Should You Buy Companies Where You Spend Your Money?

As goes the consumer, so goes the economy.

Consumer spending makes up about two-thirds of the U.S. economy, so if you took advantage of Presidents’ Day sales this weekend, you did your part to support your local economy.

Actually, consumer spending held up well even as inflation was increasing and the Federal Reserve was raising rates. We consumers deserve a pat on the back for keeping the economy going more than anyone expected.

But did you see the headlines last week? Retail sales declined in January much more than expected.

Economists expected a 0.3% drop after a 0.4% gain in December, due to all that holiday shopping. But sales actually fell 0.8%.

And in recent earnings reports, some major retailers have said Americans are under financial stress.

The market didn’t appear too concerned, and I’m not either. This could very well be because of the post-holiday hangover, the cold weather and winter storms, inflation pains, or all of the above.

And you know me. I’m not going to guess about anything. I’m going to the data.

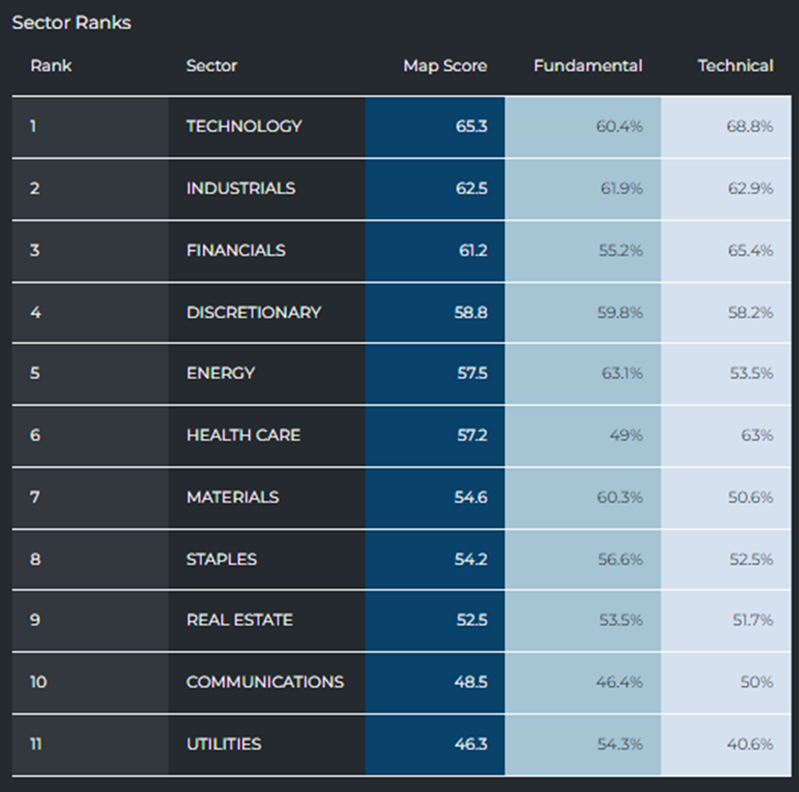

The Discretionary sector (that includes most consumer spending companies) still rates high in my Quantum Edge system, ranking the fourth strongest below Technology, Industrials, and Financials.

Source: MAPsignals.com

When trading resumes tomorrow, we’ll head into an important week for retail stocks as some of the big players report earnings. That includes Walmart (WMT), the largest retailer on the planet, which brought in $611 billion in 2023. If Walmart were an economy, it would be the 23rd largest economy in the world.

Knowing how critical the consumer is, let’s take a look at three important retailers reporting this week, run their stocks through my Quantum Edge system, and see whether any are worth considering.

Walmart Inc. (WMT)

Source: TradeSmith Finance and MAPsignals.com

Walmart reports tomorrow before the market open. Its Quantum Score – the overall ranking given by my Quantum Edge system – is solid at 65.5. As a reminder, stocks with a score between 70 and 85 are in my optimal buy zone, and WMT is just shy of that.

Walmart’s Technical Score of 73.5 is quite good after shares have run from $150 to $170 the last two months. Shares are trading above key moving averages and near 12- and 52-week highs, but one drawback is that my system hasn’t picked up a Big Money buy signal since Dec. 8.

WMT’s fundamental rating is a concern at just 54.2. Part of that is it being a retail company, which tend to have lower growth rates. But the profit margin is narrow at 1.9%, and debt is a red flag for me at 76.8% of equity.

I’m not a buyer here.

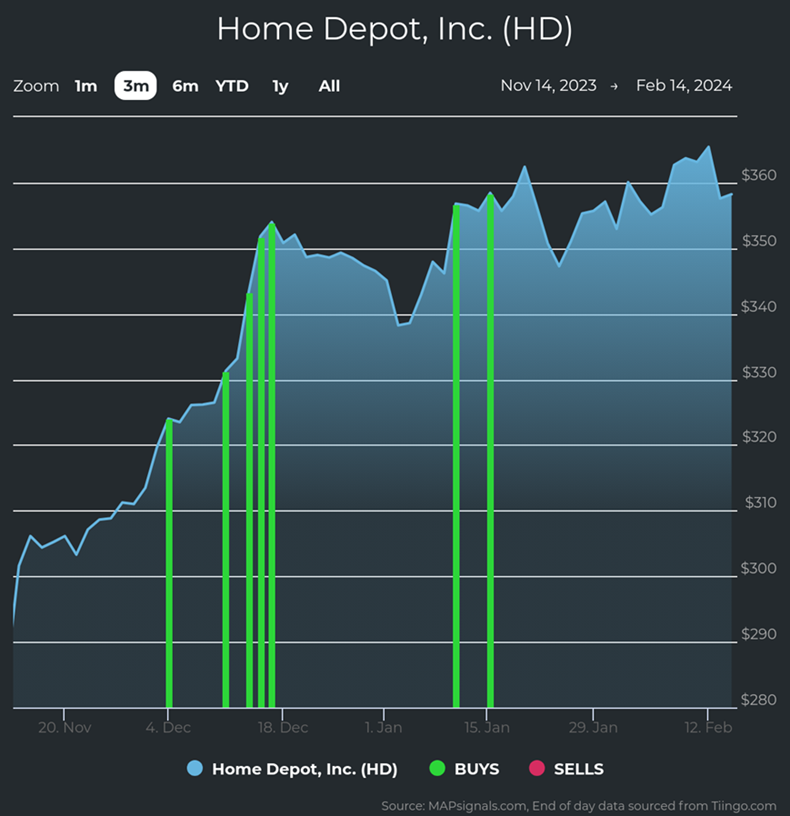

Home Depot (HD)

Source: TradeSmith Finance and MAPsignals.com

Home Depot is the largest home improvement chain in the U.S. with annual sales topping $132 billion dollars. Like Walmart, it reports tomorrow.

HD’s Quantum Score is a little more exciting at 69, though that’s still right below my optimal buy zone. Its fundamentals and technicals are also decent and better balanced – with a 70.6 Technical Score and 66.7 Fundamental.

HD has also recently hit 12- and 52-week highs, and unlike Walmart, Big Money has been more active recently. My Quantum Edge system picked up seven Big Money buy signals in the last 90 days.

Source: MAPsignals.com

Home improvement stores were among the various categories that saw sales decline over the last month – a whopping 4.1% in this case. However, weather can impact HD’s sales, so they could pick back up as warmer weather approaches. Punxsutawney Phil did predict an early spring this year.

That’s not the kind of data I rely on, but Home Depot has enough going for it to make it a possible buy. There are better opportunities for sure, but the data indicates a pretty good chance of higher prices in the future.

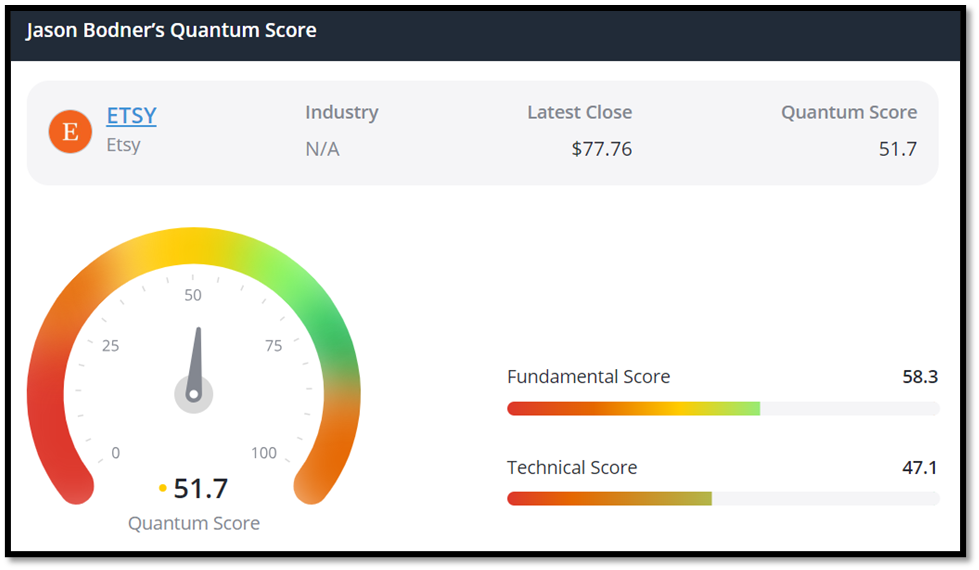

Etsy (ETSY)

Source: TradeSmith Finance and MAPsignals.com

Etsy is one of the leading online marketplaces worldwide and offers unique goods ranging from handcrafted pieces to vintage finds. The company releases its results on Wednesday after market close.

Its Quantum Score of 51.7 is a bit off putting – well below my optimal buy zone – and there isn’t much to get excited about with the technicals at 47.1 and fundamentals at 58.4. I typically stay away from a company who has a Fundamental Score below the low 60s.

Etsy’s profit margin – or lack of one – is also a red flag at -27.1%. That’s a no for me.

If you’re looking for retail buys, I’ll give you a sneak peek at interesting data I’m seeing in my system: Three of the top 10 retail/consumer stocks are “travel arrangement and reservation services” companies. Airbnb (ABNB), for instance, has a Quantum score of 82.7.

Sometimes the strongest investments aren’t the most obvious.

Talk soon,

Jason Bodner

Editor, Jason Bodner’s Power Trends

P.S. One advantage to my Quantum Edge system is its ability to analyze more than 6,000 stocks and more than a million data points every single trading day.

Finding those lesser-known winners is almost impossible without it. Like the little-known A.I. company we just booked partial profits of 250% in last week that has since taken the market by storm.

Click here to learn how you can gain immediate access to my current stock recommendations.

You’ll also learn how to get access to my Quantum Score for any stock you would like, putting the power of this predictive data to work for you.