The Worst Way to Buy Bitcoin

|

Listen to this post

|

If you ask me or quite a few smart folks I know, bitcoin is a buy below six figures.

Its fast-approaching halving event is enough to convince me of that on its own. The recent momentum, putting it at new highs ahead of that cycle for the first time since 2012, is just icing.

But today I want to talk about a pit you could be falling into as a bitcoin investor.

You see, when I say bitcoin is a great buy, I mean just that. Bitcoin is a great buy. The cryptocurrency itself. The new ETFs have some drawbacks, but they’re the next best thing.

What I DON’T necessarily think is a great buy are some of these publicly listed “crypto stocks” — companies that either mine bitcoin as a business or hold it on their balance sheet, sometimes using dangerous leverage.

And nowhere is this more evident than in the company that owns roughly 1% of all bitcoin right now: MicroStrategy Inc. (MSTR).

MicroStrategy bills itself as an analytics software company for enterprises and governments. It’s been at it a long time, too. The company went public back in 1998, and it rode the dot-com bubble almost 30 times higher from its listing price.

Here’s a long-term chart of MicroStrategy (in logarithmic scale):

Without log scale, the stock’s very respectable run in the two decades that followed the dot-com crash looks like a horizontal line. During that run from 2004 to 2016, the stock returned even more than during the bubble — over 48 times.

Afterward things cooled off a bit, with the stock falling about 59% from 2016 until the pandemic-panic bottom.

But then came 2020 … and nothing has been the same since.

MicroStrategy has taken to becoming what many call a “bitcoin proxy.” It still generates revenues from its traditional operations (software sales and support), but it also happens to hold a massive amount of bitcoin on its balance sheet. And that has become core to the company’s identity.

At writing, the company holds 214,246 bitcoins, worth about $14 billion – and about 1% of all bitcoin on the market. Those holdings make up more than half of its $23.8 billion market cap. And according to some sources, the average cost of these bitcoins is around $34,000 each.

This outsized position in bitcoin, held at a discount to bitcoin’s value, might make it seem like buying MSTR is a good way to get exposure to bitcoin. Especially given the chart’s tendency to print “vertical lines” during euphoric times.

But buying MSTR represents something far different from that. And it’s the opposite of what its outspoken founder is doing.

Diving Deep into MSTR’s Valuation

You might’ve guessed that MicroStrategy’s software sales are a small piece of the company pie. You’d be right.

Let’s set aside the bitcoin for a moment and have a look at MSTR’s income statement. (If you’d like to follow along, you can access the statement here.)

Last year, MSTR made $496 million in revenue, with net income at $429 million.

Wait… that sounds pretty good, right? It’s keeping more than 86% of the money it makes.

But it’s not. MSTR’s total operating expenses stand at $501 million — higher than its revenue. By that metric it’s losing money — at least, it’s losing cash. So how can it have positive net income if operating expenses exceed revenue?

Fact is, most of MSTR’s 2023 revenue came from a $553.6 million tax benefit called a “valuation allowance.” Since the value of the company’s bitcoin holdings went up so much, MicroStrategy was able to ”unlock” money it previously set aside to cover losses and add it to the war chest.

All this is to say, MicroStrategy is not a very productive company outside of its core asset holdings. It is, as I said above, chiefly a bitcoin proxy.

And right now, it’s not even a very good one. Despite holding bitcoin at nearly half its current price, MSTR trades at a ludicrous premium to the value of its bitcoin and its core business.

If we take all the shares outstanding (16.97 million), multiply it by the share price (about $1,646 as of Wednesday’s open), and divide that by the total value of the bitcoin holdings and revenue over the past year (~$14 billion), we get an equity premium of 1.99x, or about 99%.

In other words, if you’re buying MSTR to get exposure to bitcoin — which most folks are, given the software business is a sliver of the business — you’re essentially buying bitcoin twice as high from where it currently trades…AND you get none of the utility of holding bitcoin itself.

Raw deal, huh? But not for company founder Michael Saylor.

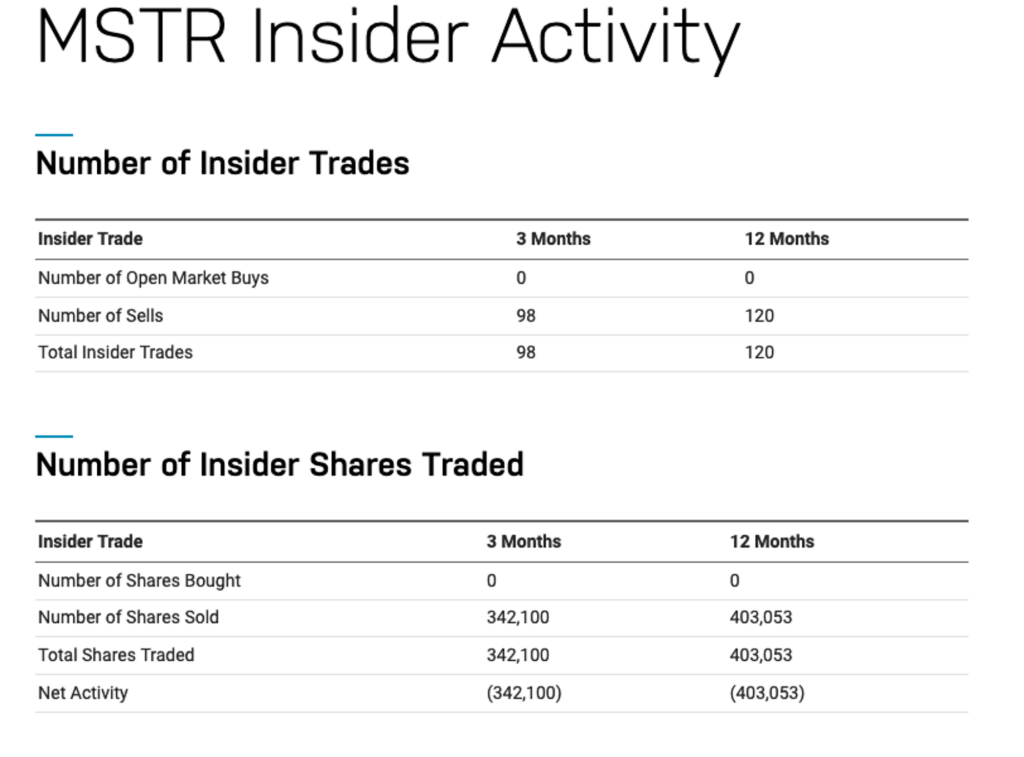

Check out how much MSTR stock he’s sold during the past three months, as prices raged higher:

Granted, these are due to stock options Saylor was granted in 2014 set to expire in April of this year. But we should keep in mind – these are options. He could also simply hold the stock.

But Saylor knows exactly what we now know. His stock trades at a huge premium to its net asset value. It’s a sell, not a buy.

Not only this, the company constantly issues convertible debt and uses the proceeds to, what else, buy more bitcoin.

Essentially, what we’re looking at is not a software company, but a highly leveraged bitcoin holding company with a relatively small software business on the side.

Maybe, in time, that will prove to be an ingenious plan. But right now, the stock is simply not a fair buy for what you get.

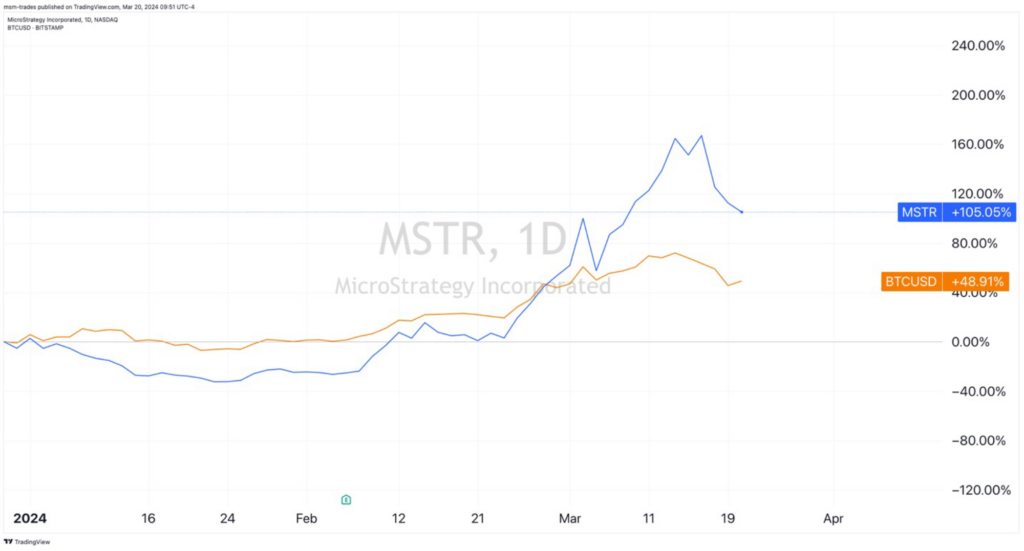

I’m sharing all this to warn you against the draw of MSTR’s stock price thus far in 2024. It has outperformed bitcoin by about double. It’s doing its job as a leveraged play on the asset.

But so long as you’re buying MSTR at such a large premium to the value of its foundational asset, you’re taking a substantial and unnecessary risk that even the company’s founder isn’t willing to take.

[I should note that my TradeSmith colleague Justice Clark Litle has had much success trading MSTR stock up and down in the past. Between Sept. 29, 2020, and March 5, 2021, his Decoder advisory made readers more than 233% on a long position. He also has four closed short positions (starting June 23, 2021), two of which were profitable.]

MSTR is a sell — or a quick trade — from what we see. If you want to get exposure to bitcoin, do what I said at the top and keep it simple.

If you have a bit of technical savvy, buy bitcoin itself and hold it in an offline wallet. Otherwise, check out my piece here from when the bitcoin ETFs launched to see which of those is right for you.

To your health and wealth,

Michael Salvatore

Editor, TradeSmith Daily