The Top Stock in the Top ETFs

After three crummy months from August through October, November was an absolute barn burner for stocks.

It was the third strongest November in the last 43 years, with the S&P 500, Dow Jones Industrial Average, and Nasdaq all up 9% to 10%.

The 15 stocks currently in our TradeSmith Investment Report portfolio surged 13.6% on average, including four that galloped ahead more than 20%.

Coming out of the painful October selling may have dulled our sense of just how phenomenal last month was.

And the same data that can help us appreciate November’s magnitude also tells us that more big gains are headed our way.

Big Money Is Flowing

I’ve been watching the markets and stocks for a long time, but even I was surprised at how quickly things turned when the calendar flipped from Halloween to Nov. 1.

My system tracks what Big Money is doing with its… well, money, even though Big Money tries to disguise it. My unique vantage point matching up institutional buyers and sellers gave me rare insight into how Big Money operates and how to spot what it’s doing and where it’s going.

On Nov. 1, unusually large selling all but vanished and gave way to serious buying. It’s still remarkable to see the Big Money sell signals (red bars) shrink to virtually nothing, while the Big Money buy signals (green bars) got larger and larger.

Source: MAPsignals.com

The brutal selling was characterized by huge volume, which is normal. When selling hits, everyone sells.

November’s huge bounce was also on big volume, which is more unusual. Buying is typically on smaller volumes than selling that spread out over a longer period of time.

But last month, Big Money flooded back into stocks big time.

Money is moving into stocks. Market interest rates are falling, even with the Fed not cutting those rates yet. And when it does, we should be in for a big and sustained run into stocks.

The $6 trillion cash bubble is about to burst.

In fact, the bursting may have begun.

3 Top ETFs – And the Stop Stock In Each

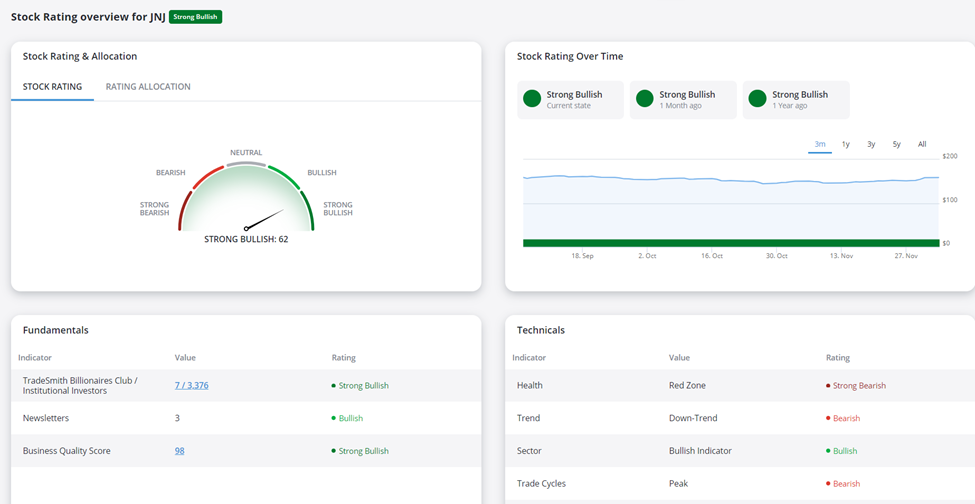

In addition to Big Money flows, my system analyzes and rates stocks and exchange-traded funds (ETFs), as well.

ETFs are not always the best investment, because you have to own all of the stocks in it – including the laggards.

But they are useful snapshots of what’s going on in the market.

With that in mind, let’s look at the top-ranked ETFs in my system.

#1 iShares Expanded Tech-Software Sector ETF (IGV)

As the name says, this ETF invests in North American stocks in the software industry, as well as select other stocks in home entertainment and media and services. IGV surged 16% in November to its highest price in nearly two years.

The ETFs Quantum Score (my system’s proprietary ranking) is excellent at 76.5. Anything in the 70 to 85 range is generally a good buy with additional upside likely.

The largest holding is Microsoft (MSFT), which constitutes 9.5% of the fund.

And Microsoft itself rates exceptionally well, especially for such a massive company – a $2.8 trillion market cap. Microsoft’s Quantum Score is a robust 81. The fundamentals are solid and the technicals very strong. Big Money was active in the stock in November, as you can see by all those green buy signals.

Source: MAPsignals.com

#2 iShares MSCI USA Momentum Factor ETF (MTUM)

This is an interesting one, and it shows what kind of November we had. MTUM is a momentum ETF investing in large- and mid-cap stocks with strong price momentum.

Its Quantum Score of 76.4 is just a fraction lower than IGV, and its 9.2% November run didn’t equal the software ETFs performance. Still, its fundamentals and technicals rate similarly to IGV.

And the largest holding in the portfolio is… Microsoft again. It makes up 5.04% of MTUM, a share more than Amazon’s (AMZN) 5.02% weighting.

By the way, Amazon’s Quantum Score is much lower at 65.5 due to weaker fundamentals.

#3 First Trust Expanded Technology ETF (XPND)

No surprise here. Technology is top-ranked sector in my system, and the two ETFs above First Trust Expanded Technology ETF are also riding tech stocks higher.

XPND’s Quantum Score largely keeps pace at 75.3. The fundamentals actually score better than IGV and MTUM, while the technicals are slightly weaker.

And by now I’m sure you’ve guessed that the largest holding here is also MSFT, at a 5.02% weighting.

Look for tech stocks to lead the run higher – and look for tech stocks with strong fundamentals and technicals with Big Money flowing in. Microsoft qualifies, and there are other highly rated stocks that shot even higher in November than MSFT’s 12% gain.

I look for that to continue, as well. Own the highest-rated stocks now, and you’ll be ready as the cash bubble bursts and a tidal wave of cash comes flooding into the best stocks in the market.

Talk soon,

Jason Bodner

Editor, Jason Bodner’s Power Trends

P.S. This first-ever cash bubble is an overlooked opportunity right now. Cash is the fuel for market rallies, and there is a record amount of it waiting to come back into stocks.

My system recently signaled “buy alerts” on three top plays to get into today. These are the stocks best positioned to benefit when the bubble bursts and the stock market booms.

I’ve put all the details in a report called, Three Stocks To Move Your Cash Into NOW.

I also recorded a special presentation explaining this unique bubble, how it will end, and three steps you can take now to make sure you’re ready. You can view it here.