The Most Important Email I’ve Ever Received

Last week, I received a very personal email from a subscriber.

He had just started taking his investing seriously last year. He manages a personal IRA and tells me he has heard about the possibility of a market reset very soon.

Naturally, he’s nervous. There’s a lot of noise out there. He is a few years away from retirement. He doesn’t have time for a 10-year recovery like so many investors faced after the 2008 crisis.

If the market takes another nosedive, he could lose a lot of money.

He asked for insight on how to be realistic on his goals and how to identify the best research to generate ideas.

I’ve been in that boat before. So, today, I want to talk about how I eliminated my fears of a nosedive and how I sleep well at night.

Let’s dive into another email that I received in February 2020.

It was the most important email I’ve ever opened.

And its message can help this reader and so many others eliminate their fear about another market correction.

Let’s dig in.

The Lucky Ones

I was one of the lucky ones.

Well, I need to stop using the word “lucky.”

Let’s use the right word.

I was one of the “informed.”

Remember last February? Remember markets before COVID-19?

Right before the S&P 500 plunged by 34% in a matter of weeks…

Before the forced selling from ETFs pummeled stocks…

Before the fastest bear market EVER occurred?

Three weeks before the markets collapsed, I received an email.

It was an alert from our company, TradeSmith.

It informed me.

It screamed: “Get off the couch, Keith. Sell. Sell. Sell.”

As the COVID pandemic accelerated, I just had to listen.

The next day, I would move nearly my entire portfolio … most of my net worth … to cash and avoid a record selloff.

How I Sleep Well at Night

I trust the math. I trust our system.

I’ve seen it be right every time I’ve been wrong.

The email said to sell.

And so I sold without any doubt. That was Feb. 27, 2020. Nearly my entire portfolio, probably 97% of it, went to cash.

It doesn’t seem that long ago.

You know what happened next; it wasn’t pretty.

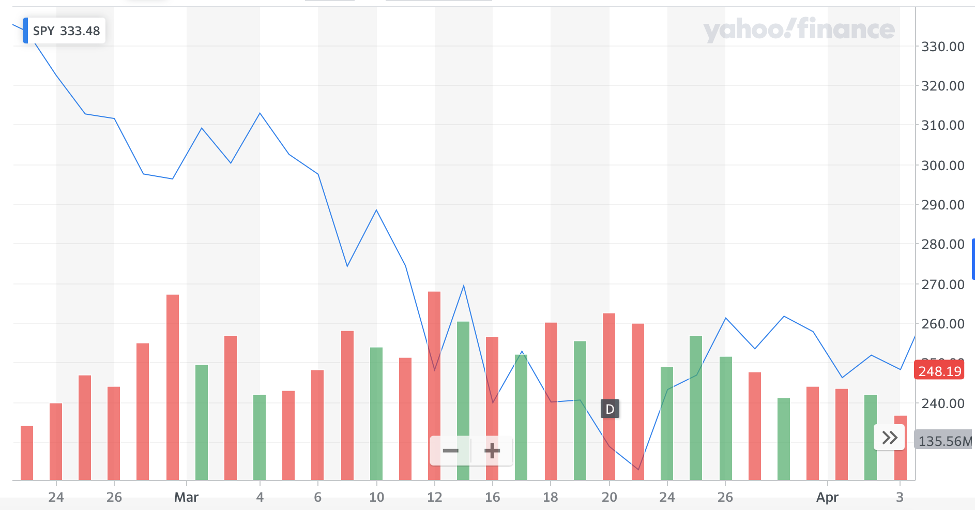

Take a look at this chart from late February to early April 2020.

Source: Yahoo! Finance

I walked away from the markets. I avoided the fastest bear market in history.

All because of TradeSmith.

Take a look at the signals I received that day.

TradeSmith alerted me to get out of these major indexes and the stocks that comprise their roster.

Did you know you can get this type of warning signal, too?

Wait… This is Possible?

If you’re nervous about the market right now, I’m with you.

The Federal Reserve could lose control of inflation.

China and the U.S. are entering a potential new Cold War.

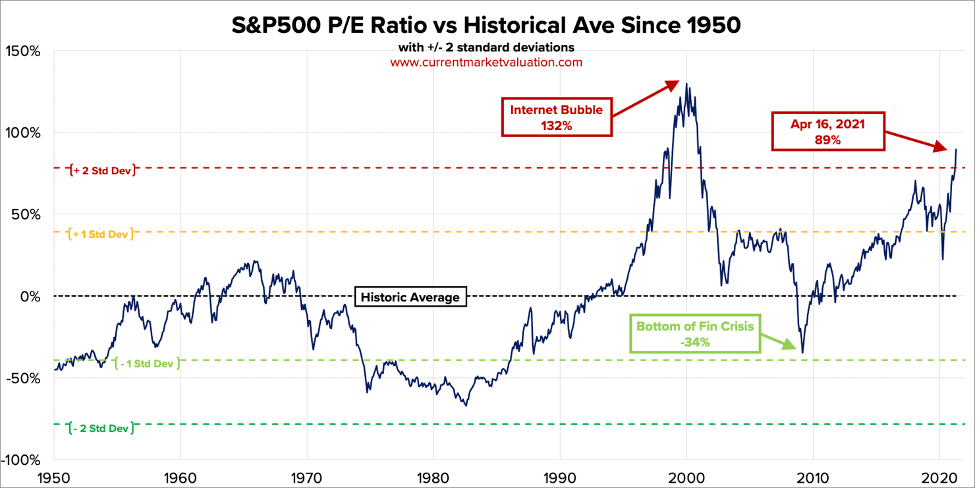

Equity valuations are stretched to their highest levels since the dot-com bubble, according to Current Market Valuation (check out the chart below).

Source: www.currentmarketvaluation.com

Small-cap, micro-cap, and nano-cap stocks have crashed over the last few weeks.

And speculators are pouring money into anything they think they can buy for a dollar and sell for two dollars. Baseball cards, NFTs, cryptocurrencies, real estate, etc…

Things could end very badly due to this speculation.

There is a LOT going on right now.

As an equity investor, I am hyper-vigilant about my retirement accounts, my portfolios, and anywhere else I put my money.

I should be stressed out right now.

I should have my finger on my computer mouse ready to click and sell whenever things look ugly.

But I sleep well at night for a reason.

Because I know TradeSmith signals exist.

We created these signals years ago. They’re based on proprietary algorithms, historical data, and significant amounts of backtesting.

They capture market momentum, short- and long-term trends, and big-money sentiment.

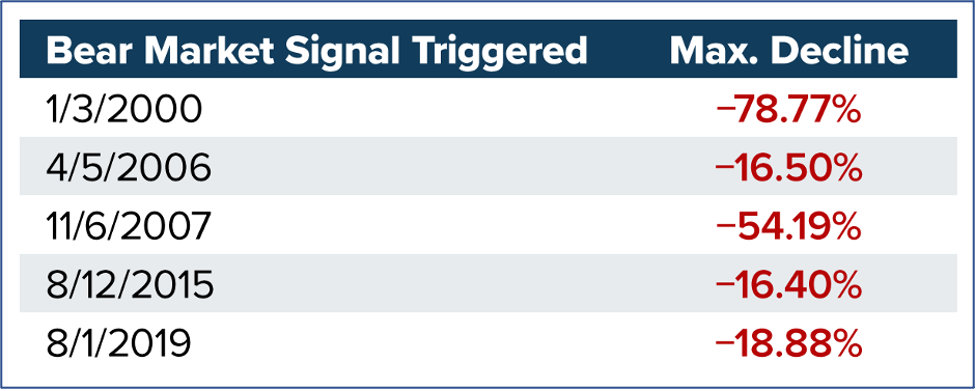

Even before the 2020 market crash, here are the other downturns that investors could have avoided based on our signals.

The moment that these bear market signals flash, it’s time to move to cash. Not only can you avoid VERY SHARP downturns, but when the ensuing all-clear signal follows, you can put your money to work.

If you subscribe to Ideas by TradeSmith, you’ll automatically receive the bear market signal. There’s nothing that you need to set up. You’ll then be protected from the overall markets.

Of course, don’t forget to set up alerts on your positions, too. There are tons to choose from to keep your profits safe. We’ve created this video to help you with the alerts.

You have the ultimate insurance policy when it comes to market moves.

You can stop following CNBC. You can stop worrying about the big macroeconomic events. You can just relax and focus elsewhere.

If you don’t yet have Ideas by TradeSmith and would like the bear market signal added to your account, click here.

Either the market will move through this choppy period, and you can ignore it and ride any rebound.

Or, in the lower-probability scenario, you’ll get an alert that lets you know when it’s time to exit the markets.

Either scenario will give you much better rest, I assure you.

Listen Up

If you’re not signed up to get your custom signals for your portfolio, you’re flying blind in this market.

So here’s the thing. If even our math can’t keep you happy in the markets — it’s totally OK to go to cash right now.

There’s nothing wrong with going to cash.

But these signals were built to arm you with the exact time to buy vs. sell. And they have been successful at doing just that.

Our tools exist to give critical insight to retail investors.

People like to complain about income inequality between institutional investors and retail investors.

But the source of that divide is actually informational inequality.

You need institutional-level insight using cutting-edge technology and advanced technicals to deliver clear market signals.

That’s what we do.

We give you the tools to manage your own money. We help you avoid paying nosebleed-level fees to fund managers.

It’s not rocket science.

It’s actually the opposite. All you need is the ability to know the difference between the words Red and Green.

Sure, it’s advanced mathematics that tracks historical performance and gives investors the peace of mind to know when the markets are on the verge of total calamity.

But I LOVE that TradeSmith brings it all down to one color and word. Nothing more.

I’ll be writing more this week about how TradeSmith can help you eliminate bias and help you sleep better at night by just following our clear signals.