This Unusual Indicator Can Turn Unknown Stocks into Gold

|

Listen to this post

|

Note from Michael Salvatore, Editor, TradeSmith Daily: Money flows are the most powerful force in markets.

Money flows represent knowledge. They express a trader’s conviction. And when you see money flows grow to unusual size, that’s a signal you should grab onto with both hands.

Jonathan Rose, founder of our corporate partner Masters in Trading, understands this well as a former CBOE dealmaker. These days, he shares his best ideas – and how to find them – to subscribers of his Advanced Notice advisory and extensive community.

If you’re a short term trader looking for a solid edge, I’d urge you to go here and see what Jonathan’s strategy is all about. And also read on to see Jonathan’s mastery of money flows in action, with a recent trade that returned more than triple the initial stake in a matter of weeks…

This Unusual Indicator Can Turn Unknown Stocks into Gold

By Jonathan Rose, Founder, Masters in Trading

This week has been an incredible reminder of just how quickly the market can turn on you. One second, price moves are just average: nothing to write home about. The next, they’re gargantuan.

But how do you get to a point where these moves are not just something that happens to you… but something you can position for in advance, to make the move work for you?

In my experience, you need to get involved with the options market. And, specifically, you need to take your cues from unusual options activity.

That single indicator is incredibly powerful once you are able to see it – and trade it.

If you are already trading options, and you aren’t paying attention to unusual options activity, then please be aware:

Unusual options activity is one of the best, if not the top indicator for finding potential outsized price moves I’ve seen ever since I started out trading on the Chicago exchange floors 25 years ago.

Over the years, my followers, colleagues, and I have found opportunities this way that turned out to be absolutely explosive: they helped me earn over $10 million from trading and investing, and they help my followers on the regular. In fact, just this week, members of my Advanced Notice service saw just how quickly a trade can shift – and go from average to incredible in the process.

So, I’m grateful for the opportunity here in TradeSmith Daily to show you how this unusual indicator can be a complete game-changer for retail investors like you and me.

What is Unusual Options Activity?

Unusual options activity is exactly what it sounds like: trading activity in options contracts that deviate significantly from the norm for a given stock or index. This can involve an unusually high number of contracts being traded or large blocks of options being purchased in a single transaction – but when trading volume begins to shift in an unusual way, it’s time to pay close attention.

When we see this kind of activity in the options market, it’s often a sign that someone knows something we don’t – maybe an upcoming merger, maybe a favorable acquisition, or some other not-yet-announced news that could significantly affect a company’s stock price.

For smaller companies with less frequently traded options, unusual options activity can be an even stronger signal. These aren’t the giants of the stock market like Apple Inc. (AAPL) or Nvidia Corp. (NVDA); they’re retail apparel chains, tech start-ups and unheard-of pharmaceutical names – companies with much smaller trading volumes where big bets can have a much bigger impact.

That’s why paying attention to these signals can be so crucial – and so lucrative when it all works out.

A Real-World Example: The CRTO Trade

Let’s talk about a specific trade to show you what I mean.

On June 27, we spotted some unusual options activity on Criteo SA (CRTO) using our Advanced Notice system. I’ll be honest: I’d never heard of them, nor had any idea what the company did before they appeared in our scans. I did know that Criteo wasn’t a headline-grabbing stock… but that week, it was showing signs that it could become one.

The ticker popped up as a top player in our system—not once, but twice, amidst a relatively quiet market history. And as I started to dig deeper into this offbeat ticker, I saw that this wasn’t just a little blip on the radar: This was a colossal number of options being traded, in a thinly-traded foreign company.

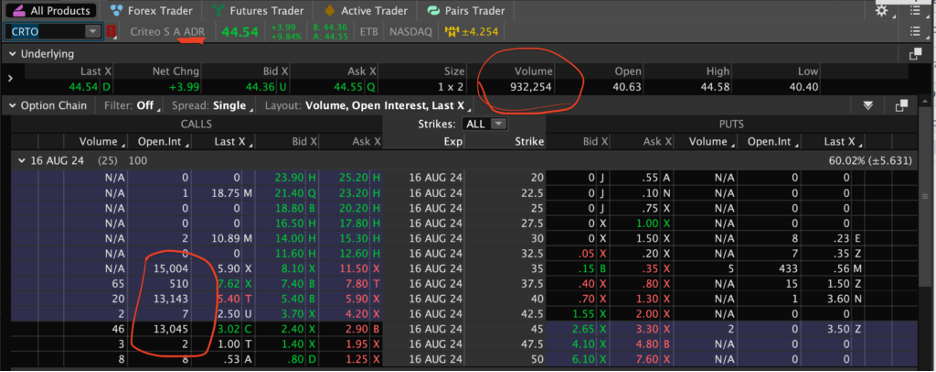

My team observed a significant volume of options trades on CRTO: 15,000 options were executed, representing a potential movement of about 1.5 million shares if those options were exercised in-the-money. This kind of volume spike on a stock like CRTO, which isn’t usually on the mainstream radar, indicated a serious shift ahead.

Given this massive option activity, we had enough indication that the stock’s underlying price could experience significant volatility. So, we entered a position of our own.

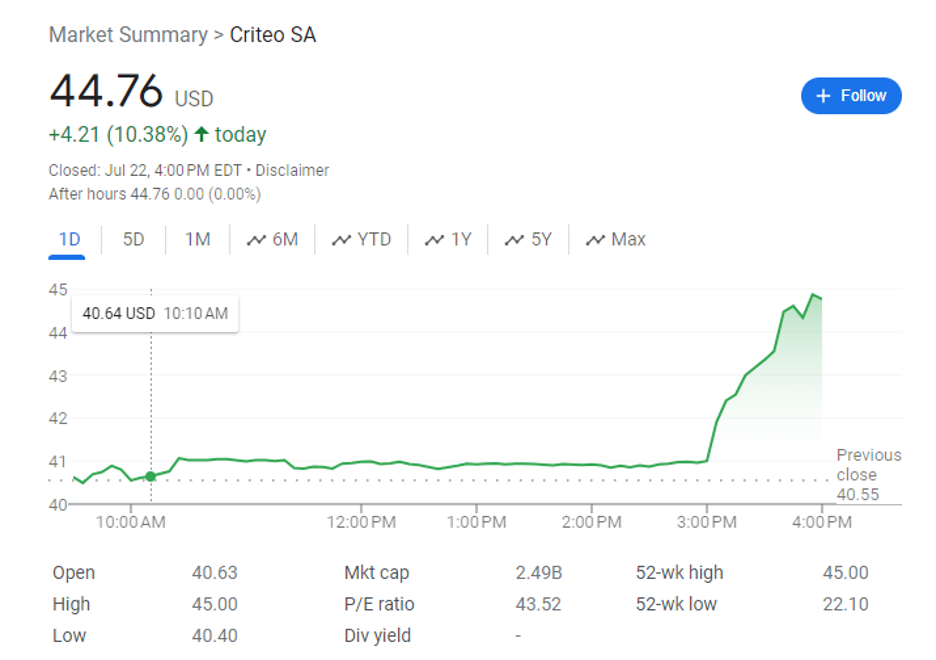

We were able to get into this CTRO trade at $2.26 – and it was in the green right out of the gate. Then on July 22, we got to see some of that recent market volatility turn this trade from good to amazing.

With an hour left to go in the trading day, CRTO jumped 10% – seemingly out of nowhere:

But on further inspection, the options chain told us everything we needed to know…

On the left of this chain, you can see three massive orders that hit the tape that day. The total options volume was just shy of 42,000 contracts, which would represent nearly 4.2 million shares if they wound up in-the-money at expiration — over four times the volume of shares traded that day.

When we see imbalances like that on a foreign company trading on multiple exchanges, that’s how shares can jump 10% on no news.

As the stock movement aligned with our predictions, the position matured beautifully, and by the next day, we signaled to exit the position – at $7.50 or better. The result? A textbook execution of leveraging market movements for substantial gains.

The Power of Unusual Options Activity

This trade underscores exactly why I love to trade unusual options activity.

Big orders on small-cap stocks like CRTO can be the precursor to significant price moves – whether the order comes in the middle of a consistent rally or during volatile markets like this week’s. And as we’ve seen, with the right tools and a strategic approach, we can leverage these trades that are practically invisible to the average market participant into phenomenal gains. Recently, this system has produced gains of 197%, 317%, and even 1,147% – each in 30 days or less.

And I’d love to share that approach – and my experience – with you.

At Advanced Notice, our system doesn’t just spot unusual options activity: It analyzes the direction of those unusual trades and ranks them using a set of proprietary data. You get the tools to spot these opportunities just like the pros.

So, if you’re ready to start making trading options based on data-driven insights that can lead to significant returns, it’s time to check out Advanced Notice.

Remember, the creative trader wins,

Jonathan Rose

Founder, Masters in Trading