The EV Bull Market is Over

“Because I used to love her,” the Rolling Stones sang, “but it’s all over now.” The electric vehicle (EV) bull market is officially over, too.

The EV bull market — which some would call a bubble, or even a mania — has shuffled off its mortal coil. It is neither resting nor pining for the fjords; it is now an “ex” bull market.

We can say this with clarity because Tesla — lord on high of the EV manor from the start — has officially entered bear market territory.

The standard threshold for bear market status is a 20% price decline from the last market peak. Once that level is triggered, by popular convention the stock retains bear market status until a new closing high is made; upon reaching that high, a fresh bull market begins.

As of Tuesday, Feb. 23, TSLA closed 20.9% down from its Jan. 26 high — good for a bear market trigger. The prior bull run is thus now in the books; a season of the bear has begun.

In terms of what makes a bear market, the 20% threshold is somewhat arbitrary. There is nothing magical about a drawdown of that size.

On the other hand, the threshold has to be set somewhere — for the sake of defining a universal standard — and 20% seems as good a level as any.

Then, too, in regard to the EV bull market, Tesla was actually one of the last names to crack.

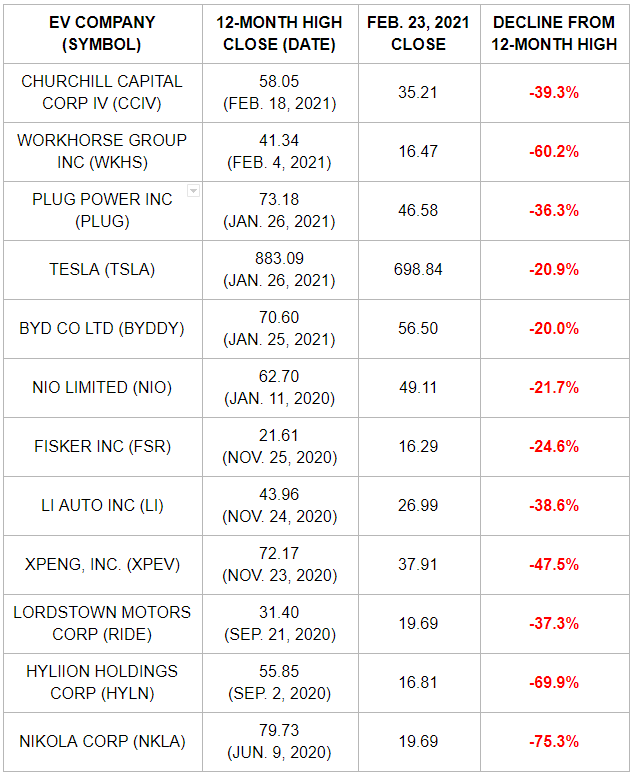

In the table below, we tallied a dozen high-profile EV plays ranked by recency of all-time highs; as you can see, every single name is in bear market territory (and a handful have outright imploded).

As the topping dates indicate, the EV bull market is not only over, it has been over for a while now. The EV highfliers started losing altitude months ago; and Tesla was merely one of the last to crack.

Bear market status does not mean the bulls have to quit, however.

It is possible — and perhaps even likely — that TSLA and other EV names with ultra-devoted followings see a follow-on rally move in an attempt to reignite bullish sentiment.

We saw some of this when the ARK Innovation ETF, symbol ARKK, went from being down nearly 12% at one point on Feb. 23 to closing out with losses of just 3.30%.

ARKK, the $27 billion flagship ETF for the ARK family of funds, saw record share turnover of $4.96 billion in a single day, according to Bloomberg, with ARK founder and technology investing legend Cathie Wood indicating her team was “buying the dip” in Tesla.

“Corrections are good, they keep us all humble,” Wood said, adding that “The strongest bull markets I’ve been in are built on walls of worry.”

Well, maybe. But it isn’t a bull market anymore — for the EV space at least — and at some point, the worries become justified. With the 20% downside threshold broken for most, if not all, high-flying EV plays, near-term bull rallies driven by cheerleading fund managers won’t count from this point forward, unless strong enough to help these names reclaim their 12-month highs.

That means lower highs will likely be paired with lower lows — the basic definition of a downtrend (lower highs and lower lows in extended succession).

That rule of thumb is in line with how bear markets tend to work psychologically: Those who are bullish on a stock (or a whole industry group) may refuse to abandon it after the first big drop, and may even attempt to bid the shares up after a second sharp price decline or even a third.

The bulls’ failure to reestablish an upward trend, however — and the tendency of hopeful efforts to fail — can ultimately wind up helping the bears.

Another problem EVs face was illustrated by Workhorse (WKHS), one of the biggest decliners in the EV space, when WKHS plummeted on news of a single missed contract.

“Electric-vehicle maker Workhorse Group Inc. plunged on Tuesday,” Bloomberg wrote, “triggering multiple trading halts, after a key U.S. Postal Service contract that some had expected it to win went to rival Oshkosh Corp. instead.”

There are only so many U.S. Postal Service vehicle contracts to go around; the demand source for government vehicle upgrades is limited.

One could say, in fact, that the demand for EVs in general appears limited relative to the glut of car automakers offering EV products — and that glut is only set to grow larger.

General Motors is determined to go all-electric down the road, with Volkswagen, Ford, Jaguar, and others joining them — and even Apple appears dead serious about entering the fray with an Apple Car by 2024. And there are still more EV automakers — like Rivian, a competitor backed by billions from Amazon — waiting to go public.

In our view, this flood of new EV competition, along with a sharply reduced footprint for consumer vehicle-buying — think municipally-owned self-driving car fleets servicing high-traffic urban areas, and a generation of new drivers who never bother with owning a car at all — will lead to a quasi-universal “demand cliff” that makes it hard for most industry players to turn a profit.

EV share prices tumbling over their own demand cliff may already be reflecting this state of affairs. And to the degree Tesla bulls pin their hopes on Chinese demand, we can only shake our heads: As we explained on Feb. 11, the Chinese government could cannibalize or destroy Tesla’s local market share at any time (and has logical strategic motives for doing so).

For tech stocks in general, the broader threat is that, as goes one of the most high-profile areas of the market, so goes speculative appetite everywhere else. The Nasdaq can attempt a strong rebound along with other tech stalwarts, but if risk appetite leaves the EV space, it may leave tech entirely.

This isn’t to say that everything in the market looks bearish. As Bloomberg noted yesterday, the S&P 500 Energy Index is on track for its strongest month ever in respect to S&P 500 outperformance.

That is the reflation trade at work, and investor capital flowing out of overvalued tech names (powered by the assumption of forever-low interest rates) and into growth-driven names with an old-economy flavor.

The distant future (in the form of electric vehicles) is not so easy to bet on when financing has a cost (due to rising long-end yields) and real alternatives actually exist: The “true believers” in the future of EV technology may be missing this point entirely, as the bear case at this point is rooted in valuations and macro-driven interest rate changes and the supply-demand picture, not the general adoption curve of electric vehicle technology.

In TradeSmith Decoder we are watching the EV space closely — along with the ARK family of funds, various IPO- and SPAC-related ETF vehicles, and over-inflated tech names generally — as speculative opportunities that could soon be worth shorting.

The basic idea, once a clear bear trend has begun, is to wait for a hope-driven rally to fizzle out, and then short as the rally fails. Instead of “buy the dip,” one could call it “sell the rip” — a sort of buying the dip in reverse.

As Jesse Livermore once said pseudonymously via Reminiscences of a Stock Operator, there is only one side to be on in the stock market, which is neither the bull side, nor the bear side, but the right side. Increasingly for EVs and other highfliers — Tesla now among them — bear season has finally arrived.