Does Coinbase Benefit from Financial Unrest?

Coinbase is one of the leaders in the cryptocurrency exchange space, providing users with the ability to buy, sell, transfer, and store cryptocurrency. By trading volume, it operates the largest cryptocurrency exchange in the United States.

This functionality appears timelier than ever.

Why?

- The financial sanctions imposed on Russia have included calls for financial exchanges to ban Russian users entirely.

- For civilians on both sides of the conflict, cryptocurrencies have been a key method of transfer and store of wealth.

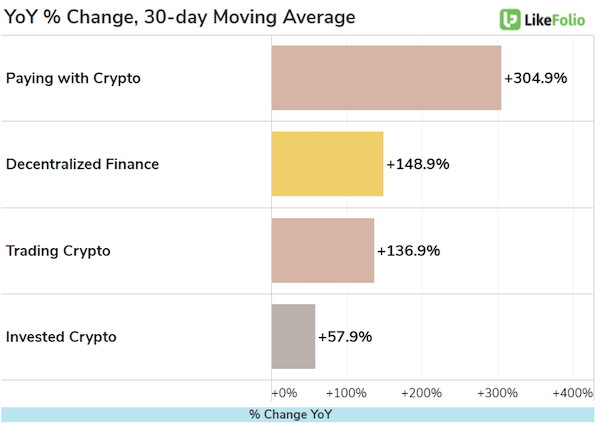

This interest in cryptocurrency is part of an ongoing spike in consumer interest. Every trend in LikeFolio’s cryptocurrency universe has increased significantly on a YoY basis.

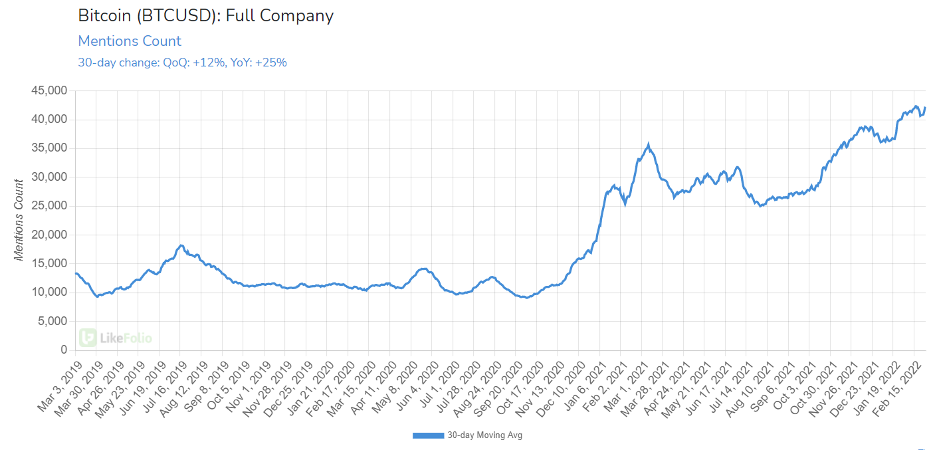

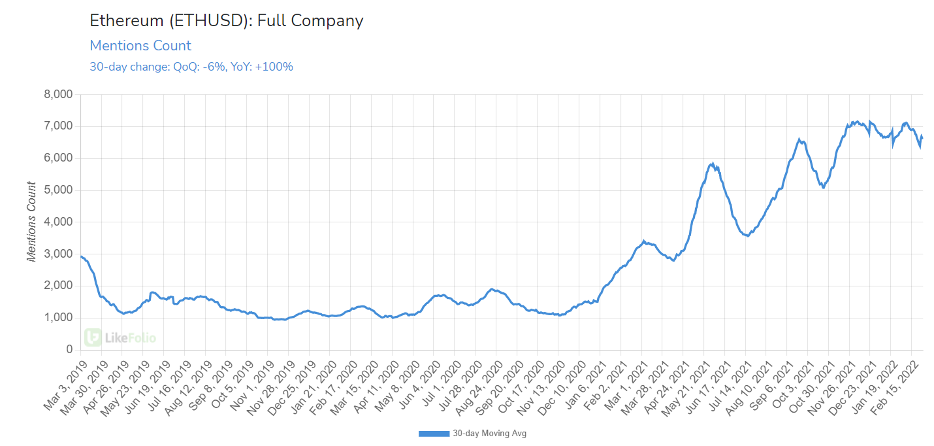

Presently, many consumers view cryptocurrencies as a flight to safety amid the chaos in Europe – with digital currencies like bitcoin and ethereum showing the highest level of new adoption.

Mentions for both currencies hover near all-time highs.

In addition, trading activity has picked up substantially during this conflict, be it hedging, speculation, or just the transfer of assets, which many Ukrainians have had to do as a means to secure their funds.

Coinbase has gained additional recognition because many people affected by the current crisis are turning to digital assets as a financial safe haven.

While heightened trading activity and use might seem positive for exchanges like Coinbase, there are also major concerns that Russians might use digital currencies as a way to circumvent the sweeping financial sanctions that the international community has imposed.

Financial sanctions against Russia have led to not only a collapse of the ruble, but also a run on Russian banks and resulted in a downturn for the country’s economy at large. This started with the move to ban Russia from the global payment system, SWIFT, but it didn’t stop there. Many countries, like the U.S. and Japan, have barred Russia’s central bank from tapping into more than $630 billion of its foreign reserves.

Not great for the Russians or their ordinary citizens.

However, this still leaves the possibility for Russia to use digital assets as a workaround, which affects Coinbase. This led some Western leaders to call for banning Russia from cryptocurrency exchanges as well.

Like many exchanges, Coinbase is limited to users in certain countries based on local laws. For example, a U.S. resident may not have access to a certain cryptocurrency exchange, just as Coinbase does not permit Russian users to use official features. However, it does currently permit transfers to and from “known” Russian wallets, and there is a push for Coinbase to institute a blanket ban on all Russian addresses/wallets.

“At this time, we will not institute a blanket ban on all Coinbase transactions involving Russian addresses,” a Coinbase spokesperson said.

Coinbase users are not necessarily denied access to transacting with Russian wallets, an important note in all of this. But Coinbase has said it will block Russian-sanctioned accounts, meaning primarily the accounts of Russian and Belarusian politicians.

Benefiting Ukrainians

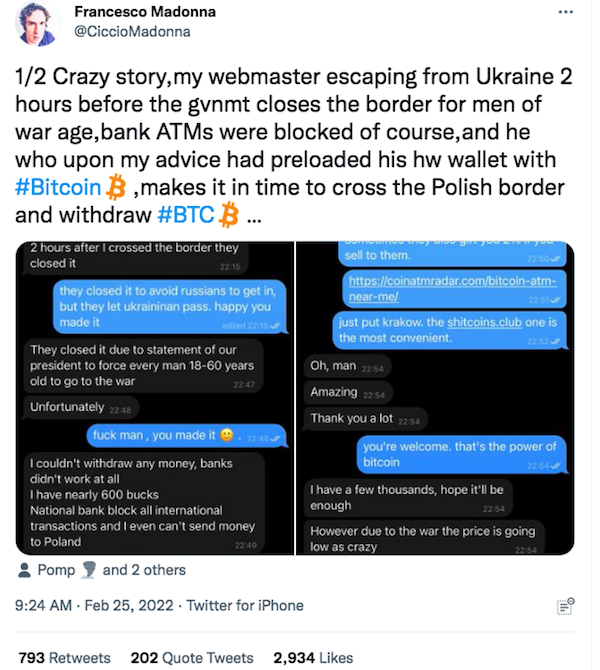

On the other side of the coin, cryptocurrency has been a benefit for Ukrainians who have had to flee the country. Many banks have become inaccessible, and there are reports of credit cards being canceled and ATMs being blocked, so Ukrainians have turned to cryptocurrency (primarily bitcoin).

Now, you would think that if credit cards and ATMs are not working that Ukrainians could still transfer their money out online. However, the Ukrainian central bank suspended electronic transfers as well.

Coinbase’s Role in the Conflict

Throughout this geopolitical unrest, Coinbase has made it clear that its mission is to “increase economic freedom in the world,” and that a “unilateral ban would punish ordinary Russian citizens who are enduring historic currency destabilization as a result of their government’s aggression against a democratic neighbor.”

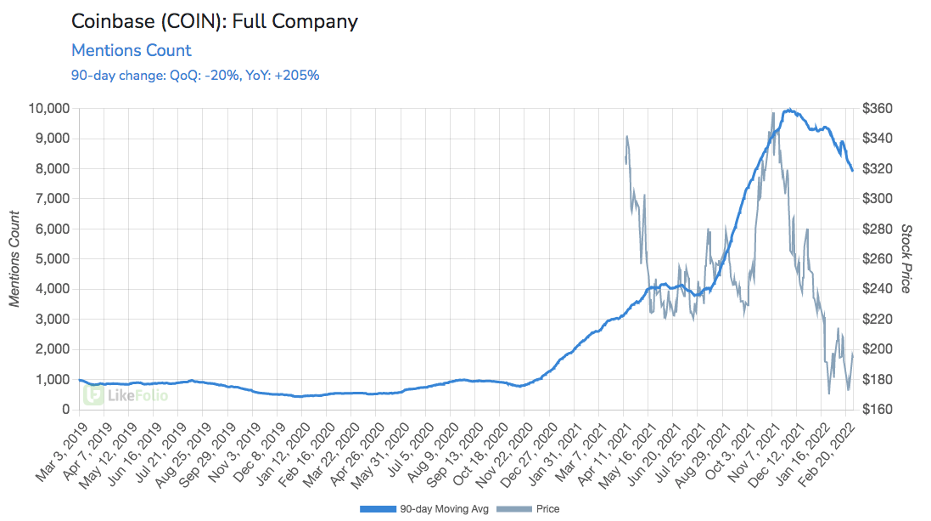

Based on LikeFolio data, Coinbase’s rejection of a blanket ban on all Russian accounts has NOT had a negative impact on company Mentions…

YoY Mentions: +205%

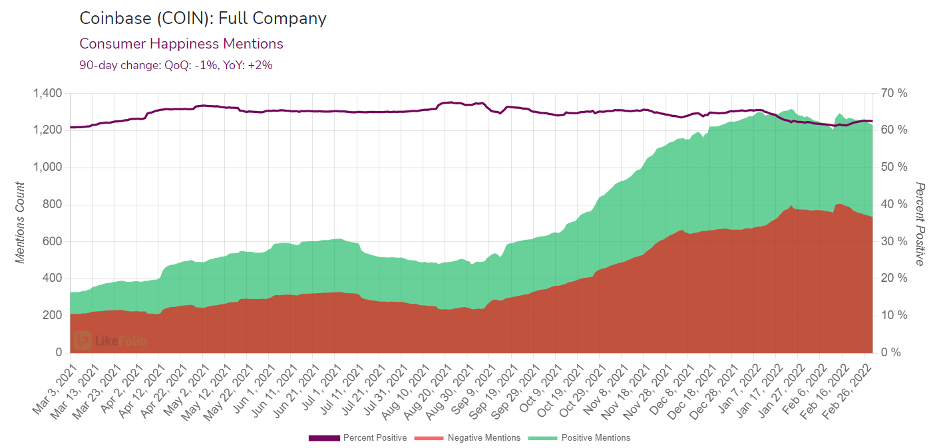

…or Consumer Happiness levels, which have remained stable over the last year.

In fact, Coinbase has assumed a partial role in the international community via donations to Ukraine in the form of digital assets — mainly bitcoin and ethereum.

To date, there has been a reported $50+ million donated since the official Twitter account of Ukrainian Vice Prime Minister Mykhailo Fedorov shared wallet addresses for cryptocurrency donations.

At the end of the day, LikeFolio data hasn’t shown any type of unprecedented upswing in Coinbase usage.

However, the scenario unfolding does make a compelling case for users who opt to retain authority over their digital assets versus holding them with a central mediator like Coinbase.

Long term, we’re keeping an eye on Coinbase and how it responds to the continued development of decentralized finance (DeFi) and Web3 (a blockchain-based version of the internet) as a whole.

Based on major consumer trends, this could just be the beginning, but Coinbase and other centralized exchanges will need to tread carefully and remain neutral if they want to coexist with future DeFi development.

Andy Swan,

Founder, LikeFolio