Monitoring Your Portfolios During a Downturn

As a TradeStops member, you know our mantra is to always have an exit strategy. One powerful exit strategy is to focus on the overall state of your portfolio by using the Portfolio Volatility Quotient (PVQ) Analyzer tool.

If you have a long-term portfolio that’s sitting on large unrealized gains, it can be difficult to monitor the historical high-water mark — and hence a true picture of the portfolio’s health. Here’s a solution we touched on in last week’s webinar focused on Portfolio Exit Strategies that can help many investors know where they stand during a market downturn.

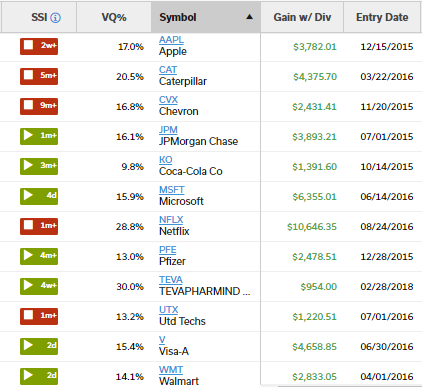

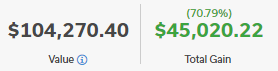

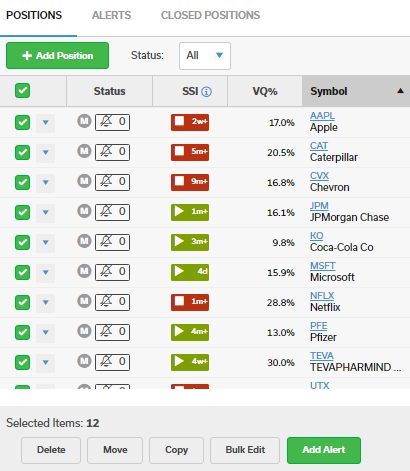

The following chart shows a sample portfolio we’ve used during many of our presentations. We’ve held some of the stocks in this hypothetical portfolio since 2015. Even though five of the 12 positions are in the Stock State Indicator (SSI) Red Zone as of this writing, all of the positions are profitable.

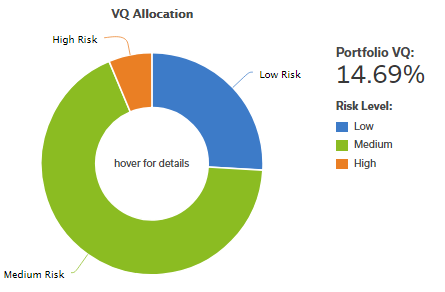

The reason this makes sense is because when some stocks are moving lower, other stocks in the portfolio could be moving higher. But if the overall portfolio drops by more than its normal volatility, it becomes an easy decision to sell everything and move to cash. Think of it as a red zone alert for your entire portfolio.

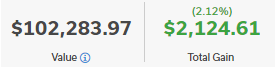

Using the PVQ Analyzer tool, we can see that the normal volatility of our sample portfolio is 14.69%. For risk management purposes, this means the overall portfolio must drop by more than 14.69% for us to exit the entire portfolio.

You can go to your brokerage firm’s website and probably see the value of your portfolio on a day-by-day basis. If that’s not available, you can look at your month-end statements, find the highest value, and use that as the starting date.

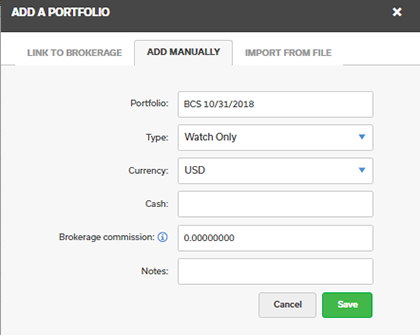

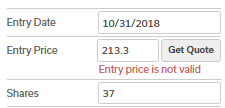

Then, we’ll create a Watch portfolio. The name of our sample portfolio is BCS Portfolio. I’ve determined that I want to follow the results of this portfolio from Oct. 31. Therefore, I’ll name the new Watch portfolio “BCS 10/31/2018”.

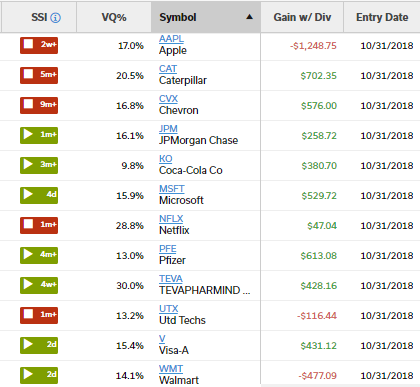

Now you can see what’s happened within our sample portfolio since Oct. 31. Yes, AAPL and WMT have lost money, but those losses have been more than made up by gains in CAT, CVX, MSFT, and PFE. There are nice gains elsewhere as well.

This Watch portfolio makes it really easy to follow the current portfolio movement from the date you determine is the top value of your portfolio. If the market does turn lower, it will be easy to know when the total loss based on the PVQ has been reached.

Cheers,

Tom Meyer

Research and Education Specialist