The Best Backdoor Play in Electric Vehicles Today

|

Listen to this post

|

The United States is a bit behind the curve when it comes to the adoption of electric vehicles.

According to Pew Research, electric vehicles represented roughly 2% of U.S. auto sales over the last three years.

It’s a far cry from the vast adoption happening in Northern Europe. For example, EVs represented 74.8% of all auto purchases in Norway in 2020. That EV figure was 52.4% of auto sales in Iceland and 32.3% in Sweden.

The U.S. is lagging in sales, but it’s worth noting that EV sales still represented just 4.6% of total global auto sales in 2020. So today, I want to highlight some recent developments in the EV market and offer reasonable expectations for this industry in the years ahead.

The EV Challenge in the U.S.

California has a reputation of being the nation’s most progressive state. So, it’s no surprise that it has the largest share of EVs on the road today. That’s being driven mainly by mandate. Last year, California Gov. Gavin Newsom issued an edict to phase out gasoline-powered engines from the state by 2035.

However, the rest of the United States — mainly rural areas — are not adopting EVs at nearly the same rate.

To promote wide-scale adoption of these vehicles, the industry will need two major catalysts to accelerate. The first catalyst is the production of electric cars themselves. Typically, consumers are the drivers of new products and innovations.

But when it comes to climate change, the U.S. government aims to increase supply and mandate demand. In August, the Biden administration signed an executive order that mimicked the environmental protection mandates of California. Biden’s order sets a target that half of all new vehicles sold in the United States by 2030 will be electric. This is a massive boon for EV producers, since it could create demand that would bring their production to near parity with that of their gas-powered counterparts.

Consumers will effectively have fewer gas-powered vehicles to choose from. The hope is that the zero-emission electric vehicles will be cost-effective, have acceptable mileage ranges, and be aesthetically pleasing to their customers.

Companies like Tesla, Volkswagen, Ford, and others around the globe continue to unveil new makes and models of EVs each year.

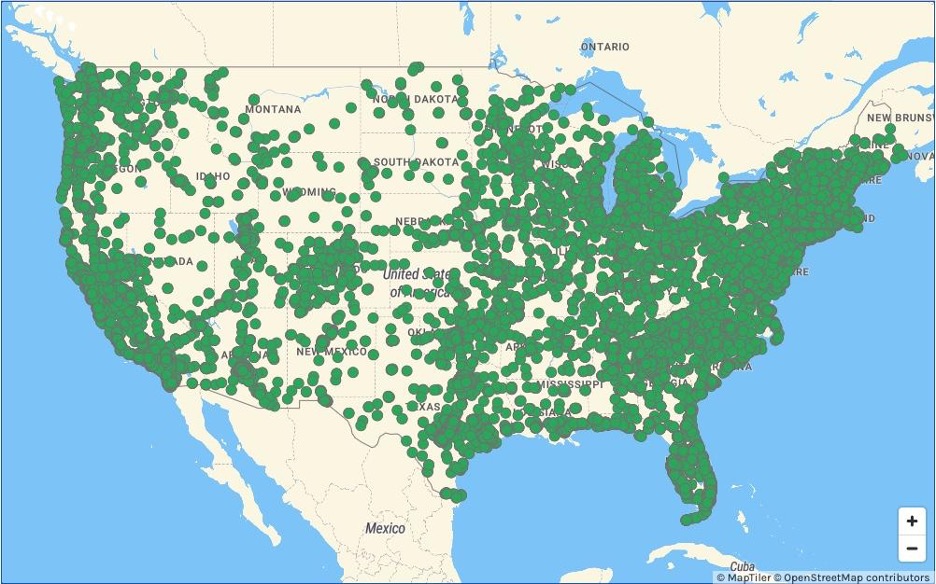

The other catalyst is the government’s goal of building electric vehicle infrastructure across the United States. This appears to be a greater uphill battle. When you analyze the current charging infrastructure in the United States, charging stations are largely concentrated in large U.S. cities and their suburbs, as shown in this image from the Alternative Fuels Data Center.

But more rural areas around the nation lack reliable access to charging infrastructure. Because EV demand is lower in these areas, companies are unwilling to make major investments in charging infrastructure there.

The Biden administration is attempting to expand this infrastructure. A new infrastructure plan unveiled Thursday includes $555 billion in climate mitigation and clean energy spending. This proposal includes building a network of charging stations, which would quickly ease consumer concerns about keeping their cars charged.

Lithium Challenges Remain

However, other challenges exist in this grand plan. You see, electric vehicles require an extensive amount of batteries, and even more so if the United States is to reach Biden’s target. Such batteries require a significant amount of lithium, a rare earth metal that has very high conductivity.

Lithium remains the most important commodity in the EV space. It takes roughly 22 pounds of lithium to manufacture an electric vehicle.

There could potentially be a shortage of this metal in the years ahead. First, the United States doesn’t have many places where lithium is accessible. And in the few places where it does, environmentalists are working to prevent mining of the metal due to endangered species like plants in the area. A lawsuit in Nevada threatens a new lithium mine over a rare weed called Tiehm’s buckwheat.

Roughly 60% of the world’s lithium reserves are located in China. That makes the entire global EV market heavily dependent on a single nation to reach these ambitious goals that will require significant budgetary considerations in the future.

Lithium demand is expected to surpass 2 million tonnes by 2030, according to Benchmark Mineral Intelligence. Those same analysts predict a shortage of the metal as soon as 2022.

So, solving that shortage will be critical to unlocking the future of EV.

Investors who are interested in electric vehicles might want to avoid speculating on which vehicle manufacturers are going to come out ahead and focus on the companies that can alleviate any supply-demand gap.

Standard Lithium (SLI) is a more speculative play in the lithium space, but it operates in a very specialized niche of the lithium extraction industry. It is currently in the Green Zone of TradeSmith Finance and has positive momentum. However, it does have sky-high risk given its recent run.

The company could revolutionize lithium extraction and make investors a significant amount of money in the future. It has developed a new direct extraction process called “LiSTR” that enables producers to pull the metal from brine in as little as a few hours (as compared with more than a year previously).

What does that mean for investors?

I’m going to break down this company on Monday and offer a few ways to trade the stock.

In the meantime, what green energy stocks do you have your eye on? I’d love to hear from you. I can’t respond to every email, but I read them all.