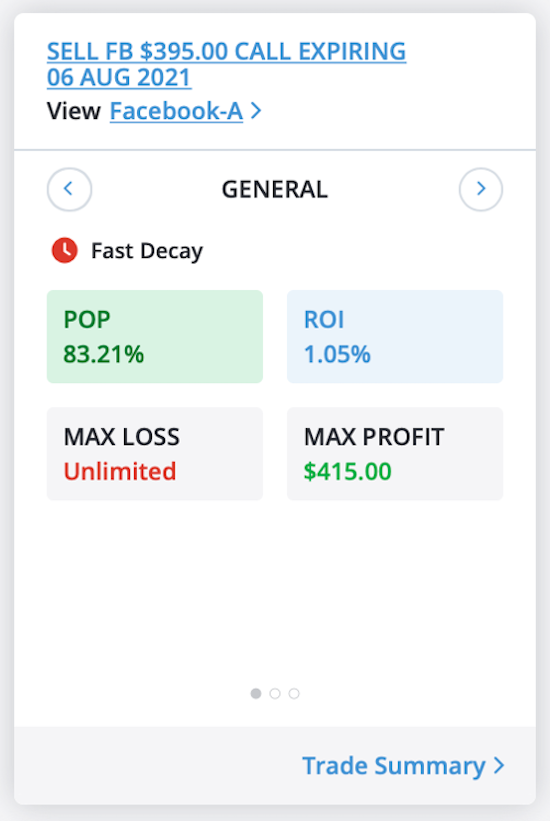

For this example, we’ll use one of our current “Sell Calls” opportunities from CoPilot by TradeSmith.

As you can see, we can sell one FB $395 call option expiring on Aug. 6 against our 100 shares of FB and collect $415 in premium up front.

That’s a potential return on investment (ROI) of 1.05% on the capital at risk in only two weeks. And according to our CoPilot algorithms, it has a probability of profit (POP) of 83.21%.

In other words, there is a better than 83% chance this option will expire worthless, and we’ll get to keep all $415 as profit while still holding on to our 100 shares of FB stock.

(Note: The potential “unlimited” max loss mentioned above only applies when selling naked calls. As you’ll see below, your risk is strictly limited when selling covered calls.)

Of course, if you aren’t a CoPilot subscriber, you won’t have access to our proprietary POP metrics. But don’t worry, you can still do just fine without them.

The most important thing to understand here is that POP and ROI tend to move inversely. In other words, the higher the chance that an option will expire worthless (POP), the lower the premium (ROI) is likely to be, and vice versa.

That means choosing the right option is a balancing act of sorts. You want to find the “sweet spot” that offers sufficient reward while still offering a good enough chance of success.

In practice, there’s no one “right way” to do this. For example, some folks might prefer a higher chance of success with a lower ROI, while others might lean the other way. But I’ve found the following guidelines to be useful when selling covered calls:

- It’s generally best to stick to options expiring no more than a few months out. As you go further out, your likelihood of success (POP) tends to drop quickly.

- That is intuitive… the longer the trade lasts, the more time the stock has to potentially move against you.

- (Our CoPilot Sell Calls and Sell Puts strategies limit this even further, to just 60 days or less. Our research shows this time frame generally offers the best combination of POP and ROI.)

- Targeting strike prices of somewhere between 5% and 20% above the stock’s current price is usually a good place to start, depending on the volatility of that stock. Generally, the more volatile the stock, the more “space” you’ll want to give it.

- Aiming for a premium (ROI) of somewhere between 0.5% and 1.5% on capital at risk is reasonable in most situations. Less than that may not be worth the effort, and more than that typically comes with a significantly lower chance of success.

Ok, so we’ve chosen the stock (FB) and the specific option we’d like to sell on it ($395 call expiring Aug. 6, 2021).

Now, let’s take a look at how this trade could play out. There are two general outcomes…

Scenario 1: FB shares close below $395 on Aug. 6

In this scenario, the stock closes below the strike price, and the option expires worthless.

Under most circumstances, we could simply keep the trade open through expiration and keep the entire $415 in premium as profit.

Alternatively, we could choose to close the trade early if the option has lost most of its value at any point before expiration. That would require “buying to close” the option at the current (lower) price, and we’d get to keep the remaining premium as profit.

In either case, we win our “bet.” We get to keep all or most of our premium as profit. And because we still own those same 100 shares of FB, we could choose to sell another call on them and do it all over again.

But there is one caveat here…

If FB shares rise above $395 at any point between now and Aug. 6, the holder (buyer) of that option might choose to exercise it. It isn’t guaranteed, but it is a possibility.

In that case, our shares of FB would be “called away” from us… meaning we’d have to sell them for $395 per share.

Because we already own the shares, we wouldn’t technically lose money on this trade… We’d receive $39,500 for selling the 100 shares (which is more than they’re worth today), and we’d still have the $415 premium we received up front.

That is why selling covered calls is considered less risky than selling naked calls or puts. The worst that can happen is that you’re required to sell the shares you already own, and you miss out on any additional upside.

Scenario 2: FB shares close above $395 on Aug. 6

In this scenario, the stock closes above the strike price.

If we choose to hold through expiration – or the holder (buyer) of that option decides to exercise it early, as I mentioned above – our shares will be called away.

We’ll get the same $39,500 for selling our shares, and we’ll still get to keep the premium.

However, if it appears the stock is going to close above the strike price – and the holder of the option does NOT choose to exercise it early – we could also decide to close the trade before expiration.

That would require “buying to close” the option, most likely for more than we received up front.

Unlike the first result above, this could generate an actual loss for us. But because we closed the trade before the option was exercised, we’d still get to hold on to our FB shares.

In either case, we lose our “bet.” We either take a loss by closing the trade before expiration or we “lose” the potential upside in the shares we had to sell.

I hope today’s lesson was helpful. Next week we’ll take a closer look at buying calls and puts.

In the meantime, if you have any questions or comments about today’s Money Talks, I’d love to hear from you. As always, you can reach me directly at [email protected].