The Pain for Tech Stocks is Only Just Beginning

The bursting of the tech bubble has taken down the Nasdaq, but left the Dow intact. This has created the greatest divergence between the Dow and the Nasdaq since 1993.

March 8 was “the first time since 1993 that the Dow rose and closed within 1% of a record,” Bloomberg reports, “while the tech-heavy gauge was down more than 10% from its high.”

As we’ve explained at length in these pages, silly-season tech valuations were a byproduct of the implied belief that near-zero interest rates would last forever. That was always a foolish assumption.

Even the mega-cap tech juggernauts — Apple and the like — are starting to feel the pain, as a combination of rising rates and real economic growth make their inflated valuations look non-sustainable.

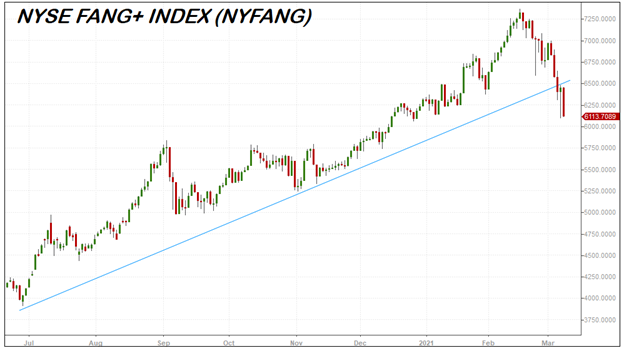

You can see mega-cap distress in the path of the NYSE FANG+ Index, which, as of the March 8 close, was nearly 17% below its Feb. 16 highs. That is well into correction territory (a 10 to 20% decline) and nearing full-on bear market status (a 20% or greater decline).

Value investors have an old saying: “Good things happen to cheap stocks.”

What we are seeing now in tech-land is the reverse application of that maxim: “Bad things happen to insanely expensive stocks.”

It’s all about the valuation, which is why even world-class profit machines like Apple (AAPL) are in trouble here. As we explained in comparing big tech to zero coupon bonds, even the mightiest FANG can take a share price haircut of 40% (or more) if valuations are inflated enough.

Technology stocks also have an ARK problem: The ARK Invest family of funds swelled to gargantuan size at almost the worst possible time. (In TradeSmith Decoder, we shorted an ARK fund in late February.)

The ARK Invest family of funds increased its total assets under management (AUM) by more than 1,000% in 2020, going from $3.1 billion to $34.5 billion. In the first two months of 2021, ARK accumulated assets at an even faster clip, adding $12.5 billion in just six weeks or so.

The trouble is that, as the rate-driven tech bubble unwinds itself, the late-to-the-party arrival of tens of billions of dollars means a sizable portion of ARK investors are now underwater.

The vast majority of inflows ARK has ever accumulated came within the past six months — and most of those purchases are now in the red. This increases the odds a critical mass of investors will rotate their capital out of ARK, putting further pressure on ARK’s illiquid technology holdings via forced redemptions.

Perhaps long-end yields will stop going up, and thus give tech investors a break? Don’t count on it. The 2021 growth rate for the U.S. economy is now expected to be blistering hot, which strongly implies long-end yields are still too low.

A combination of one of the best vaccine rollouts in the world, plus a $1.9 trillion stimulus, which will put immediate spending power in the hands of low-income consumers, has led the Organization for Economic Cooperation and Development (OECD) to more than double its U.S. growth projections.

At the same time, average growth projections from Bloomberg surveys now have U.S. GDP growth at 7.6% on the year — a pace that could make China’s look tame.

With that kind of growth ahead, long-term treasury yields look surprisingly low.

“Treasury yields haven’t been this low relative to U.S. economic growth estimates since 1966,” Bloomberg reports. That suggests there is plenty of scope for long-term yields to rise further — which means more pain for rate-dependent tech stocks.

A red-hot growth forecast, coupled with a cartoonishly steep yield curve, also suggests various reflation-oriented areas of the market, like energy stocks and financials and transports, could be considered reasonably priced in valuation terms, or mildly expensive at best.

As economic growth gains take hold, long-end rates should head higher still, with recovery-oriented areas of the market (the aforementioned energy and financials and transports) able to handle it, because growth means a sharp rebound in revenues and margins.

This is, frankly, a slow-motion disaster scenario for overvalued tech stocks.

Not only is tech-related pain likely to increase (via an ongoing rise in yields), there are other parts of the market investors can readily shift capital toward, making it even easier to dump the old paradigm (perpetual near-zero rates) in favor of the new one (real growth in stuff that isn’t insanely valued).

Perhaps, though, the Federal Reserve or U.S. Treasury will come to the rescue?

Nope. The curious keep asking — Are you worried about rising yields? Are you worried about inflation? — and Jay Powell and Janet Yellen keep saying no.

In a CNBC interview on Monday, Yellen was asked if runaway inflation was a concern, given the tremendous size of the stimulus.

“I really don’t think that’s going to happen,” Yellen replied. “If it turns out to be inflationary, there are tools to deal with that,” she added.

There will be rebounds and optimistic rallies — hope springs eternal and all that — but the picture is fairly clear at this point.

We are going to see blockbuster rates of U.S. economic growth, in part because pent-up demand, further powered by stimulus checks, will send consumption through the roof. That, in turn, will generate concerns of inflation, while igniting keen interest in energy, transports, and financials (this has already started).

In response to the growth, long-end yields will likely continue to rise overall, even as capital continues to rotate out of technology stocks. If inflation becomes an issue, the Fed and Treasury’s most likely move is to pretend it isn’t actually an issue — until long-end yields rise even more.

And if the Federal Reserve feels compelled to “do something” about inflation, that something will be a tightening effort — whereas if they feel compelled to “do something” about spiking long-end yields, their only last-ditch option (yield curve control) might require making inflation worse.

It is hard to see how tech stocks rebound (other than temporarily) under these circumstances. It is easy to see, in contrast, how they could fall much farther.