The High-Odds Way to Trade Options

|

Listen to this post

|

Every single day at 12 p.m. ET, I get an email in my inbox that gives me at least an 80% chance of making money.

Sometimes the payouts are $100, sometimes $200, and sometimes a little less and sometimes even more.

But they always come, right on time and ready for me to act on.

In my view, this daily email is the greatest technical innovation to come out of TradeSmith since we debuted TradeStops 19 years ago. And I can personally attest that it’s been a huge factor in helping me grow my wealth over time.

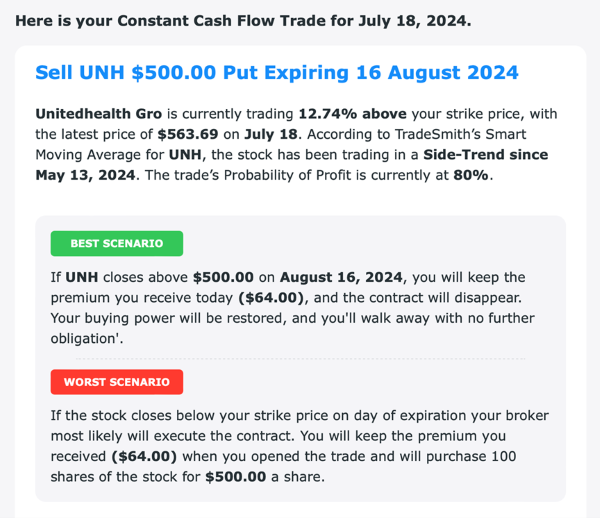

Here’s what that alert looks like:

Right there in plain English, there’s an opportunity to draw $64 in income from the options market by selling an uncovered put option on UnitedHealth Group (UNH).

(And by the way, even though I wrote this on Thursday, you can still take the trade above by the time you’re reading this. I’d just recommend reading the rest of this message before you do… especially if you’ve never made a trade like this before.)

You might be surprised to hear there’s no person typing up this email every day. No analyst crunching all the numbers on a company’s fundamentals, then having to pick an options trade. No one from our email design and fulfillment team has to work on each day’s alert email, either (and they’re thankful for that!).

Our AI-driven algorithm generates each trade. And because of the way we’ve programmed it, it’s guaranteed to only give you the type of risk-reward scenario I’d be happy to take with my own money.

Though, we’re not so bold to say there’s no human behind the wheel.

These positions are overseen by our senior analyst Mike Burnick, a 35-plus-years options veteran. Mike writes to our subscribers every day and lets them know what they need to do with these positions – even though, 99% of the time, what you need to do is “nothing.”

This alert service is called Constant Cash Flow. And today, I want to show you why Constant Cash Flow is my No. 1 favorite tool among the dozens we’ve developed at TradeSmith.

And the only thing I need to show that is to explain the strategy itself – selling uncovered put options.

You’ll learn how it’s done, the risks involved, and what you need to get started.

As you’ll see, this strategy is not for everyone. It’s not for someone who’s never invested before and doesn’t have the money to trade seriously.

Regardless, selling options is one of the best income strategies on the planet. Constant Cash Flow makes it even better. So if you can’t use it now, you should work toward it.

Here’s why…

Trading Options the High-Odds Way

A lot of investors have the wrong idea about options. Looking at what’s transpired over the past several years, it’s hard to blame them.

Options trading has come to be associated with the likes of Keith Gill, more notoriously known as Roaring Kitty.

Traders like Gill buy options to take on massive leverage – aka, massive risk – on the rare chance that a low-odds bet pays off. Trading this way can be like buying a ton of cheap lottery tickets and hoping you’re the lucky winner.

The difference between most traders and Gill is, he has the influence to post a meme on Twitter (now X) and force his positions higher by causing the crowd to pile in.

I don’t have that influence… and I’m guessing you don’t either.

Now to be clear, there are intelligent ways to buy options and speculate on prices – I even do it a bit myself.

But the vast majority of my options trading is not buying options, it’s selling them. Here’s why…

If buying options is like buying lottery tickets with low odds, then selling options is like, well… selling lottery tickets.

Think about it this way. According to Mega Millions, the odds of winning the jackpot are one in 302,575,350. The cost to play Mega Millions is about $2. And the most recent jackpot crested $552 million.

In other words, spending $2 on a ticket to win the jackpot earns you odds of about… 0.0000003305%. So, we’re talking infinitesimally small odds.

Let’s try to get a little closer… say a 1% chance.

To have just a 1% chance of winning the Mega Millions jackpot, you’d have to buy 3,025,754 lottery tickets at $2 each. That’ll run you well over $6 million. Not to mention you’d have one heck of a time looking for your winning ticket.

For coin-flip odds of 50%, you’d have to spend about $300 million on tickets – and at that point, you’re not even doubling your money on the jackpot.

Now, I know this isn’t news to you. The lottery wouldn’t exist if it were easy to win. In fact, Mega Millions says 60% of its prize pool comes from ticket sales. And half of that revenue goes straight to the state hosting the lottery.

And that’s exactly my point. The very profitable business of the lottery heavily favors the sellers of the lottery tickets.

And selling uncovered put options is quite similar…

How Uncovered Put-Selling Really Works

Think about that trade from the beginning of today’s essay.

What you’re really doing with that trade is selling someone the right to sell you 100 shares of UnitedHealth for $500 by Friday, Aug. 16.

For that to be worth it, UNH shares would have to fall almost 12% (from today’s prices), giving the option holder the right to sell their shares at a higher price.

The odds of that happening, at the time the alert came out, were only 20%.

But let’s say the share price does fall – what then?

To be clear, this risk is what keeps this strategy out of reach of some investors. If that does happen, you’d be on the hook to buy 100 shares of UNH at $500 per share. That would cost $50,000.

What you’d do next is up to you. You can immediately turn around and sell the UNH shares, incurring what’s likely to be a small loss. If you think UNH will rebound, you can hang on and try to sell at a higher price, potentially collecting dividends along the way. Or you can even turn around and start selling covered calls as another way to earn income on the position – something I recently highlighted here.

If you’re going to trade this way, you need to prepare for that scenario.

But again – you have to think about the odds. The size of the move you’d need to see in UNH, along with the short amount of time for it to happen, makes it extremely unlikely that this scenario plays out.

And that brings me to my favorite thing about Constant Cash Flow – its track record.

Since inception, Constant Cash Flow has only had four losing trades out of 448. That’s a 99.1% win rate.

That’s thanks to our Probability of Profit algorithm, which uses advanced options mathematics to determine the likelihood of any given scenario depending on a stock’s unique volatility footprint. Using that algorithm – and the expertise of Mike Burnick – is why the track record is so incredible.

Now, I’m not going to sit here and blow smoke. Selling options is not something every Tom, Dick, and Harry can start doing. And that’s one of the main reasons it works.

You need some upfront capital. There’s a bit of a learning curve, too. But we’ve done a ton of work to help you climb it.

The Constant Cash Flow advisory is chock full of masterclass videos, special reports, tutorials — everything you need to get up and running, quickly.

The system also shows the risk of every trade down to the percentage point, filtering for only those with high odds of success.

And every week, Mike Burnick will keep you in the loop on what he’s seeing in the broad market, and how it will affect the Constant Cash Flow trade recommendations — plus how he recommends you handle each open trade — in his Mike’s Money Line video updates.

For investors with a mature investment account looking to get ahead of a choppy market, there’s almost nothing better out there. Up, down, or sideways, Constant Cash Flow almost always provides an opportunity to quickly generate cash from the market.

That’s why it’s my absolute favorite piece of the TradeSmith toolkit.

Whether you decide to join Mike or not, it’s important to know more about strategies like these.

No matter whether inflation is low or high, whether markets are booming or busting, and especially if you’re at or near retirement and have never considered this strategy, it’s important to at least have knowledge of what you can do as an investor.

Click here to learn more about Constant Cash Flow and get started.

All the best,

Keith Kaplan

CEO, TradeSmith