Does Anyone Still Buy GoPros? (Answer and Profit Opportunity Inside)

Back in the day, GoPro (GPRO), the company founded in 2002 by Nick Woodman, was as popular as they come. GoPro had several forces working in its favor in building its brand, which included the rise of social media and sharing photos and videos, offering the ability to strap the camera to almost anything, and the wallet-friendly prices.

But in recent years the stock has traded more like a penny stock than the large technology company that it once was, and the start of its downfall can be pinpointed to 2016.

In 2016 the company had some mishaps, including a massive revenue miss of 30%, coupled with the launch of a faulty drone that was recalled instantly.

But GoPro vowed to turn things around… and for the first time in a while, LikeFolio data suggests the company’s strategy is FINALLY working.

This is extremely powerful information for investors to have.

Why?

Because it’s April. And GoPro isn’t expected to report earnings until early May.

But thanks to real-time consumer insights, we already have an idea of how GoPro may perform, at least when it comes to top-line revenue growth.

Here’s why we’ve got our eyes on GoPro:

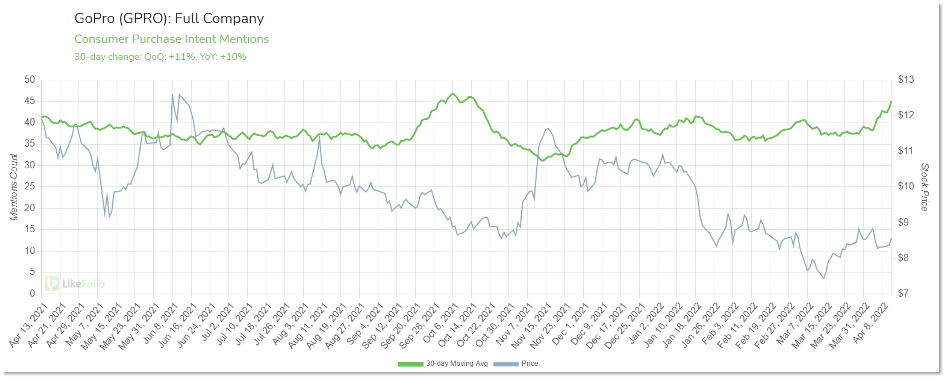

1. Consumer Purchase Intent Mentions Are Pacing for YoY Growth for the First Time in More Than Two Years

And we know that for GoPro, Purchase Intent mentions are positively correlated to revenue. This makes sense.

After all, Purchase Intent captures mentions from consumers who recently made or plan to make a purchase soon.

Right now, Purchase Intent mentions are pacing for +10% YoY growth on a 30-day moving average.

This increase in consumer demand is happening as shares continue to slide, losing about 16% in value over the last three months.

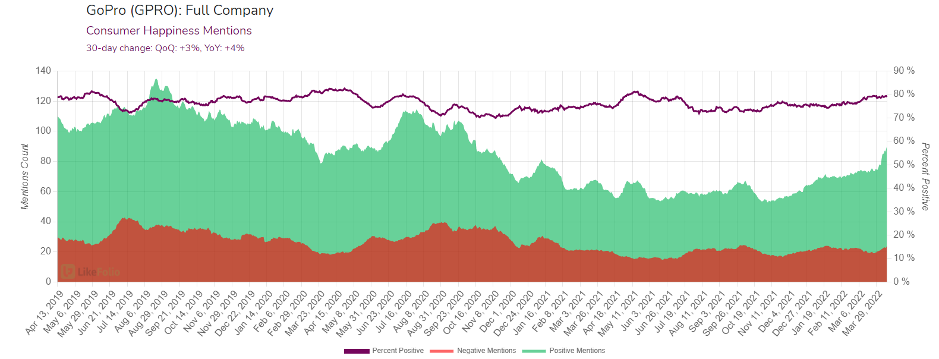

In addition, other critical GoPro metrics are improving… notably the metric most closely tied with long-term growth: Consumer Happiness.

2. Consumer Happiness Is Rising

The percentage of consumers who have reported a positive experience with GoPro’s products and services has risen by 4 points YoY and continues to push higher in the current quarter.

What’s driving this?

The company is giving consumers what they want.

Consider the company’s newly released GoPro Hero10 Black Bones, a lightweight camera designed specifically to be mounted on drones.

GoPro realized consumers were stripping off bulky elements of existing GoPro models to specially fit drones and allow for longer flying time.

So it designed a stripped-down model to solve this problem for consumers.

Now drone operators can record shots, like this bowling alley one (it’s worth the watch), without manual retrofitting.

This is the type of move investors want to see from companies: effectively listening to consumers and adapting accordingly.

GoPro also realized that the creator ecosystem extended BEYOND the pure adventure seekers and hobbyists the company initially captured.

With the rise of social media influencers and the consumer addiction to short-form video (hello, TikTok), an opportunity was present to connect with social content creators.

The GoPro Creator Edition was released a few weeks ago. Including an extra battery, SD card, grip, and light mod, it essentially bundles all the elements creators need into a single purchase.

So far, influencers love it.

Collectively, these improvements are sending GoPro brand buzz higher.

While the brand has some catching up to do to attain prior levels of glory, the company is gaining real traction with consumers for the first time in years.

And this type of momentum is exactly the kind of thing that drives enormous earnings surprises.

Lucky for our members, spotting enormous opportunities like this is what we do at LikeFolio.

And when GoPro does report earnings, you can be sure it will be included on our famous “Sunday Sheet” for Earnings Season Pass members!

I can’t wait to play this one!

Enjoy,

Andy Swan

Founder, LikeFolio