The Netflix Warning We Should Have Seen Coming…

For a long time, people have warned me about trading stocks and options around earnings season.

It can be an emotional time, and I don’t want to make any rash decisions.

This season is especially challenging for retail investors.

And for good reasons.

We remain engulfed in a pandemic.

Inflation is rising while the dollar has dropped this quarter.

And companies face more variables than ever.

Even good news isn’t rewarded.

We saw the largest banks report blowout earnings, only to see shares pull back sharply.

Next week will be one of the busiest weeks for earnings all quarter.

Tesla (TSLA), Advanced Micro Devices (AMD), Microsoft Corp. (MSFT), Alphabet (GOOGL), Visa (V), Starbucks (SBUX), Apple (AAPL), and Facebook (FB)…

There are hundreds of companies reporting next week.

And if you own any that are consumer-facing, you might be interested in this secret weapon.

The Warning Signs Were Clear for This Tech Giant

Many of Silicon Valley’s largest tech firms are reporting earnings next week.

And you want to have confidence if you own any of the companies listed above, right?

Well, take a look at what recently happened to Netflix.

This was among the ultimate at-home stocks, right?

Its growth over the last few years has been remarkable.

Since Q1 2013, the company’s global subscriber base has surged from 34.24 million to 207.64 million in Q1 2021, according to Statista.

It has produced multiple films and documentaries that have won Academy Awards, Emmy Awards, a Grammy Award, and Golden Globe Awards, including 37 Oscar nominations in 2021, surpassing the 24 from last year.

However, shares of NFLX are off nearly 10% since Monday after the company reported a stunning statistic.

You see, on Monday, the company dramatically disappointed investors during its earnings call. Even though Netflix crushed per-share earnings expectations and topped revenue forecasts, they reported a HUGE miss on new subscribers.

The world’s largest streaming platform reported net new subscribers at 3.98 million, well below the 6.2 million expected by analysts, according to FactSet.

Netflix relies on consistent subscriber growth to keep its investor base happy.

Subscriber growth is the lifeblood of the balance sheet.

This growth is critical as it faces competitive pressures from Hulu, ViacomCBS, NBC’s Peacock, and other streaming networks. According to Allied Market Research, the global streaming market is worth more than $50 billion and could more than triple in the next five years. The competition will heat up…

If Netflix wants to produce billions of dollars in new programming, it needs new subscribers to help fund those ambitious projects. If it wants to expand into new countries, it requires strong cash flow to afford those expansion plans.

If I were an investor in Netflix, I would have at least liked a hint that things were slowing down in terms of subscriber growth. Luckily, it turns out that such a signal exists.

The Ultimate Social Indicator

Honestly, the reason Netflix missed big on these numbers doesn’t matter. It could have been the programming. It could have been recent price hikes. It could have been the competition.

But I don’t care about any of these factors. Quite frankly, I don’t need to speculate.

That’s because I have access to an inside indicator that was available before Netflix reported its earnings.

And investors could have used this indicator to protect their principal and gains.

Armed with the knowledge I’m about to share, they could have bought puts or even sold the stock.

The signal I want to share came from our friends at LikeFolio.

As CEO of a company that helps investors navigate markets with algorithms and data analysis, I LOVE fresh insight that tells a complete story about a stock. LikeFolio analyzes social media data to understand major shifts in consumer behavior.

So, take a look at these two charts.

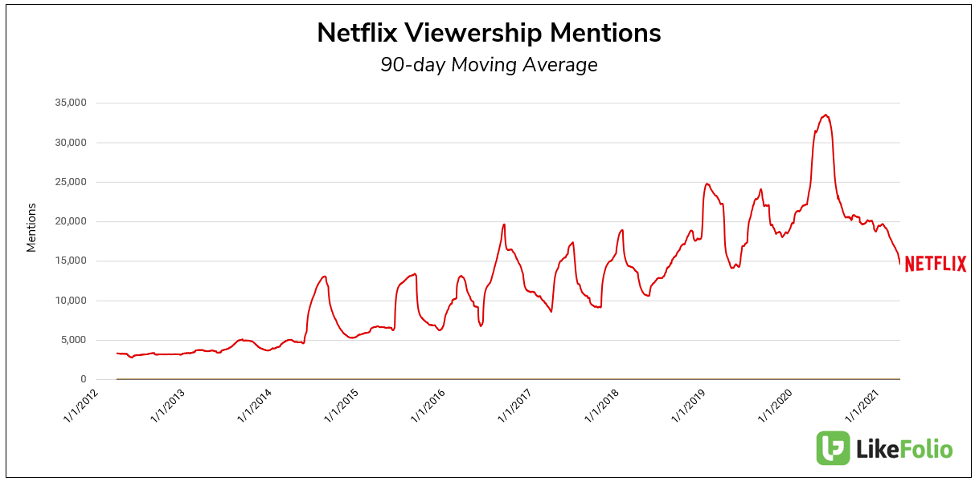

This first is the 90-day moving average of Netflix viewership mentions on social media. As you can see, the number of mentions from the middle of last year plunged over the final quarter of 2020 and the first quarter of this year.

What can that tell us? It suggests that with social mentions dropping to their lowest levels since 2019, consumers are not actively purchasing Netflix services.

So, when we head into the earnings report, the customer growth levels may not align with the aggressive forecasts issued by Wall Street.

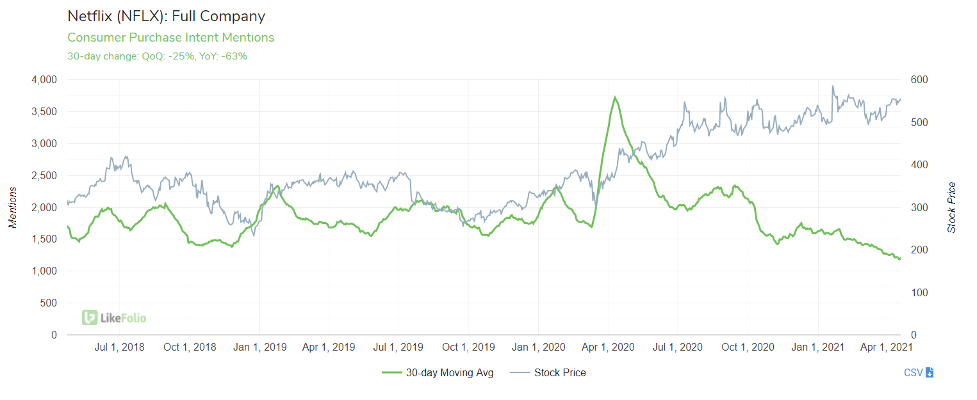

Check out this chart as well.

It measures mentions on social media that reflect “Customer Purchase Intent” over 30 days as compared to the stock price.

As you can see, the company’s share price has continued to rally since October 2019.

However, we see a significant decline in purchasing intent among consumers on social media since April. It appears that this intent maxed out at the onset of the pandemic (in April 2020).

The number of mentions that would indicate an intent to purchase Netflix services has declined by 63% year-over-year and 25% from the previous quarter.

These two charts signal the increasing likelihood that fewer people are signing up for Netflix services and that fewer people intend to purchase the company’s services in the future.

This Signal Eliminates the Noise of Earnings Season

You can’t trust the Wall Street analysts who are rarely short technology stocks.

They’re always clamoring over each other to prove the most bullish case possible with the highest price target profitable.

But they typically miss out on the short-term catalysts driving a stock up or down.

Things like: Are consumers adding Netflix subscriptions or ditching it for other streaming services?

LikeFolio’s analysis offered a complete picture of what Netflix customers and potential customers are doing. As you saw in the chart above, fewer people are talking about owning Netflix or purchasing the firm’s services than in the past.

And check this out.

LikeFolio just launched the first week of this earnings season’s predictions in their Earnings Season Pass product, which offers deep consumer sentiment ahead of each company’s report.

With Netflix, LikeFolio not only predicted the sharp drop in consumer enthusiasm, but they’re also on the verge of making a lot of money on what I’d consider a low-risk, high-reward bet on their data.

You see, they risked $240 to earn a profit potential of $260.

With the trade they made … as long as Netflix remains under $540 by Friday, they’re looking at a gain of more than 100%.

Since subscriber growth is such a critical catalyst for the buying and selling of stock, shares have gone down, just as LikeFolio predicted.

Earnings Season Pass implemented a strategy to help readers double their money in just a few days with a maximum loss as small as $240.

I don’t know about you, but that’s the type of returns and insight that I’m looking for.

We’re entering the heart of earnings season. So, I want to give TradeSmith Daily readers a chance to access this tool before next week.

If you like what you see, head over to LikeFolio and take advantage of Earnings Season Pass. But hurry… today is the last day to make the most of the current earnings season! Click here before midnight tonight.

I’ll be back tomorrow to talk about some other traps you can avoid during earnings season.