TradeSmith Snippets for the Week of March 6

|

Listen to this post

|

Happy Monday — we’re glad you’re here to start the week with us in a new issue of TradeSmith Snippets.

With the constant bombardment of news, many investors are facing decision fatigue, not knowing how to act on what they are hearing.

In TradeSmith Snippets, we’re here to tell you what really matters and help you overcome that analysis paralysis. We run these ideas through our proprietary trading tools as well as our experts’ proprietary tools to give you actionable information, spotlighting places to make money and the potholes that can wipe out that money.

All while doing it in a format that maximizes your time.

There’s a lot to go over, so let’s jump right in.

Snippet No. 1: More Scrutiny for the MSFT/ATVI Deal

Overview

The European Union (EU) antitrust regulators have set an April 25 deadline for their decision on whether to allow Microsoft Inc. (MSFT) to acquire Activision Blizzard Inc. (ATVI) for $69 billion.

The Breakdown

Microsoft has projected confidence that the deal will close, but the Federal Trade Commission issued a complaint in December 2022, saying that the deal would suppress competition in the video game industry.

To ease the concerns of regulators, Microsoft president Brad Smith had a busy February, meeting with the U.K. Competition & Markets Authority (CMA) in London and meeting with regulators from the European Commission in Brussels.

To show that it can play nice with other video game makers, Microsoft has a 10-year contract with Nintendo (NTDOY) to bring Activision’s “Call of Duty” gaming franchise to Nintendo players, a deal that is contingent on Microsoft’s acquisition of Activision closing.

The TradeSmith Takeaway

The TradeSmith team has been keeping close tabs on this potential acquisition since bringing it to your attention in our Special-Situation Central series.

There is an arbitrage opportunity here: If the deal closes, Microsoft will pay $95 per share for ATVI.

ATVI is trading at $77.25 as of this writing, which presents a potential profit opportunity of 23% if the deal closes. Of course, any arbitrage deal involves risk, and there’s no guarantee that the deal will close. But there are still a few reasons to like ATVI even if the deal doesn’t materialize.

One is that Berkshire Hathaway Inc. (BRK.A) owns 52 million shares of ATVI, which provides conviction that some of the smartest investors in the world see upside in ATVI.

The other is that ATVI is in our Green Zone, which means it’s considered a “buy.”

We’ll continue to watch this story closely and keep you in the loop with any important updates.

Snippet No. 2: Another Run at $68,000 for Bitcoin (BTC)

Overview

Even in the face of more interest rate hikes and persistent inflation, Bitcoin has been surprisingly resilient.

The Breakdown

The cryptocurrency is up nearly 40% over the last 90 days, and crossing the $20,000 threshold could make millionaires of long-term holders of BTC.

As of March 1, there were 67,000 BTC wallets that were worth $1 million or more.

But if you weren’t early to the Bitcoin party, that’s okay…

The TradeSmith Takeaway

Our friends over at LikeFolio recently released a video report about three investments that could triple in price in 2023, and LikeFolio co-founder Landon Swan pounded the table for Bitcoin.

How much folks are buzzing about Bitcoin on social media is a leading indicator of where the BTC price could head next — and right now, LikeFolio is seeing a rapid uptick in chatter through its proprietary data.

Could what we’ve seen over the last 90 days be the start of the next 3x, 4x, or 5x move?

It sure could.

Landon believes that Bitcoin could climb near its previous all-time highs this year, and at the 1:35 mark of the video, he will share everything you need to know.

Snippet No. 3: Welcome to Investor Day – Musk Style

Overview

The Tesla Inc. (TSLA) investor day revealed Elon Musk’s “Master Plan 3.”

The Breakdown

There was a lot to unpack from the investor day, so here are a few of the highlights:

- Tesla confirmed it is building a manufacturing plant in Mexico.

- It will roll out the “Tesla Electric” program in Texas this summer, offering an electricity plan to Tesla owners in the state that provides unlimited overnight home charging for $30 a month.

- The long-awaited Cybertruck will launch this year.

Musk also revealed his “Master Plan 3,” which includes $10 trillion in capital expenditures to develop storage batteries and vehicle batteries and to cover the mining and refining of raw materials.

The TradeSmith Takeaway

At the end of 2022, investors were concerned that Musk’s acquisition of Twitter was distracting him from managing Tesla, but people have a short memory, especially with a rising stock.

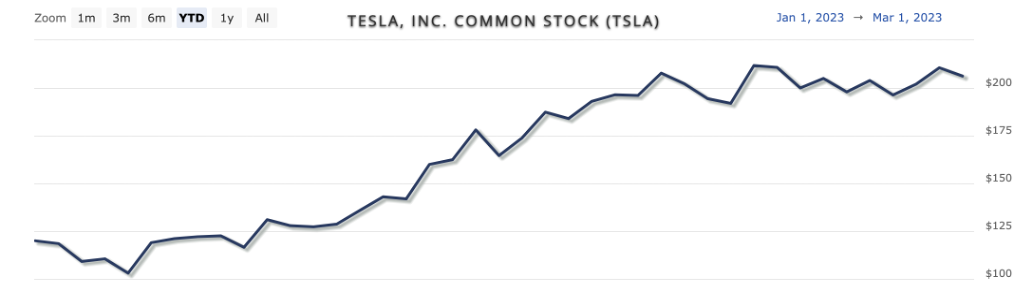

TSLA is up 76.37% to start the year, which may be partially due to investors anticipating Musk’s release of his third “Master Plan.”

In 2016, ahead of Musk’s second “Master Plan,” the stock price went on a monthlong runup of 22%.

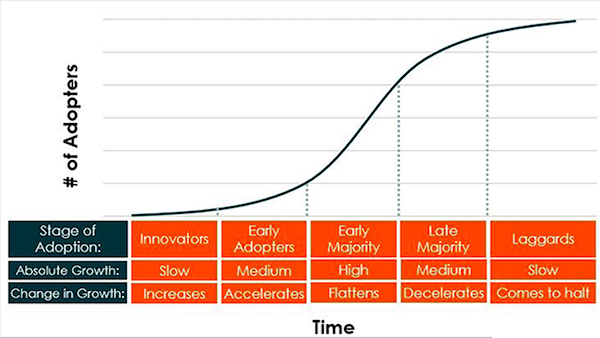

Over the long term, there are plenty of reasons to be bullish about the electric vehicle (EV) market, especially because of what happened this past summer: In July 2022, when EVs accounted for 5% of new car sales in the United States, that was a potential tipping point — a Bloomberg report said it’s the signal that we’re now headed toward mass adoption of EVs.

The adoption of technology, from televisions to mobile phones to the internet, tends to follow an S-shaped adoption curve, where sales start slowly and then reach a point of rapidly going mainstream.

Source: Global X ETFs

For electric vehicles, the 5% threshold appears to be the point in time when early adoption tips into mainstream demand.

Twenty-five percent of all new car sales in the United States could be electric by 2025, if the U.S. follows the trajectory set by 18 other countries.

Accounting for roughly 65% of new EV sales in 2022, Tesla currently has a strong lead in this growing market.

But before racing out to scoop up TSLA shares, let’s see what TradeSmith’s proprietary investing tools say about the stock.

It has a Business Quality Score of 90, with 100 being our top score, so Tesla has about as high of a mark as you can get.

However, there are a few other metrics to consider, especially for risk-averse investors:

- Our Volatility Quotient (VQ) classifies TSLA as having sky-high risk.

- TSLA was stopped out in our system in November 2022, placing it in the Red Zone.

- In our Money Movers feature, where we analyze several smart money signals to identify which assets are starting to get pushed up and which are starting to get pushed down, Insider Sentiment also says that this is a sell.

On top of that, Quantum Edge Pro Editor Jason Bodner thinks something big is missing with Tesla for anyone on the fence about buying the stock.