My Top A.I. Pick Just Soared 36% In One Day – What’s Next?

Sometimes megatrends grow and spread like a rising tide, moving their way forward almost unnoticeably until you realize how deep the water has gotten.

Other times, they explode onto the scene like a massive storm surge.

Artificial intelligence is clearly an explosion, and we largely pinpoint the date to Nov. 30, 2022, when ChatGPT was released.

Less than 15 months ago, artificial intelligence was known about and discussed, but more as this mysterious concept from the future. Now, almost every business on the planet is racing to embrace A.I. and all it can do – not to mention riding the buzz.

Stocks sure have ridden the wave. Record numbers of companies mentioned A.I. in the earnings calls last year, and we can expect more this year. We should hear a lot of chatter when the big players release results next week.

It’s a who’s who of Big Tech and A.I. – Microsoft (MSFT), Advanced Micro Devices (AMD), Alphabet (GOOGL), Apple (AAPL), Amazon (AMZN), and Meta Platforms (META).

Those stocks have soared 88.9% on average since ChatGPT was released, with Meta Platforms 224% rally leading the way.

But even that can’t match the performance of Wall Street’s A.I. darling, one that everybody knows.

And even Wall Street’s darling can’t match the performance of my top A.I. pick, which is less than one-fifth the size of Wall Street’s favorite investment – and it shot up 36% on Friday alone.

Wall Street’s A.I. Obsession

The A.I. stock everyone knows about is Nvidia (NVDA).

And I’ll give the crowd credit this time. It’s a great company. I have owned it personally for a long time, and I still think it’s a strong investment.

Source: MAPsignals.com and TradeSmith Finance

NVDA rates a buy in my Quantum Edge system with an overall Quantum Score of 81.0. That’s my system’s proprietary rating based on nearly three dozen factors and thousands of data points per stock. Anything between 70 and 85 is almost always a good buy.

Nvidia has grown like gangbusters thanks to strong demand for its A.I. chips. It’s considered the leader – though AMD says some of its chips perform certain tasks even better than Nvidia’s. Still, companies are gobbling up chips from both.

Just last week, Meta CEO Mark Zuckerberg said his company will have bought 350,000 of Nvidia’s H100 graphics cards by the end of this year as it builds out a massive computing infrastructure. At an estimated cost of $25,000-$30,000, Meta will spend roughly $9 billion on those chips alone.

I bought NVDA for myself back when it was around $25 per share. I’m very happy with the more than 2,000% return, and I don’t plan to sell it anytime soon.

But let’s face it. NVDA is a $1.5 trillion stock – and it has already roared 3.5X higher since ChatGPT was released. As stocks get larger and larger, it gets harder and harder to multiply your money many times over.

That’s one reason NVDA is not my favorite A.I. stock.

Here’s My #1 A.I. Stock

I was an early A.I. adopter when I developed my Quantum Edge system more than a decade ago. I set my computers to work retrieving the most important data and designing sophisticated algorithms to analyze that data to identify the best opportunities in the market with the highest probability of making money.

I’ve been studying A.I., machine learning, database architecture, and algorithm construction for nearly a decade. And I’m incorporating more of it into my stock-picking system to bolster our already high success rate – and give us that necessary “edge” to keep us ahead of the always-aggressive Wall Street.

And guess what? The highest-rated stock in my system today also happens to be my top A.I. pick – Super Micro Computer (SMCI).

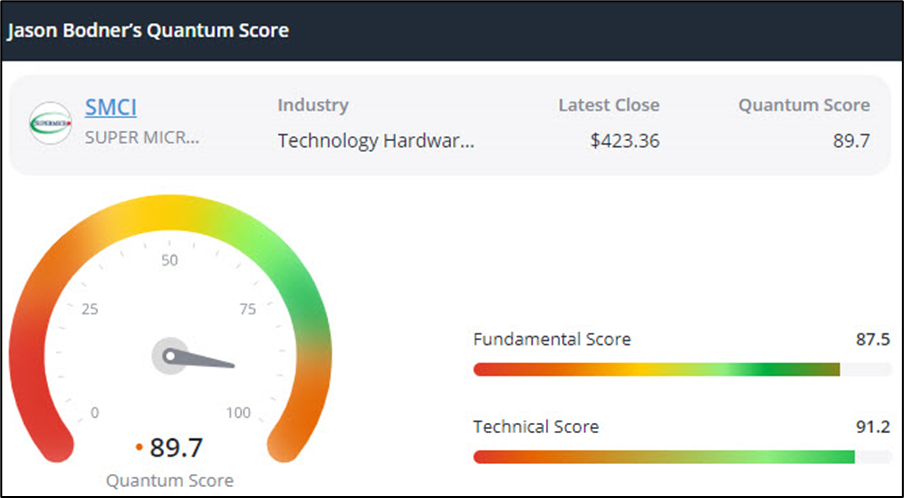

Source: MAPsignals.com and TradeSmith Finance

Super Micro Computer (SMCI) has everything I look for in a stock – outstanding fundamentals and growth, strong technicals, and Big Money flowing in. Notice that SMCI’s Fundamental Score of 87.5 is quite a bit higher than NVDA’s at 66.7.

Supermicro (as it’s called for short) is an information technology company right in the thick of multiple growth trends in tech – artificial intelligence, cloud computing, edge computing, 5G wireless, Internet of Things (IoT), and more.

The company provides high-performance and high-efficiency servers, server management software, and storage for all of those markets. It is positioned to benefit from the proliferation of artificial intelligence as its new servers are designed for A.I. applications… and we know that A.I. workloads will only increase as the technology spreads like wildfire.

Shares soared 36% on Friday alone after the company said earnings would be better than expected because of a strong market and customer demand. With another 3% move higher today, shares are now up 58% in the portfolio in just three and a half months – that’s more than 230% on an annual basis.

With SMCI up 75% in the last three months – and after Friday’s rocket shot higher – shares may now be a little overheated. I can tell you that they are over my recommended buy limit price in Quantum Edge Pro. Its Technical Score of 91.2 is also near the zone that often signals a pullback. NVDA’s Technical Score shows the same thing after its 44% run the last three months.

I’d be careful running out and buying either stock at current prices. In addition to their own valuations, my proprietary Big Money Index (BMI) shows the market as a whole is also overbought. That means pullbacks are likely, and those would be buying opportunities.

In fact, I told my Quantum Edge Pro subscribers earlier today that we might well raise SMCI’s buy limit to take advantage of any future short-term weakness. If you’d like to be alerted if and when I do raise the limit, click here to learn how to join us.

In the meantime, keep artificial intelligence stocks on your radar. It’s not a fad, and there’s more money to be made. Just avoid the hype… and focus on the data.

Talk soon,

Jason Bodner

Editor, Jason Bodner’s Power Trends

P.S. With A.I. popping up everywhere these days, there are a lot of exciting opportunities in lesser-known stocks.

In Quantum Edge Pro, we own two other stocks that have returned more than 50% profits so far that also relate to A.I. – a semiconductor design company and a semiconductor production company.

They have helped power 12 of our 16 stocks higher – a 75% win rate – with the average gain of 19%.

That’s the power of megatrends like artificial intelligence. And it’s the power of quantitative analysis.

Click here to learn how you can invest in these same stocks today.

Disclosure: On the date of publication, Jason Bodner held a position in Nvidia (NVDA), mentioned in this article.